The global insurance fraud detection market size is estimated to account for USD 9.7 billion by 2025. The market is projected to grow at 13.7% CAGR as per Million Insights. Over the past few years, insurance fraud has emerged as a huge challenge for insurers. The rise in the number of fraudulent claims has resulted in a growing focus on the deployment of advance and effective detection solution. The advent of advance tools such as image screening, predictive analytics, self-learning models and text mining among others have immensely improved the insurance claim services and reduced the occurrence of fraudulent activities.

Claimants have been using sophisticated methods to defraud the insurers. This has led to coherent action by leading insurance providers companies against perpetrators. As estimated by FBI, the insurance companies suffer over USD 40 billion in losses due to defraud in an insurance claim in the United States. In addition, this has resulted in increased premium by USD 420 to 700 in a year per family in the country. Similarly, the Association of British Insurers has found over 113,000 fraudulent claims costing millions of dollars each year. Therefore, rise in the number of fraudulent activities has forced the governments to introduce stringent regulatory guidelines. The imposition of stringent regulatory measures are further estimated to drive the demand for the fraud detection system.

To download the sample PDF of “Insurance Fraud Detection Market” Report please click here: https://www.millioninsights.com/industry-reports/global-insurance-fraud-detection-market/request-sample

North America accounted for the highest share in the insurance fraud detection market in 2018 and the region would maintain its dominance in all likelihood. The presence of the number of solution providers in the region is driving regional growth. Asia Pacific is likely to register the highest growth rate over the forecast years owing to increasing awareness about reducing the fraudulent activities.

To browse report summary & detailed TOC, please click the link below: https://www.millioninsights.com/industry-reports/global-insurance-fraud-detection-market

Further key findings from the report suggest:

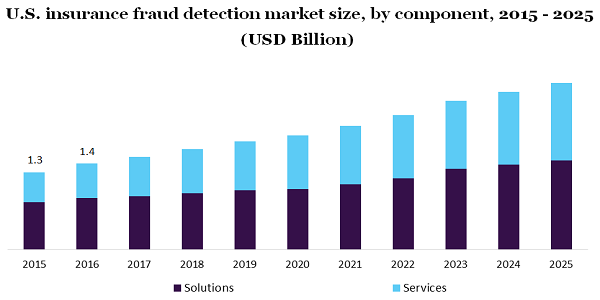

• In 2018, the solution division dominated the market and estimated to continue its position from 2019 to 2025.

• Managed services category is likely to be the fastest growing segment with CAGR of over 15%.

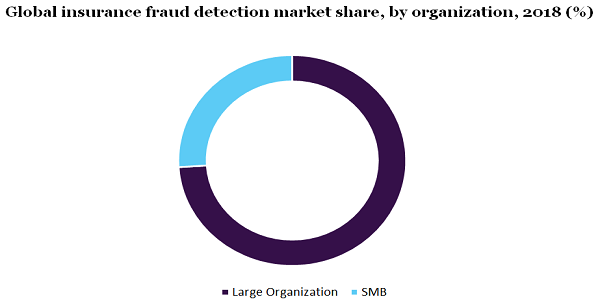

• In 2018, large enterprises held the highest share in the market owing to their increased customer base.

• Asia Pacific is anticipated to register the maximum growth over the forecast duration.

Million Insights has segmented the global insurance fraud detection market on the basis of component, solutions, services, deployment, organization and region:

Insurance Fraud Detection Component Outlook (Revenue, USD Million, 2015 - 2025)

• Solutions

• Services

Insurance Fraud Detection Solutions Outlook (Revenue, USD Million, 2015 - 2025)

• Fraud Analytics

• Authentication

• Governance, Risk, and Compliance (GRC)

Insurance Fraud Detection Services Outlook (Revenue, USD Million, 2015 - 2025)

• Professional Services

• Managed Services

Insurance Fraud Detection Deployment Outlook (Revenue, USD Million, 2015 - 2025)

• Cloud

• On-Premise

Insurance Fraud Detection Organization Outlook (Revenue, USD Million, 2015 - 2025)

• Small & Medium Business (SMB)

• Large Enterprise

Insurance Fraud Detection Regional Outlook (Revenue, USD Million, 2015 - 2025)

• North America

• U.S.

• Canada

• Europe

• U.K.

• Germany

• Asia Pacific

• China

• India

• Japan

• Latin America

• Brazil

• Mexico

• MEA

Browse latest market research reports available with Million Insights:

• Women’s Health App Market: The global women’s health app market was prized by USD 2.3 billion in 2020. It is estimated to witness 19.0% CAGR from 2021 to 2028.

• Biohacking Market: The global biohacking market was prized by USD 15.42 billion in 2020. It is estimated to witness 19.4% CAGR from 2021 to 2028.

About Million Insights

Million Insights, is a distributor of market research reports, published by premium publishers only. We have a comprehensive marketplace that will enable you to compare data points, before you make a purchase. Enabling informed buying is our motto and we strive hard to ensure that our clients get to browse through multiple samples, prior to an investment. Service flexibility & the fastest response time are two pillars, on which our business model is founded. Our market research report store includes in-depth reports, from across various industry verticals, such as healthcare, technology, chemicals, food & beverages, consumer goods, material science & automotive.

Media Contact

Company Name: Million Insights

Contact Person: Ryan Manuel

Email: Send Email

Phone: 91-20-65300184

Address:Office No. 302, 3rd Floor, Manikchand Galleria, Model Colony, Shivaji Nagar

City: Pune

State: Maharashtra

Country: India

Website: https://www.millioninsights.com/industry-reports/global-insurance-fraud-detection-market