At the end of this year's Q3, Grupo Nutresa's consolidated sales reached COP 15.3 trillion, with a 13.3% increase.

Sales in Colombia were COP 9.0 trillion, growing 10.3%. We highlight the growth in the Coffee, Chocolates, Retail Food, and the Biscuit businesses.

International revenues reached COP 6.3 trillion, representing a 17.9% increase. In dollars, they translate to USD 1.5 trillion with a 13.7% increase.

The company's strategic initiatives for flexibility, competitiveness, and global orientation have led to a reported EBITDA growth of 29.8%, reaching COP 2.32 trillion, and with a 15.2% margin over sales. Excluding the non-recurring expenses associated with the implementation of these initiatives, adjusted EBITDA growth is 35,7% with a 15.9% margin.

The Company's net profit amounted to COP 963,668 million, growing 66.9%. Excluding non-recurrent expenses, the adjusted growth is 69,2%.

By the end of September 2025, Grupo Nutresa's social investment in Colombia totaled COP 20 billion, strategically directed towards three core pillars: Education, Health, and Nutrition.

MEDELLÍN, CO / ACCESS Newswire / October 30, 2025 / Grupo Nutresa S.A. (BVC:NUTRESA) discloses its consolidated financial results for Q3, 2025, and reports its progress on relevant topics for the organization.

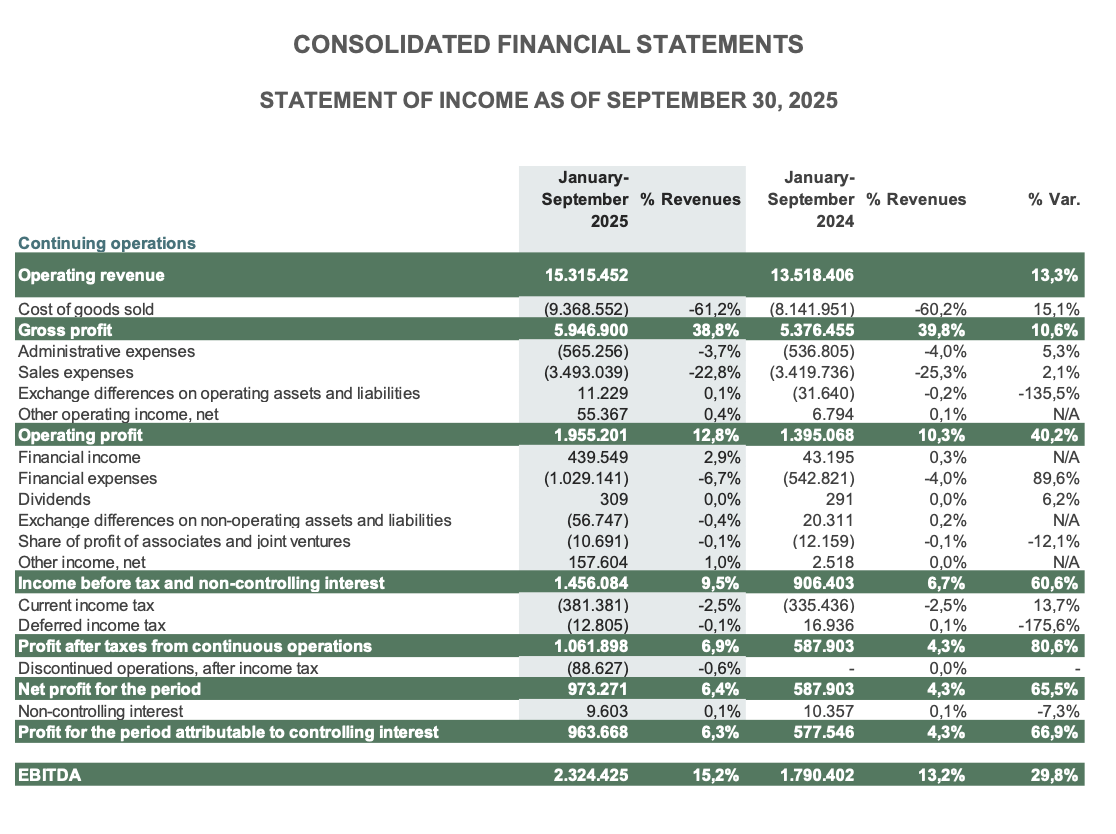

STATEMENT OF INCOME AS OF SEPTEMBER 30, 2025

Consolidated Financial Results as of September 30th, 2025

During the first nine-months of the year, Grupo Nutresa reports sales of COP 15.3 trillion, representing a 13.3% increase over the same period in 2024.

This growth was underpinned by favorable commercial dynamics, both domestically and within the core regional markets, where the company has effectively leveraged the strength of its brands and the efficiency of its distribution network.

Sales by Geography and Business

Colombia

In Colombia, revenues reached COP 9.0 trillion, representing a 10.3% growth. This performance is the result of effective business strategies across core segments, as well as continued portfolio innovation.

We highlight the above-average performance of Coffee: +27.5%, Chocolates: +14.0%, Restaurants: +9.3%, Cookies: +8.1%.

International

Sales on international platforms reached COP 6.3 trillion, an increase of 17.9%, representing 41.2% of total sales. In dollars, these revenues translate to USD 1.5 billion, representing a 13.7% increase.

International dynamism was evident across the group's main geographies. In USD, the significant growth in the Coffee (+40.7%) and Chocolate (+37.6%) business units stands out, contributing significantly to the results.

Margins and profitability

Sales growth translated into solid operating value generation. Gross profit for the period reached COP 5.9 trillion, representing a 10.6% increase compared to the same period last year. This translates into a gross margin on sales of 38.8%, reflecting an improvement in cost efficiency compared to the first half of the year.

Meanwhile, the optimization of internal processes, along with an efficient cost and expense management strategy, has driven a significant 40.2% growth in operating profit, which reached COP 1.96 trillion. It is important to note that, excluding non-recurring expenses associated with the ongoing organizational transformation plan, the Group's adjusted operating profit would´ve amounted to COP 2.06 trillion, reflecting an even broader growth of 47.7%.

In terms of key profitability, the Group's reported EBITDA stands at COP 2.32 trillion, with a growth of 29.8% and a margin on sales of 15.2%. Adjusting this indicator by the non-recurring expenses mentioned above, the adjusted EBITDA amounts to COP 2.43 trillion, with a margin on sales of 15.9%.

Post-operating Expenses and Net Income

An increase of COP 89,966 million in net financial expenses is reported in post-operating expenses, mainly explained by higher debt from the issuance of international bonds and the expenses associated with this operation.

As a result of the operational and financial effects described above, consolidated net income for the period was COP 963,668 million, representing a 66.9% increase compared to the same period last year. Excluding the effects of non-recurring expenses, adjusted net income growth would have been 69.2%.

Other Relevant Topics

During Q3, Grupo Nutresa successfully tapped into its inaugural bond, with a USD 1.0 billion-dollar issuance. The proceeds were primarily used to improve the financial conditions of its pre-existing debt and improve the company´s financial profile.

Social Investment and Sustainability

Supporting society through investments that transform realities is a priority for Grupo Nutresa.

To achieve this, the Company has committed to supporting social transformation in Colombia through three fundamental pillars: education, funding close to 200 youngsters through the "Nutresa Scholarships" program; health, contributing with scholarships for medical specialties and hospital equipment for various institutions in the country; and nutrition, recovering more than 4.2 million kilograms of food in alliance with ÁBACO's ReAgro program. Through these initiatives, more than 46,000 people in Colombia have benefited.

To support this effort, the organization will allocate COP 150 billion for social investment over a five-year period, representing a 5x funds-increase. So far this year, Grupo Nutresa has executed COP 20 billion out of a total budget of COP 30 billion, aside from the COP 22 billion already invested in 2024.

In other sustainability programs, the Company advanced in the consolidation of strategies to produce clean energy and to reduce its carbon footprint, installing 2,852 solar panels during the year and consolidating a total of 22,000 over the strategic region.

In terms of responsible and productive sourcing, the company continues to develop relationships with cocoa and coffee suppliers and farming communities in Colombia. This has been achieved with an investment of more than COP 15 billion, benefiting approximately 14,700 producing families in the country.

Jaime Gilinski, President of Grupo Nutresa, stated that "Grupo Nutresa's financial results as of the end of September 2025 are a testament to the strength of our strategy and the commitment of our teams. This achievement is possible thanks to our consumers' continued trust, our brands' equity and value, and our teams' resilience in quickly adapting to the ever-changing market dynamics.

He also stated: "As we close out the year, we will maintain our focus on innovation, operational excellence, and portfolio affordability in order to achieve the goals we have set out as an organization."

Separate Financial Statements

The Separate Financial Statements of Grupo Nutresa S.A. report net operating income of COP 995,101 million, of which COP 814,461 million correspond to profit from investments in food companies using the equity method, COP 296 million to dividends from the investment portfolio, and COP 180,344 million to income from investments sales. Net income is COP 962,604 million.

The consolidated and separate financial statements of income, the statement of financial position as of September 30, 2025, and related financial indicators, are an integral part of this news release.

Contact Information

CAMILA REY

Directora de Cuentas

camila.rey@publicisgroupe.com

SOURCE: NUTRESA

View the original press release on ACCESS Newswire