Quantum computing has gone from a lab curiosity to a boardroom talking point, but few names carry as much legacy weight as IBM (IBM). Investors watching the space want to know which firms can turn breakthroughs into real products and, eventually, profits.

IBM says it plans to deliver a system with quantum advantage by 2026 and reach fault-tolerant quantum computing by 2029, driven by its new Quantum Nighthawk processor. Nighthawk is billed to run noticeably more complex circuits and link scores of qubits with next-generation couplers, while software and error-correction gains aim to boost accuracy and cut execution costs.

For long-term growth seekers, that roadmap raises a clear question: Does IBM’s scale and fab strategy give it a lead worth buying now, or is the stock priced for perfection before the hard work of commercialization begins? Let's try to find out the answer.

About IBM Stock

Founded in 1911, International Business Machines is one of the world’s oldest tech companies, offering enterprise hardware, software, and services. IBM’s portfolio spans mainframe servers, enterprise software (Red Hat, WatsonX AI tools, etc.), and IT consulting. It operates globally (175+ countries) with a large roster of Fortune 500 clients and is now pivoting toward hybrid cloud and generative AI.

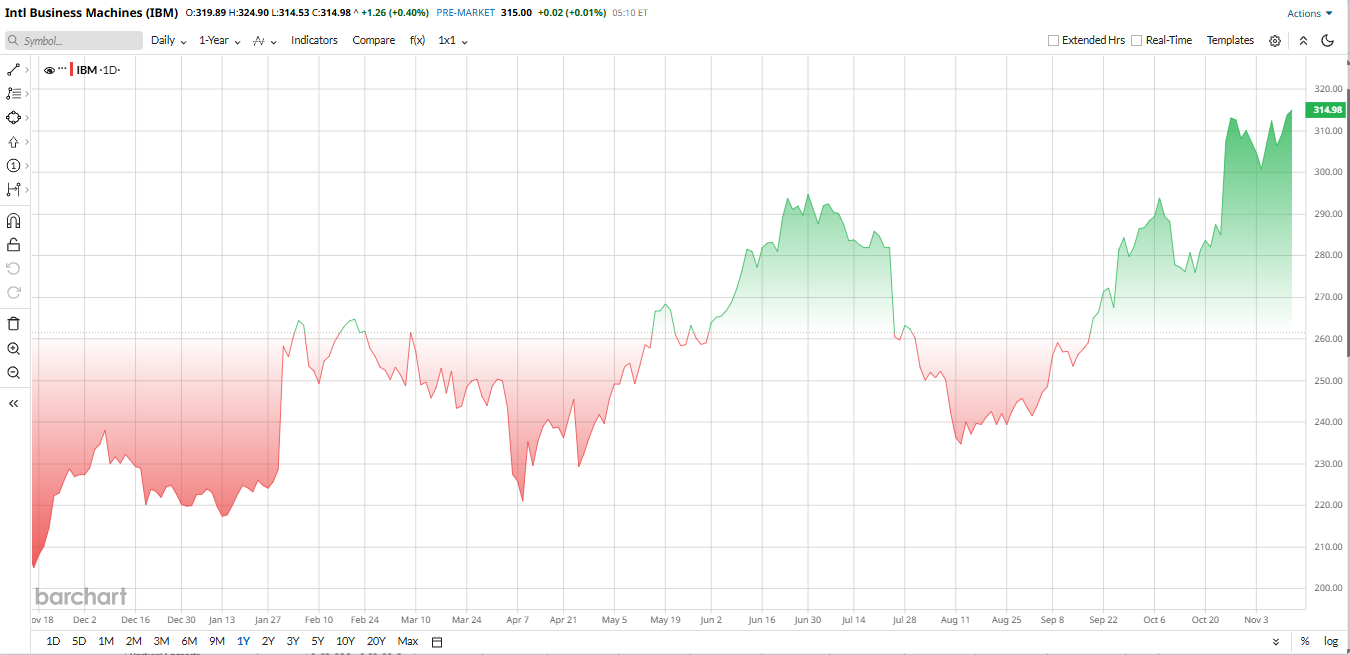

Valued at around $295 billion by market cap, IBM’s stock has been one of the market’s winners in 2025. Its shares have surged roughly 41% year-to-date (YTD), easily outperforming the 15% rise of the S&P 500 ($SPX). This rally was fueled by IBM’s strong earnings and the quantum news at the developer conference. Investors cite multiple drivers like solid cloud/AI growth, mainframe demand, and confidence in IBM’s AI/business transformation.

From a valuation perspective, IBM isn’t a screaming bargain. Its forward P/E is about 26x and its EV/EBITDA is near 25x. Those are well above industry medians of around 24x and 11x, respectively. Put simply, IBM isn’t “cheap” or “expensive” on these metrics; it trades at moderate premiums to peers.

IBM Delivered a Beat-and-Raise Quarter

IBM delivered a beat-and-raise third quarter with revenue of $16.3 billion, up 9% year-over-year (YoY) (7% constant currency). The Growth was driven by a broad-based approach. Software revenue rose 10% to $7.2 billion, Consulting increased 3% to $5.3 billion, and Infrastructure jumped 17% to $3.6 billion. Hybrid cloud and AI-related units, led by Red Hat, which grew by 14%, drove gains.

In profitability terms, net income was $1.7 billion, compared with a loss a year earlier, while adjusted EPS climbed 15% to $2.65. IBM’s gross margin expanded to 57.3%, supporting strong profitability.

Free cash flow reached $2.4 billion, up $0.3 billion, with cash and securities totaling $14.9 billion.

Following the report, Wedbush raised its full-year EPS forecast to $11.44. IBM raised its guidance and now expects FY2025 revenue growth above 5% (constant FX) and free cash flow around $14 billion, signaling stronger Q4 momentum.

CEO Arvind Krishna highlighted the company’s accelerating performance, citing broad-based growth and execution: “Clients globally continue to leverage our technology and domain expertise… Our AI book of business now stands at more than $9.5 billion.”

Overall, IBM’s Q3 report was solid, easing concerns about legacy drag. Strength in AI, cloud, and recurring revenues, combined with healthy cash generation, indicates that IBM’s multi-year transformation remains on track.

IBM’s Quantum Leap

IBM made headlines at its Quantum Developer Conference on Nov. 12 after unveiling its new 120-qubit Quantum Nighthawk processor and updated roadmap. The chip, featuring 218 tunable couplers, can execute circuits roughly 30% more complex than previous systems. IBM said the breakthrough marks a crucial step toward achieving quantum advantage by 2026 and fault-tolerant quantum computing by 2029.

The company also showcased an experimental “Quantum Loon” platform integrating all components needed for error-corrected quantum systems. The announcements fueled investor optimism, sending IBM shares up about 2% on intraday trading to a fresh all-time high. IBM plans to expand Nighthawk’s capabilities to 7,500 two-qubit gates by 2026, scaling to 15,000 by 2028.

What Do Analysts Say About IBM Stock

The analyst community is usually bullish on IBM. Following Q3 earnings, Goldman Sachs reiterated a “Buy” rating with a lofty $350 price target. GS analysts applauded IBM’s strong margin expansion and FCF guidance, and they expect software growth to accelerate in 2026 as the business pivot continues. They see IBM’s strategy on track, ultimately supporting a higher valuation.

By contrast, Morgan Stanley’s Erik Woodring remains cautious. He kept an “Equal-Weight” rating and slightly lowered his target to about $252 post-earnings. MS notes that while IBM is executing, short-term headwinds in traditional software and modest Red Hat growth could pressure results. They’re skeptical that recent beats will sustain long-term upside without tangible AI and quantum wins.

Meanwhile, RBC Capital is more optimistic. In mid-October, RBC’s Matt Swanson affirmed an “Outperform” stance, though he trimmed his price target from $315 to $300. Generally, RBC argues IBM’s growth momentum and cash flow justify a “Buy” thesis.

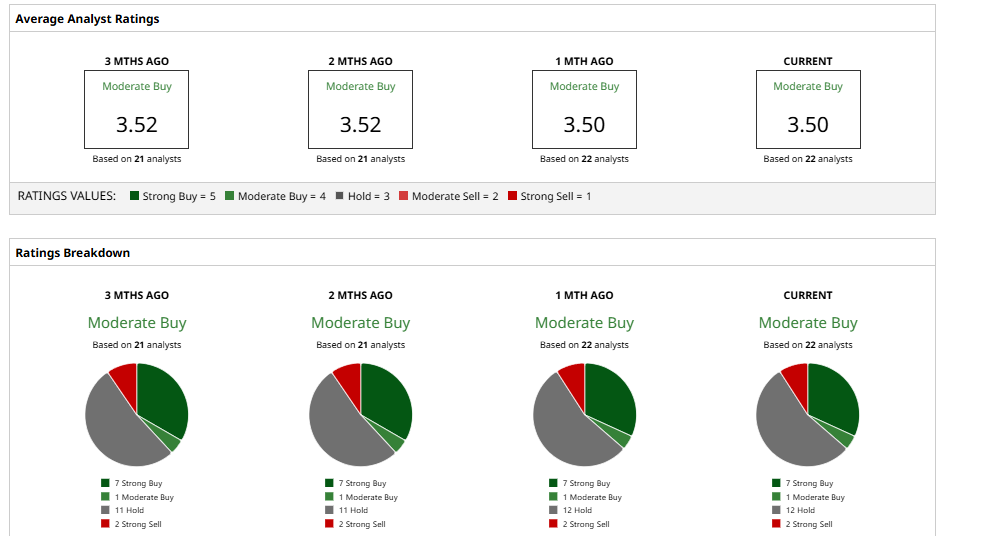

Overall, consensus from 22 Wall Street analysts is “Moderate Buy,” with a mean price target of $286, which implies an expected 7% upside from current levels.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Find Stocks to Trade Before the Rest of the Market by Adding This Trend Indicator to Your Charts

- IBM Is Staring Down Quantum Advantage. Should You Buy IBM Stock First?

- Michael Burry Shutters Hedge Fund as Trump’s 50-Year Mortgage Threatens an $11 Trillion Housing Collapse – Is Big Short 2.0 Brewing in Housing, Not Tech?

- Nvidia Stock Is a High-Stakes Trade Ahead of November 19. How to Hedge the Risk of a Post-Earnings Plunge.