With a market cap of $116.6 billion, Chubb Limited (CB) is the world’s largest publicly traded property and casualty insurance company, offering a wide range of insurance and reinsurance products to businesses and individuals worldwide. Headquartered in Zurich, Switzerland, Chubb is known for its strong underwriting expertise, financial strength, and broad global presence.

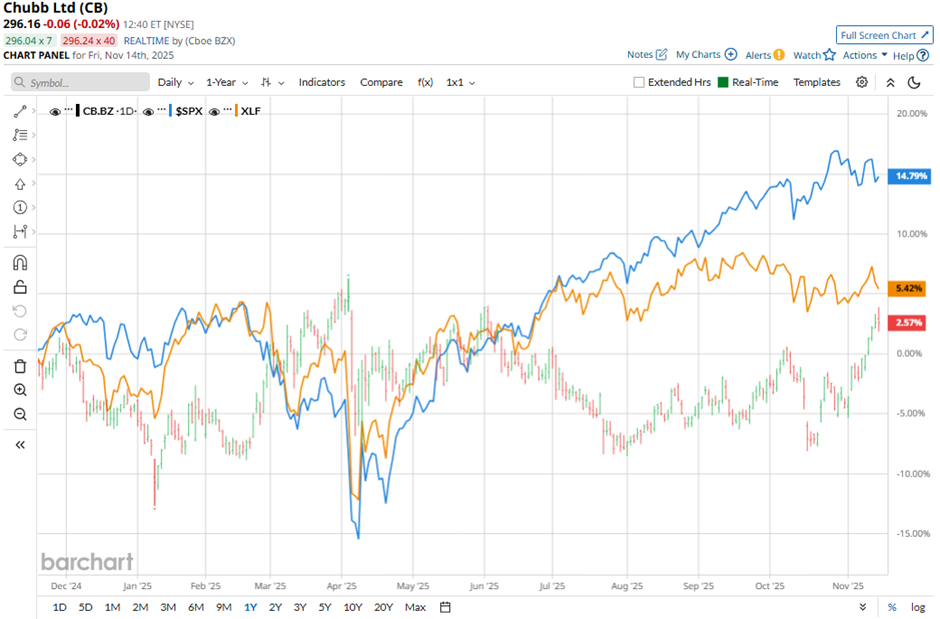

The insurer's shares have underperformed the broader market over the past 52 weeks. CB stock has risen 3.1% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 22.3%. Moreover, shares of the company are up 7.1% on a YTD basis, compared to SPX’s nearly 4% gain.

In addition, shares of Chubb have also lagged behind the Financial Select Sector SPDR Fund’s (XLF) 6.3% return over the past 52 weeks.

Shares of Chubb rose 2.7% following its Q3 2025 results on Oct. 21 as the company reported adjusted EPS of $7.49, topping forecasts. Investors were encouraged by a sharp improvement in underwriting performance, including record underwriting income of $2.26 billion and a record combined ratio of 81.8%. Sentiment was further boosted by stronger profitability drivers such as a 9.3% increase in net investment income to $1.65 billion, lower catastrophe losses of $285 million, and solid 5.3% growth in global P&C premiums.

For the fiscal year ending in December 2025, analysts expect CB’s adjusted EPS to grow 4.4% year-over-year to $23.50. The company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

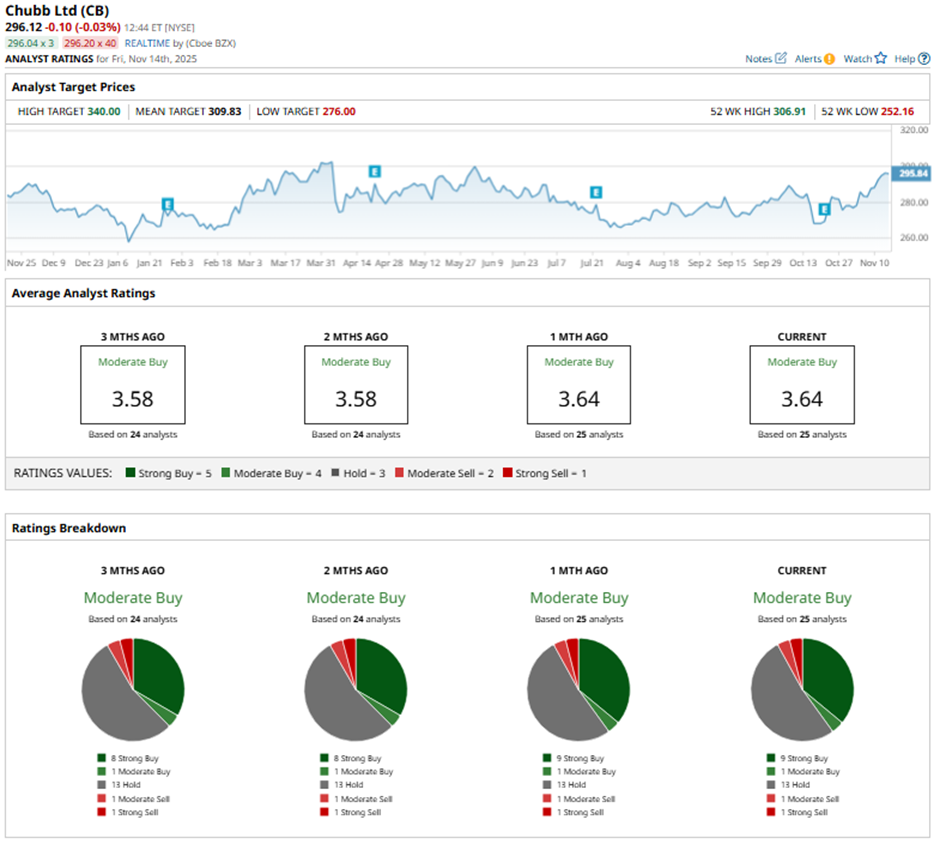

Among the 25 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on nine “Strong Buy” ratings, one “Moderate Buy,” 13 “Holds,” one “Moderate Sell,” and one “Strong Sell.”

This configuration is slightly more bullish than three months ago, with eight “Strong Buy” ratings on the stock.

On Oct. 27, Cantor Fitzgerald raised its price target on Chubb to $300 while maintaining a “Neutral” rating.

The mean price target of $309.83 represents a 4.6% premium to CB’s current price levels. The Street-high price target of $340 suggests a 14.8% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Analyst Warns Tesla Stock Could Plunge 70% Despite Elon Musk’s $1 Trillion Pay Package Win

- Michael Burry Warned That the AI Bubble Is About to Burst. If You Agree, Use Options to Bet Against These 2 Stocks.

- Cathie Wood Is Buying the Dip in Circle Stock. Should You?

- These 3 Unusually Active Puts Deep ITM Offer Strategic Plays for Both Bulls and Bears