Recently, Robinhood Markets (HOOD) shares took a hit as a selloff in cryptocurrencies rippled through the market. Bitcoin (BTCUSD) and other coins slumped as Bitcoin briefly touched $98.4K on Nov. 13, and HOOD stock slid about 10% on the same day. Still, big players are not giving up on Robinhood. Hedge fund Bridgewater Associates disclosed that it opened a new $115.6 million position in Robinhood in Q3. The timing is notable: Bridgewater’s buy contrasts with the recent volatility. That move tells you two things at once: big-money managers see value buried under the short-term crypto slump, and they’re willing to back Robinhood’s comeback story. Despite near-term headwinds, Robinhood still owns a huge branded user base, growing non-crypto revenue streams, and the kind of retail distribution others envy.

If Bridgewater’s sniff test matters to you, HOOD looks like a beaten-down growth play that could rebound as markets normalize and the company monetizes its audience more effectively.

About HOOD Stock

Founded in 2013, Robinhood Markets is a fintech brokerage entity. It offers commission-free trading of stocks, ETFs, options, and cryptocurrencies via a mobile app. The company has since expanded into new services, like prediction markets, digital banking, and a crypto exchange, to broaden its retail-finance platform.

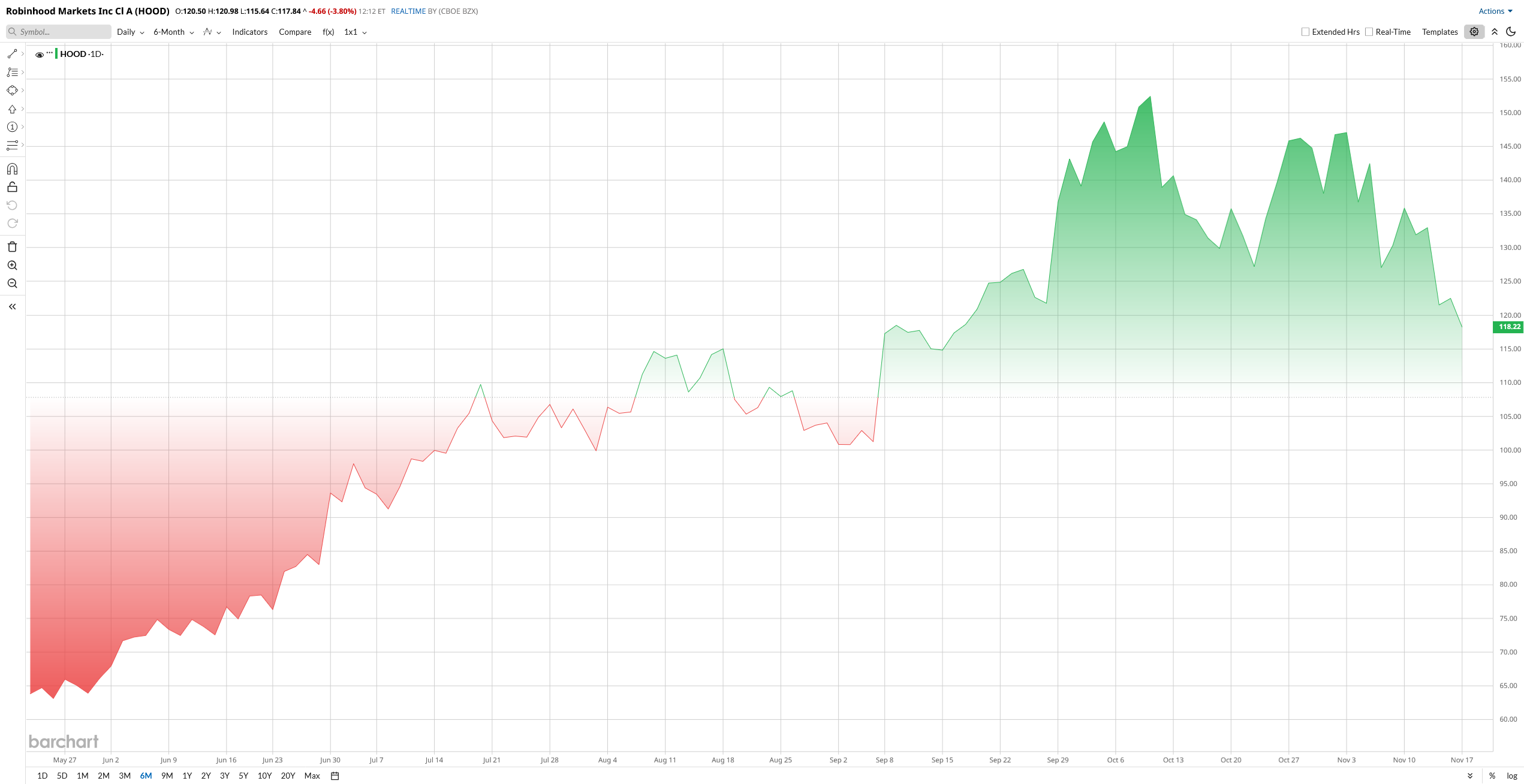

Valued at $110 billion by market cap, Robinhood shares have performed exceptionally in 2025, soaring about 215% year-to-date (YTD) as booming crypto and equity trading fueled explosive revenue growth. Strong Q3 results, surging activity, and upbeat investor sentiment pushed the stock sharply higher before November’s profit-taking pullback.

After the big run-up, the stock now looks pricey. Its price-to-book (P/B) ratio sits at 13.67, far above the sector’s 1.21 average, which makes it look expensive compared to similar companies. With valuations this high, the stock may be getting ahead of itself.

Crypto Market Impact

Late in Q3 and early Q4, a broad crypto downturn dragged on Robinhood. Traders pulled back as Bitcoin and Ethereum (ETHUSD) declined in November, softening volumes. For example, on Nov. 13, the entire crypto sector tumbled, and Robinhood’s stock fell 10% on that one day. Analysts noted that even though crypto revenue tripled year-over-year, it fell slightly short of lofty estimates, which rattled sentiment. As one J.P. Morgan analyst put it, “The earnings beat was driven by tax benefits, but the top-line was weaker versus expectations in the highly scrutinized crypto revenue line.”

The selloff looks like a cyclical hiccup. Robinhood is diversifying fast: CEO Vlad Tenev emphasized “relentless product velocity” as new services (prediction markets, soon-to-roll-out banking) start to contribute. And Bridgewater’s big bet shows some investors see value in the dip. If crypto markets stabilize and Robinhood’s new products gain traction, the stock could bounce back. In the near term, expect volatility. But long-term, HOOD’s fast growth pipeline (crypto, options, new offerings) may justify bullishness.

HOOD Beats Q3 Earnings Estimate

Robinhood reported a blowout quarter, with every major line item swinging sharply higher from a year ago. Revenue hit $1.27 billion, roughly double last year’s tally. Most of that came from a surge in trading activity; transaction-based fees climbed to $730 million, while net interest revenue added another $456 million, and the rest came from about $88 million in other income.

Earnings were just as strong. Net income jumped to $556 million, up more than 270%, and diluted EPS landed at $0.61, also more than tripling year-over-year (YoY).

The balance sheet stayed solid, too. Robinhood closed the quarter with $4.3 billion in cash and equivalents, slightly below the $4.6 billion it held a year earlier. Free cash flow wasn’t broken out, but liquidity doesn’t appear to be an issue.

During the earnings call, management also spotlighted its new growth engines. Both Prediction Markets and the Bitstamp crypto exchange, acquired earlier in the year, are now each generating $100-plus million in annualized revenue. CEO Vlad Tenev said October kicked off Q4 with fresh volume highs across equities, options, futures, and prediction markets.

If we look at forward-looking numbers, they were thin. Robinhood didn’t issue full-quarter or full-year revenue guidance, though CFO Jason Warnick did lift the company’s 2025 operating expense outlook to about $2.28 billion, up from the prior $2.15 to $2.25 billion range.

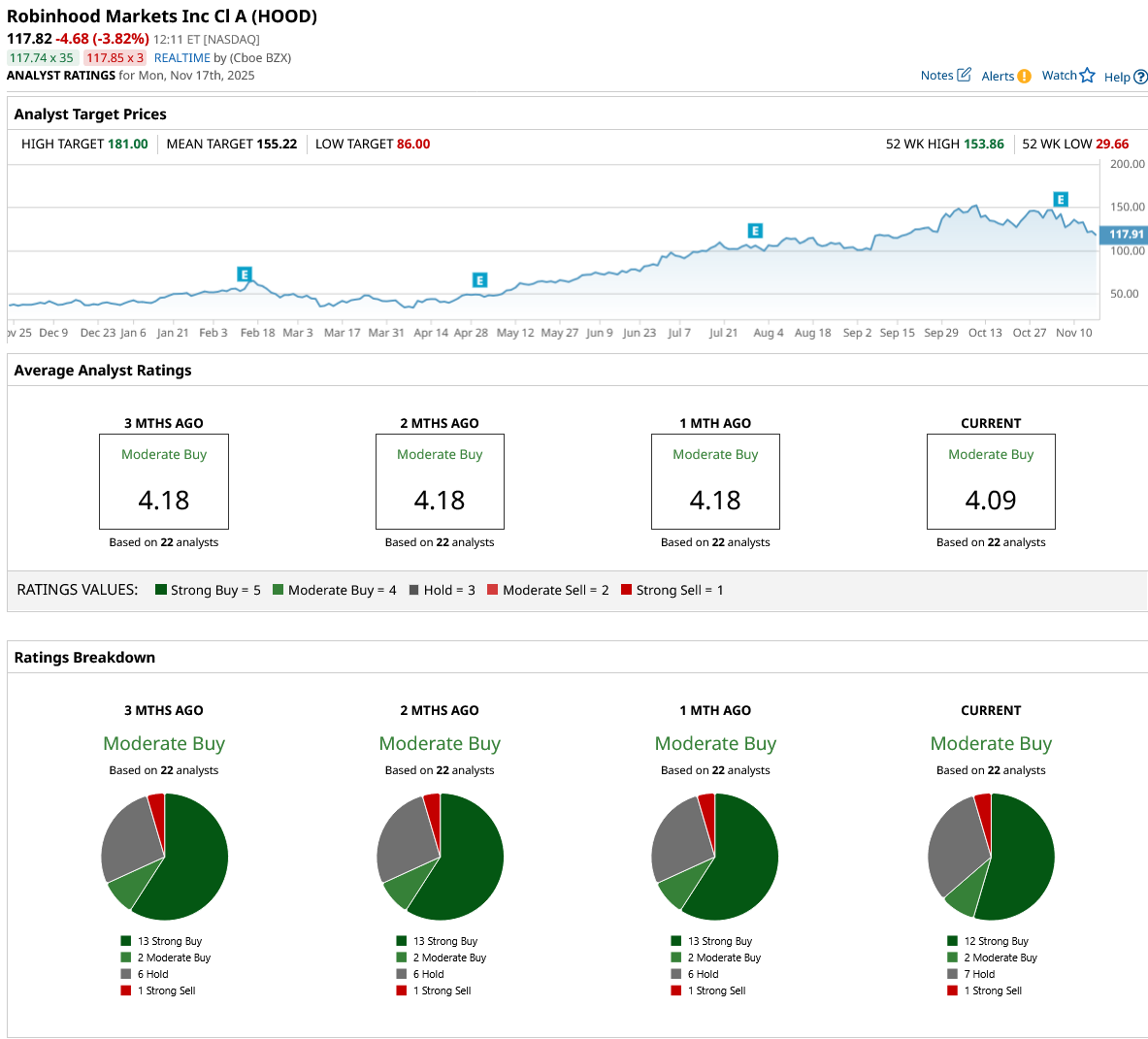

Analyst Sentiment and Price Targets

Wall Street’s recent comments on HOOD skew upbeat. After the Q3 report, several firms raised their targets. For instance, Morgan Stanley analyst Michael Cyprys maintained an “Equal-Weight” rating but upped his 1-year target to $146 from $110. Goldman Sachs’ Will Nance, who has a “Buy” rating, has a $152 target. Needham’s John Todaro, also a “Buy,” nudged his target to $145.

For comparison, before this rally, some targets were in the $100s or lower. Even Citigroup and Deutsche Bank recently pushed their targets into the $155 range. The average consensus price target is now around $155, implying only modest upside from current levels of roughly $125 to $130.

Overall, analysts are moderately bullish on HOOD stock, with a consensus rating of “Moderate Buy” from 22 analysts in coverage. The average 12-month price target set by analysts is $155.22, which implies an expected 27% upside potential from current levels.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The Crypto Selloff Is Weighing Down Robinhood Stock, but Bridgewater Is Betting Big

- Bullish Shares Are Down 35% in the Past Month. Should You Buy the Dip in BLSH Stock?

- MicroStrategy Falls Below Net Asset Value Amid Crypto Crash. Should You Buy the Dip in MSTR Stock?

- Cathie Wood Is Buying the Dip in Circle Stock. Should You?