With a market cap of $59.3 billion, Vistra Corp. (VST) is the largest competitive power generator in the U.S., with 41,000 megawatts of capacity, enough to power 20 million homes. Its diverse natural gas, nuclear, coal, solar, and battery storage portfolio supports its goal of cutting emissions 60% by 2030 and reaching net-zero by 2050.

Shares of the Irving, Texas-based company have outpaced the broader market over the past 52 weeks. VST stock has soared nearly 19% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 12.3%. Moreover, shares of the company are up 26.5% on a YTD basis, compared to SPX's 12.5% gain.

Looking closer, shares of Vistra have outperformed the Utilities Select Sector SPDR Fund's (XLU) 11.6% rise over the past 52 weeks.

VST shares fell 2.5% on Nov. 6 because Q3 2025 net income dropped sharply to $652 million, down from $1.84 billion last year, driven largely by a $1.67 billion decline in unrealized mark-to-market gains and the Martin Lake Unit 1 outage. Investors also reacted to the company narrowing its 2025 adjusted EBITDA guidance to $5.7 billion - $5.9 billion.

For the fiscal year ending in December 2025, analysts expect VST's EPS to decline 2% year-over-year to $6.86. The company's earnings surprise history is mixed. It beat or met the consensus estimates in three of the last four quarters while missing on another occasion.

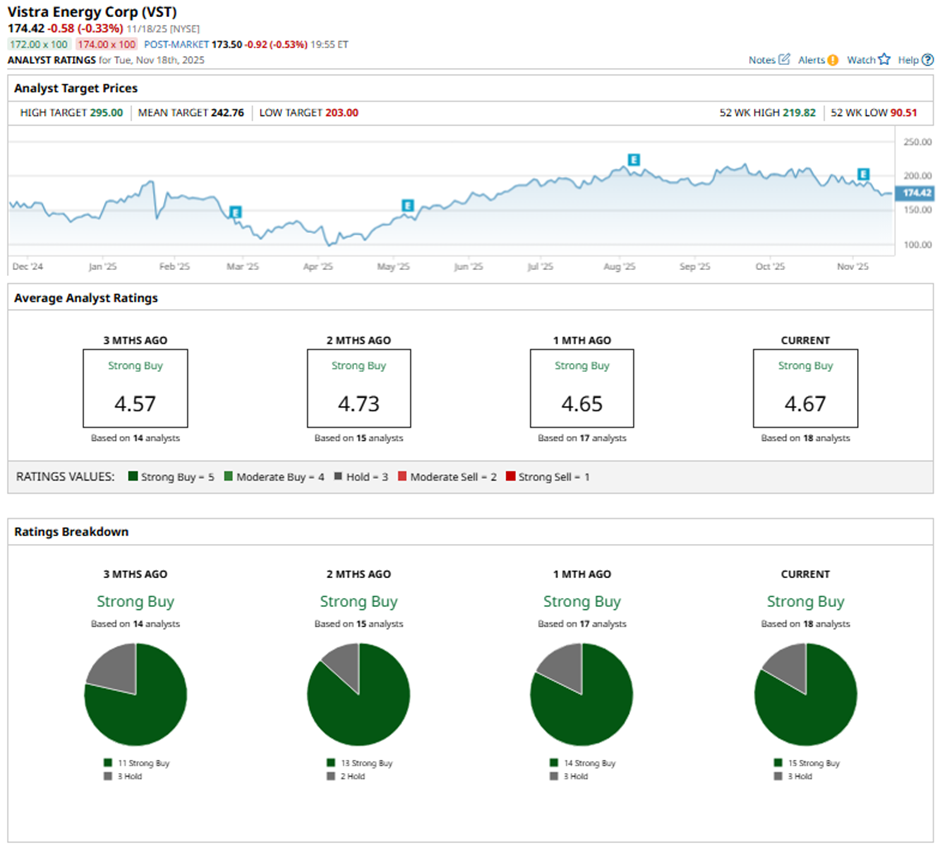

Among the 18 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 15 “Strong Buy” ratings and three “Holds.”

This configuration is more bullish than three months ago, with 11 “Strong Buy” ratings on the stock.

On Nov. 7, BMO Capital’s James Thalacker raised Vistra’s price target to $245 and reiterated an “Outperform” rating.

The mean price target of $242.76 represents a premium of 39.2% to VST's current price. The Street-high price target of $295 suggests a 69.1% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This High-Yield Dividend Stock Can Keep Your Portfolio Safe in a Storm

- Should You Buy the Dip in Cloudflare Stock or Stay Far Away After Widespread Internet Outages?

- AI Spending Is ‘NOT’ Slowing Down, According to Wedbush. That Makes Nvidia Stock a Buy Before November 19.

- This Consumer Stock is Already in a Bear Market. Smart Money Sees 20% More Downside Ahead.