New York-based The Goldman Sachs Group, Inc. (GS) is a financial institution that provides a range of financial services for corporations, financial institutions, governments, and high-net-worth individuals. With a market cap of $240.6 billion, the company specializes in investment banking, trading and principal investments, asset management and securities services.

Companies worth $200 billion or more are generally described as “mega-cap stocks,” and GS definitely fits that description, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the capital markets industry. Goldman Sachs' diversified revenue streams, driven by trading and investment banking, help mitigate economic risks. Its strategic advisory, underwriting, and market-making expertise showcase its strength in client transactions and risk management, giving it a competitive edge.

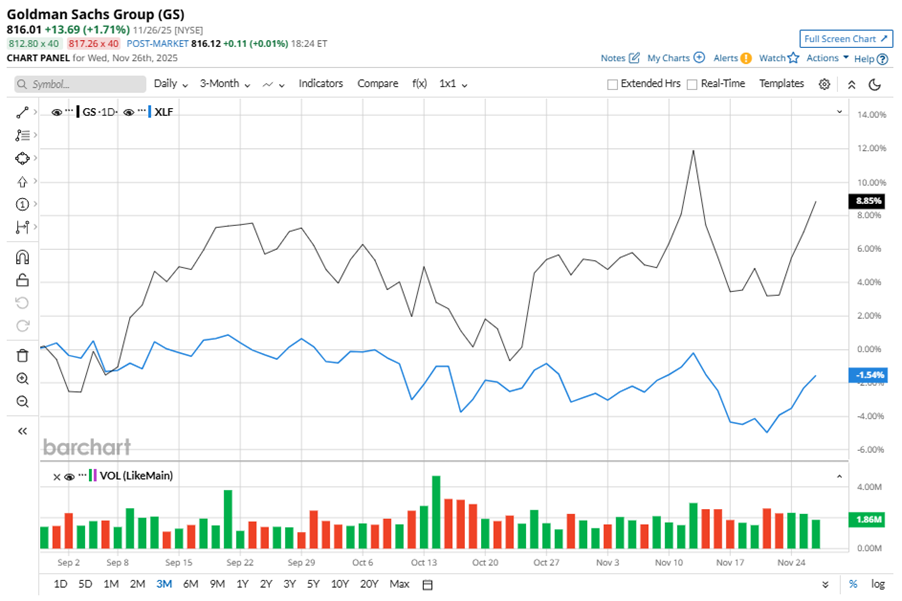

Despite its notable strength, GS slipped 3% from its 52-week high of $841.28, achieved on Nov. 13. Over the past three months, GS stock gained 9%, outperforming the Financial Select Sector SPDR Fund’s (XLF) 1.3% dip during the same time frame.

In the longer term, shares of GS rose 42.5% on a YTD basis and climbed 34.8% over the past 52 weeks, outperforming XLF’s YTD gains of 9.6% and 3.5% returns over the last year.

To confirm the bullish trend, GS has been trading above its 50-day and 200-day moving averages since early May, with slight fluctuations.

Goldman Sachs is crushing it due to its Excel Sports Management deal and strong investment banking performance. They're seeing a resurgence in M&A, record inflows in asset and wealth management, and growth in prime brokerage and structured lending. Their One Goldman Sachs 3.0 initiative, fueled by AI, is driving efficiency and scalability. With a constructive regulatory environment and anticipated interest rate cuts, they're expecting ongoing strength in investment banking and private market solutions.

On Oct. 14, GS shares closed down more than 2% after reporting its Q3 results. Its EPS of $12.25 exceeded Wall Street's $11.11 estimate. The company’s revenue net of interest expense was $15.2 billion, topping Wall Street forecasts of $14.1 billion.

In the competitive arena of capital markets, Morgan Stanley (MS) has lagged behind the stock, showing resilience with 33.6% gains on a YTD basis and a 27.9% uptick over the past 52 weeks.

Wall Street analysts are reasonably bullish on GS’ prospects. The stock has a consensus “Moderate Buy” rating from the 25 analysts covering it. While GS currently trades above its mean price target of $805.48, the Street-high price target of $960 suggests a 17.6% upside potential.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- ‘Insatiable’ Demand Is Powering This ‘Picks and Shovels’ AI Stock up 245%. Should You Buy It Here?

- Using Probability Density to Extract a Huge Payout from Microchip’s Potential Breakout

- Dear UnitedHealth Stock Fans, Mark Your Calendars for January 30

- As Founder Ray Dalio Warns the Market Is in a Bubble, Bridgewater Associates Just Bought CoreWeave Stock