The demand for high-precision lasers is soaring, and the runway ahead looks even more electrified. As artificial intelligence (AI) workloads grow heavier and cloud giants race to upgrade their optical backbones, demand for faster, sharper, and more resilient laser technology is rising, setting the stage for some suppliers to thrive.

Lumentum Holdings (LITE) is the optical-components craftsman quietly powering this surge. Known for its mastery in Indium Phosphide and cutting-edge electro-absorption modulated lasers, the company has evolved far beyond its telecom roots, becoming an essential cog in the AI-driven cloud infrastructure machine.

No surprise, then, that the stock has rocketed 267% in 2025, propelled by an avalanche of hyperscale demand reshaping the firm into one of the fastest-rising players in next-gen connectivity. Wall Street is leaning in too, with analysts increasingly upbeat about the company’s accelerating momentum. Needham even crowned it a “Top Pick for 2025,” citing “insatiable laser demand” and unmatched fabrication prowess.

But with the stock already soaring, is now the moment for investors to jump in, or wait for a better entry point?

About Lumentum Stock

Lumentum, valued at $20.1 billion and founded in 2015, is a San Jose-based optical technology leader powering the modern AI era. The company builds laser chips, photonic components, and high-speed transceivers used across AI data centers, cloud networks, and global fiber systems. Operating worldwide, Lumentum runs two segments - Cloud & Networking - supplying advanced optics to hyperscalers and network equipment makers, and Industrial Tech, providing precision lasers for semiconductors, solar, displays, and EV manufacturing.

This year, Lumentum emerged as a standout beneficiary of the AI infrastructure boom. Shares of the optical components manufacturer spiked and hit $300 recently before easing slightly, a breather after a stunning run fueled by knockout earnings and bullish analyst targets.

Over the past 52 weeks, shares have climbed 254%, with a breathtaking 307% surge in just six months. That’s the kind of momentum that usually signals a shift in a company’s long-term trajectory. Trading volume has picked up noticeably, confirming strong confidence underneath the rally.

Technically, the picture shows a market still energized but catching its breath. The 14-day RSI, which briefly flashed overbought a couple of days ago, has cooled to 66.38, suggesting momentum remains strong but no longer overheated.

Meanwhile, the MACD yellow line, which spent weeks comfortably above the blue signal line, has now crossed beneath it. It is an early bearish crossover that typically indicates slowing short-term momentum. The histogram has dipped slightly into negative territory, reinforcing this cooling phase. Yet the weakness appears modest, suggesting a normal cooldown rather than a real break in the stock’s broader upward trend.

Lumentum’s stock is priced at about 53 times forward adjusted earnings and 11.3 times sales – it sits above sector peers and its own historical averages. That is the kind of premium the market reserves for a company riding a powerful structural wave, yet one that also tests how much future brilliance investors are willing to price in.

Lumentum’s Shares Rise After Q1 Results

Lumentum released its Q1 fiscal 2026 results on Nov. 4, and the quarter impressed investors, with the stock rising nearly 24% in the next trading session. Revenue surged to $533 million, a towering 58% year-over-year (YOY) jump and the largest quarterly figure in the company’s decade-long history. Adjusted EPS spiked to $1.10, from $0.18 in last year’s quarter, surging past Wall Street’s expectation – signaling a business hitting a new gear as AI demand floods in.

What stands out most is the company’s shifting center of gravity. Over 60% of Q1 revenue is now tied directly or indirectly to cloud and AI infrastructure, underscoring how decisively Lumentum has stepped beyond its telecom heritage.

As the company’s profile changed rapidly, management introduced a clearer breakdown of its business lines. The new Components segment, home to laser chips, assemblies, subsystems, and wavelength-management parts, delivered $379.2 million, up 18% sequentially and 64% YOY. The Systems business, which includes transceivers, optical circuit switches, and industrial lasers, contributed $155 million, down modestly from Q4 but up 47% annually.

Gross margin widened to 39.4%, thanks to stronger utilization and swelling shipments of high-performance laser chips built for hyperscale workloads. Plus, the company held $1.1 billion in total cash, cash equivalents, and short-term investments at the end of the first quarter of fiscal year 2026, up $244.7 million from the end of the fiscal Q4 2025.

But the real jolt comes from Lumentum’s accelerated growth trajectory. A milestone initially expected sometime in mid-2026 has been pulled dramatically forward. Management now projects Q2 revenue to land between $630 million and $670 million, with a midpoint of $650 million – shattering its old timeline by two quarters. Both components and systems segments are expected to fuel this sequential climb, led by continued momentum in high-speed cloud transceivers.

Looking ahead, Lumentum sees itself still in the early innings of an AI-centric expansion supercycle. Cloud transceivers, optical circuit switches, and co-packaged optics are set to act as the company’s long-term growth engines. Adjusted EPS for Q2 is guided to come in between $1.30 and $1.50, reflecting rising profitability alongside rapid scaling.

Meanwhile, analysts monitoring Lumentum expect the company’s Q2 EPS growth of 735.7% YOY to $0.89, with revenue around $646 million. Fiscal 2026 EPS is expected to be $3.61, up 836.7% annually, and rise by another 65.7% to $5.98 in fiscal 2027.

What Do Analysts Expect for Lumentum Stock?

Needham’s upgraded stance on Lumentum is like a meticulously crafted stamp of confidence. The brokerage firm reiterated its “Buy” rating and raised the price target sharply higher to $290 from $235, signaling conviction that the AI-driven laser boom is still in its early chapters.

Analyst Ryan Koontz paints Lumentum as a powerhouse riding “insatiable laser demand,” with its Indium Phosphide and EML technologies facing global shortages and widening supply gaps through 2026. The analyst believes Lumentum’s aggressive capacity expansion, flexible production lines, and deep specialization position it as the largest commercial laser supplier to the cloud industry.

The brokerage firm highlights that Cloud Light’s transceivers are already shipping to all three hyperscalers and that high-speed XCVR demand is set for over 30% CAGR through 2028. In Needham’s eyes, Lumentum is not just keeping pace, but it is becoming a key supplier shaping the AI optical race.

Mizuho lifted its price target to $325 from $290 while reiterating its “Outperform” rating, signaling strengthened conviction in LITE’s role at the center of the AI hardware stack. What sparked the upgrade is a surge in optimism around Google’s TPU ramp-up, which Mizuho views as a direct catalyst for Lumentum’s optical compute switch business – a technology increasingly vital as hyperscalers push for faster, denser, and more energy-efficient data movement.

Mizuho says Meta’s potential shift to Google TPUs strengthens the industry’s tilt toward TPU-centric systems, boosting Lumentum’s optical switch opportunity. Combined with strong AI infrastructure spend and HBM momentum, the firm sees a stronger runway for Lumentum ahead.

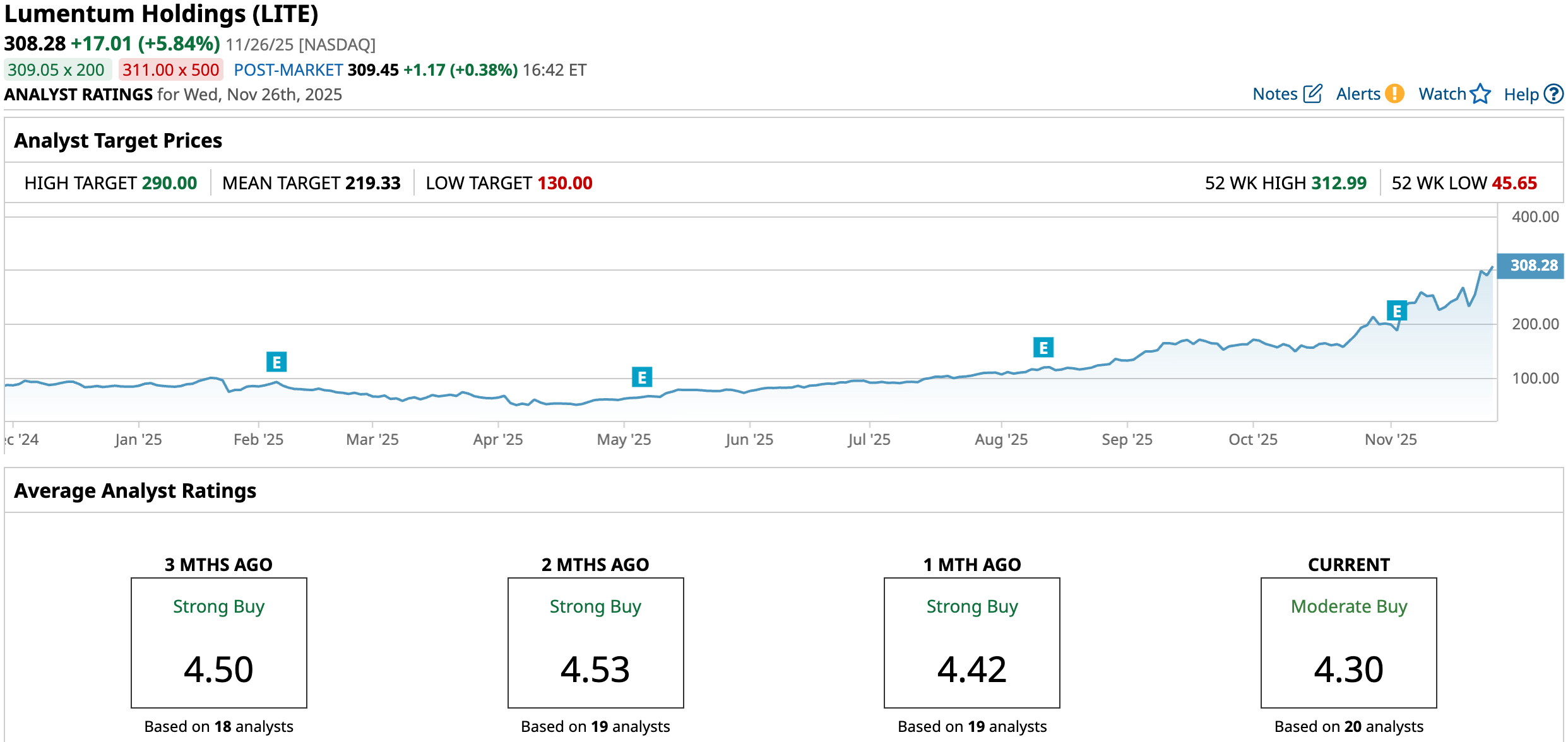

Lumentum has a consensus “Moderate Buy” rating overall – a downgrade from the “Strong Buy” rating a month back. Out of the 20 analysts offering recommendations for the stock, 12 suggest a “Strong Buy,” two advise a “Moderate Buy,” and the remaining six give a “Hold” rating.

After its impressive run this year, LITE now trades above its average price target of $219.33. Yet, Mizuho’s Street-high $325 target price still flags roughly 5.42% upside potential from here.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 3 Buy-Rated Dividend Aristocrats Easily Beating Inflation

- ‘Insatiable’ Demand Is Powering This ‘Picks and Shovels’ AI Stock up 245%. Should You Buy It Here?

- Using Probability Density to Extract a Huge Payout from Microchip’s Potential Breakout

- Dear UnitedHealth Stock Fans, Mark Your Calendars for January 30