GameStop Corp (GME) reported excellent results yesterday for its fiscal Q2 ended Nov. 1. Today, there is a huge, unusual call options trading in GME. GME stock is well off its recent highs. Should investors buy GME stock?

GME is down today, trading at $21.75 per share, up from a recent low of $19.94 on Nov. 20. Nevertheless, GME is still well off its recent closing peak of $27.69 on Oct. 1.

Strong Results, But Lower Than Last Quarter

GameStop Corp.'s Q3 revenue was down 4.57% YoY, but it does not report its comparable store sales, nor its store count (which is likely down YoY).

Nevertheless, compared to last quarter, its $821 million in Q3 sales were off 15.5% ($972.2 million).

However, the company reported a strong 33.3% gross margin, up from 29.9% a year ago and 29.1% last quarter. This was driven by strong Collectibles sales (up +49.7% YoY and +12.5% QoQ).

At this pace, GameStop store revenue will be mostly made up of Collectibles like Pokémon cards in the next year or so. These sales have much higher margins than its hardware and software sales.

As a result, its adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) margin kept pace, despite lower sales and lower adj. EBITDA compared to last quarter.

It came in at 7.84% of sales in Q2, vs. 7.79% in Q1. This cash flow measure implies that GameStop's profitability is continuing strongly.

Moreover, its free cash flow (FCF) margin rose in Q3 vs. Q2, according to Stock Analysis data.

It generated $107 million in FCF on $821.0 million in sales or a 13.0% FCF margin. That was higher than the 11.65% FCF margin last quarter, despite slightly lower FCF (i.e., $113.3m FCF/$972.2m sales = 11.65%).

That means the company is squeezing out more cash from its operations, despite declining sales revenue. That has good implications going forward.

That could also be why investors are buying large amounts of its call options.

Huge Unusual Call Options Volume

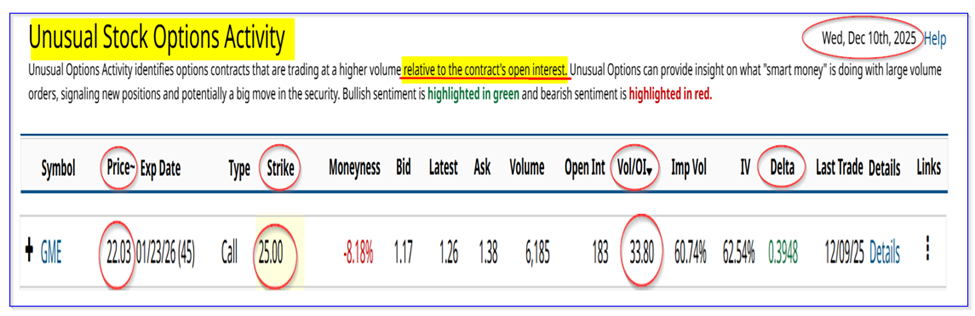

This can be seen in today's Barchart Unusual Stock Options Activity Report. It shows that 6,185 GME call options have traded at the $25.00 strike price, which is well over today's price. They expire in 45 days, Jan. 23, 2026, implying that investors initiating the trades are relatively bullish on GME stock.

For example, GME only has to rise by over 14.94% or $3.25 for these call options to begin to have some intrinsic value. The net breakeven, given the $1.26 premium, is over 20% higher:

$25+$1.26=$26.26; $26.26-$21.75=$4.51; $4.51/$21.75 = 1.207-1= +20.7%

In other words, buyers of these calls hope to see GME stock rise 21% in the next month and a half for their investment to have positive intrinsic value.

Of course, the premium could rise faster than this due to its projected accrued extrinsic value.

Moreover, even sellers of these calls may expect GME to rise from here. They are likely selling covered calls and are happy to collect a 5.38% income (i.e., $1.17/$21.75 = 0.0538) for the next month.

And even if GME rises to $25 by Jan. 23, its total return is +20.32% (+14.94% +5.38% = 20.32%). So, that also implies a bullish outlook on GME stock as well.

So, should investors follow this trade and/or buy GME stock here? It looks like a good bet on a sum-of-the-parts (SOTP) basis.

Sum-of-the-Parts (SOTP) Price Target

I discussed GameStop's SOTP value in my last Barchart article on Sept. 14. This adds up the value of its stores, Bitcoin holdings, and its net cash.

Stores. For example, I projected that the stores could be worth $8.32 billion, or 2.0x analysts' sales projections of $4.16 billion, according to Seeking Alpha.

That also works out to 23x (i.e., a 4.033% FCF yield), its FCF projected next year:

0.0784 x $4.28 billion 2026 sales est. (Seeking Alpha) = $335.55 million

$335.55/$8,320m valuation = 0.04033

That $8.32 billion valuation works out to $18.58 per share (based on 447.7 million basic shares outstanding).

Bitcoin Holdings. GameStop did not add to its BTC holdings during the quarter. It is slightly lower than last quarter but is still worth $519.4 million, down from $528.6 million in Q2. This works out to $1.16 per share.

Net Cash. GameStop has $8.83 billion in cash and marketable securities. That's up from $135.6 million from last quarter ($8.694.4 billion), mainly due to its strong free cash flow and interest accumulation.

Its convertible debt is $4.162.6 billion, only slightly higher than last quarter. As a result, the net cash holdings are now $4.6674 billion, or $10.43 per share.

Total SOTP. This SOTP works out to $13.5 billion, or $20.88 per share:

Stores ………… $8,320 million, or $18.58 per share

Bitcoin ………. $519.4 million, or $1.16 p/sh

Net Cash ……. $4,667.4 million or $10.43 p/sh

Total …………… $13,506.8 million, or $30.17 p/ sh

However, I also believe that investors should add extra value due to its large cash holdings. This earnings power is not included in the value of the stores above.

For example, if it makes 3.75% on average from this 8.83 billion in net cash, the annual interest is worth $331 million. And assuming it does not do anything major with that cash for the next year or two, that works out to about $1.10 per share (i.e., $331 x 1.5 yrs = $496.5m/447.7m shs = $1.10.

So, the Total SOTP is about $14 billion (i.e., $13.5b +$500 m in interest accumulation before it's spent), or $31.27 per share.

Expected Return

In other words, investors may reasonably expect to make a good return, or almost $10 per share, assuming the company could be liquidated at its SOTP. That works out to an expected return (ER) of +43.77% (i.e., $31.27/$21.75 -1=0.4377) .

Assuming it takes 3 years for this to work out, the compounded annualized return for an investor in GME works out to about 12.85% per year (i.e., 1.4377^.0333 0-1). That is better than the market's average return.

So, on average, it looks like GME has a good expected return. Nevertheless, unless the company spends its large cash balance in a healthy, profitable manner, the company's true potential may not be realized.

Moreover, whether this will push GME stock over 21% higher in the next 45 days remains to be seen. Investors should be very cautious in buying short-term out-of-the-money calls. However, for existing shareholders, the covered yield highlighted above looks very attractive.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Unusual Call Options Volume in GameStop Corp. Stock - Should Investors Buy GME Stock?

- Creating a 39% “Dividend” on MRVL Stock Using Options

- The Options Market Is Pricing in Huge Uncertainty for AST SpaceMobile (ASTS): Here’s How to Break the Deadlock

- How to Make a 1.1% Yield Shorting One-Month Microsoft Puts