Valued at a market cap of $12.9 billion, Wynn Resorts, Limited (WYNN) is a global luxury hospitality and gaming company that develops and operates high-end integrated resorts featuring casinos, hotels, fine dining, retail, and entertainment. The Las Vegas, Nevada-based company’s portfolio includes flagship properties in Las Vegas and Macau, with additional exposure through its Boston-area resort.

Companies worth $10 billion or more are typically classified as “large-cap stocks,” and WYNN fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the resorts & casinos industry. Wynn is known for its premium brand positioning, strong focus on service quality, and significant leverage to high-end tourism and gaming demand, particularly in the Macau market.

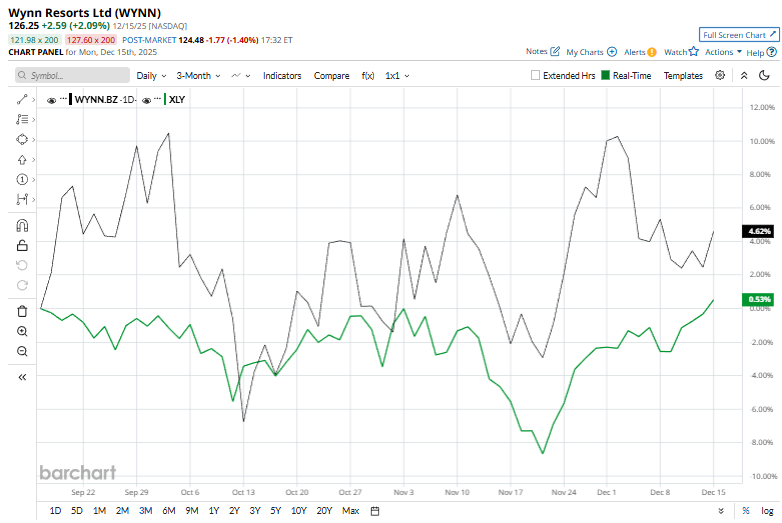

This luxury resort operator is currently trading 6.3% below its 52-week high of $134.72, reached on Dec. 1. Shares of WYNN have rallied 2.8% over the past three months, outperforming the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 1.2% return during the same time frame.

In the longer term, WYNN has surged 33.6% over the past 52 weeks, notably outpacing XLY's 3.4% uptick over the same time period. Moreover, on a YTD basis, shares of WYNN are up 46.5%, compared to XLY’s 8.5% rise.

To confirm its bullish trend, WYNN has been trading above its 200-day and 50-day moving averages since early May, despite recent fluctuations.

Shares of Wynn Resorts rose 3.7% on Dec. 1 after The Goldman Sachs Group, Inc. (GS) added the stock to its “Conviction Buy” list, citing strength in the company’s Las Vegas operations and improving conditions in Macau. Goldman reiterated its “Buy” rating and set a $145 price target, supported by data showing Macau gaming revenue rose 14.4% year over year in November, marking the tenth consecutive month of growth. The upbeat outlook helped push Wynn shares toward multi-year highs during the session.

WYNN has also outperformed its rival, Las Vegas Sands Corp. (LVS), which gained 24.4% over the past 52 weeks and 30.4% on a YTD basis.

Given WYNN’s recent outperformance, analysts remain highly optimistic about its prospects. The stock has a consensus rating of "Strong Buy” from the 17 analysts covering it, and the mean price target of $144.94 suggests a 14.8% premium to its current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart