With a market cap of $16.6 billion, Dow Inc. (DOW) is a global materials science company that delivers innovative solutions for packaging, infrastructure, mobility, and consumer markets worldwide. Operating through its Packaging & Specialty Plastics, Industrial Intermediates & Infrastructure, and Performance Materials & Coatings segments, the company offers a broad portfolio of plastics, chemicals, coatings, and specialty materials.

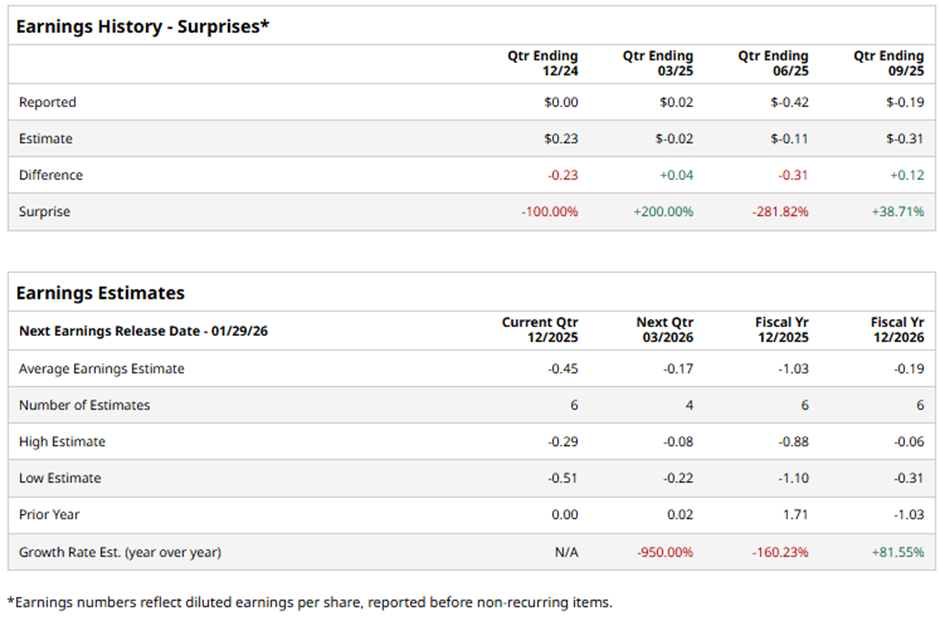

The Midland, Michigan-based company is set to announce its fiscal Q4 2025 results on Thursday, Jan. 29. Ahead of the event, analysts expect DOW to report an adjusted loss of $0.45 per share. It has surpassed Wall Street's bottom-line estimates in two of the past four quarters while missing on two other occasions.

For fiscal 2025, analysts project the materials science company to report an adjusted loss of $1.03 per share, a sharp decline from adjusted EPS of $1.71 in fiscal 2024. However, it is expected to rebound in fiscal 2026, with an estimated 81.6% year-over-year improvement, narrowing the adjusted loss to $0.19 per share.

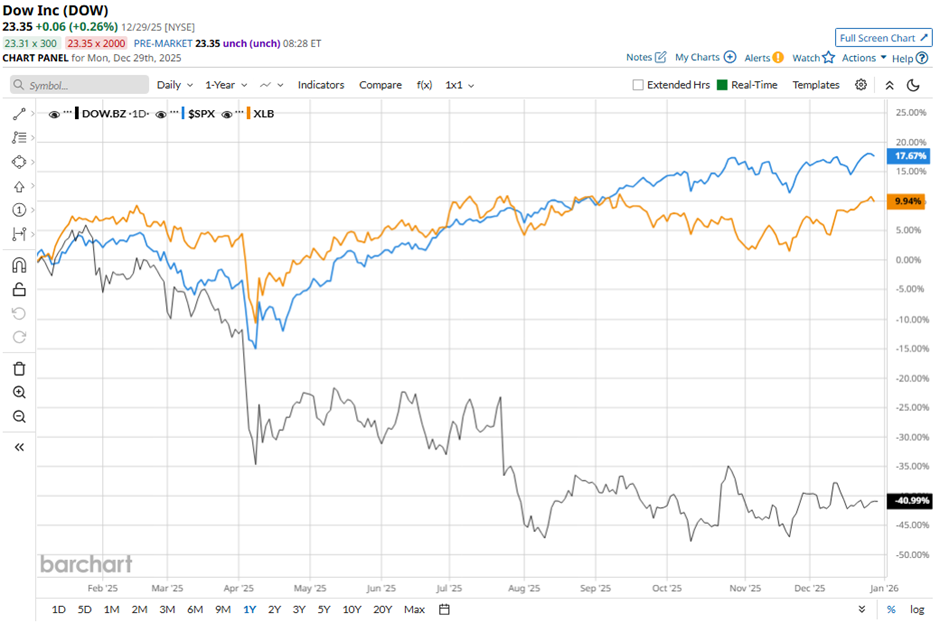

DOW stock has dropped 41.7% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 16.9% increase and the State Street Materials Select Sector SPDR ETF's (XLB) 7.7% rise over the same period.

Despite reporting weaker-than-expected Q3 2025 revenue of $9.97 billion, Dow’s shares jumped nearly 13% on Oct. 23 as its adjusted loss of $0.19 per share was significantly smaller than the expected loss. Investors cheered the company’s strong cost discipline, having achieved over half of its planned $6.5 billion in near-term cash support, including $1 billion in capital spending cuts and accelerated cost reductions. Additionally, higher volumes from new U.S. Gulf Coast polyethylene and alkoxylation assets lifted margins.

Analysts' consensus view on DOW stock is cautious, with an overall "Hold" rating. Among 20 analysts covering the stock, two recommend a "Strong Buy," 17 give a "Hold" rating, and one has a "Strong Sell." The average analyst price target for Dow is $26.83, suggesting a potential upside of 14.9% from current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart