Lucid Group (LCID) was once the electric dream everyone wanted a piece of, an electric vehicle (EV) darling blazing with promise in a market racing toward the future.

But as the industry cools, Morgan Stanley (MS) now warns that those flames are flickering into an “EV winter.” The bank anticipates U.S. EV demand slipping hard in 2026, with volumes dropping by double digits and consumers squeezed by affordability, credit tightening, and tariff-driven costs.

In that chilly backdrop, analyst Andrew Percoco has downgraded Lucid to “Underweight,” slashing its target price to $10. Lucid’s premium shine and battery tech still stand out, but the road ahead is steep as dilution risks loom, profitability sits far on the horizon, and its next major platform won’t ramp until 2027. The once-hot stock now faces a long, cold climb.

Let’s take a closer look.

About Lucid Motors Stock

Headquartered in Newark, California, Lucid Group is a Silicon Valley-born innovator redefining electric mobility. With the record-setting Lucid Air and Gravity SUV, the company blends cutting-edge tech, sleek design, and efficiency. Assembled in its advanced Arizona facility, Lucid is pushing the EV frontier for performance, sustainability, and global impact. Its market capitalization currently stands at $4.1 billion.

LCID stock has shed nearly 82.7% in three years, and 2025 alone has carved out another 58.36% year-to-date (YTD) drop. Volume has thinned on rallies and picked up on selloffs, signaling traders still lean toward caution. The 14-day RSI has been steadily drifting lower, now sitting at 36 and signaling continued weakness in buying momentum.

But the recent shift is interesting. The MACD oscillator just flashed a subtle change in tone, with the yellow MACD line crossing above the blue signal line, and the histogram turning positive. That usually indicates early bullish momentum or at least the slowing of downside pressure.

Lucid’s shares may be drowning in red this year, but its valuation sits in a curious middle ground, priced at 3.16 times sales, richer than its peers yet cheaper than its own historical average. It is a tightrope valuation, balancing between fading hype and hidden potential, offering investors both caution and a whisper of comeback possibility.

A Closer Look at Lucid’s Q3 Results

Lucid’s Q3 earnings report landed on Nov. 5, with revenue of $336.6 million, a striking 68% year-over-year (YOY) jump and a signal that demand for its sleek, premium EVs is not evaporating. Yet beneath that headline sat a harsher truth – a per-share loss of $3.31. Though narrower than last year’s $4.10 loss, it was still far wider than Wall Street hoped, reminding investors that Lucid’s march toward profitability remains a long, uphill ascent. Plus, adjusted loss per share shrank by 4% annually to $2.65.

Costs continued to overpower gains. Lucid’s cost of revenue nearly doubled its revenue, resulting in a gross loss margin hovering near 100%. Adding in operating expenses, Lucid sank into a $942 million operating loss for the quarter, pushing nine-month operating losses beyond $2.4 billion.

Still, the company is not running on fumes. Lucid ended the quarter with $5.5 billion in liquidity, including a substantial undrawn credit line, and cash levels were steady at $1.6 billion. Management asserts that this war chest carries the company into the first half of 2027, buying time as it scales.

And scale, at least on the delivery front, is happening. Lucid notched its seventh straight quarter of record deliveries, handing over 4,078 vehicles, up 47% YOY. Production hit 3,891 units, an impressive 116% leap from last year.

Yet optimism was tempered by a second consecutive trim to annual production guidance, now narrowed to roughly 18,000 units. Capital expenditure guidance also eased slightly, with the low end reduced by $100 million.

Beyond the numbers, Lucid is shoring up its strategic foundations. The company secured an expansion of its delayed-draw term loan facility, boosted from $750 million to nearly $2 billion, from Saudi Arabia’s Public Investment Fund, reaffirming deep-pocketed backing when it’s most needed. Lucid also welcomed a $300 million strategic investment from Uber (UBER), a partnership that tightens alignment in the premium EV and autonomous mobility world.

Operational momentum continues as well. Lucid delivered its first vehicles to Nuro’s robotaxi engineering fleet, laying groundwork for a 2026 autonomous rollout in San Francisco. Organizational changes were also announced to accelerate global expansion and sharpen execution.

Analysts tracking Lucid are optimistic, estimating fiscal 2025 losses to shrink by 24.9% YOY to $9.39 per share and further narrow by 22.7% to $7.26 per share.

What Do Analysts Expect for Lucid Stock?

Morgan Stanley’s Andrew Percoco is warning that the once-surging EV wave is slowing into a deep, uncomfortably cold “EV winter” in 2026, with light-vehicle sales expected to slip to 15.9 million units and EV volumes dropping nearly 20%. Battery-electric penetration, once climbing steadily, is now seen retreating to 6.5%.

He argues that consumers will face a triple squeeze, affordability challenges, tighter underwriting, and tariff-driven inflation. Hybrids and combustion models may get a slight lift, and pent-up replacement demand might soften the blow, but policy uncertainty and technology-driven adoption curves keep the outlook unusually wide.

Within that cooling backdrop, Percoco’s view on Lucid grows even more cautious. He downgrades the stock to “Underweight” from “Equal Weight” and cuts the target price to $10, marking a potential all-time low. Despite Lucid’s premium positioning offering some insulation from the loss of EV tax credits, the company remains heavily exposed to the sharp EV demand downturn.

The deeper concerns center on timing, scale, and capital. Lucid’s midsize, more affordable platform won’t begin production until late 2026 and won’t ramp until 2027, delaying its path to profitability. Percoco does not expect gross profitability until 2028, with losses persisting until 2031. Meanwhile, he flags significant dilution risk, estimating Lucid will need roughly $2 billion in equity by late 2026 relative to its $4.6 billion market cap.

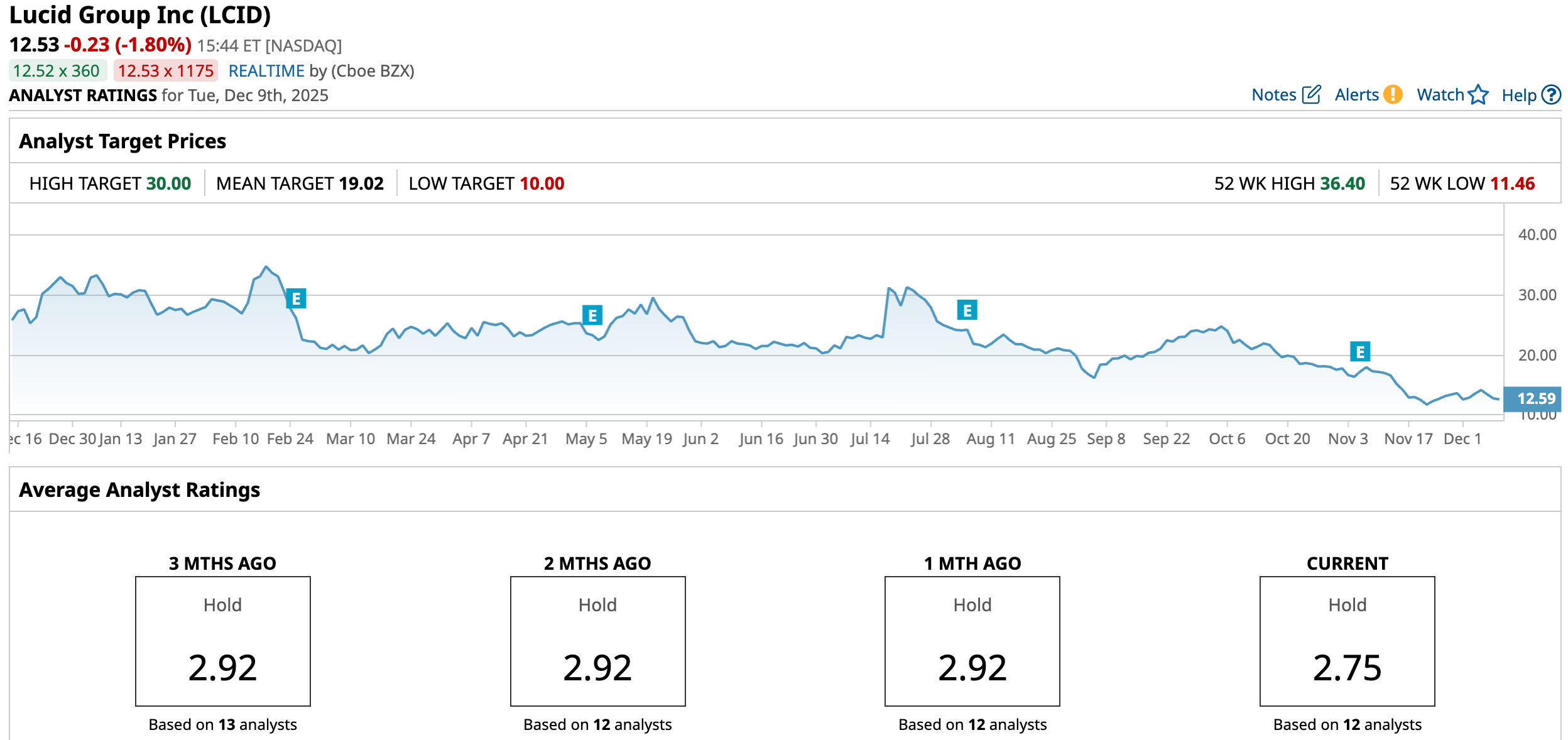

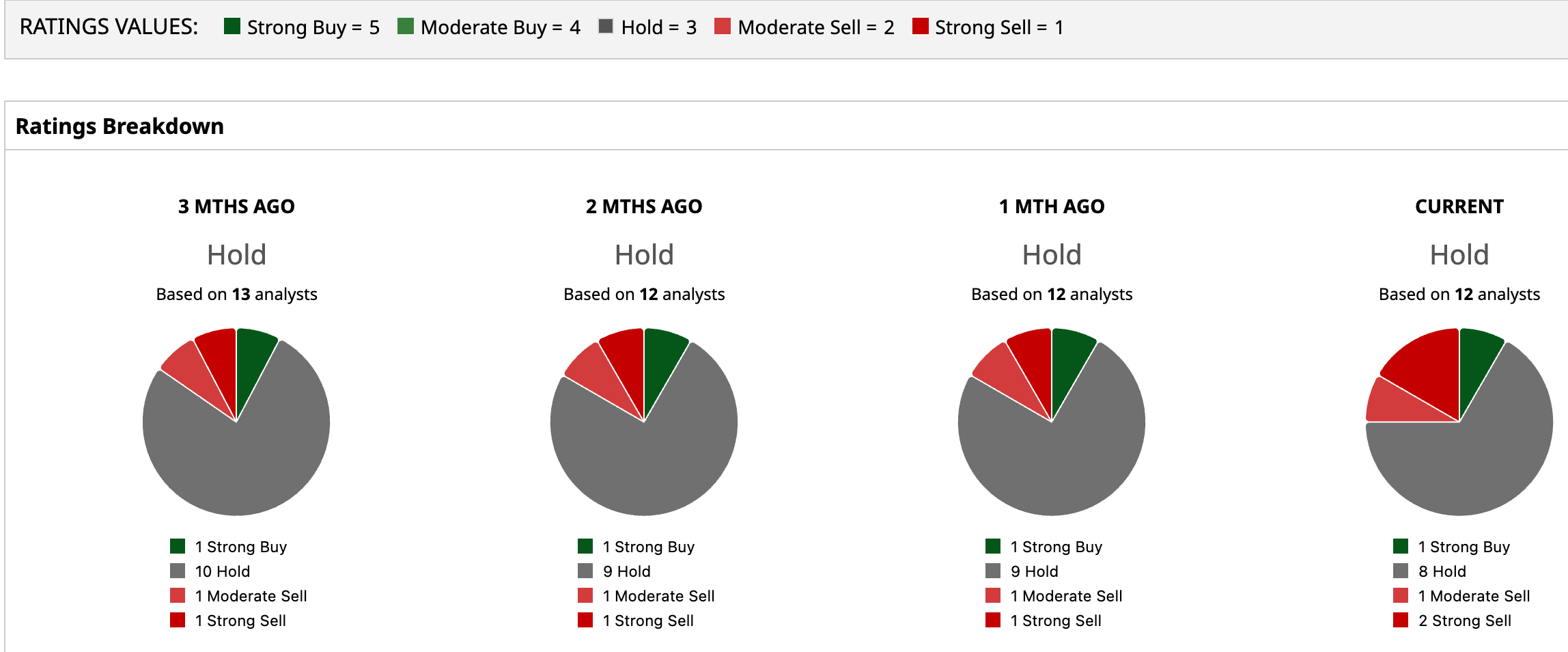

Analysts are playing it safe with LCID, giving a consensus rating of “Hold.” Out of 12 analysts covering the stock, just one suggests a “Strong Buy,” eight recommend a “Hold,” one advises a “Moderate Sell,” and the remaining two analysts give a “Strong Sell” rating.

Still, there’s room to accelerate. The mean price target of $19.02 suggests the stock could surge by 51.9% from the current price levels. The Street-high target of $30 represents potential upside of 139.4%.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Morgan Stanley Is Sweetening on MP Materials Stock Following ‘Historic Deal.’ Should You Buy MP Here?

- This Semiconductor Giant Is in Talks With Microsoft for Custom Chips. Should You Buy Its Stock Now?

- Is MicroStrategy Stock a Buy Now Amid the Bitcoin Rally?

- Apple Stock Marks a Solid Comeback. Is AAPL a Buy, Sell, or Hold for 2026?