Paramount Skydance (PSKY) is taking its bid for Warner Bros. Discovery (WBD) directly to shareholders after getting shut out by Netflix (NFLX). The company announced on Monday that it will offer $30 per share in cash, the same price Warner Bros. rejected last week. This values the entire company at $108.4 billion.

The hostile takeover attempt comes after Netflix agreed to buy Warner Bros.'s studio and streaming assets for $27.75 per share just days earlier. Paramount argues its all-cash deal is worth $17.6 billion more to shareholders and keeps the company intact instead of breaking it up.

Paramount has lined up financing from the Ellison family, RedBird Capital, and major banks, including Bank of America (BAC) and Citi (C). Middle Eastern investors, such as Saudi Arabia's Public Investment Fund (PIF), are also backing the bid. Also notable, Affinity Partners, son-in-law of the president Jared Kushner's investment firm, is involved in the bid.

Shares of Paramount jumped 9% on the news, while Warner Bros. rose 4% and Netflix fell 3%.

Paramount Expects $6 Billion in Annual Cost Savings

Paramount's leadership made clear on its investor call that it believes Warner Bros. Discovery ignored a superior offer. CEO David Ellison said it submitted a fully financed proposal on Dec. 4 but never received a response before Netflix's deal was announced the next day. The tender offer will stay open for 20 business days, with Warner Bros. required to respond within 10 days.

The core argument centers on value and regulatory risk. Paramount claims Netflix's offer is actually worth less than advertised if you account for the debt-heavy cable networks business that Warner Bros. shareholders would be stuck with.

The company values those networks at just $1 per share, bringing Netflix's real offer down to around $28.75 when you include timing delays. Paramount expects regulatory approval in 12 months compared to a much longer timeline for Netflix.

Beyond the numbers, Paramount is positioning this as a fight for Hollywood's future. The company plans to release over 30 theatrical films annually and argues that combining with Warner Bros. creates a stronger competitor to streaming giants without dominating the market. By contrast, a Netflix-Warner Bros. combination would control 43% of global streaming subscribers, which Paramount calls anticompetitive.

Paramount expects $6 billion in cost savings by eliminating duplicate functions in back-office operations, not in creative departments. At closing, the combined entity would generate $70 billion in revenue and $10 billion in cash flow. Paramount also committed to maintaining investment-grade credit ratings by deleveraging from 4x debt-to-EBITDA at closing to below 3x within two years.

Is Paramount Stock a Good Buy Right Now?

Paramount reported mixed third-quarter results as the company works through its transformation under new leadership. The streaming business added 1.4 million subscribers, bringing total subscribers to 79 million, with Paramount+ revenue climbing 24%. The direct-to-consumer segment will turn profitable in 2026 as the company scales its platform globally.

CEO David Ellison laid out plans to spend an additional $1.5 billion on content next year across films, streaming originals, and sports. The theatrical business will expand from eight releases annually to at least 15 starting in 2026. Major content deals already secured include the UFC, streaming rights to South Park, and partnerships with creators like the Duffer Brothers and James Mangold.

The company increased its efficiency target from $2 billion to over $3 billion in cost savings. Most of these cuts will come from consolidating three separate streaming platforms into one unified system by mid-2026. This technical overhaul should improve the user experience and advertising capabilities while reducing operational costs. The company expects to reach investment-grade credit metrics by 2027.

Paramount has guided $30 billion in revenue for 2026 with adjusted operating income of $3.5 billion. Free cash flow will appear negative next year due to $800 million in one-time transformation costs, but it remains positive on an adjusted basis. The broadcast network CBS continues performing well as the most-watched network for 17 consecutive years, providing a stable cash flow that funds streaming investments.

Management emphasized the company can achieve its growth targets without major acquisitions, though it remains open to deals that accelerate its three priorities: investing in content, scaling streaming globally, and driving operational efficiency.

What Is the PSKY Stock Price Target?

Analysts tracking PSKY stock forecast revenue to increase from $29 billion in 2025 to $31.5 billion in 2028. In this period, adjusted earnings are forecast to expand from $0.67 per share to $1.74 per share. If PSKY stock is priced at 15x forward earnings, which is reasonable, it should trade around $26 in late 2027, indicating an upside potential of 80% from current levels.

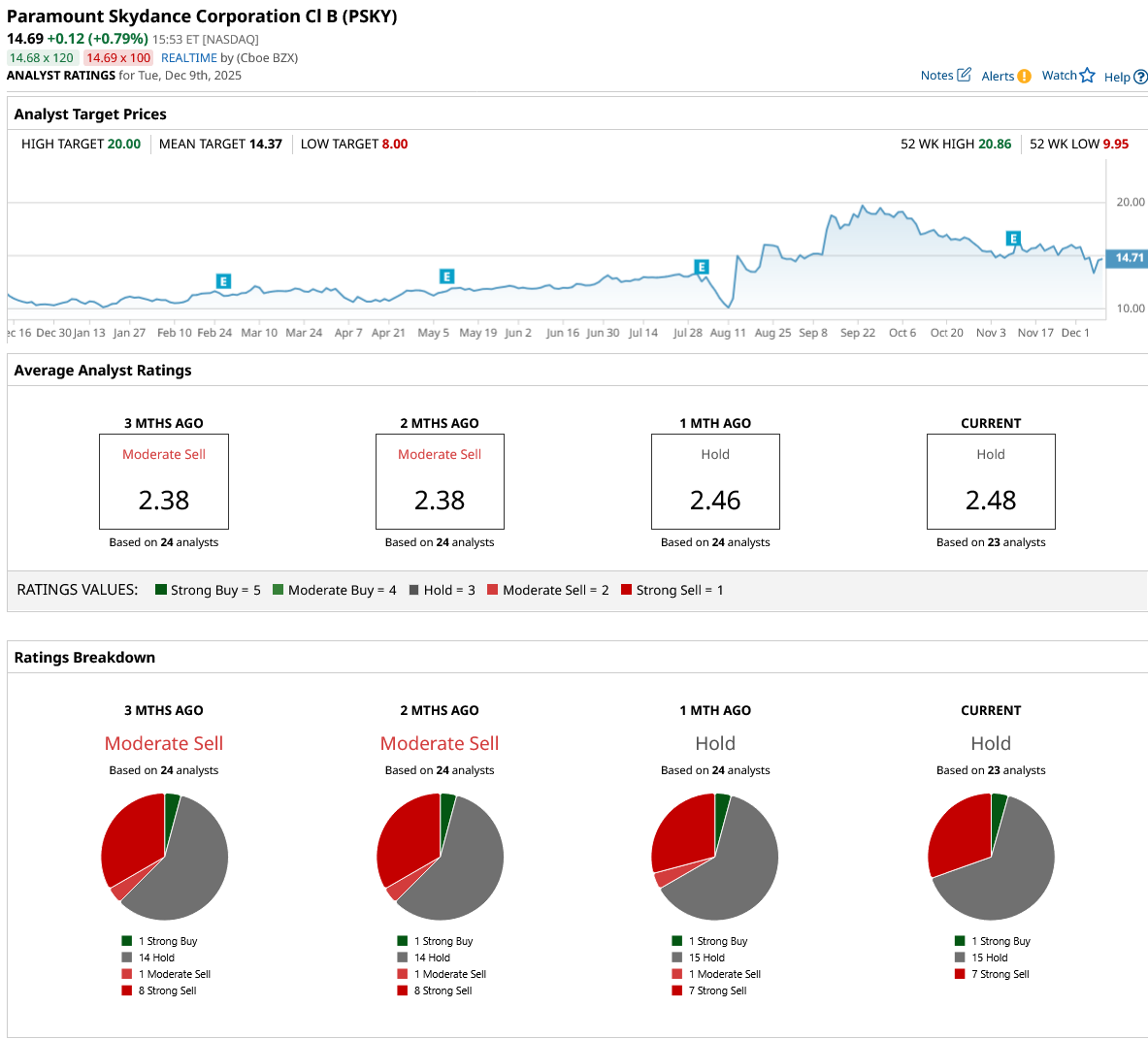

Out of the 23 analysts covering Paramount Skydance stock, one recommends “Strong Buy,” 15 recommend “Hold,” and seven recommend “Strong Sell.” The average PSKY stock price target is $14.37, which is similar to the current price.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Morgan Stanley Is Sweetening on MP Materials Stock Following ‘Historic Deal.’ Should You Buy MP Here?

- This Semiconductor Giant Is in Talks With Microsoft for Custom Chips. Should You Buy Its Stock Now?

- Is MicroStrategy Stock a Buy Now Amid the Bitcoin Rally?

- Apple Stock Marks a Solid Comeback. Is AAPL a Buy, Sell, or Hold for 2026?