SanDisk (SNDK) entered 2026 with considerable momentum and is one of the top performers in the data storage space. Shares of the manufacturer and provider of data storage devices and solutions are already up 60% year-to-date (YTD). Moreover, SNDK stock has climbed over 226% over the past three months. This sharp jump reflects a broader resurgence across memory and data storage stocks, driven by strong demand tailwinds.

The primary growth catalyst for memory and storage stocks is the explosive rise of artificial intelligence (AI). As companies race to build and expand AI data centers, demand for high-performance memory and storage hardware has surged. Notably, massive demand and a global supply shortage have created a favorable pricing environment for manufacturers. Higher prices, combined with strong volumes, have translated into expanding profit margins across the sector, and Sandisk has been a top beneficiary of these dynamics.

The stock received an additional catalyst last week following remarks from Nvidia (NVDA) CEO Jensen Huang at the Consumer Electronics Show (CES). Huang highlighted the AI industry’s accelerating need for memory and storage solutions, strengthening the view that demand is strong and likely to remain robust in 2026. Further, supply shortage will drive average pricing, supporting the profitability of companies like SanDisk.

Looking ahead, continued investment in AI infrastructure could provide sustained support for SanDisk's growth prospects. Data centers are becoming increasingly storage-intensive, and memory remains a critical bottleneck for efficiently scaling AI applications. While the long-term fundamentals appear compelling, the pace of the recent rally raises valuation concerns.

SanDisk Poised to Deliver Strong Growth

SanDisk appears well-positioned to benefit from AI-driven infrastructure spending. As investments in AI and data center buildouts accelerate globally, the need for energy-efficient storage is rising, likely giving SanDisk's NAND portfolio a significant boost.

The company continues to see demand for its NAND products exceed available supply, a dynamic that management expects to persist in the near future. This favorable supply–demand environment is already supporting stronger pricing and improving margins, providing a solid foundation for earnings growth.

During its first-quarter earnings call, management highlighted that global spending on data centers and AI infrastructure will continue to rise, driving a surge in demand for high-capacity storage solutions that can handle massive data volumes with greater efficiency. SanDisk's BiCS8 technology enhances its competitiveness in the data center market and strengthens its position across edge and consumer applications.

Momentum in the company’s data center business is likely to remain strong. Hyperscale cloud providers, NeoCloud players, and original equipment manufacturers (OEMs) are deepening their partnerships with the company. Demand is also growing for SanDisk's storage-optimized solid-state drive (SSD) platform, which is undergoing qualification with two hyperscalers, with additional hyperscaler and major storage OEM engagements planned for 2026.

Overall, SanDisk is engaged with five major hyperscale customers across its data center portfolio. At the same time, the edge market is providing another avenue for growth. The expected increase in PC unit shipments and growth in storage capacity per device will drive demand for the company’s products. Beyond PCs, premium smartphones are likely to contribute to its growth.

Will SNDK’s Rally Sustain?

The strong demand and improving pricing environment are already translating into stronger margins and earnings for the company. Although SNDK stock has rallied, it still trades at a forward price-to-earnings ratio of 28.8, which appears reasonable given the company’s solid earnings growth potential and favorable industry dynamics. Analysts estimate a 551.7% jump in SNDK’s EPS in fiscal 2026, followed by 110.6% growth in fiscal 2027.

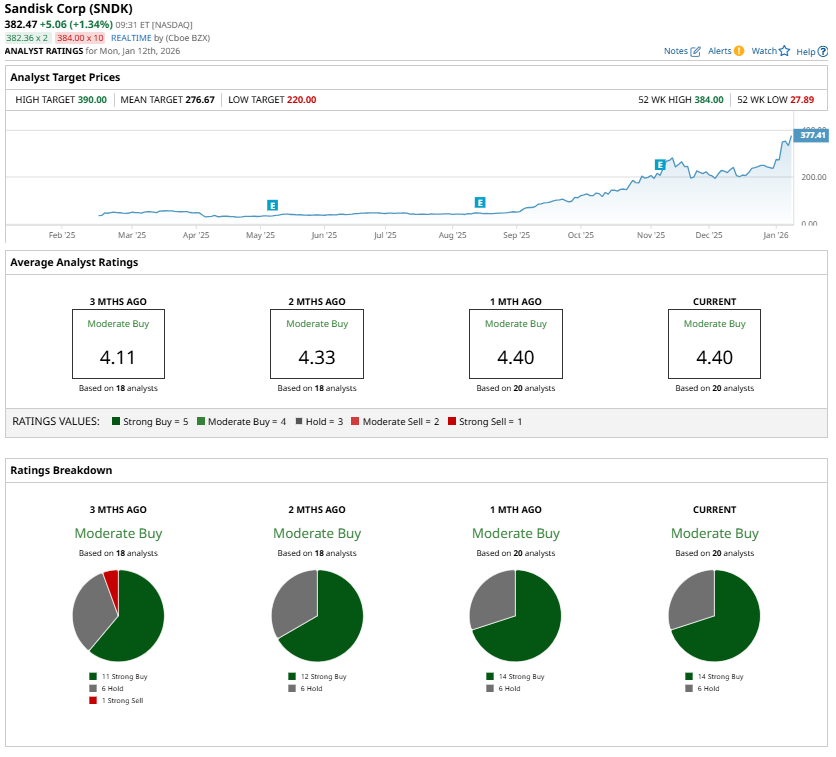

While Wall Street currently assigns SanDisk a “Moderate Buy” consensus rating, strong demand, constrained supply, and pricing suggest that earnings estimates may rise over time, supporting the rally in SNDK stock.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart