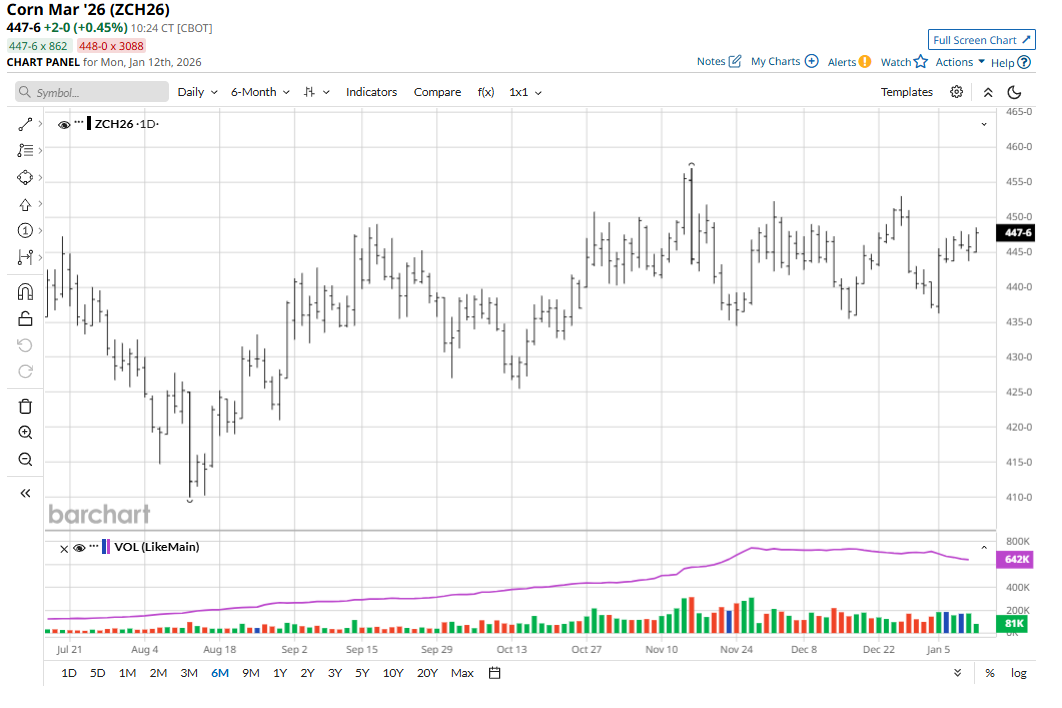

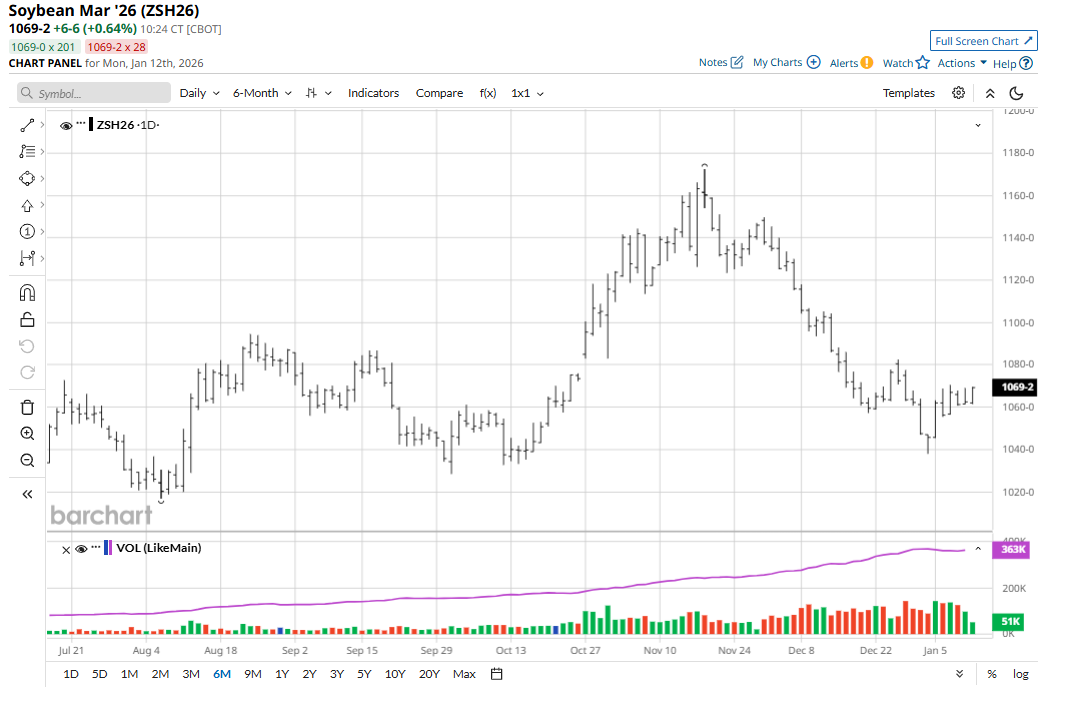

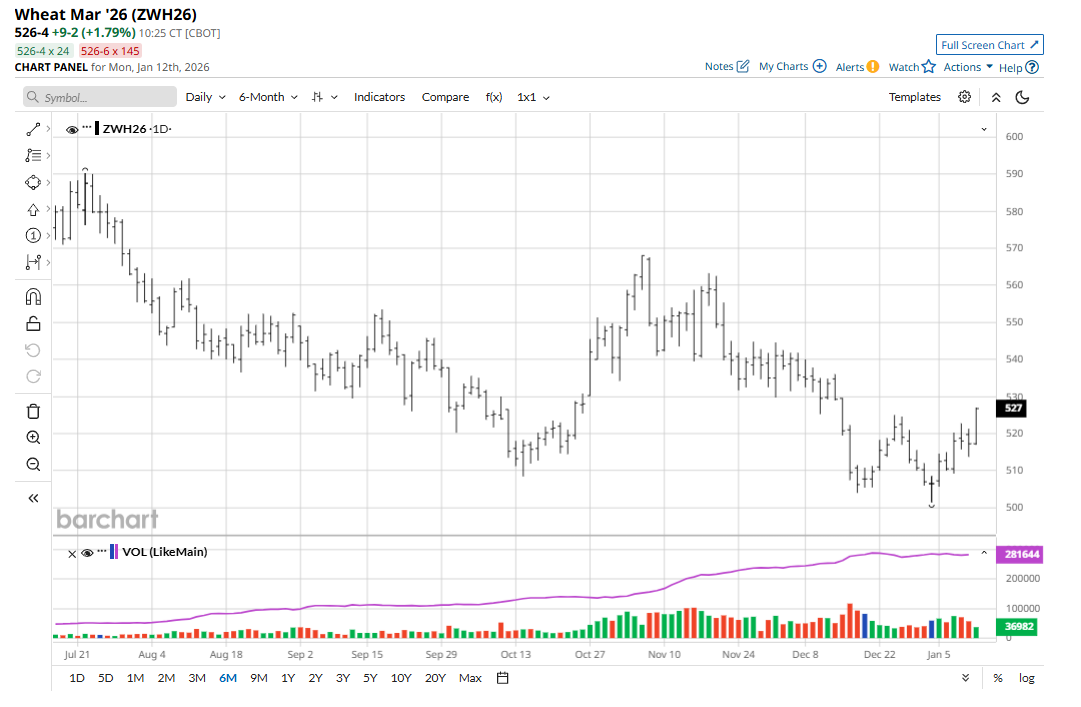

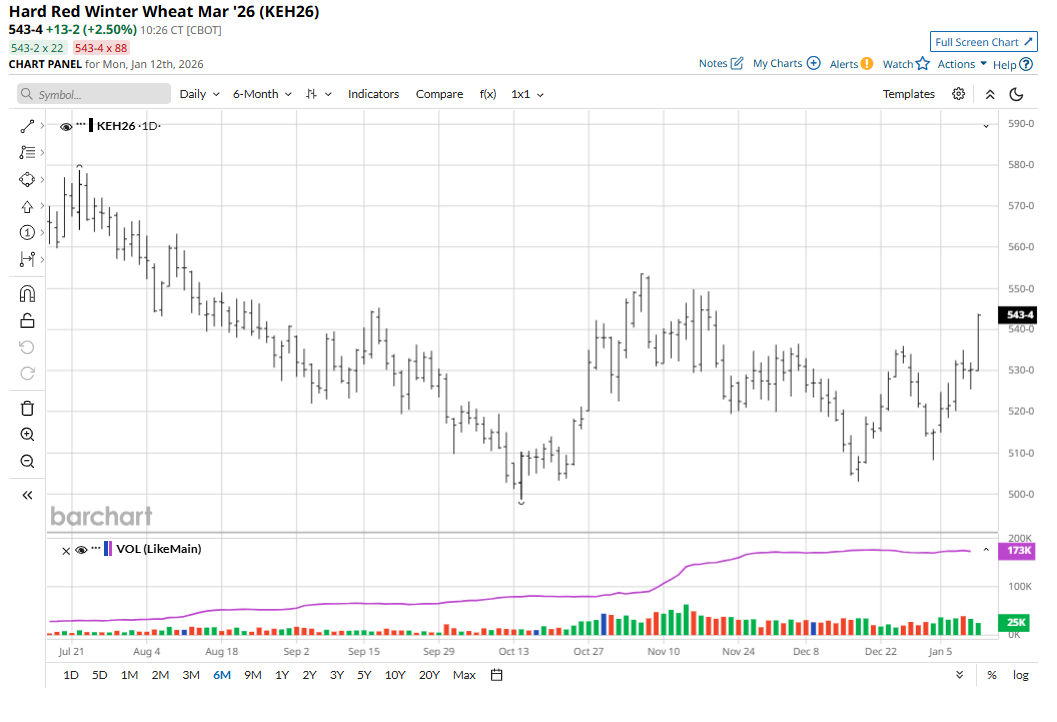

Last week was not bad for corn (ZCH26) and soybean (ZSH26) futures bulls, as prices consolidated most of the week after last Monday’s good gains. Corn futures remain in the middle of a choppy and sideways trading range, but that could change starting today. Soybeans have made a solid rebound from the early January low, with winter wheat futures (ZWH26) (KEH26) markets bulls also showing some strength last week.

Today’s midday USDA supply and demand report will kick things into gear this week for grain markets traders. A Reuters poll showed analysts expect, on average, 2025 U.S. corn production at 16.552 billion bu. (16.752 billion in the November report) and an average yield of 184.00 bu. an acre (186.0 in the November report). U.S. quarterly corn stocks as of Dec. 1 are estimated at 12.962 billion bu. (12.075 billion bu. on Dec. 1, 2024). The 2025-26 marketing year ending stocks for U.S. corn are seen at 1.972 billion bu. (2.029 billion bu. in the December report). The 2025-26 Argentine corn crop is seen at 53.63 million MT (53.0 million MT in the December report). The 2025-26 Brazilian corn crop is seen at 132.46 million MT (131.00 million MT in the December report). The 2025-26 global ending stocks for corn are seen at 279.62 million MT (279.15 million MT in the December report).

The Reuters poll showed analysts on average expect 2025 U.S. soybean production at 4.229 billion bu. (4.253 billion in the November report) and an average yield of 52.7 bu. an acre (53.0 in the November report). U.S. quarterly soybean stocks as of Dec. 1 are 3.25 billion bu. (3.10 billion on Dec. 1, 2024). The 2025-26 marketing year ending stocks for U.S. soybeans are seen at 292 million bu. (290 million in the December report). Argentina’s 2025-26 soybean crop is seen at 48.53 million MT (48.50 million MT in the December report). Brazil’s 2025-26 soybean crop is seen at 176.35 million MT (175.0 million MT in the December report). The 2025-26 global ending stocks for soybeans are seen at 123.07 million MT (122.37 million MT in the December report).

U.S. wheat quarterly stocks as of Dec. 1 are seen at 1.636 billion bu. (1.573 billion on Dec. 1, 2024), according to the Reuters survey. The 2025-26 marketing year ending stocks for U.S. wheat are seen at 896 million bu. (901 million in the December report). The 2025-26 global ending stocks for wheat are seen at 275.95 million MT (274.87 million MT in the December report). U.S. all wheat planted acres for harvest in 2026 is seen at 32.413 million (33.153 million in 2025).

Monday may well be the most active trading day of the week, as there could well be one or two surprises in the USDA data.

Weather in South American Corn, Soybean Regions in Focus

Corn and soybean traders will continue to closely monitor growing conditions for South American crops. Dryness in southern Argentina is still a concern, but some rain is expected during this week. Brazil crops are rated well amid a good mix of rain and sunshine that is expected over the next two weeks.

U.S. Corn, Soybean Export Numbers Need to Continue to Be Solid

Export demand for U.S. corn has been good. While corn futures prices have languished the past few weeks, the solid U.S. corn sales abroad should keep a floor under futures prices.

90-day outlook: Soybean traders remain on alert for China to continue to purchase U.S. soybeans but are leery of such as Brazilian producers begin to harvest what appears to be a big soybean crop. U.S. trade relations with China will continue to be near the front burner of the soy complex futures markets. China is so far meeting its pledge to the U.S. regarding the amount of U.S. soybeans purchased.

Global Wheat Market Is Well-Supplied

Hefty global wheat supplies and mostly favorable weather conditions around the globe have kept wheat futures prices muted. However, there is lingering uncertainty over U.S. planted acres and whether it will be harvested or grazed. The all-important late-March USDA planting intentions report will provide grain traders with more definitive crop acres numbers.

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.