The global entertainment and media market is expected to reach over 3.5 trillion by the end of 2029 as the industry moves away from traditional linear television and leans more on streaming-first business models. Streaming video subscription revenue in the U.S. alone is expected to keep rising through 2026, while the broader video streaming market worldwide is forecast to reach $98.37 billion in revenue this year.

Even with that shift, big legacy media companies are still dealing with real pressure. Disney's (DIS) fiscal Q4 2025 results showed Entertainment division revenue down 6% and linear networks operating income down 21%, even as its direct-to-consumer streaming business posted operating income of $352 million.

Former House Speaker Nancy Pelosi has disclosed selling approximately $5 million worth of Disney shares as part of a $69 million portfolio reshuffle. That reshuffle included trimming Apple (AAPL) and Nvidia (NVDA) stakes, while rotating into call options and dividend-paying financial stocks. Pelosi’s Disney sale came months after Disney board chairman James Gorman purchased $2 million of DIS shares at $111.89 in December, a move that pointed to insider confidence.

With one high-profile insider buying and another selling, which signal should investors follow, or does Disney's mixed fundamental picture warrant a deeper look before making any move? Let’s find out.

How Strong Is Disney’s Financial Engine?

Disney is a broad entertainment business that earns money from theme parks, streaming services like Disney+ and Hulu, linear TV, and a large content library it sells across films, licensing, and consumer products.

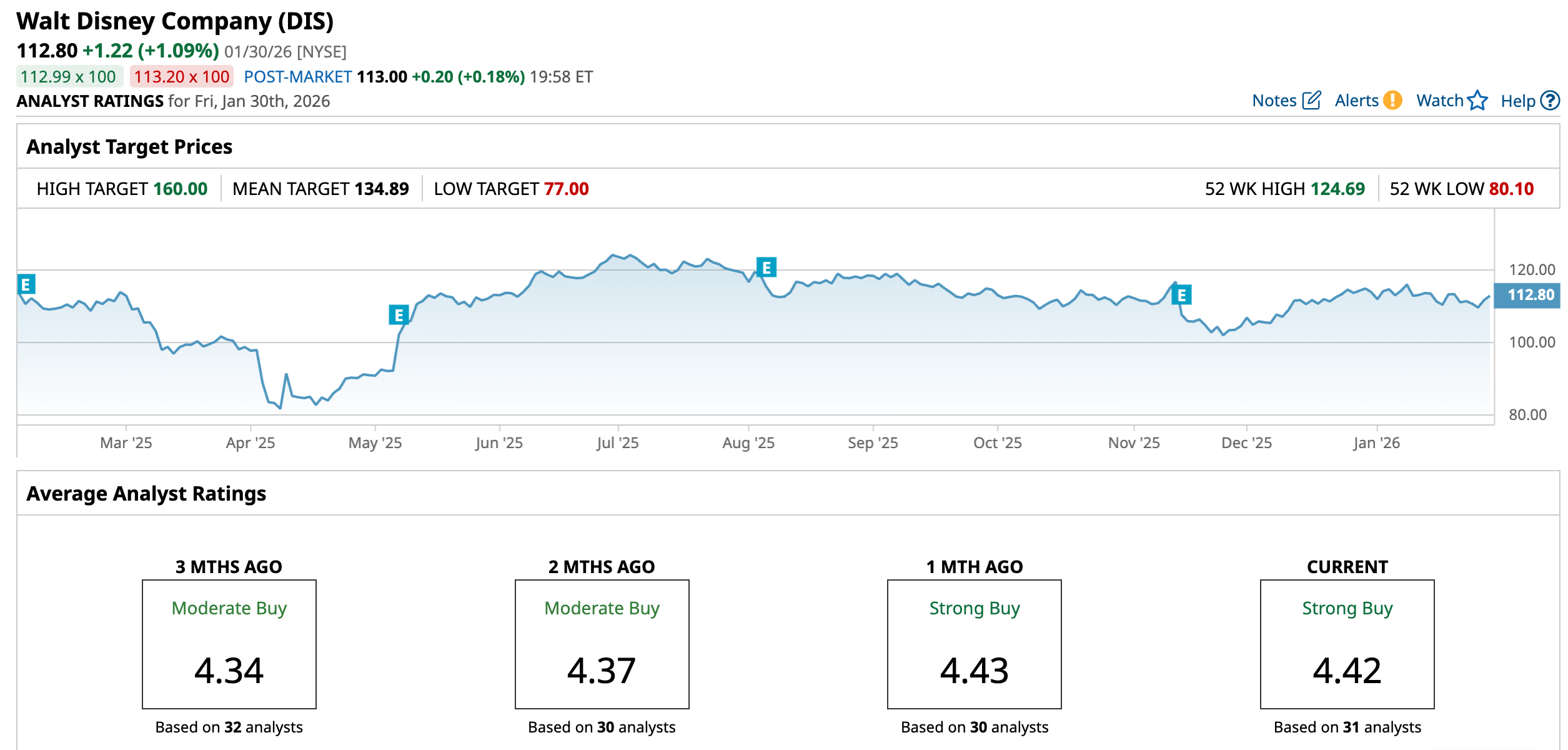

Over the past 52 weeks, the stock is down about -0.56%, and it’s down roughly -0.85% year-to-date (YTD), which shows investors are still not fully sold on Disney’s long restructuring plan.

On valuation, the stock trades at about 16.96x forward earnings, slightly above the sector’s 16.62x forward multiple, suggesting the market still expects some improvement in growth and profits instead of treating the company like a lost cause.

On the results side, revenue in fiscal 2025 rose 3% to $94.4 billion, even though Q4 revenue was basically flat at $22.5 billion, which points to steady but not rapid growth. Income before income taxes more than doubled in Q4 to $2.0 billion and increased to $12.0 billion for the year from $7.6 billion, showing the benefits of cost cuts and tighter control of spending on content.

Total segment operating income increased 12% for the year to $17.6 billion, which suggests the improvement was spread across the business, not driven by a single one-off. Diluted EPS for Q4 rose to $0.73 from $0.25, and for the full year it increased to $6.85 from $2.72, while adjusted EPS rose 19% to $5.93, which supports the idea that earnings are improving on the core business.

With an annual dividend yield of about 1.14%, a forward payout ratio near 17.33%, and just one year of semi-annual dividend increases so far, Disney appears to be rewarding shareholders again while still maintaining ample capacity to fund growth.

Are Disney’s Core Growth Drivers Intact?

Disney’s growth case right now is being supported by deals that strengthen its IP position and expand how it can earn from that IP. The long-term media IP license agreement with Adeia gives Disney access to Adeia’s full media IP portfolio in one agreement and, just as important, it resolves all outstanding litigation between the two companies tied to that technology.

On the experience side, the Formula 1 collaboration is straightforward. Disney is pairing its characters and storytelling with a major global sport, then turning that attention into content, live events, and merchandise sales. The partnership launches at the Las Vegas Grand Prix with a show at the Fountains of Bellagio, character appearances, and an exclusive Formula 1 merchandise line, setting up a playbook Disney can repeat around big races and fan moments.

Then there’s the WEBTOON Entertainment deal, which targets digital comics and mobile-first reading. Disney and WEBTOON plan to build a new digital comics platform that brings together current runs and decades of past comics across Disney’s portfolio, including Marvel, Star Wars, 20th Century Studios, and more. For the first time, more than 35,000 comics from Marvel, Star Wars, Disney, Pixar and 20th Century Studios would sit in one subscription service, built and operated by WEBTOON, with both vertical and traditional formats and a mix that also includes select WEBTOON Originals.

What the Street Sees Next for Disney

Street estimates now call for an average EPS of 1.56 for the current quarter (12/2025), down from 1.76 a year ago, which works out to -11.36% year-over-year (YOY). From there, expectations pick up: for the next quarter (03/2026), the average estimate moves to 1.63 versus 1.45 last year, implying +12.41% growth. Looking further out, analysts see 6.58 for fiscal 2026 (ended 09/2026) compared with 5.93 last year, a +10.96% gain.

That longer-term setup is what the bulls keep pointing to. J.P. Morgan’s David Karnovsky reiterated a Buy and a $138 price target, citing streaming profitability, strength in parks, and improving content economics as reasons Disney can earn a higher multiple over time. Needham’s Laura Martin also stayed with a Buy and a $125 target, arguing the market is still not fully recognizing Disney’s longer-term EPS growth path.

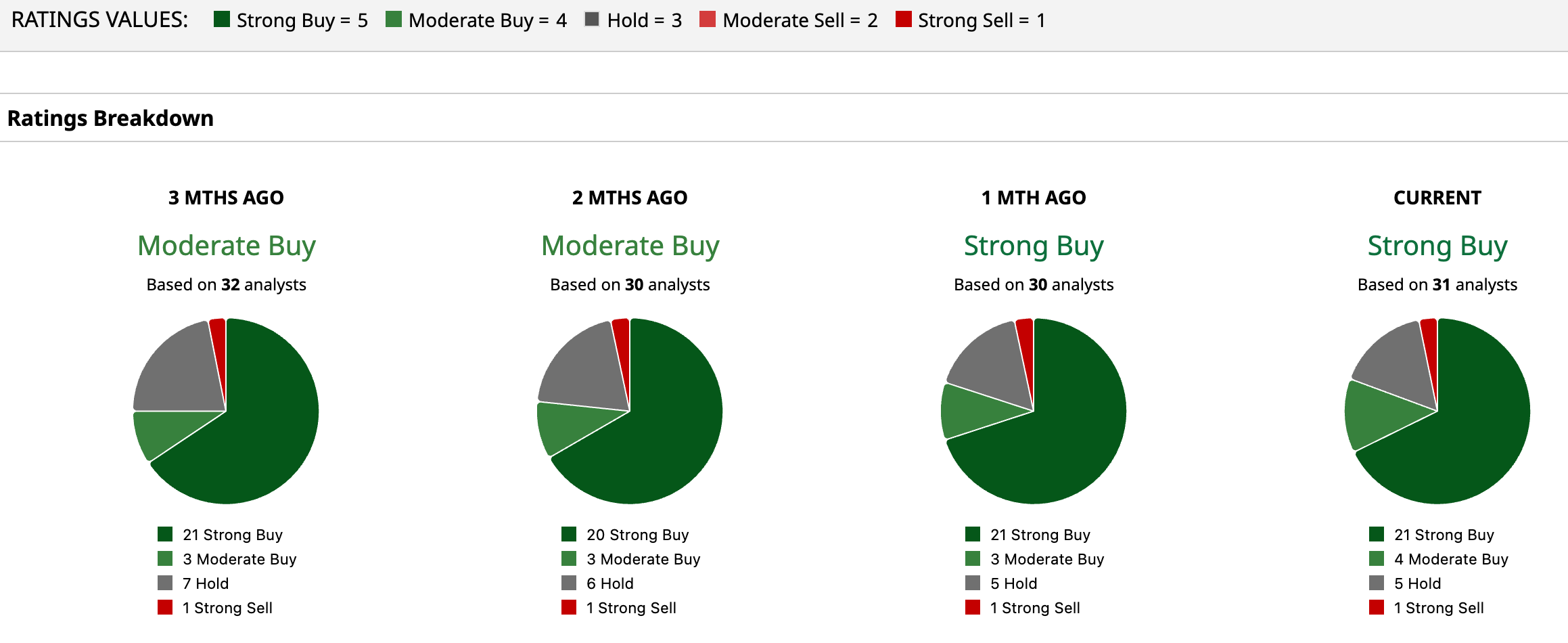

Stepping back, among 31 analysts, the consensus rating is “Strong Buy,” and the mean target is $134.89. With the stock at $112.80, that suggests about 19.58% upside.

Conclusion

Pelosi selling Disney does not automatically mean you should sell too, because her move looks more like portfolio reshuffling than a clear verdict on Disney’s business. If you own DIS, the cleaner call is to base your decision on whether you believe the earnings path the Street is modeling can actually play out, since that is what ultimately supports the upside case. Shares are more likely to grind higher than break down from here, but with volatile stretches around earnings and any streaming or linear TV headlines. If you cannot tolerate that volatility, trimming makes sense; if you can, holding is the better bet.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart