- What’s new: Pattern emerges suggesting relationship between household legal stress and outcome of presidential contest

- What to watch: The spread between swing state stress and national stress average

- March Divergence: Blue state stress on the rise, red and purple states falling

- Beyond the horse race: National CSLI fell to its lowest level in 12 months

LegalShield’s March Consumer Stress Legal Index (CSLI) is starting to exhibit a pattern seen in the past five presidential election cycles: The relationship of swing-state stress as measured in LegalShield’s CSLI relative to the national average echoes the results of the 2008, 2012 and 2020 presidential elections.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240423795718/en/

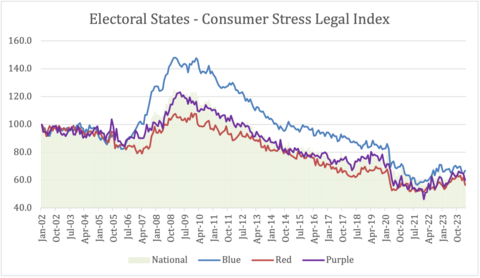

Consumer stress levels by political geography. Red states voted Republican in 2020 presidential election, blue states voted Democratic, and purple "swing" states were closely divided (Ariz., Ga., Mich., Nev., N.C., Pa., Wis.). (Graphic: Business Wire)

“The trend suggests that when ‘swing state’ consumer stress, as measured by more than 150,000 consumer legal inquiries we field each month, dips below national stress average in October and November, conditions favor a Democratic win,” said Matt Layton, LegalShield senior vice president of consumer analytics. “That’s where we are now; we’ll be watching this relationship closely.”

The converse is also true, said Layton:

“When stress in swing states rose above the national index, a Republican was elected. We’ll watch to see how the data moves between now and November.”

LegalShield’s CSLI was launched in 2018 and is based on a dataset of more than 35 million consumer requests for legal assistance since 2002. On average, LegalShield receives approximately 150,000 contacts each month from consumers seeking legal help in more than 90 areas of law, including key consumer issues.

For the first time, LegalShield broke out consumer stress levels on a politically geographic basis, separating red, blue, and purple swing states. For the purposes of the current data view, LegalShield classified states based on the outcome of the 2020 election. Swing states in March’s study are Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania and Wisconsin.

“LegalShield’s CSLI tracks consumer actions as opposed to polling data or sentiment surveys, providing a unique view of the economic experience in red, blue and purple states,” said Warren Schlichting, LegalShield CEO. “These potential voters are calling our provider attorneys because they need help, and it’s striking to see that blue states have a noticeably higher stress level, red state a lower level, and swing states track closely to the national level. And in March we see the lines diverge to a pronounced split.”

The data reveals a noticeable jump in stress in blue states to 10 points higher than red states. Stress in red and purple states fell in March.

Consumer stress rose in blue states that voted Democrat in 2020 by 2.4 points to 66.8, above the national level and 10.3 points (18%) higher than red states. The blue states have exhibited higher stress than red and swing states every month since October 2006.

In contrast, red states experienced stress relief in March by 5.5 points to 56.5, below the national index.

The swing states also reported a drop in stress of 4.5 points to 60.0, just slightly below the national index.

Nationally, the CSLI fell to its lowest level in 12 months, dropping 2.6 points to 61.4. All three sub-indices that make up the flagship index, Bankruptcy, Consumer Finance and Foreclosure, declined in March.

The Consumer Finance Index, which tracks approximately 60 areas of law related to personal finances, is down 1.2 points to 99.7, its lowest level since January 2020, just before the COVID-19 pandemic.

The Bankruptcy Index declined 1.9 points in March to 30.0. Up 21.0% year over year, the Bankruptcy Index historically leads actual bankruptcy filings as reported by the U.S. court system by two quarters, with a .98 correlation.

The Foreclosure Index fell 3.9 points to 36.2, down 1.4% year over year and below the two-year average of 39.5.

The current CSLI reading is in line with macroeconomic indicators trending in a positive direction. The latest jobs report shows the U.S. economy added 303,000 jobs in March, well outpacing economic forecasts. At the same time, unemployment remained relatively steady at 3.8%. However, the annual rate of inflation came in higher than economists expected in March with the consumer price index at 3.5%. As a result, economists do not expect interest rates to ease at the Federal Reserve meeting in June which could continue to put pressure on consumers' debt.

Since its inception, the CSLI has been a 60–90-day leading indicator of the closely watched Consumer Confidence Index (CCI) with an inverse correlation level of -0.85. The CCI reported just a 0.1 point downward change to 104.7 in March.

About the LegalShield Consumer Stress Legal Index:

As part of LegalShield’s mission to ensure every person has equal access to justice, we mine our data for insights policymakers can use to make a real, positive impact in their decision making. Released monthly, the LegalShield Consumer Stress Legal Index is comprised of three sub-indices which reflect the demand for various legal services. LegalShield’s dataset includes more than 35 million consumer requests for legal assistance since 2002, averaging approximately 150,000 calls received monthly. The CSLI uncovers the daily challenges people are facing and provides actionable intelligence to help policymakers and industry leaders bridge those gaps.

About LegalShield:

For more than 50 years, LegalShield has provided everyday Americans with easy and affordable access to legal advice, counsel, protection, and representation. Serving millions, LegalShield is one of the world's largest platforms for legal, identity, and reputation management services protecting individuals and businesses across North America. Founded in 1972, LegalShield, and its privacy management product, IDShield, has provided individuals, families, businesses, and employers with tools and services needed to affordably live a just and secure life. Through technology and innovation, LegalShield is disrupting the traditional legal system and transforming how and where people receive legal guidance and services, with access to thousands of qualified, trusted attorneys and law firms. LegalShield and IDShield are products of Pre-Paid Legal Services, Inc. To learn more about LegalShield and IDShield, visit LegalShield.com and IDShield.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240423795718/en/

Contacts

LegalShield Media Contact:

Hollon Kohtz, Director of Communications

hollonkohtz@pplsi.com