With approximately one-third of the S&P 500 reporting, all eyes will be on large-cap earnings this week. Rest assured, though; there will also be plenty of action in mid-cap land.

Historically the more volatile asset class, U.S. mid-caps, can produce some potent trades when earnings seasons roll around. This is because such companies are less widely followed than the Apples and Microsofts of the world and can deliver some major surprises.

The mid-cap space is also a good place to find short-term winners because, coming out of 2022’s bear market, the group is relatively undervalued. On a forward-earnings basis, the mid-cap S&P 400 has a P/E ratio of 14x. Compare this to the S&P 500’s forward P/E of 18x.

Last week, positive earnings surprises from water tech specialist Badger Meter and insurer RLI Corp. sparked high-volume jumps. Even the downtrodden regional bank Western Alliance Bancorp gapped up after overdelivering. On the other hand, misses at auto parts supplier Autoliv and Independent Bank Corp. prompted significant selloffs.

Which mid-caps have the potential for big moves next? Keep an eye on these three names.

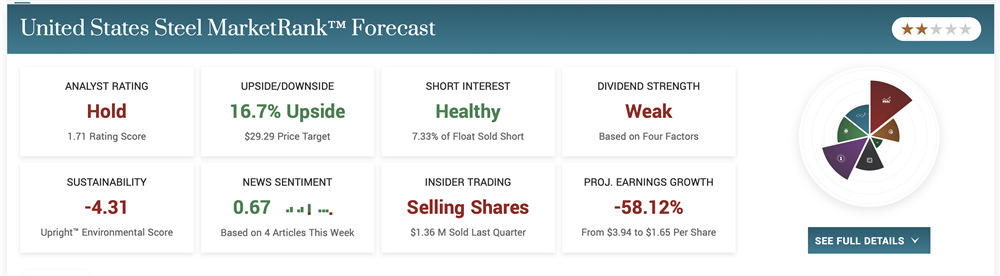

What Could Drive a U.S. Steel Earnings Beat in Q1?

United States Steel Corp. (NYSE: X) announces first quarter results after the market close on April 27th. Facing another tough comparison to a usually strong 2022 performance, the steelmaker is expected to suffer a third straight earnings drop. The consensus EPS forecast of $0.45 implies an 85% year-over-year decline and an acceleration from the 64% and 76% EPS plunges in the prior two quarters. Street estimates show an improving bottom line from there, though, which suggests Q1 was an inflection point.

In the back half of last year, U.S. Steel was slowed by lower realized prices and higher metallics and scrap expenses. While cost pressures are likely to have persisted in the first few months of 2023, management said it sees steel prices trending higher in 2023. Steel rebar prices rose for most of Q1 before a mid-March downturn. Production levels and the extent to which rising steel prices offset cost inflation will largely dictate whether this quarter’s low bar will be exceeded.

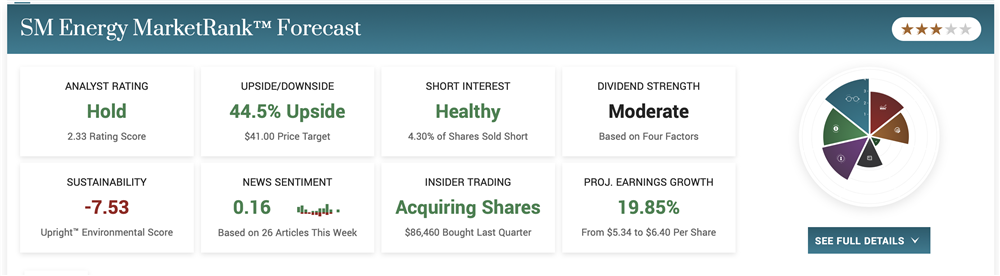

Will SM Energy Extend Its Earnings Beat Streak?

SM Energy Co. (NYSE: SM) comes into its April 27th post-market report with the Street anticipating the company’s first year-over-year earnings decline since the start of the pandemic. Mainly due to falling commodity prices, the independent oil and gas player is projected to report EPS of $1.23, which would represent a 38% decrease from last year.

Yet this shouldn’t deter traders from keeping the stock on the trading list. In fact, with SM Energy having topped EPS estimates for eight straight quarters, it only makes SM Energy a strong positive surprise contender.

Last time out, higher average realized oil prices and lower operating expenses drove a 7% beat. With crude and natural gas prices sliding during most of Q1, SM Energy won’t have a price tailwind — but it will have a leaner cost structure to lean on for another potential outperformance.

In February 22nd’s Q4 release, lower exploration and SG&A expenses drove a 14% decrease in fourth-quarter operating expenses. This helped the stock go on a seven-day run from $27.92 to $32.23. Interestingly, the share price is back to where it was at the time of the Q4 report. A ninth consecutive beat could mean déjà vu for SM.

When Does Caesars Holdings Report Q1 Results?

Caesars Holdings, Inc. (NASDAQ: CZR) will be expected to report a one penny per share loss when it reports first-quarter numbers on May 2nd. It would be the casino and hotel operator’s first net loss since Q1 of last year but a sharp improvement from the $2.19 per share loss posted then.

With Q1 being Caesars’ seasonally weakest period, muted travel volumes and slower guest traffic compared to the holidays are behind the low expectation. The impact of higher prices and rates on discretionary spending doesn’t help, nor does increase operating expenses. But there’s a silver lining.

Analysts have been raising their 2023 EPS estimates in recent weeks. This is probably due to the momentum in Caesars’ booking trends tied to the return of business conferences and group events — and management’s upbeat tone about more of the same in the years ahead.

The October 2022 bottom in Caesars stock was followed by two strong earnings beats that pushed it into the mid-$50s in February. A low volume pullback to the mid-$40s has set up a favorable earnings trade for the bulls.

In 2022, Caesars’ Las Vegas occupancy rates rebounded to 92%. This trend, along with a growing contribution from the Caesars Digital business, could drive a positive encore performance.