Looking back on immuno-oncology stocks’ Q2 earnings, we examine this quarter’s best and worst performers, including Exact Sciences (NASDAQ: EXAS) and its peers.

Over the next few years, immuno-oncology companies, which harness the immune system to fight illnesses such as cancer, faces strong tailwinds from advancements in precision medicine (including the use of AI to improve hit rates) and growing demand for treatments targeting rare diseases. However, headwinds such as rising scrutiny over drug pricing, regulatory unknowns, and competition from larger, more resourced pharmaceutical companies could weigh on growth.

The 4 immuno-oncology stocks we track reported an exceptional Q2. As a group, revenues beat analysts’ consensus estimates by 9.1%.

Luckily, immuno-oncology stocks have performed well with share prices up 24.7% on average since the latest earnings results.

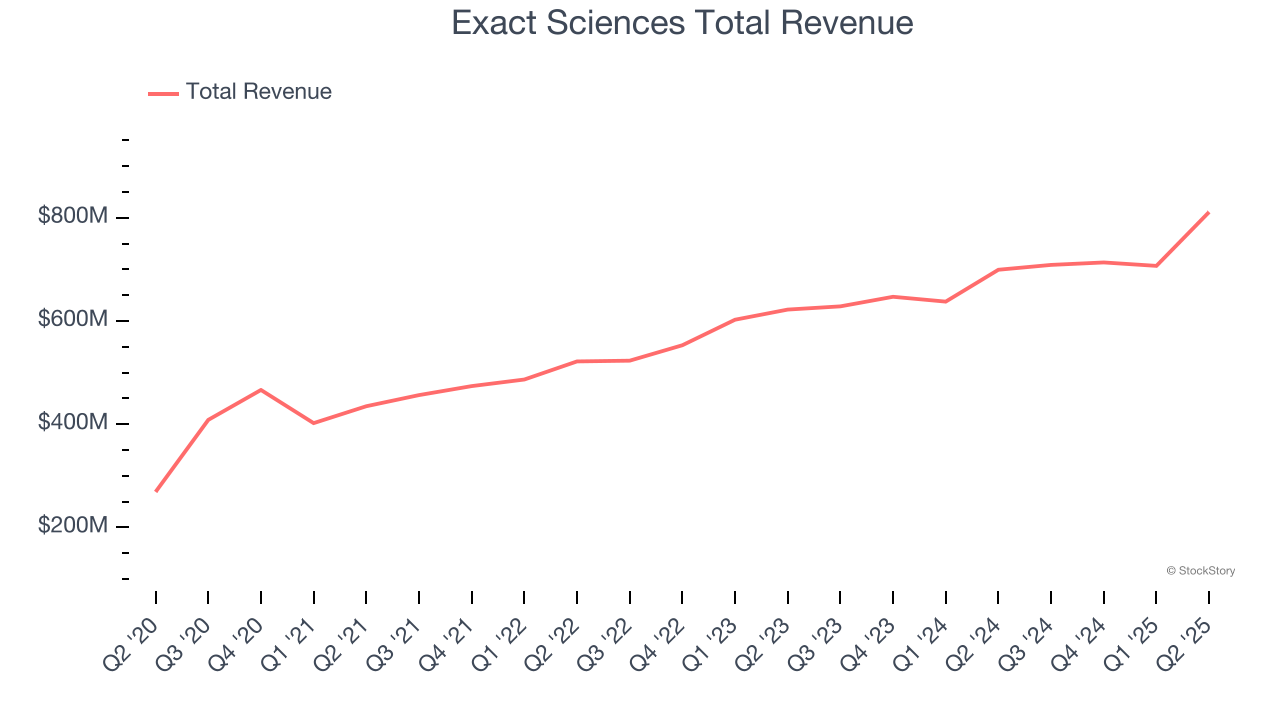

Exact Sciences (NASDAQ: EXAS)

With a mission to detect cancer earlier when it's more treatable, Exact Sciences (NASDAQ: EXAS) develops and markets cancer screening and diagnostic tests, including its flagship Cologuard stool-based colorectal cancer screening test.

Exact Sciences reported revenues of $811.1 million, up 16% year on year. This print exceeded analysts’ expectations by 4.9%. Overall, it was an exceptional quarter for the company with a beat of analysts’ EPS and revenue estimates.

“The Exact Sciences team continues to build momentum, advancing our mission through earlier detection,” said Kevin Conroy, chairman and CEO.

Exact Sciences delivered the weakest performance against analyst estimates and weakest full-year guidance update of the whole group. Interestingly, the stock is up 34.6% since reporting and currently trades at $63.49.

Is now the time to buy Exact Sciences? Access our full analysis of the earnings results here, it’s free for active Edge members.

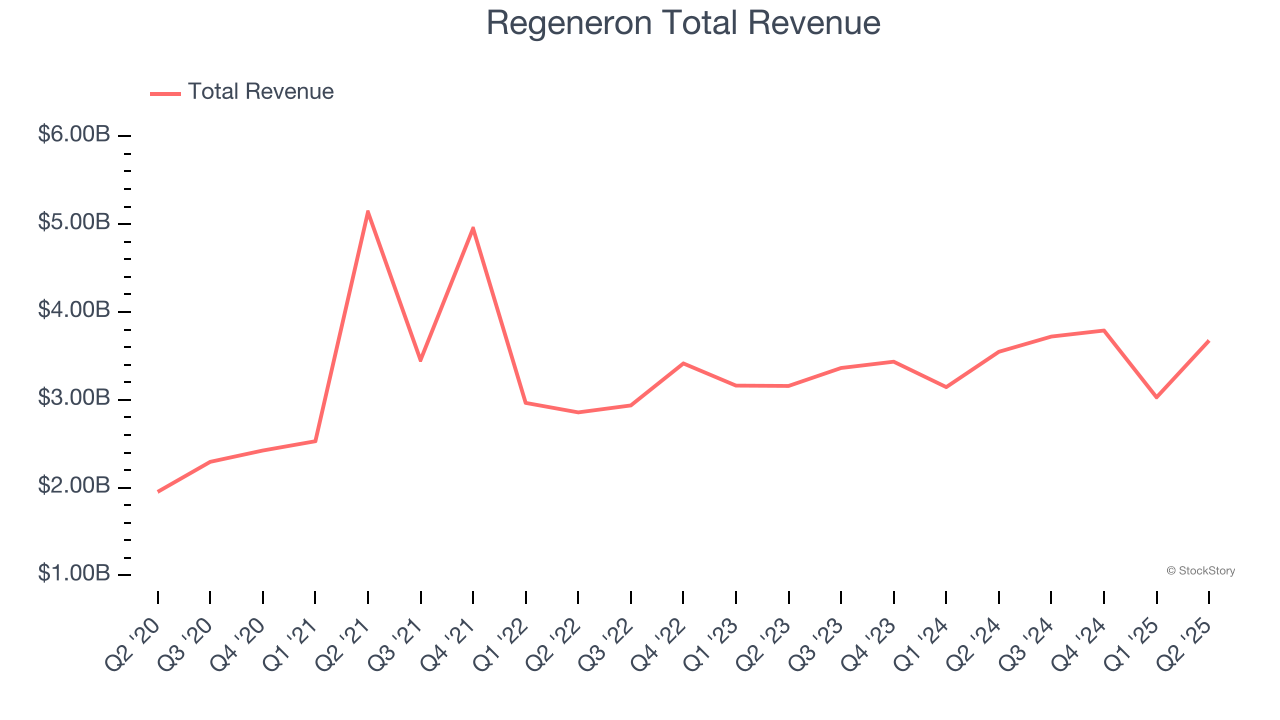

Best Q2: Regeneron (NASDAQ: REGN)

Founded by scientists who wanted to build a company where science could thrive, Regeneron Pharmaceuticals (NASDAQ: REGN) develops and commercializes medicines for serious diseases, with key products treating eye conditions, allergic diseases, cancer, and other disorders.

Regeneron reported revenues of $3.68 billion, up 3.6% year on year, outperforming analysts’ expectations by 11.3%. The business had an incredible quarter with an impressive beat of analysts’ EPS and revenue estimates.

The market seems happy with the results as the stock is up 5.6% since reporting. It currently trades at $575.67.

Is now the time to buy Regeneron? Access our full analysis of the earnings results here, it’s free for active Edge members.

Natera (NASDAQ: NTRA)

Founded in 2003 as Gene Security Network before rebranding in 2012, Natera (NASDAQ: NTRA) develops and commercializes genetic tests for prenatal screening, cancer detection, and organ transplant monitoring using its proprietary cell-free DNA technology.

Natera reported revenues of $546.6 million, up 32.2% year on year, exceeding analysts’ expectations by 14.7%. It may have had the worst quarter among its peers, but its results were still good as it also locked in an impressive beat of analysts’ revenue estimates and full-year revenue guidance exceeding analysts’ expectations.

Interestingly, the stock is up 34% since the results and currently trades at $189.49.

Read our full analysis of Natera’s results here.

Incyte (NASDAQ: INCY)

Founded in 1991 and evolving from a genomics research firm to a commercial-stage drug developer, Incyte (NASDAQ: INCY) is a biopharmaceutical company that discovers, develops, and commercializes proprietary therapeutics for cancer and inflammatory diseases.

Incyte reported revenues of $1.22 billion, up 16.5% year on year. This print topped analysts’ expectations by 5.5%. It was an exceptional quarter as it also recorded a solid beat of analysts’ revenue estimates and a beat of analysts’ EPS estimates.

The stock is up 24.6% since reporting and currently trades at $87.48.

Read our full, actionable report on Incyte here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.