Coconut water company The Vita Coco Company (NASDAQ: COCO) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 37.2% year on year to $182.3 million. Its GAAP profit of $0.40 per share was 35.9% above analysts’ consensus estimates.

Is now the time to buy Vita Coco? Find out by accessing our full research report, it’s free for active Edge members.

Vita Coco (COCO) Q3 CY2025 Highlights:

- Revenue: $182.3 million vs analyst estimates of $158.3 million (37.2% year-on-year growth, 15.2% beat)

- EPS (GAAP): $0.40 vs analyst estimates of $0.29 (35.9% beat)

- Adjusted EBITDA: $32.39 million vs analyst estimates of $24.28 million (17.8% margin, 33.4% beat)

- EBITDA guidance for the full year is $92.5 million at the midpoint, above analyst estimates of $90.38 million

- Operating Margin: 15.3%, in line with the same quarter last year

- Free Cash Flow Margin: 19.6%, up from 6.7% in the same quarter last year

- Sales Volumes rose 28.8% year on year (-3.1% in the same quarter last year)

- Market Capitalization: $2.4 billion

Company Overview

Founded in 2004 followed by a 2021 IPO, The Vita Coco Company (NASDAQ: COCO) offers coconut water products that are a natural way to quench thirst.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $609.3 million in revenue over the past 12 months, Vita Coco is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

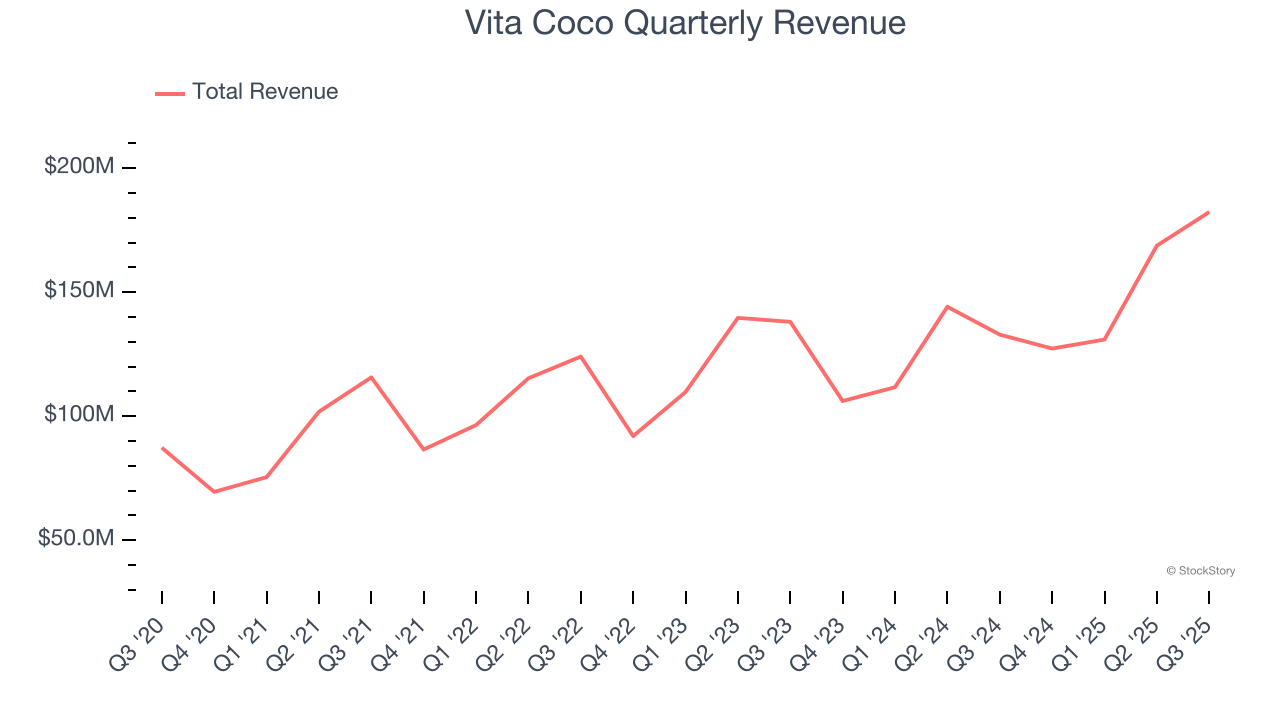

As you can see below, Vita Coco grew its sales at a solid 13% compounded annual growth rate over the last three years as consumers bought more of its products.

This quarter, Vita Coco reported wonderful year-on-year revenue growth of 37.2%, and its $182.3 million of revenue exceeded Wall Street’s estimates by 15.2%.

Looking ahead, sell-side analysts expect revenue to grow 4.9% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and suggests its products will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Volume Growth

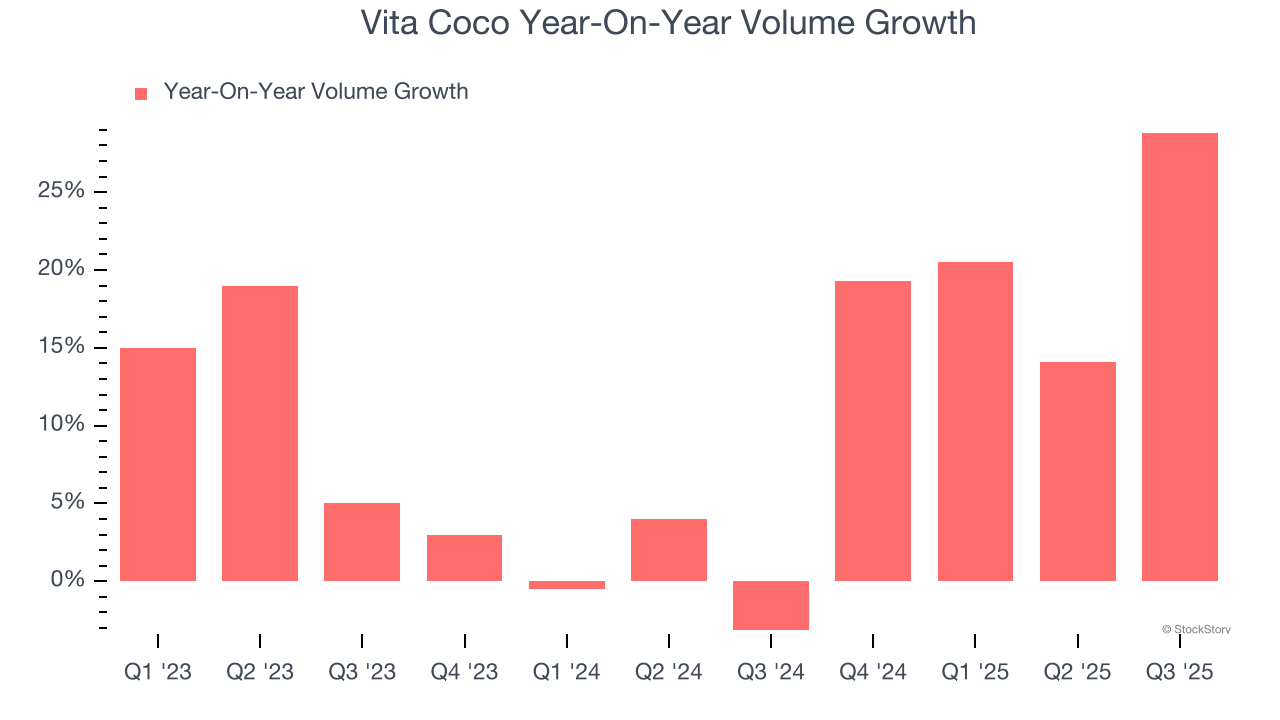

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Vita Coco’s average quarterly volume growth of 10.8% over the last two years has beaten the competition by a long shot. This is great because companies with significant volume growth are needles in a haystack in the stable consumer staples sector.

In Vita Coco’s Q3 2025, sales volumes jumped 28.8% year on year. This result was an acceleration from its historical levels, certainly a positive signal.

Key Takeaways from Vita Coco’s Q3 Results

We were impressed by how significantly Vita Coco blew past analysts’ EBITDA expectations this quarter and issued EBITDA guidance comfortably above Wall Street's estimates. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock traded up 8.9% to $46.05 immediately following the results.

Vita Coco may have had a good quarter, but does that mean you should invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.