Hyatt Hotels has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 15.4% to $154.36 per share while the index has gained 13%.

Is there a buying opportunity in Hyatt Hotels, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free for active Edge members.

Why Is Hyatt Hotels Not Exciting?

We're sitting this one out for now. Here are three reasons there are better opportunities than H and a stock we'd rather own.

1. Weak RevPAR Growth Points to Soft Demand

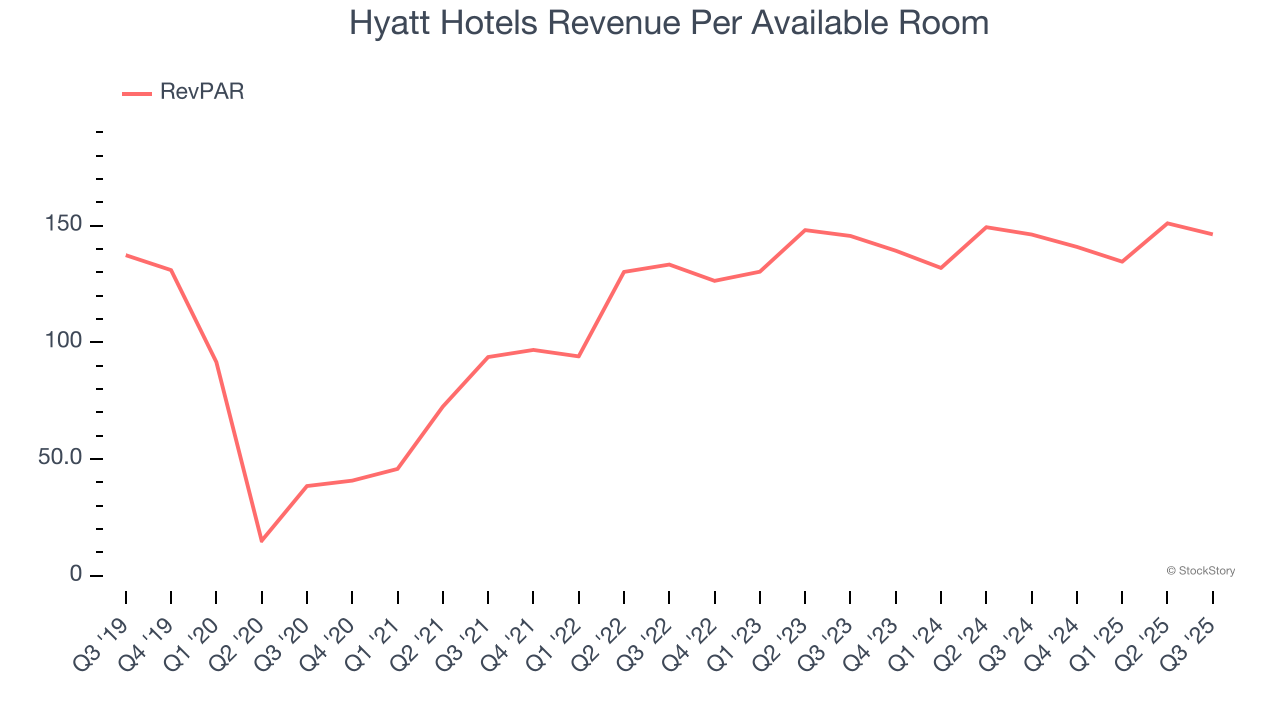

Investors interested in Travel and Vacation Providers companies should track RevPAR (revenue per available room) in addition to reported revenue. This metric accounts for daily rates and occupancy levels, painting a holistic picture of Hyatt Hotels’s demand characteristics.

Hyatt Hotels’s RevPAR came in at $146.24 in the latest quarter, and over the last two years, its year-on-year growth averaged 2.1%. This performance was underwhelming and suggests it might have to invest in new amenities such as restaurants and bars to attract customers - this isn’t ideal because expansions can complicate operations and be quite expensive (i.e., renovations and increased overhead).

2. Weak Operating Margin Could Cause Trouble

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Hyatt Hotels’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 4.8% over the last two years. This profitability was lousy for a consumer discretionary business and caused by its suboptimal cost structure.

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Hyatt Hotels’s five-year average ROIC was negative 0.8%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

Final Judgment

Hyatt Hotels isn’t a terrible business, but it doesn’t pass our bar. That said, the stock currently trades at 44.9× forward P/E (or $154.36 per share). This multiple tells us a lot of good news is priced in - you can find more timely opportunities elsewhere. We’d suggest looking at one of our top software and edge computing picks.

High-Quality Stocks for All Market Conditions

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.