Medical technology company Becton, Dickinson and Company (NYSE: BDX) met Wall Streets revenue expectations in Q3 CY2025, with sales up 8.3% year on year to $5.89 billion. Its non-GAAP profit of $3.96 per share was 1.2% above analysts’ consensus estimates.

Is now the time to buy BD? Find out by accessing our full research report, it’s free for active Edge members.

BD (BDX) Q3 CY2025 Highlights:

- Revenue: $5.89 billion vs analyst estimates of $5.91 billion (8.3% year-on-year growth, in line)

- Adjusted EPS: $3.96 vs analyst estimates of $3.91 (1.2% beat)

- Adjusted EBITDA: $1.33 billion vs analyst estimates of $1.78 billion (22.5% margin, 25.6% miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $14.90 at the midpoint, in line with analyst estimates

- Operating Margin: 11.8%, in line with the same quarter last year

- Free Cash Flow Margin: 17%, similar to the same quarter last year

- Constant Currency Revenue rose 7% year on year, in line with the same quarter last year

- Market Capitalization: $50.56 billion

"Our resilient business model and commitment to commercial and operational execution enabled us to deliver 3.9% organic growth in New BD along with substantial adjusted margin and earnings growth in fiscal 2025," said Tom Polen, chairman, CEO and president of BD.

Company Overview

With a history dating back to 1897 and a presence in virtually every hospital around the globe, Becton Dickinson (NYSE: BDX) develops and manufactures medical supplies, devices, laboratory equipment and diagnostic products used by healthcare institutions and professionals worldwide.

Revenue Growth

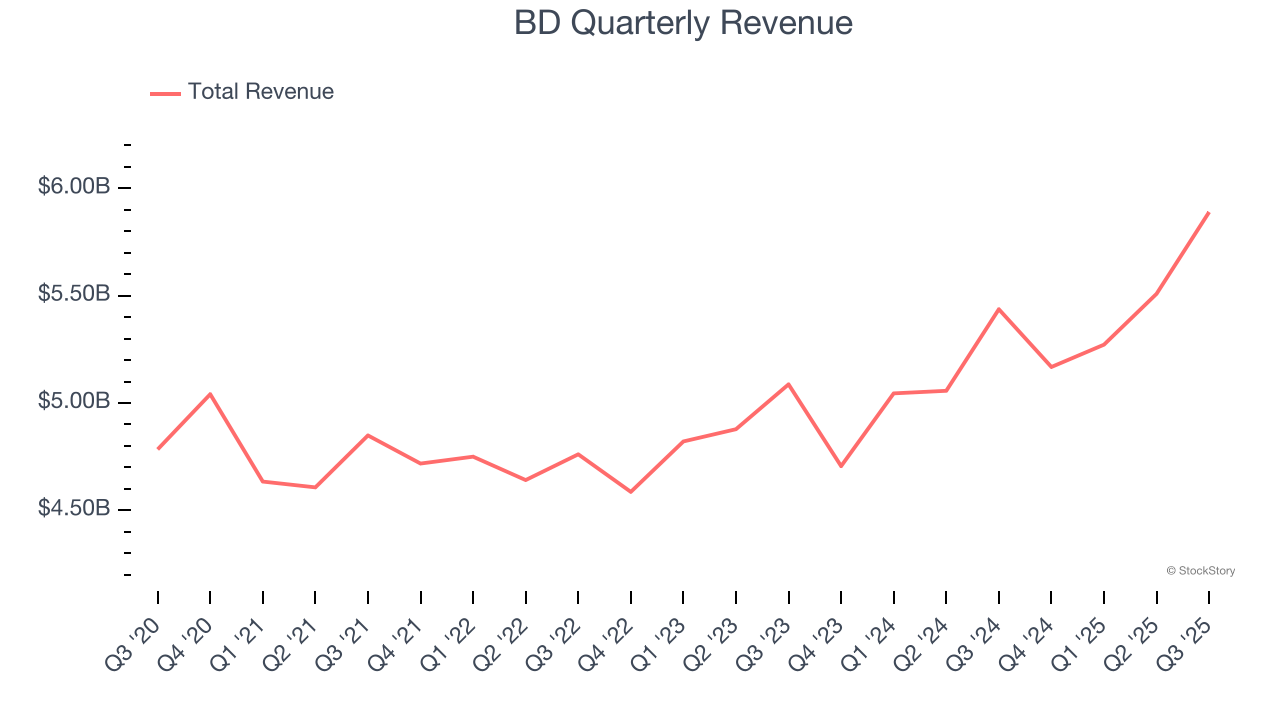

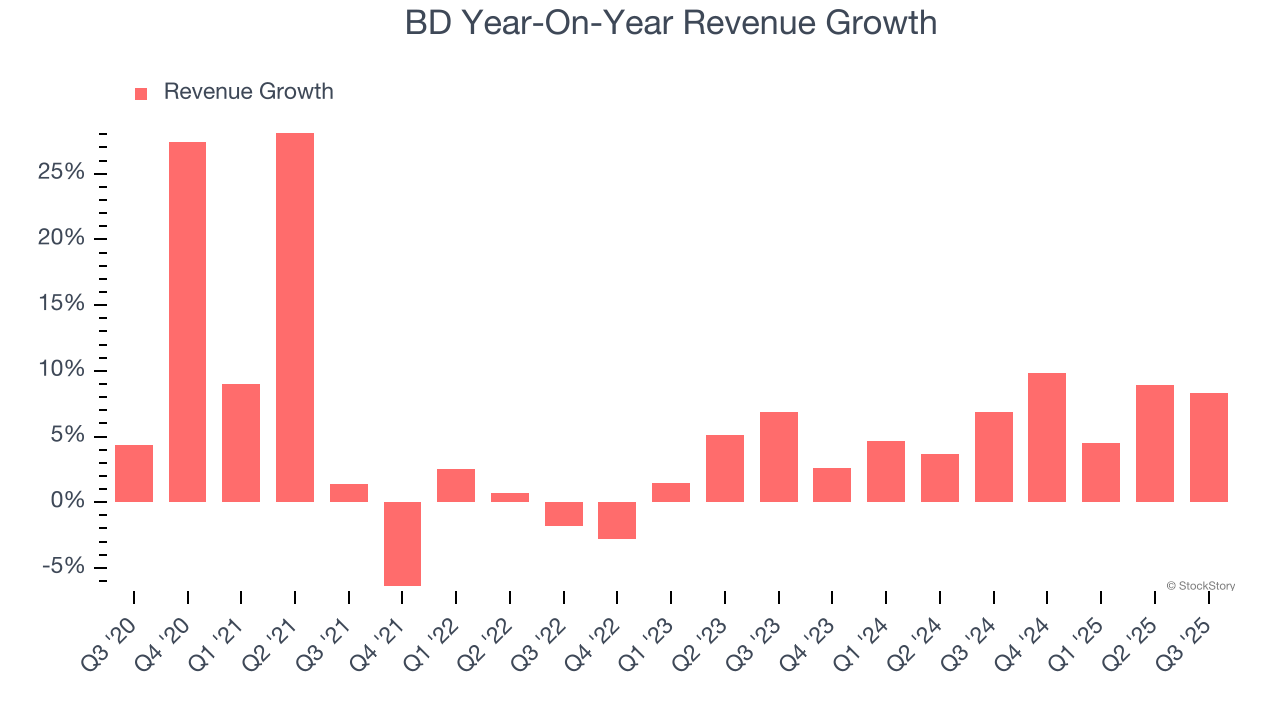

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, BD’s 5.7% annualized revenue growth over the last five years was mediocre. This fell short of our benchmark for the healthcare sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. BD’s annualized revenue growth of 6.2% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

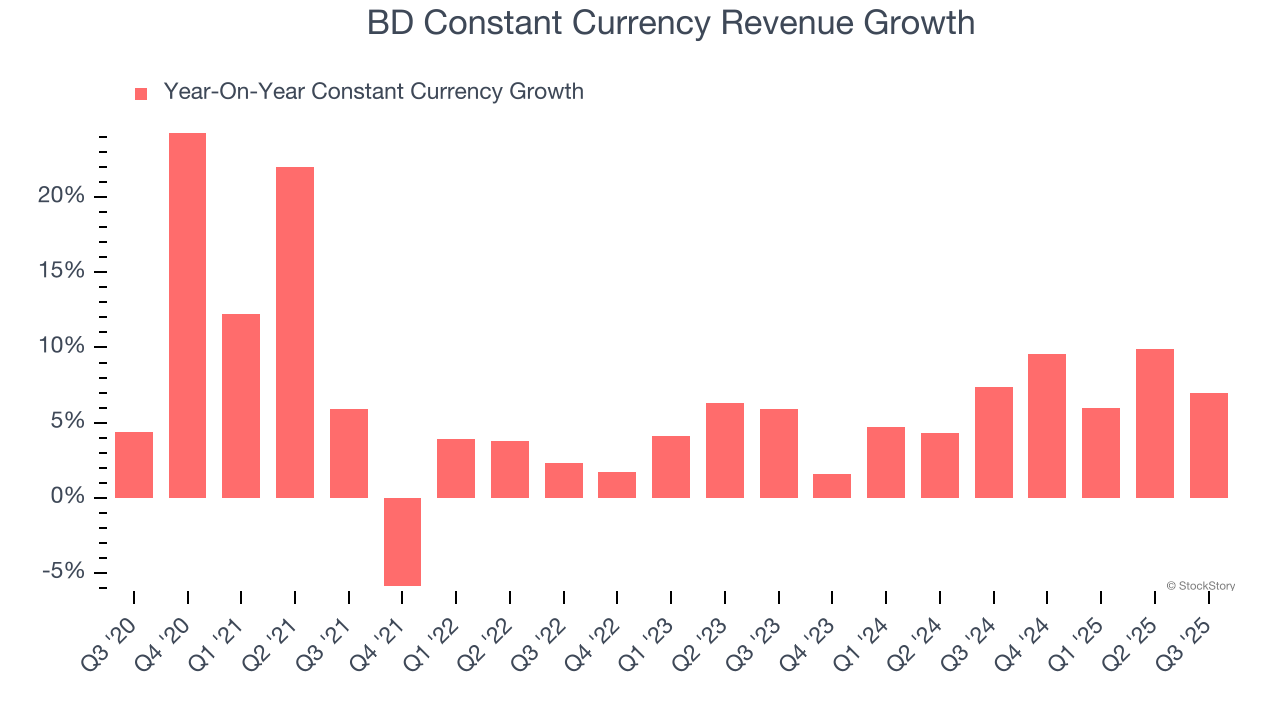

BD also reports sales performance excluding currency movements, which are outside the company’s control and not indicative of demand. Over the last two years, its constant currency sales averaged 6.3% year-on-year growth. Because this number aligns with its normal revenue growth, we can see that BD has properly hedged its foreign currency exposure.

This quarter, BD grew its revenue by 8.3% year on year, and its $5.89 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.4% over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will face some demand challenges.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

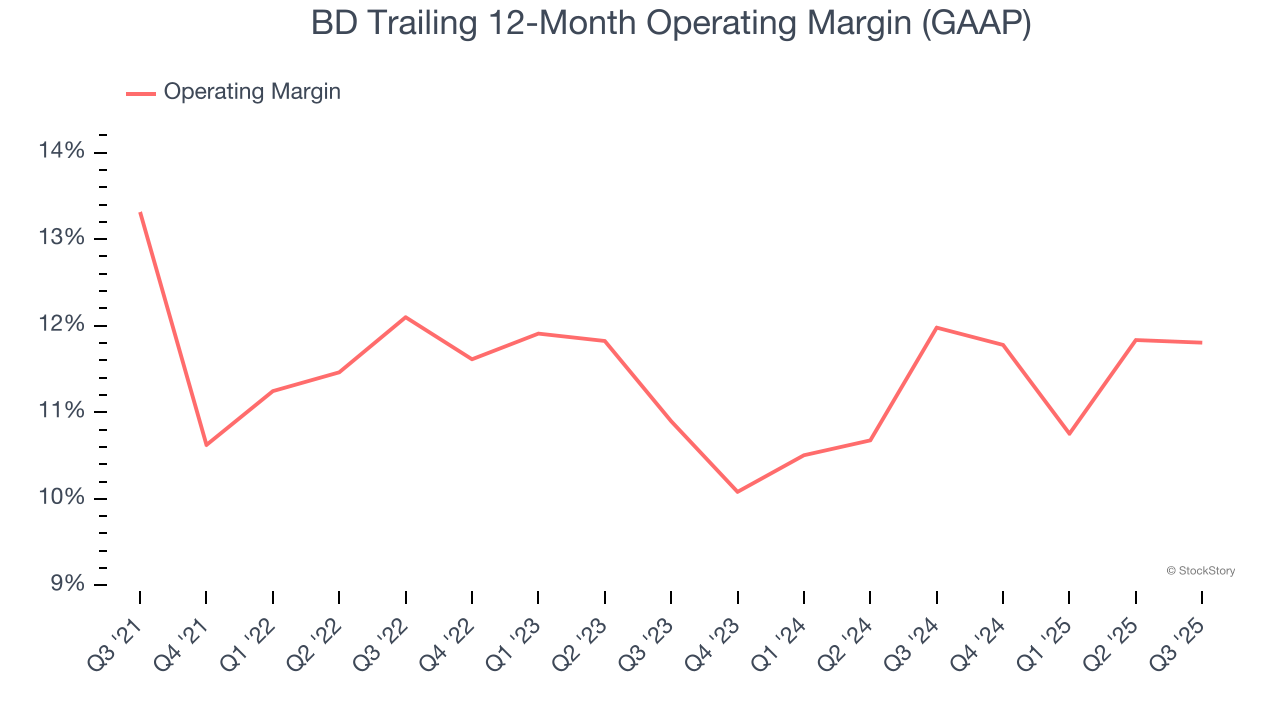

BD has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 12%, higher than the broader healthcare sector.

Looking at the trend in its profitability, BD’s operating margin decreased by 1.5 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, BD generated an operating margin profit margin of 11.8%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

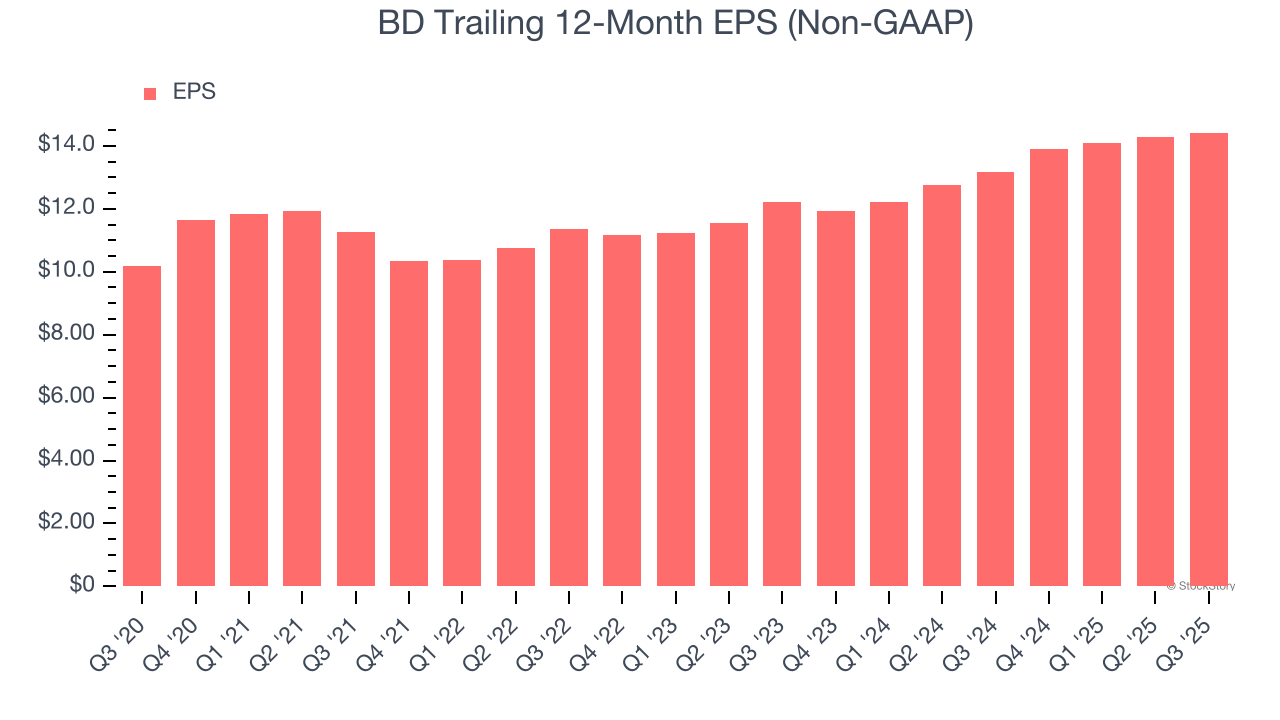

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

BD’s solid 7.2% annual EPS growth over the last five years aligns with its revenue performance. This tells us its incremental sales were profitable.

In Q3, BD reported adjusted EPS of $3.96, up from $3.81 in the same quarter last year. This print beat analysts’ estimates by 1.2%. Over the next 12 months, Wall Street expects BD’s full-year EPS of $14.42 to grow 2.3%.

Key Takeaways from BD’s Q3 Results

We struggled to find many positives in these results. Its constant currency revenue slightly missed and its revenue was in line with Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 3.4% to $170.33 immediately following the results.

Is BD an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.