Blackstone trades at $155.91 per share and has stayed right on track with the overall market, gaining 8.6% over the last six months. At the same time, the S&P 500 has returned 13.3%.

Is BX a buy right now? Find out in our full research report, it’s free for active Edge members.

Why Is BX a Good Business?

With over $1 trillion in assets under management and investments spanning real estate, private equity, credit, and hedge funds, Blackstone (NYSE: BX) is a global alternative asset manager that invests capital on behalf of pension funds, sovereign wealth funds, and other institutional investors.

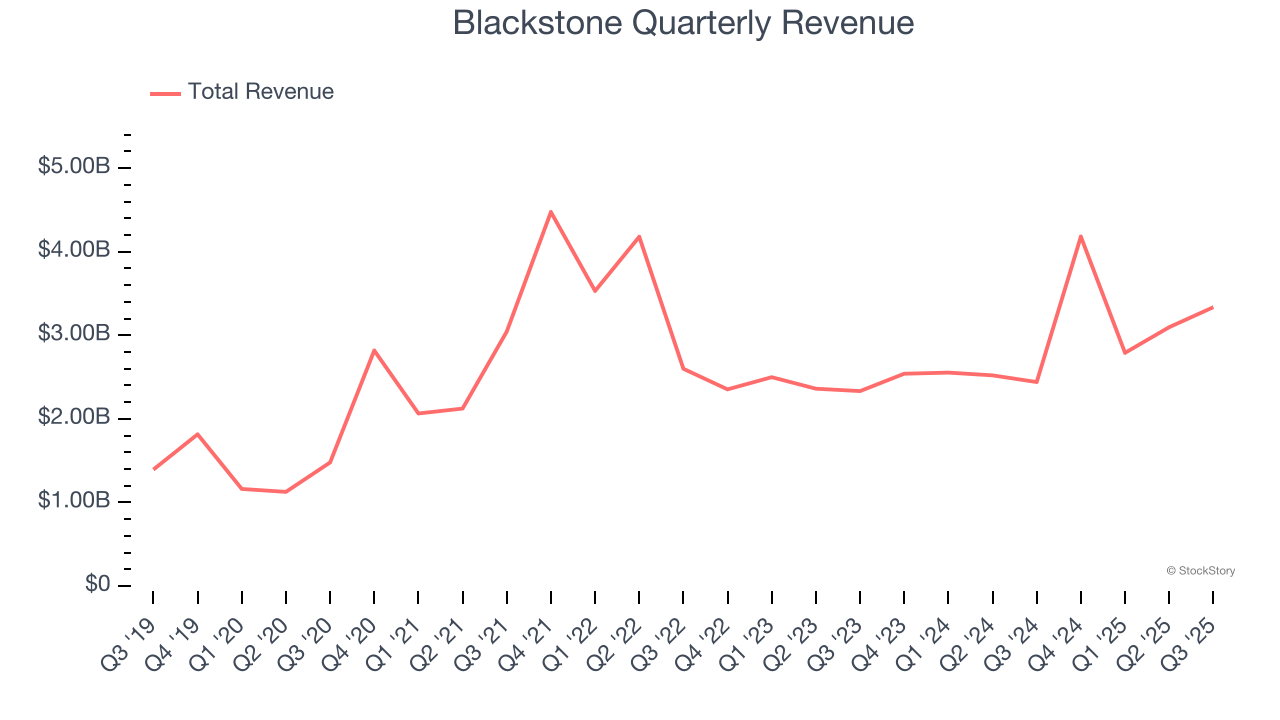

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

Over the last five years, Blackstone grew its revenue at an excellent 19.2% compounded annual growth rate. Its growth surpassed the average financials company and shows its offerings resonate with customers.

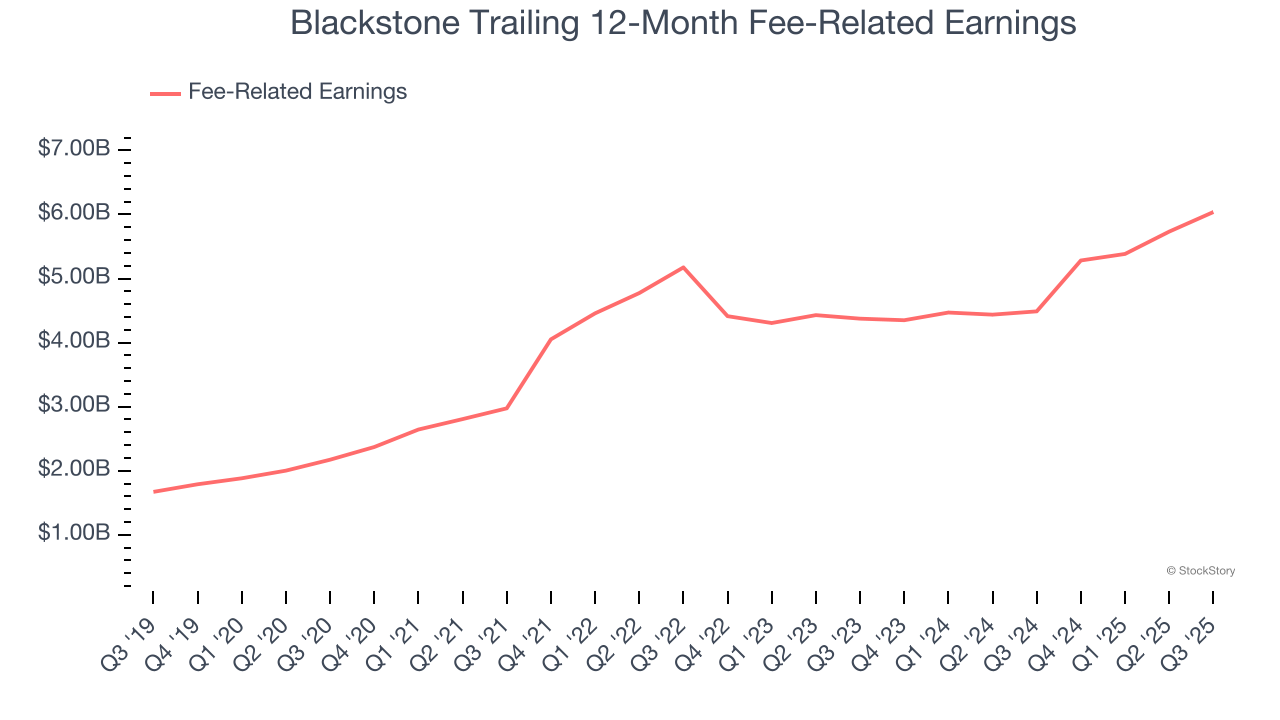

2. Fee-Related Earnings Jumped Higher

Topline performance tells part of the story, but sustainable profitability is the real measure of success. In the asset management space, fee-related earnings isolate the consistent profits from ongoing fee-based operations, filtering out the volatility of performance fees and investment income. This gives us a clear view of the company’s recurring earnings potential.

Blackstone’s annual fee-related earnings growth over the last five years was 22.7%, a top-notch result.

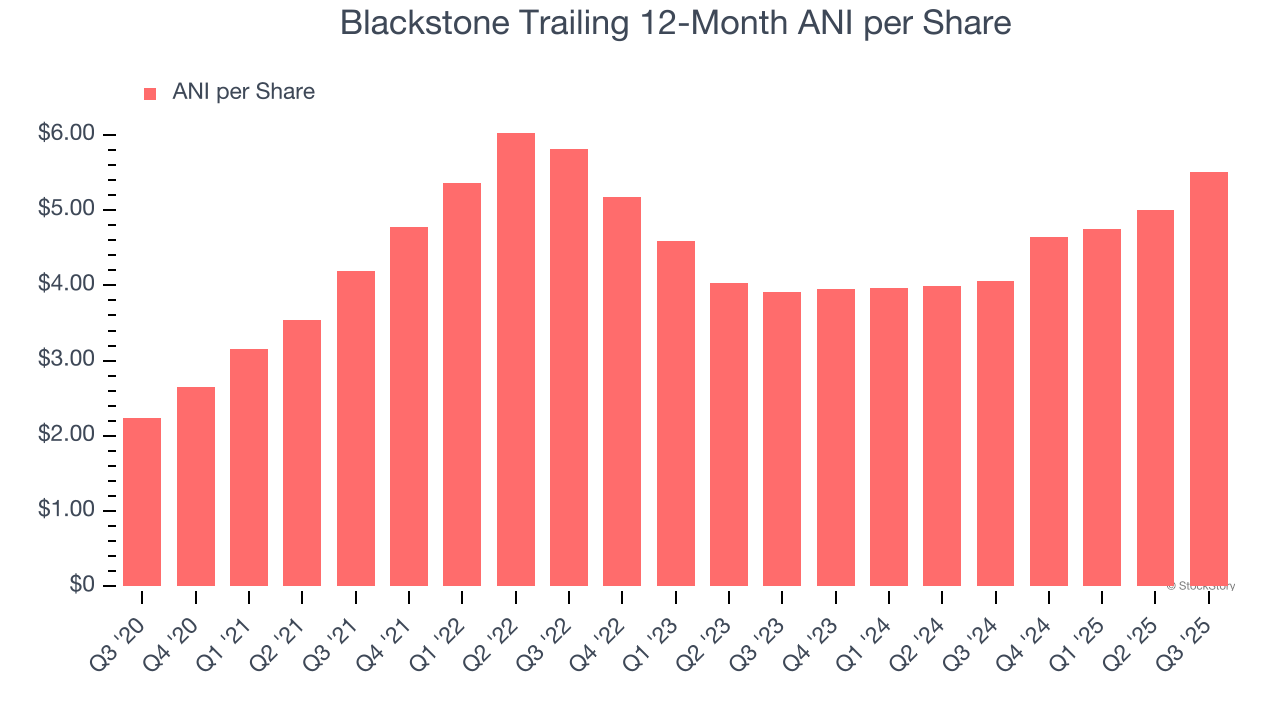

3. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Blackstone’s remarkable 19.7% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Final Judgment

These are just a few reasons why Blackstone ranks highly on our list, but at $155.91 per share (or 25.2× forward P/E), is now the right time to buy the stock? See for yourself in our comprehensive research report, it’s free for active Edge members .

Stocks We Like Even More Than Blackstone

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.