Since August 2024, Inspire Medical Systems has been in a holding pattern, posting a small loss of 2.8% while floating around $183.55. The stock also fell short of the S&P 500’s 6.1% gain during that period.

Does this present a buying opportunity for INSP? Or is its underperformance reflective of its story and business quality? Find out in our full research report, it’s free.

Why Are We Positive On INSP?

Founded in 2007, Inspire Medical Systems (NYSE: INSP) develops and markets products for obstructive sleep apnea (OSA), with its flagship product being a neurostimulation system designed to improve breathing during sleep.

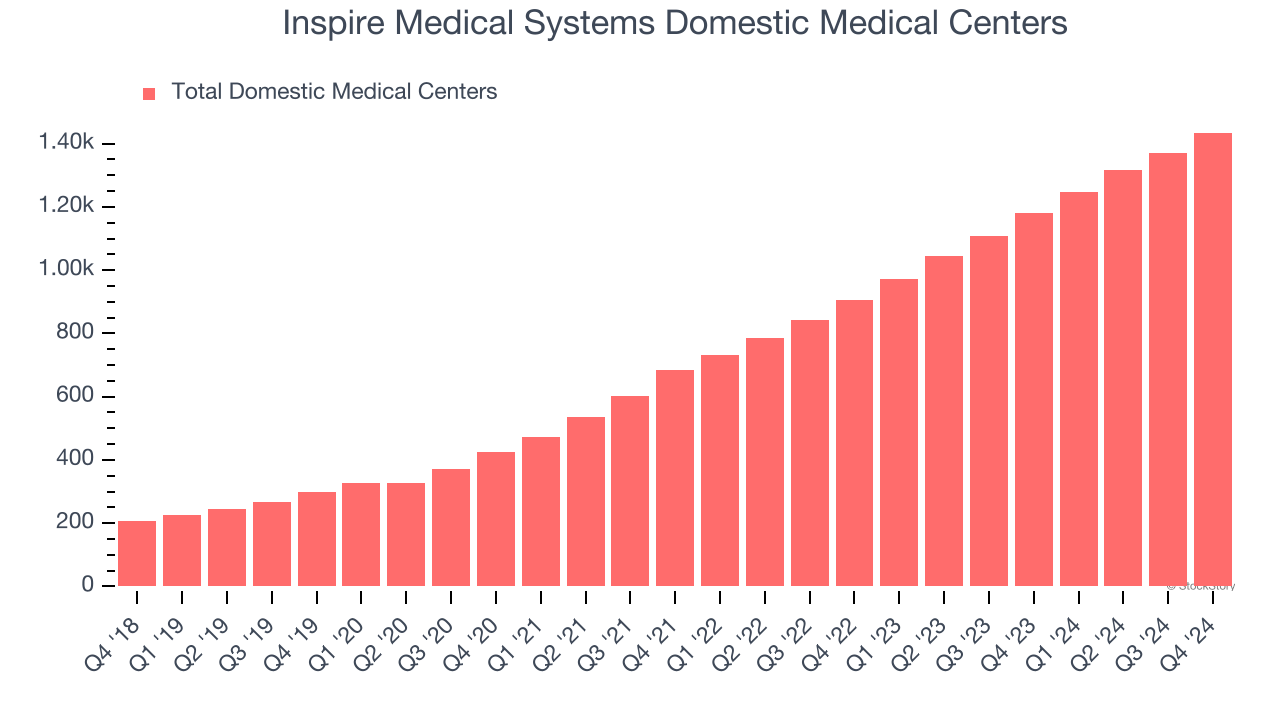

1. Increasing Number of Domestic Medical Centers Leads to More Shots On Goal

Sales growth for companies like Inspire Medical Systems can be broken down into the number of facilities/providers and the revenue for each. While both are important, the latter is the lifeblood of a successful Medical Devices & Supplies - Specialty company because there’s a ceiling to how many facilities and providers one can secure.

Inspire Medical Systems’s number of domestic medical centers punched in at 1,435 in the latest quarter, and over the last two years, averaged 28.4% year-on-year growth. This pace was fast and gives the company more opportunities to increase its revenue.

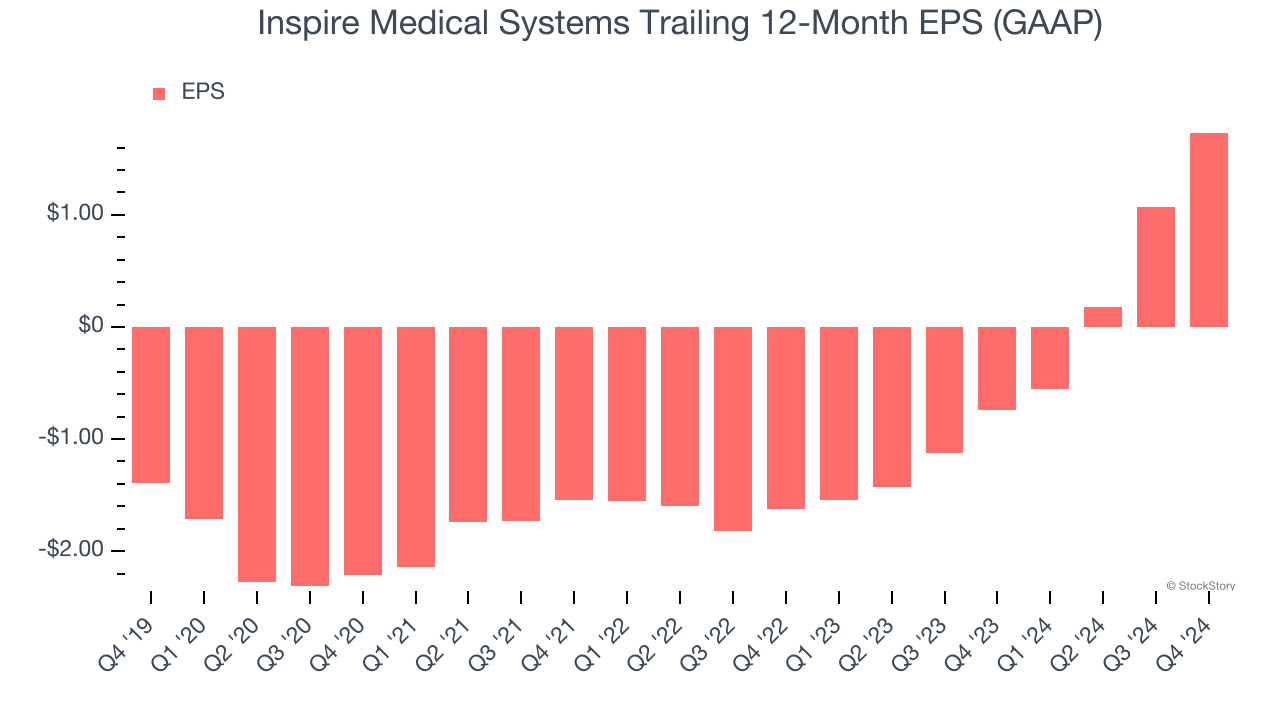

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Inspire Medical Systems’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

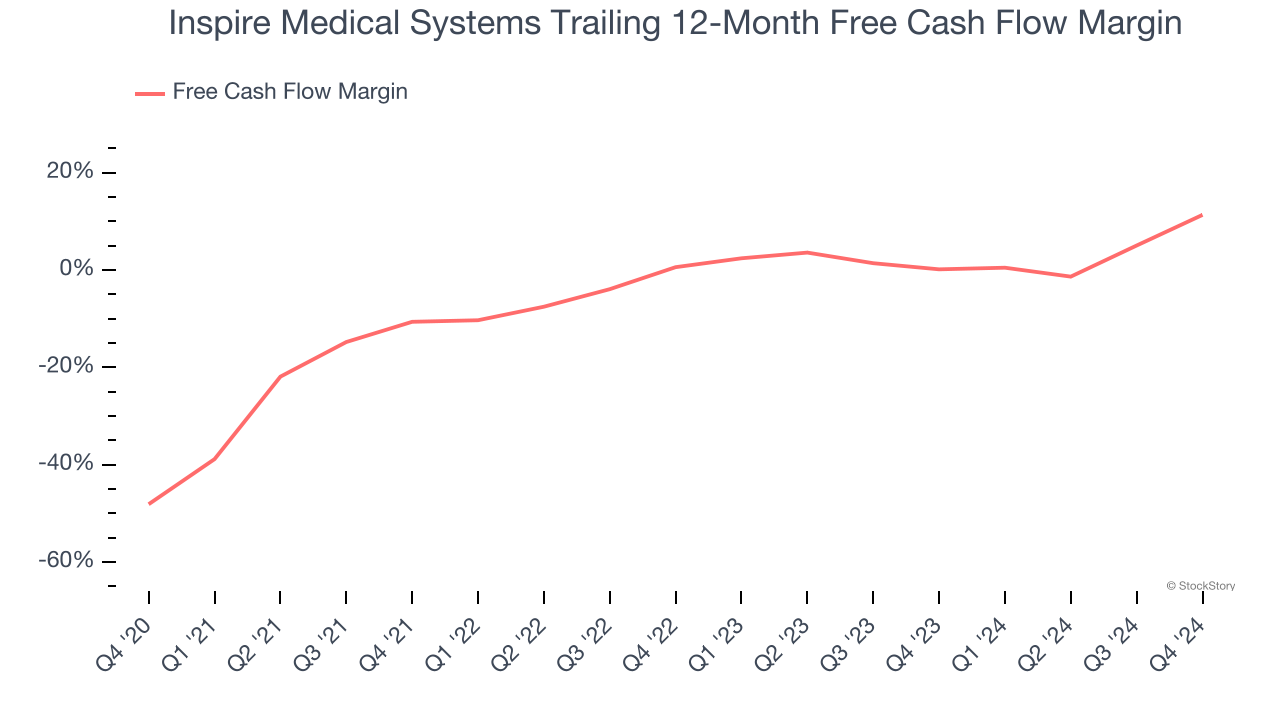

3. Increasing Free Cash Flow Margin Juices Financials

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Inspire Medical Systems’s margin expanded by 59.5 percentage points over the last five years. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability. Inspire Medical Systems’s free cash flow margin for the trailing 12 months was 11.4%.

Final Judgment

These are just a few reasons Inspire Medical Systems is a high-quality business worth owning. With its shares underperforming the market lately, the stock trades at 95.5× forward price-to-earnings (or $183.55 per share). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Inspire Medical Systems

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.