Packaged foods company B&G Foods (NYSE: BGS) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, but sales fell by 4.6% year on year to $551.6 million. The company expects the full year’s revenue to be around $1.92 billion, close to analysts’ estimates. Its non-GAAP profit of $0.31 per share was in line with analysts’ consensus estimates.

Is now the time to buy B&G Foods? Find out by accessing our full research report, it’s free.

B&G Foods (BGS) Q4 CY2024 Highlights:

- Revenue: $551.6 million vs analyst estimates of $546.5 million (4.6% year-on-year decline, 0.9% beat)

- Adjusted EPS: $0.31 vs analyst estimates of $0.30 (in line)

- Adjusted EBITDA: $86.08 million vs analyst estimates of $85.14 million (15.6% margin, 1.1% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $1.92 billion at the midpoint, in line with analyst expectations and implying -0.6% growth (vs -6.3% in FY2024)

- Adjusted EPS guidance for the upcoming financial year 2025 is $0.70 at the midpoint, beating analyst estimates by 4.9%

- EBITDA guidance for the upcoming financial year 2025 is $295 million at the midpoint, in line with analyst expectations

- Operating Margin: -46.6%, down from 7.2% in the same quarter last year

- Sales Volumes were up 2.2% year on year

- Market Capitalization: $533.6 million

Company Overview

Started as a small grocery store in New York City, B&G Foods (NYSE: BGS) is an American packaged foods company with a diverse portfolio of more than 50 brands.

Shelf-Stable Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $1.93 billion in revenue over the past 12 months, B&G Foods is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

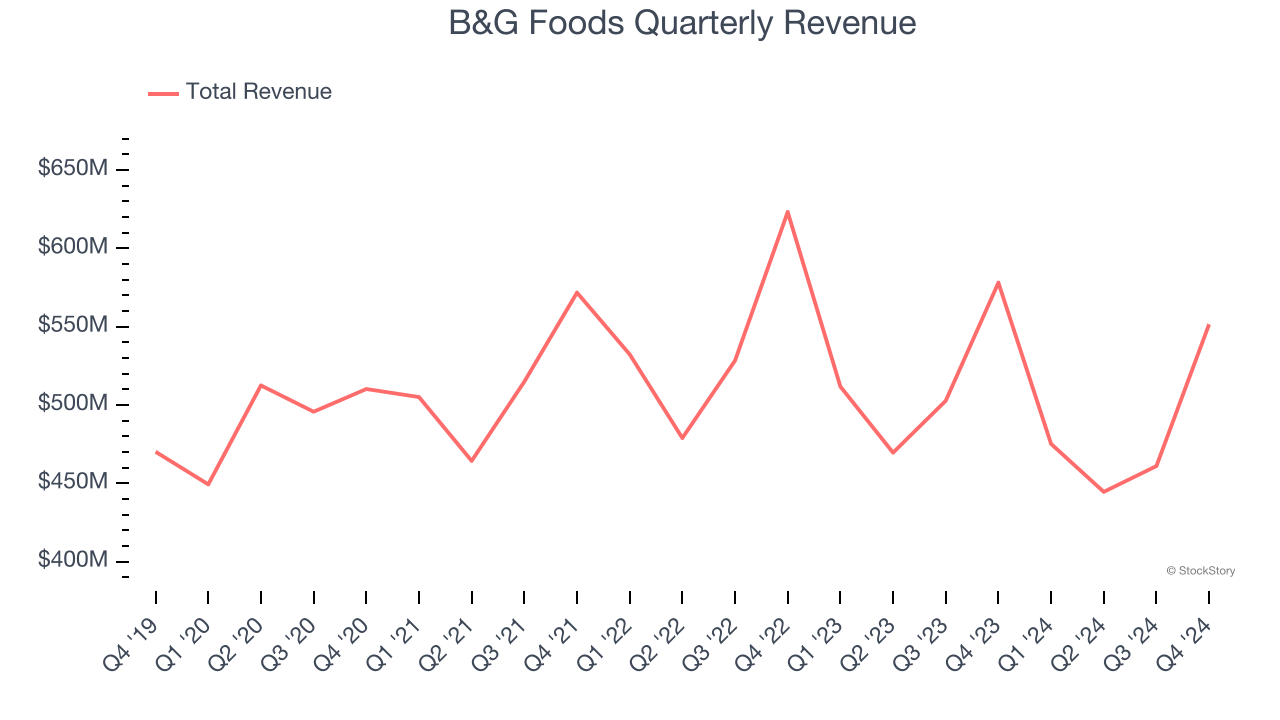

As you can see below, B&G Foods’s demand was weak over the last three years. Its sales fell by 2% annually despite consumers buying more of its products. We’ll explore what this means in the "Volume Growth" section.

This quarter, B&G Foods’s revenue fell by 4.6% year on year to $551.6 million but beat Wall Street’s estimates by 0.9%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection indicates its newer products will catalyze better top-line performance, it is still below average for the sector.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

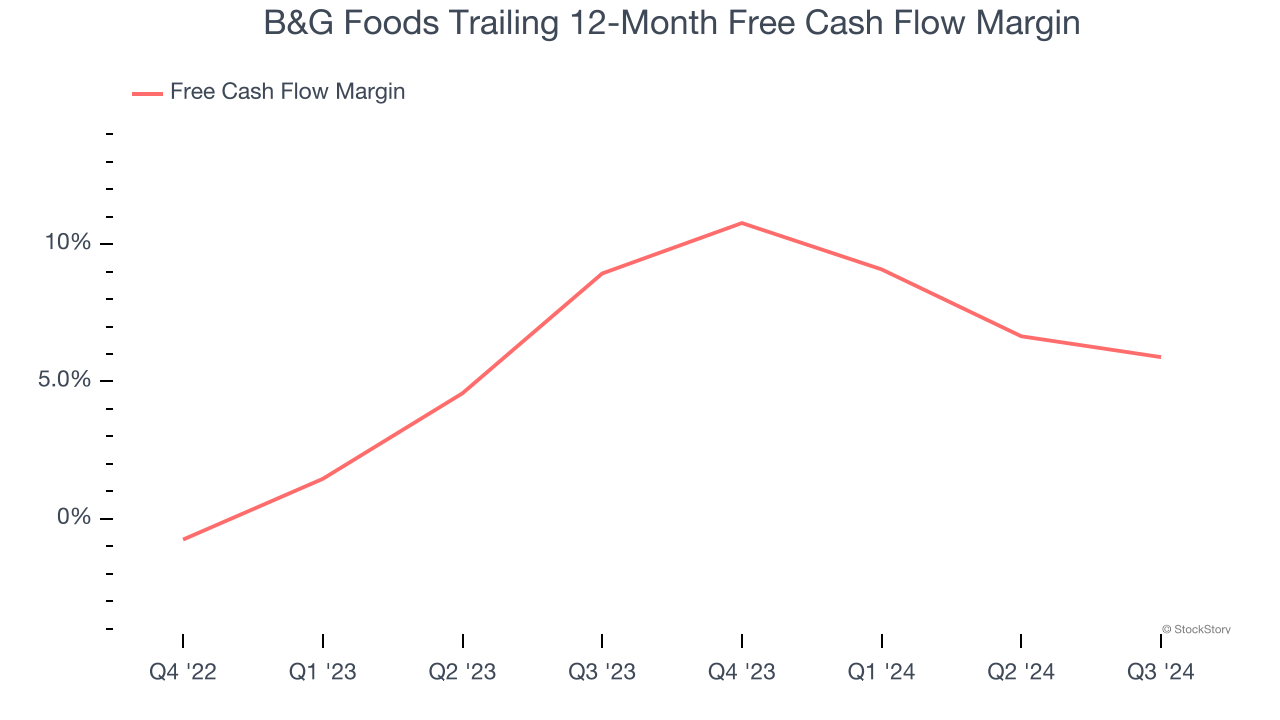

B&G Foods has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 7.4% over the last two years, better than the broader consumer staples sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Key Takeaways from B&G Foods’s Q4 Results

It was good to see B&G Foods narrowly top analysts’ revenue and EBITDA expectations this quarter. On the other hand, its gross margin missed. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The market seemed to focus on the negatives, and the stock traded down 2% to $6.70 immediately following the results.

Should you buy the stock or not? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.