Since May 2020, the S&P 500 has delivered a total return of 107%. But one standout stock has more than doubled the market - over the past five years, O'Reilly has surged 243% to $1,337 per share. Its momentum hasn’t stopped as it’s also gained 7.9% in the last six months, beating the S&P by 10.3%.

Following the strength, is ORLY a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Is O'Reilly a Good Business?

Serving both the DIY customer and professional mechanic, O’Reilly Automotive (NASDAQ: ORLY) is an auto parts and accessories retailer that sells everything from fuel pumps to car air fresheners to mufflers.

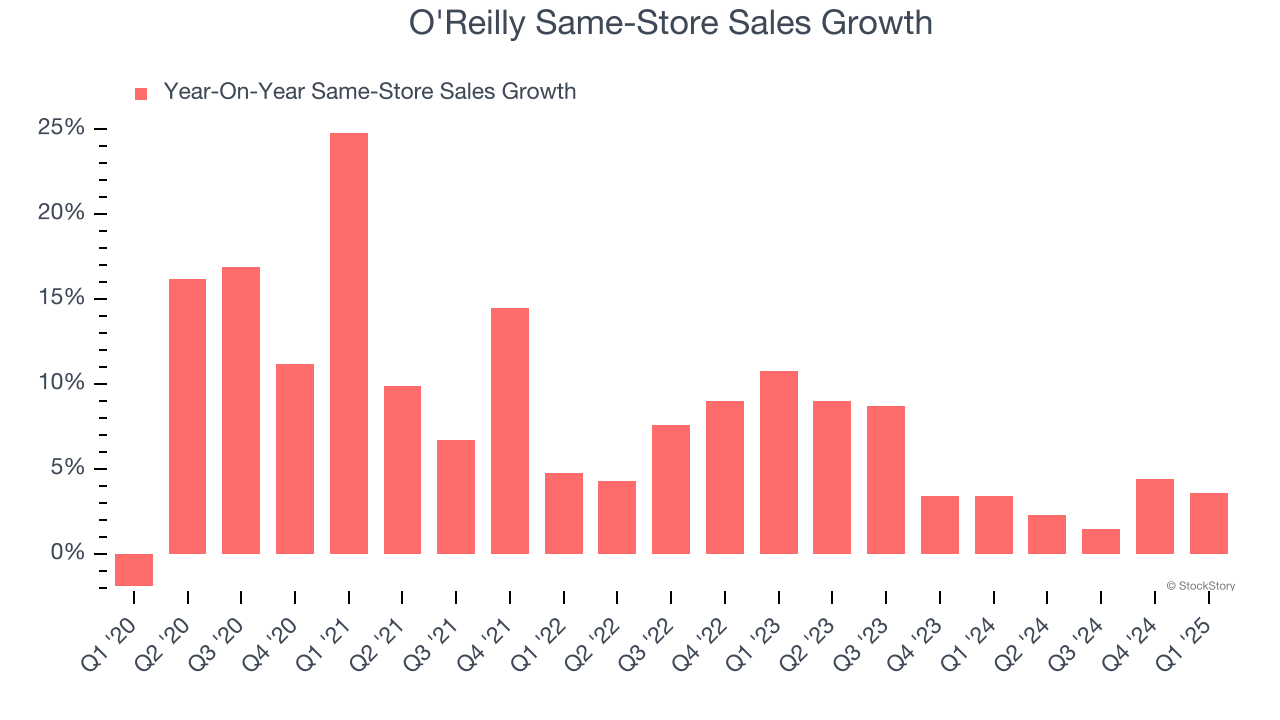

1. Surging Same-Store Sales Show Increasing Demand

Same-store sales show the change in sales for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year. This is a key performance indicator because it measures organic growth.

O'Reilly has been one of the most successful retailers over the last two years thanks to skyrocketing demand within its existing locations. On average, the company has posted exceptional year-on-year same-store sales growth of 4.5%.

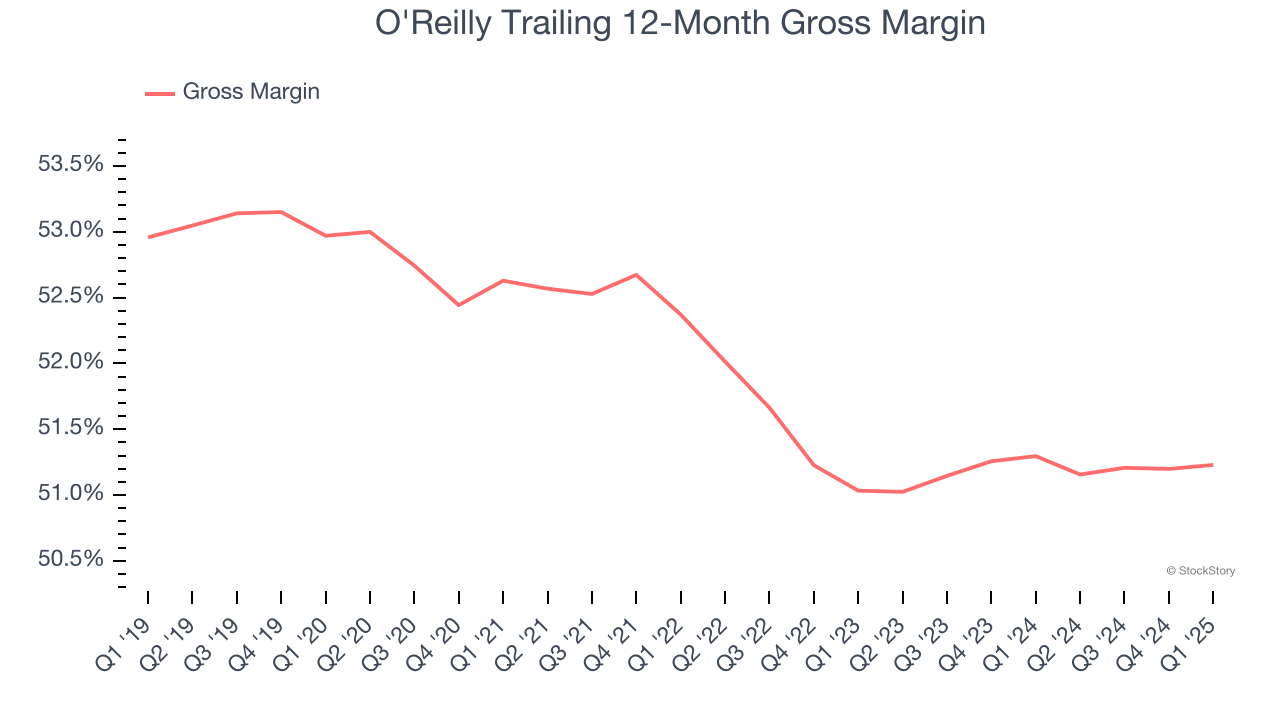

2. Elite Gross Margin Powers Best-In-Class Business Model

We prefer higher gross margins because they not only make it easier to generate more operating profits but also indicate product differentiation, negotiating leverage, and pricing power.

O'Reilly has best-in-class unit economics for a retailer, enabling it to invest in areas such as marketing and talent. As you can see below, it averaged an elite 51.3% gross margin over the last two years. That means O'Reilly only paid its suppliers $48.74 for every $100 in revenue.

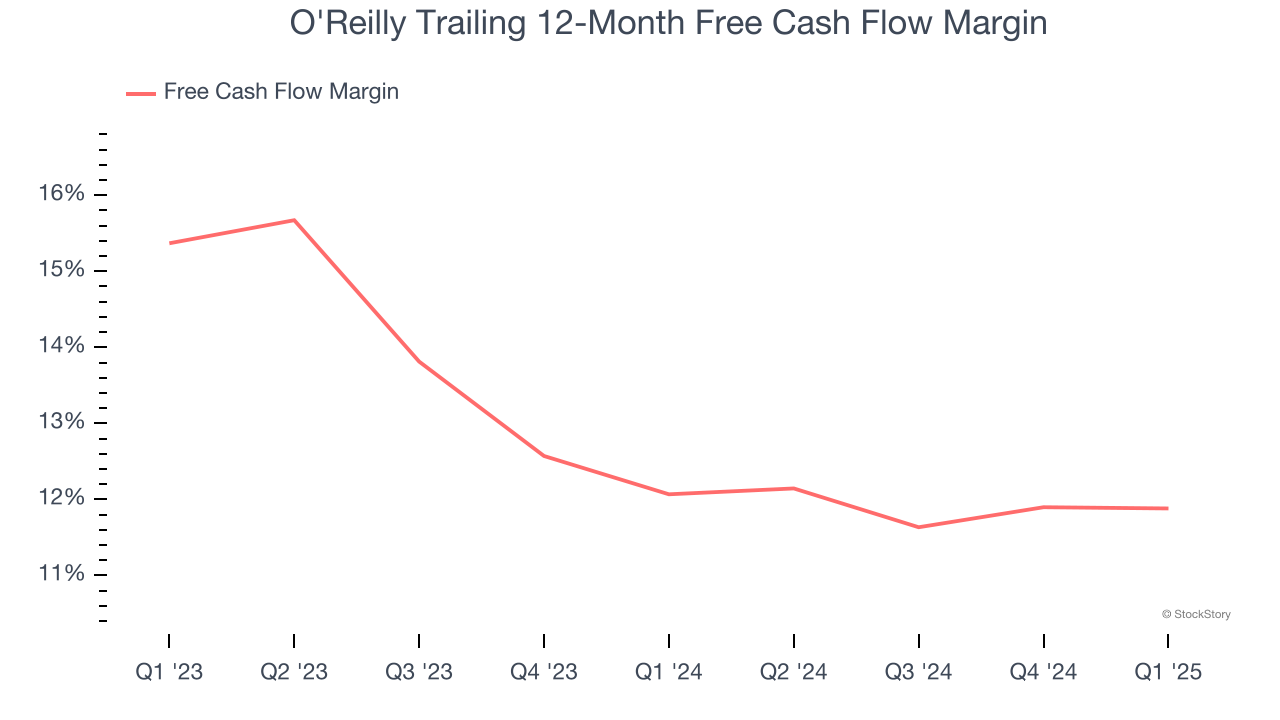

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

O'Reilly has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer retail sector, averaging 12% over the last two years.

Final Judgment

These are just a few reasons O'Reilly is a high-quality business worth owning, and with its shares beating the market recently, the stock trades at 29.4× forward P/E (or $1,337 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than O'Reilly

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 176% over the last five years.

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.