As the Q1 earnings season wraps, let’s dig into this quarter’s best and worst performers in the medical devices & supplies - cardiology, neurology, vascular industry, including Merit Medical Systems (NASDAQ: MMSI) and its peers.

The medical devices and supplies industry, particularly in the fields of cardiology, neurology, and vascular care, benefits from a business model that balances innovation with relatively predictable revenue streams. These companies focus on developing life-saving devices such as stents, pacemakers, neurostimulation implants, and vascular access tools, which address critical and often chronic conditions. The recurring need for these devices, coupled with growing global demand for advanced treatments, provides stability and opportunities for long-term growth. However, the industry faces hurdles such as high research and development costs, rigorous regulatory approval processes, and reliance on reimbursement from healthcare systems, which can exert downward pressure on pricing. Looking ahead, the industry is positioned to benefit from tailwinds such as aging populations (which tend to have higher rates of disease) and technological advancements like minimally invasive procedures and connected devices that improve patient monitoring and outcomes. Innovations in robotic-assisted surgery and AI-driven diagnostics are also expected to accelerate adoption and expand treatment capabilities. However, potential headwinds include pricing pressures stemming from value-based care models and continued complexity changing from navigating regulatory frameworks that may prioritize further lowering healthcare costs.

The 4 medical devices & supplies - cardiology, neurology, vascular stocks we track reported a very strong Q1. As a group, revenues beat analysts’ consensus estimates by 3.3%.

Thankfully, share prices of the companies have been resilient as they are up 6.6% on average since the latest earnings results.

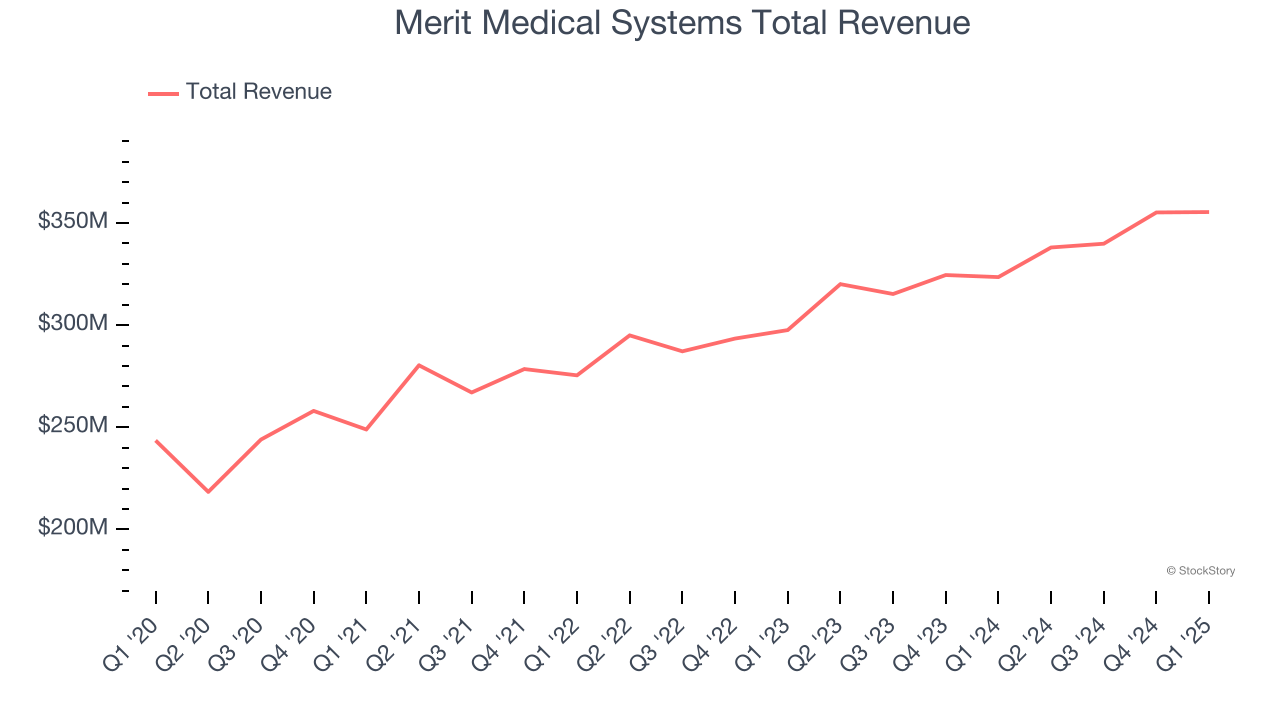

Weakest Q1: Merit Medical Systems (NASDAQ: MMSI)

Founded in 1987 and now offering over 1,700 patented products across global markets, Merit Medical Systems (NASDAQ: MMSI) manufactures and markets specialized medical devices used in minimally invasive procedures for cardiology, radiology, oncology, critical care, and endoscopy.

Merit Medical Systems reported revenues of $355.4 million, up 9.8% year on year. This print exceeded analysts’ expectations by 0.8%. Despite the top-line beat, it was still a mixed quarter for the company with a solid beat of analysts’ EPS estimates but a significant miss of analysts’ full-year EPS guidance estimates.

“We delivered better-than-expected financial performance in the first quarter, with our constant currency revenue, organic, our constant currency total revenue and our non-GAAP EPS exceeding the high-end of our expectations,” said Fred P. Lampropoulos, Merit’s Chairman and Chief Executive Officer.

Merit Medical Systems delivered the weakest performance against analyst estimates of the whole group. Interestingly, the stock is up 3.8% since reporting and currently trades at $98.10.

Is now the time to buy Merit Medical Systems? Access our full analysis of the earnings results here, it’s free.

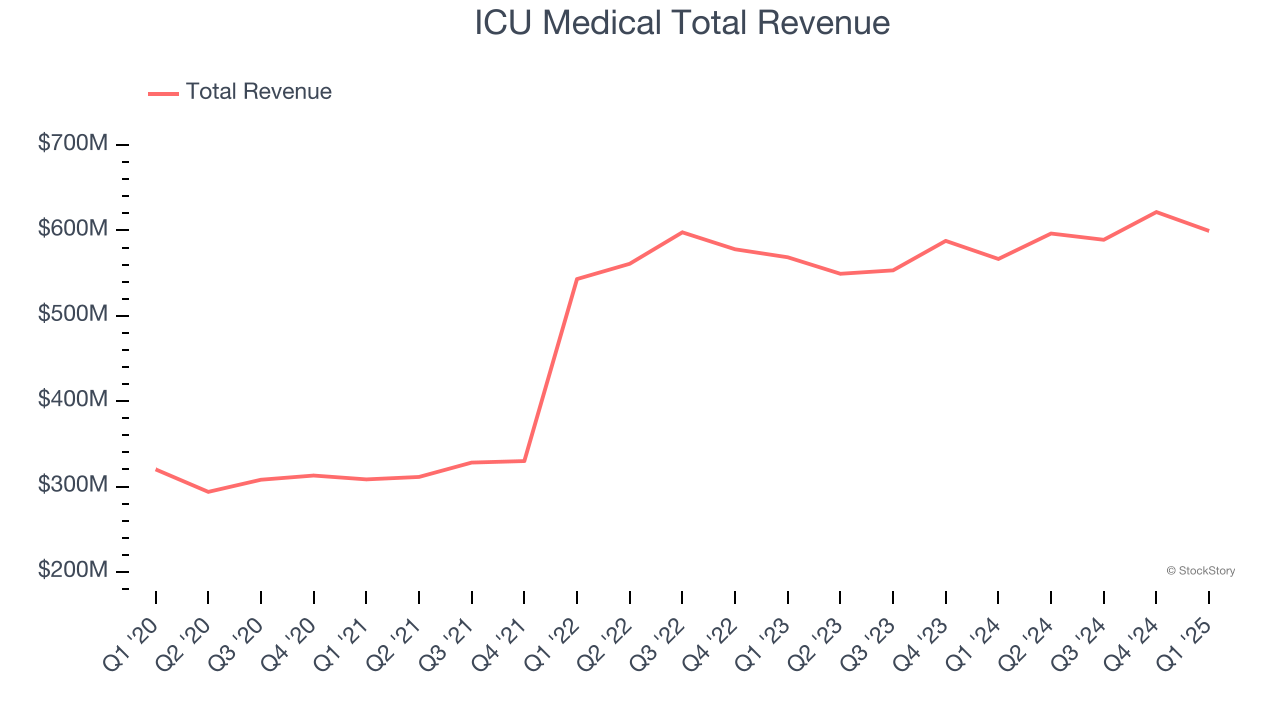

Best Q1: ICU Medical (NASDAQ: ICUI)

Founded in 1984 and named for its initial focus on intensive care units, ICU Medical (NASDAQ: ICUI) develops and manufactures medical products for infusion therapy, vascular access, and vital care applications used in hospitals and other healthcare settings.

ICU Medical reported revenues of $599.5 million, up 5.8% year on year, outperforming analysts’ expectations by 5.7%. The business had an incredible quarter with an impressive beat of analysts’ EPS estimates.

ICU Medical scored the biggest analyst estimates beat among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 3.4% since reporting. It currently trades at $138.

Is now the time to buy ICU Medical? Access our full analysis of the earnings results here, it’s free.

Penumbra (NYSE: PEN)

Founded in 2004 to address challenging medical conditions with significant unmet needs, Penumbra (NYSE: PEN) develops and manufactures innovative medical devices for treating vascular diseases and providing immersive healthcare rehabilitation solutions.

Penumbra reported revenues of $324.1 million, up 16.3% year on year, exceeding analysts’ expectations by 2.7%. It may have had the worst quarter among its peers, but its results were still good as it also locked in an impressive beat of analysts’ constant currency revenue and EPS estimates.

Penumbra delivered the fastest revenue growth but had the weakest full-year guidance update in the group. Interestingly, the stock is up 1.1% since the results and currently trades at $281.56.

Read our full analysis of Penumbra’s results here.

Artivion (NYSE: AORT)

Formerly known as CryoLife until its 2022 rebranding, Artivion (NYSE: AORT) develops and manufactures medical devices and preserves human tissues used in cardiac and vascular surgical procedures for patients with aortic disease.

Artivion reported revenues of $98.98 million, up 1.6% year on year. This number topped analysts’ expectations by 4.2%. Overall, it was an exceptional quarter as it also produced a solid beat of analysts’ sales volume and EPS estimates.

Artivion delivered the highest full-year guidance raise but had the slowest revenue growth among its peers. The stock is up 24.8% since reporting and currently trades at $29.71.

Read our full, actionable report on Artivion here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.