Financial services giant Wells Fargo (NYSE: WFC) reported revenue ahead of Wall Street’s expectations in Q2 CY2025, but sales were flat year on year at $20.82 billion. Its GAAP profit of $1.60 per share was 13.6% above analysts’ consensus estimates.

Is now the time to buy Wells Fargo? Find out by accessing our full research report, it’s free.

Wells Fargo (WFC) Q2 CY2025 Highlights:

- Net Interest Income: $11.71 billion vs analyst estimates of $11.88 billion (1.8% year-on-year decline, 1.5% miss)

- Net Interest Margin: 2.7% vs analyst estimates of 2.7% (7 basis point year-on-year decrease, in line)

- Revenue: $20.82 billion vs analyst estimates of $20.65 billion (flat year on year, 0.8% beat)

- Efficiency Ratio: 64% vs analyst estimates of 64.9% (0.9 percentage point beat)

- EPS (GAAP): $1.60 vs analyst estimates of $1.41 (13.6% beat)

- Market Capitalization: $271.5 billion

Company Overview

Founded during the California Gold Rush in 1852 to provide banking and express delivery services to miners and merchants, Wells Fargo (NYSE: WFC) is a diversified financial services company that provides banking, lending, investment, and wealth management services to individuals and businesses.

Sales Growth

From lending activities to service fees, most banks build their revenue model around two income sources. Interest rate spreads between loans and deposits create the first stream, with the second coming from charges on everything from basic bank accounts to complex investment banking transactions.

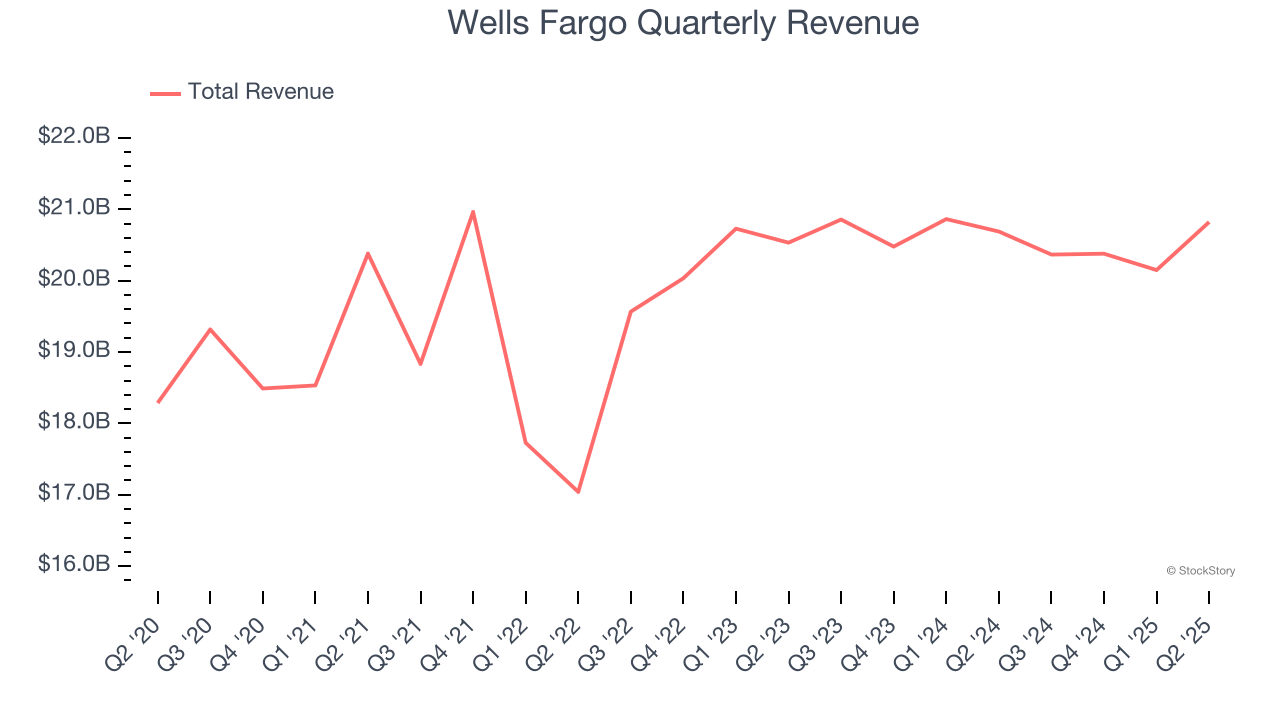

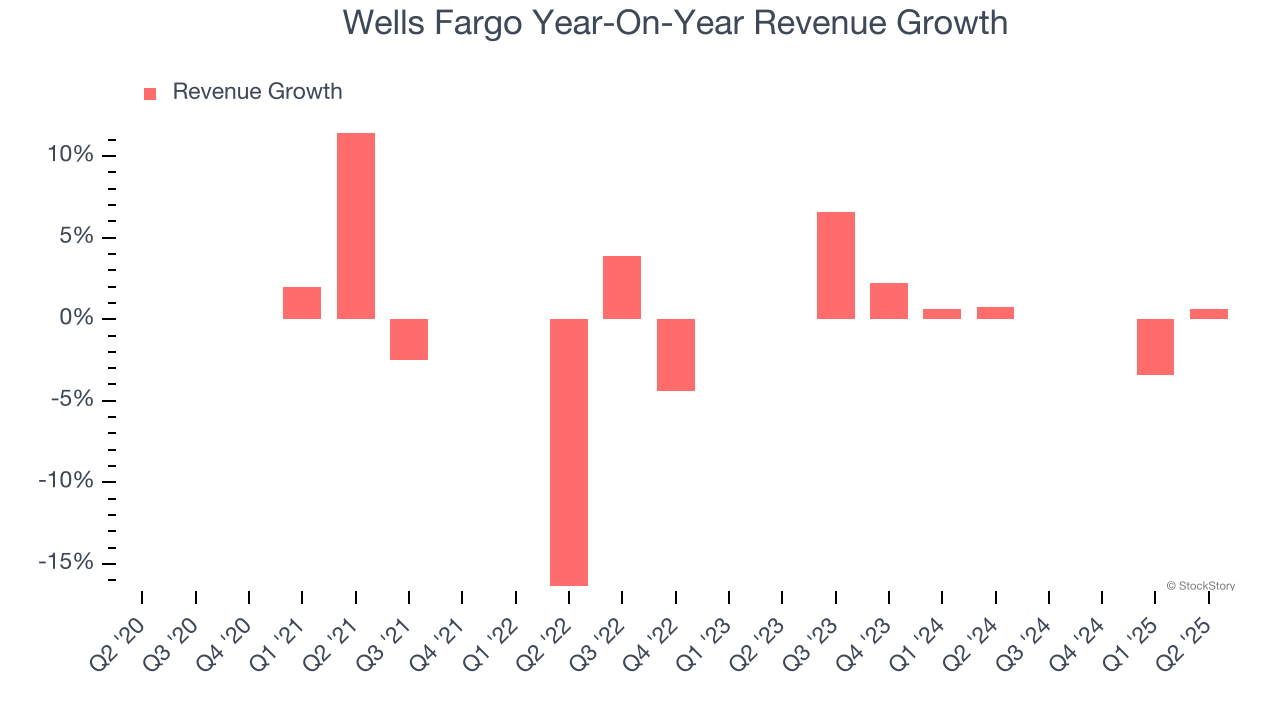

Unfortunately, Wells Fargo struggled to consistently increase demand as its $81.72 billion of revenue for the trailing 12 months was close to its revenue five years ago. This was below our standards and is a poor baseline for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Just like its five-year trend, Wells Fargo’s revenue over the last two years was flat, suggesting it is in a slump.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Wells Fargo’s $20.82 billion of revenue was flat year on year but beat Wall Street’s estimates by 0.8%.

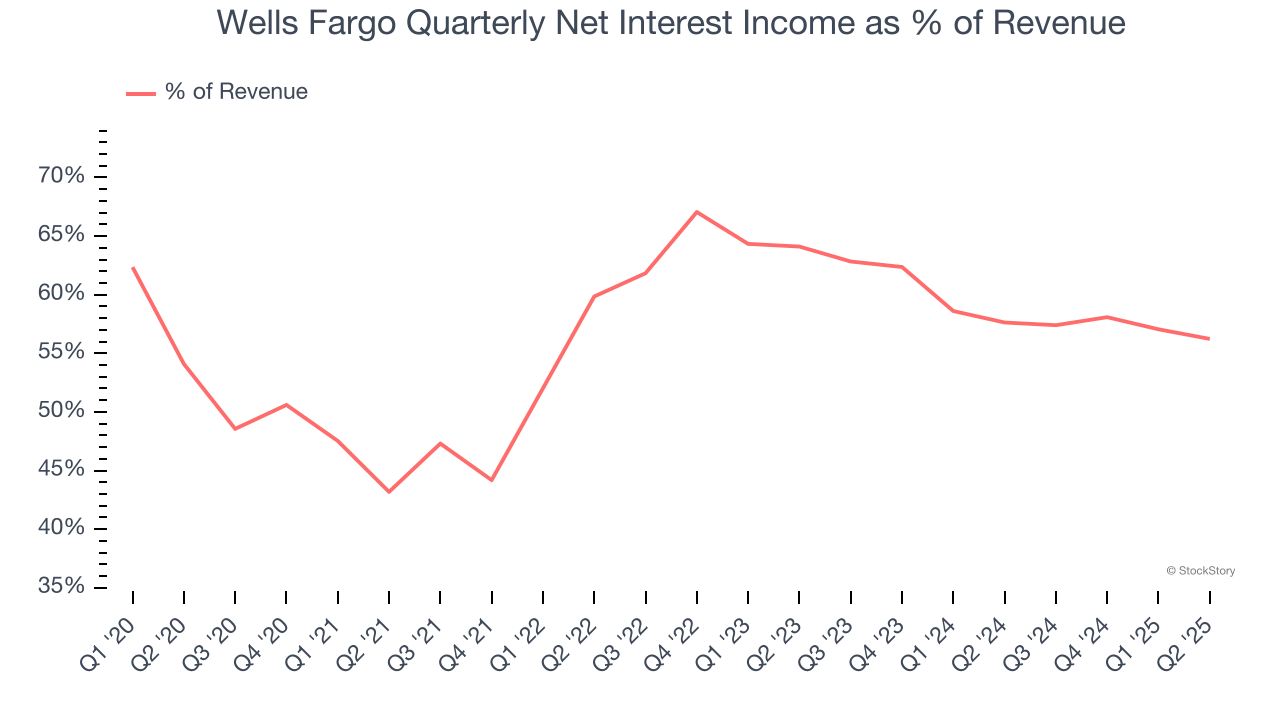

Net interest income made up 56% of the company’s total revenue during the last five years, meaning Wells Fargo’s growth drivers strike a balance between lending and non-lending activities.

Net interest income commands greater market attention due to its reliability and consistency, whereas non-interest income is often seen as lower-quality revenue that lacks the same dependable characteristics.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Net Interest Income

Wells Fargo’s net interest income has grown at a 1.8% annualized rate over the last five years, much worse than the broader bank industry and in line with its total revenue.

When analyzing Wells Fargo’s net interest income over the last two years, we can see its numbers turned red as income dropped by 5.2% annually.

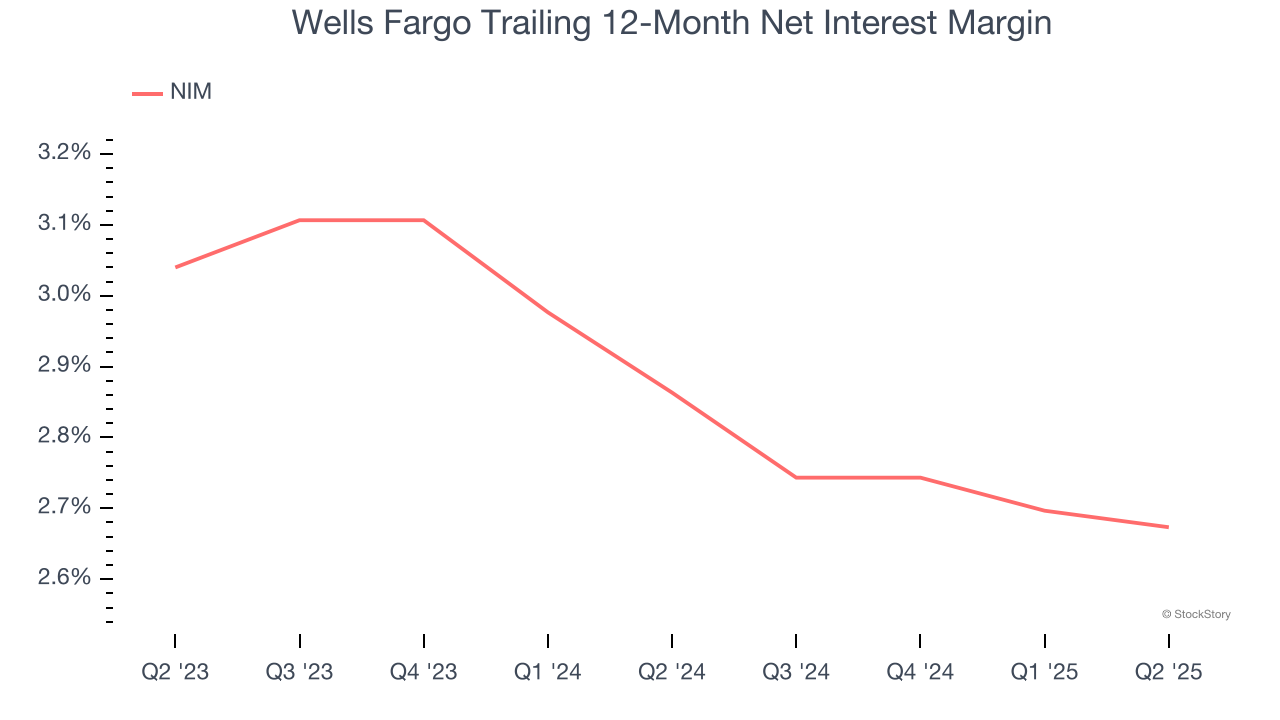

From a unit economics perspective, we can see the company’s net interest margin averaged a weak 2.8% over the past two years. Its margin also contracted by 36.7 basis points (100 basis points = 1 percentage point) over that period.

This decline was a headwind for its net interest income. While prevailing rates are a major determinant of net interest margin changes over time, the decline could mean Wells Fargo either faced competition for loans and deposits or experienced a negative mix shift in its balance sheet composition.

This quarter, Wells Fargo’s net interest income was $11.71 billion, down 1.8% year on year and short of Wall Street Consensus estimates. Net interest margin was 2.7%, in line with sell-side expectations.

Looking ahead, sell-side analysts expect net interest income to grow 5.1% over the next 12 months.

Key Takeaways from Wells Fargo’s Q2 Results

We enjoyed seeing Wells Fargo beat analysts’ EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its net interest income slightly missed. Overall, this print was mixed, and the stock traded down 1.1% to $82.44 immediately following the results.

So do we think Wells Fargo is an attractive buy at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.