Over the past six months, Five Below has been a great trade, beating the S&P 500 by 20.8%. Its stock price has climbed to $181.59, representing a healthy 30.3% increase. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy Five Below, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Five Below Not Exciting?

Despite the momentum, we don't have much confidence in Five Below. Here are three reasons there are better opportunities than FIVE and a stock we'd rather own.

1. Fewer Distribution Channels Limit its Ceiling

With $4.43 billion in revenue over the past 12 months, Five Below is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers. On the bright side, it can grow faster because it has more white space to build new stores.

2. Low Gross Margin Reveals Weak Structural Profitability

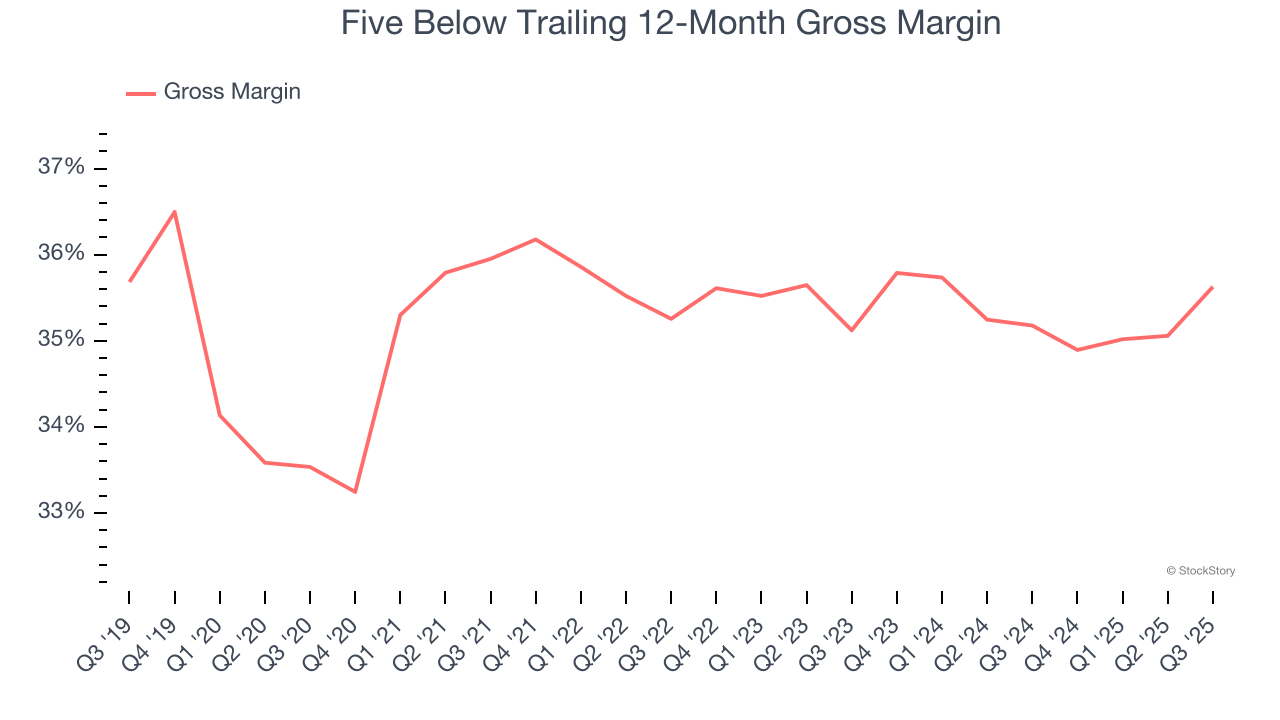

Gross profit margins are an important measure of a retailer’s pricing power, product differentiation, and negotiating leverage.

Five Below has bad unit economics for a retailer, giving it less room to reinvest and grow its presence. As you can see below, it averaged a 35.4% gross margin over the last two years. Said differently, Five Below had to pay a chunky $64.58 to its suppliers for every $100 in revenue.

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Five Below historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 10.4%, somewhat low compared to the best consumer retail companies that consistently pump out 25%+.

Final Judgment

Five Below isn’t a terrible business, but it isn’t one of our picks. With its shares outperforming the market lately, the stock trades at 28.7× forward P/E (or $181.59 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward our favorite semiconductor picks and shovels play.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.