The COVID-19 pandemic has changed the lives of nearly every American, and a new survey from Discover Personal Loans sheds light on how the pandemic is affecting consumers’ financial situations. Fifty-four percent of consumers who reported having anxiety when it comes to their financial situation say the pandemic is the cause of at least half of their stress. However, Americans were not letting their concerns keep them from taking action to better their financial futures, with 60% of respondents saying they are actively working to improve their financial situation. The survey from Discover Personal Loans polled 1,500 consumers and was fielded between July 1 and July 8, 2020.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20201208005188/en/

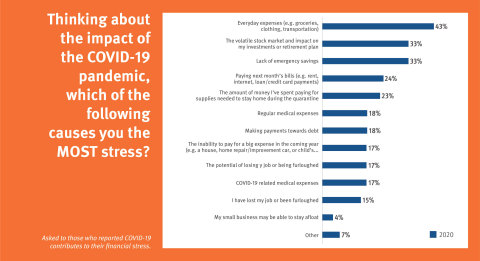

Among those who reported financial stress due to the COVID-19 pandemic, almost half are most worried about its impact on their ability to afford everyday expenses. The impact of a volatile stock market on their retirement plan and a lack of emergency savings are also key concerns. (Graphic: Business Wire)

“The pandemic has affected all of us in countless ways,” said Matt Lattman, vice president of personal loans at Discover. “Within the uncertainty, many have paid down debt and found ways to shore up savings – possibly as a result of budgeting or help from a stimulus check. Consumers should continue these positive steps to better their financial situation and prepare for the future to be ready for the unexpected.”

Sources of Anxiety Amid the Pandemic

Seventy-seven percent of Americans reported feeling prepared to handle next month’s bills, and 59% said they feel financially well enough to handle short term unemployment. However, a quarter of Americans still report having less than $500 in their savings and more than half say they do not feel prepared if they were to lose their job or handle an unexpected expense of $5,000 (54% and 52% respectively).

Among those who reported financial stress due to the COVID-19 pandemic, almost half are most worried about its impact on their ability to afford everyday expenses. The impact of a volatile stock market on their retirement plan and a lack of emergency savings are also key concerns.

Americans’ Strategies to Improve their Finances

Saving money is the most notable way Americans are working to improve their finances. In fact, 43% report taking this action; a 6% increase from 2019.

Americans are also focused on cutting down expenses, paying down debt and tracking expenses. However, few reported consolidating their high-interest debt or using online tools to manage their finances.

“While basic budgeting behaviors and even stimulus checks can go a long way in helping maintain your day-to-day finances, taking advantage of products and technologies to consolidate and pay down high-interest debt can help make larger financial goals more attainable,” Lattman continued. “For many, personal loans can help lower monthly payments, allowing consumers to use their savings to build emergency funds and manage everyday expenses.”

In fact, a separate study of Discover Personal Loans customers showed high-interest debt consolidation may help lessen financial anxiety, as 82% of customers who consolidated debt with a Discover personal loan said they felt less stressed – and 73% of customers said taking out a Discover personal loan to consolidate debt helped improve their overall credit1.

About Survey

The national survey of 1,500 U.S. consumers ages 18 and up was commissioned by Discover and conducted by Dynata (formerly Research Now/SSI), an independent survey research firm, between July 1 and July 8, 2020. The maximum margin of sampling error was +/-3 percentage points with a 95 percent level of confidence. Generations are defined as: Generation Z, born after 1997; millennials, born between 1981 and 1996; Generation X, born between 1965 and 1980; and Baby Boomers, born between 1946 and 1964.

About Discover

Discover Financial Services (NYSE: DFS) is a digital banking and payment services company with one of the most recognized brands in U.S. financial services. Since its inception in 1986, the company has become one of the largest card issuers in the United States. The company issues the Discover card, America's cash rewards pioneer, and offers private student loans, personal loans, home loans, checking and savings accounts and certificates of deposit through its banking business. It operates the Discover Global Network comprised of Discover Network, with millions of merchant and cash access locations; PULSE, one of the nation's leading ATM/debit networks; and Diners Club International, a global payments network with acceptance around the world. For more information, visit www.discover.com/company.

1ABOUT SURVEY

All figures are from an online customer survey conducted September 9 to September 23, 2020. A total of 703 Discover personal loan debt consolidation customers were interviewed about their most recent Discover personal loan. All results @ a 95% confidence level. Respondents opened their personal loan between April and July 2020 for the purpose of consolidating debt.

View source version on businesswire.com: https://www.businesswire.com/news/home/20201208005188/en/

Contacts:

Sarah Grage Silberman

224-405-6029

sarahgragesilberman@discover.com

@Discover_News