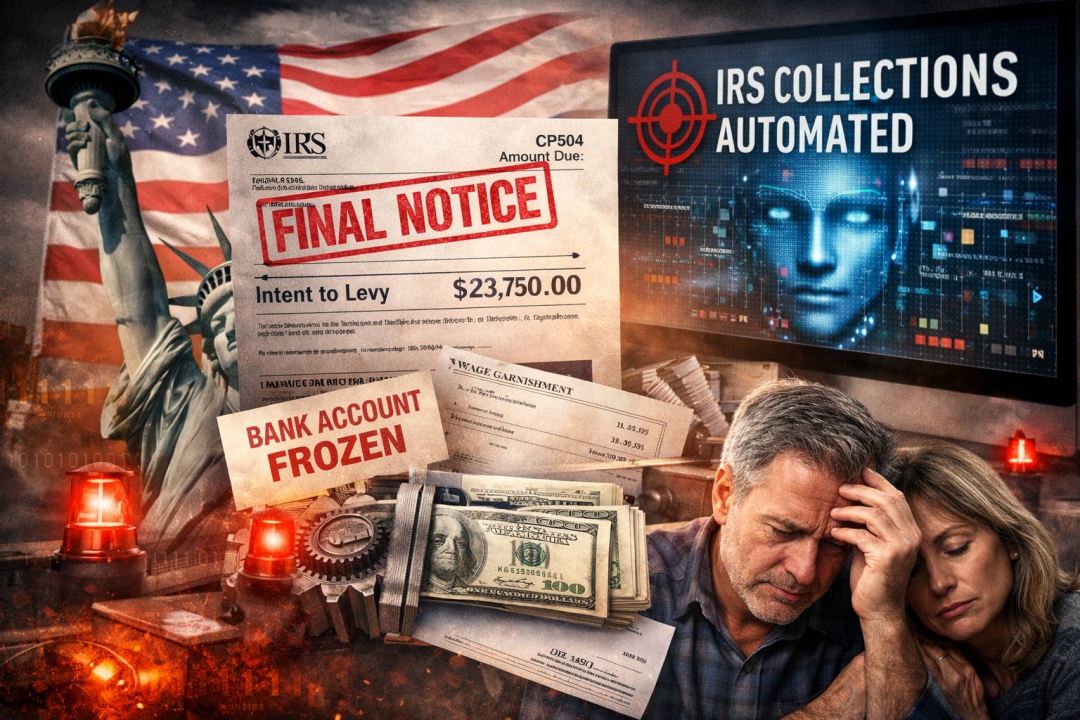

CORAL SPRINGS, Fla. - Jan 30, 2026 - The Internal Revenue Service is expanding automated tax collection systems that could accelerate bank levies, wage garnishments and federal tax liens for delinquent taxpayers, tax professionals and policy analysts said, as the agency deploys data-driven enforcement tools following a multibillion-dollar modernization push.

Congress provided roughly $80 billion in additional funding to the IRS over a decade through the Inflation Reduction Act of 2022, including about $4.8 billion dedicated to business systems modernization, according to the U.S. Government Accountability Office. The agency has used the funding to upgrade analytics systems, automate case routing and expand third-party data matching to improve compliance and collections.

“Automation is shortening the time between noncompliance and enforcement,” said Rona Durandisse, an IRS Enrolled Agent and chief executive officer of Ultra Care Tax, a Florida-based tax resolution firm. “Taxpayers receiving final notices may have significantly less time to negotiate before levies or garnishments begin.”

The modernization effort is part of a broader strategy to close the federal tax gap — the difference between taxes owed and taxes paid on time — which the IRS estimates at roughly $696 billion annually for tax year 2022, with individual income taxes accounting for more than $500 billion of that total. GAO estimates show taxpayers voluntarily pay about 85 percent of taxes owed, leaving a substantial share subject to enforcement actions.

Durandisse said automated workflows can increase consistency but may reduce the time available for taxpayers to respond to notices such as CP504 and LT11, which precede levies and liens.

“Technology improves scale and efficiency, but it also reduces human discretion in early stages of collections,” she said. “That raises policy questions about procedural safeguards and error correction when decisions are increasingly data-driven.”

Florida, one of the fastest-growing states by population and self-employment activity, represents a high-volume compliance market. Analysts say gig-economy income, real estate transactions and digital-asset reporting requirements are increasing the complexity of taxpayer profiles subject to automated compliance screening.

Tax professionals note that taxpayers still have options once final notices are issued, including installment agreements, offers in compromise and hardship classifications, but the window for intervention may narrow as automation accelerates enforcement timelines.

Industry and Policy Context

The IRS relies extensively on information technology to collect trillions of dollars annually and distribute hundreds of billions in refunds, and has spent about $1.5 billion on modernization programs in fiscal 2024 alone, GAO reported. Policymakers, financial institutions and tax practitioners are monitoring how algorithmic enforcement affects compliance outcomes, taxpayer rights and potential error rates as federal agencies expand data-driven regulatory tools.

About Ultra Care Tax

Ultra Care Tax is a Florida-based tax compliance and resolution advisory firm providing representation in federal and state tax matters, audit defense and regulatory consulting.

Media Contact

Company Name: Gadgetlesstech

Contact Person: Charmain Monroe

Email: Send Email

Phone: 2032960995

Address:456 Glenbrook Rd. Suite11 #564

City: STAMFORD

State: CT

Country: United States

Website: https://gadgetlesstech.com