VANCOUVER, BC / ACCESSWIRE / February 26, 2024 / Metallic Minerals Corp. (TSX.V:MMG)(OTCQB:MMNGF) ("Metallic Minerals" or the "Company") is pleased to announce the first National Instrument 43-101 ("NI-43-101") mineral resource estimate (the "2024 Resource Estimate") on the Company's Keno Silver project, adjacent to Hecla Mining's ("Hecla") high-grade operations in the iconic Keno Silver District of Canada's Yukon Territory. The combined underground and in-pit total resource estimate from four separate deposits (Formo, Fox, Caribou and Homestake) comprises an Inferred Resource of 2.5 million tonnes ("Mt") at 223 grams per tonne ("g/t") silver equivalent ("AgEq") equating to 18.16 million ounces ("Moz") of contained silver equivalent. Significant resource expansion is anticipated with further drilling as each of these deposits are contained within 250 meters depth from surface and are open along strike in all directions and at depth where grades typically trend higher.

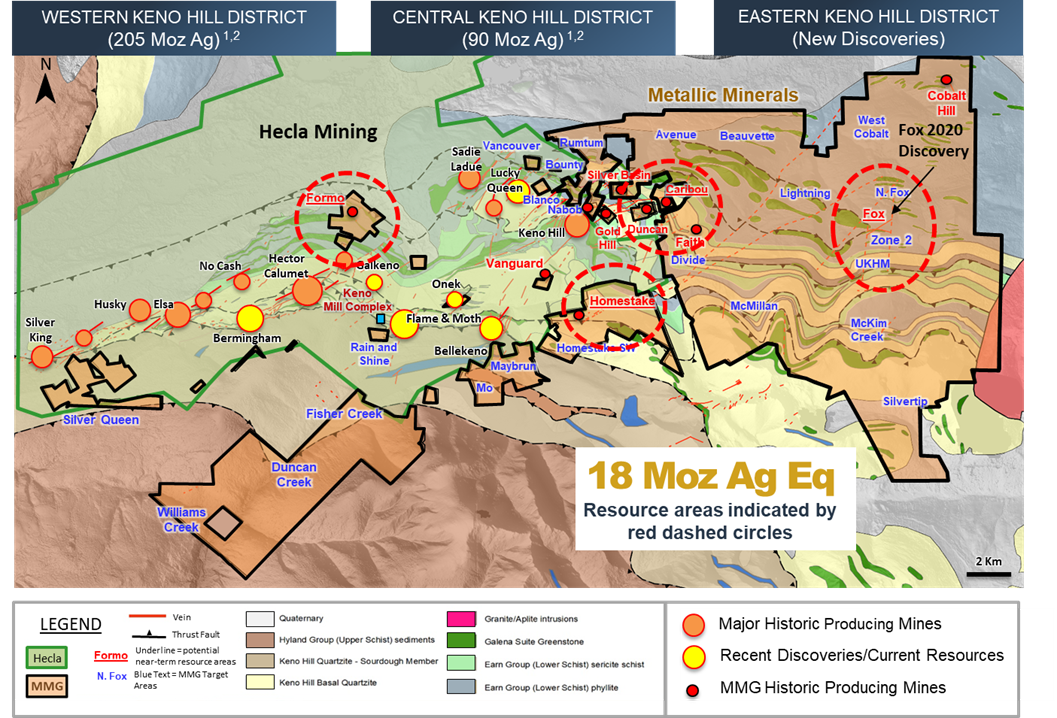

Subsequent campaigns, expected to commence in the 2024 field season, will focus on expansion through the drilling of extensions of current resource deposits, definition drilling of very prospective early-stage drilled targets and targeting of new discoveries at high-priority targets that have yet to be drill tested. This 2024 Resource Estimate is contained within four of 11 target areas that have returned positive results from initial drill testing to date, with 42 additional targets identified on the 171 square kilometer project since 2016 remaining, as yet, undrilled (see Figure 1).

PDAC 2024 Core Shacks and Exhibitor Hall

Metallic Minerals will be participating in the 2024 Prospectors and Developers Convention in Toronto. The Company invites investors to visit us in the Investors Exchange (Booth 3318) from March 3-6 as well as the Core Shack Booth 3116B March 5-6. In addition, Metallic Minerals, along with fellow Metallic Group companies, Stillwater Critical Minerals and Granite Creek Copper, and our Yukon Mining Alliance peers, will be participating in the Yukon Mining Alliance Core Shack to be held in the PDAC Investors Exchange at Booth 3310 from March 3-6.

2023 Resource Estimate Highlights

- Underground Inferred Mineral Resources include the Formo deposit containing 12.77 Moz AgEq (7.11 Moz of silver, 3,000 oz of gold, 36.02 Mlbs of lead, and 66.14 Mlbs of zinc) within 1.08 Mt grading 369 g/t AgEq (206 g/t silver, 0.08 g/t gold, 1.52% lead, and 2.79% zinc). The Formo deposit is directly adjacent to the Silver Trail highway (Highway 11) and power lines that feed the central Keno Hill mill which is operated by Hecla, the largest primary silver producer in Canada and the USA. The Formo deposit directly adjoins Hecla's Keno Hill property, where Hecla is actively mining the nearby Bermingham deposit.

- In-Pit Inferred Mineral Resources include Caribou, Fox and Homestake and contain 5.40 Moz AgEq (2.70 Moz of silver, 5,500 oz of gold, 8.86 Mlbs of lead, and 32.95 Mlbs of zinc) within 1.46 Mt grading 115 g/t AgEq (58 g/t silver, 0.12 g/t gold, 0.28 % lead, and 1.02 % zinc). Bulk tonnage operations in the district include the historic open pit production from the Silver King, Hector Calumet, Onek and other deposits (currently held by Hecla) and feature significantly lower development and operating costs than more selective underground mining methods1.

- The 2024 Resource Estimate represents the equivalent of several years of production through the Keno area mill based on production guidance provided by Hecla which is planning to mine up to 4 million ounces of silver at Keno in 20242.

- Having identified the productive structures and defined this very significant mineral resource, the Company expects to be able to add significant ounces during subsequent drill campaigns.

- The 2024 Resource Estimate was completed by SGS Geological Services ("SGS") based on 293 surface diamond core and reverse circulation drill holes totaling 17,654.6 meters.

Scott Petsel, Metallic Minerals' President, states, "We are very pleased to achieve this major milestone of an inaugural resource estimate for the Keno Silver project, which we see as having clear potential for major expansion within this world-class silver district, directly adjacent to one of the world's highest grade silver mines. Since the first acquisitions of Kenoproperties in 2016, the Company has worked diligently towards this announcement through a series of systematic advancements including successfully consolidating the current 171km2 property package, district-wide data compilation, target development and drill testing. With 42 early-stage targets developed on the property, 11 targets that have been drill tested with significant results, and now four target areas that have advanced to Inferred Resources, we see this milestone as a foundation from which there are very clear opportunities to quickly and efficiently grow the 2024 Resource Estimate with additional drilling, while continuing to advance early-stage targets to new discoveries."

"Metallic Minerals' combined Inferred mineral inventory, now including both the Keno Silver and La Plata projects, consists of 35.76 million ounces of silver and 1.2 billion pounds of copper. Further updates are expected in the coming weeks, including first drill results from the ongoing campaign at La Plata in Colorado which continue to be processed."

The 2024 Resource Estimate will be incorporated into an NI 43-101-compliant technical report for the Keno Silver project which will be available within 45 days.

Table 1. Keno Silver Project Mineral Resource Estimates, February 1, 2024.

Deposit |

Cut-off Grade (AgEq g/t) |

Tonnes |

AgEq (g/t) |

Ag (g/t) |

Au (g/t) |

Pb (%) |

Zn (%) |

AgEq (Moz) |

Ag (Moz) |

Au (oz) |

Pb (Mlbs) |

Zn (Mlbs) |

Formo |

150 |

1,075,000 |

369 |

206 |

0.08 |

1.52 |

2.79 |

12.77 |

7.11 |

3,000 |

36.02 |

66.14 |

Caribou |

50 |

589,000 |

149 |

94 |

0.09 |

0.50 |

0.82 |

2.82 |

1.78 |

2,000 |

6.46 |

10.60 |

Fox |

50 |

793,000 |

83 |

28 |

0.02 |

0.09 |

1.26 |

2.11 |

0.73 |

500 |

1.53 |

22.04 |

Homestake |

50 |

78,000 |

187 |

77 |

1.10 |

0.50 |

0.18 |

0.47 |

0.19 |

3,000 |

0.87 |

0.31 |

Total |

50/150 |

2,535000 |

223 |

120 |

0.1 |

0.8 |

1.77 |

18.16 |

9.81 |

8,500 |

44.88 |

99.08 |

Notes to Table 1 reported values:

- The base-case AgEq Cut-off grades consider metal prices of $22.50/oz Ag, $1,800/oz Au, $1.00/lb Pb and $1.30/lb Zn, and considers metal recoveries of 95% for Ag, 50% for Au, 94% for Pb and 88% for Zn.

- AgEq = Ag ppm + (((Au ppm x Au price/gram) + (Pb% x Pb price/t) + (Zn% x Zn price/t))/Ag price/gram) at the above assumed metal prices.

Keno Deposit Mineral Resource Estimate Notes (Table 1):

- The effective date of the Keno deposit Mineral Resource Estimate is February 1, 2024.

- The Mineral Resource Estimates were estimated by Allan Armitage, Ph.D., P. Geo. of SGS Geological Services and is an independent Qualified Person as defined by NI 43-101.

- The classification of the current Mineral Resource Estimate into Inferred Mineral Resources is consistent with current 2014 CIM Definition Standards - For Mineral Resources and Mineral Reserves.

- All figures are rounded to reflect the relative accuracy of the estimate and numbers may not add due to rounding.

- The Mineral Resources are presented undiluted and in situ, constrained by continuous 3D wireframe models, and are considered to have reasonable prospects for eventual economic extraction.

- Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that most Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- The Keno Mineral Resource Estimate is based on a validated database which includes data from 293 surface diamond, RC and RAB drill holes totalling 17,654.63 m, and 292 surface and underground channels (Formo) for 450.43 m. The resource database totals 5,429 assay intervals representing 6,734.09 m of data.

- The Mineral Resource Estimate is based on 29 three-dimensional ("3D") resource models for Fox (19), Caribou (4), Formo (4) and Homestake (2), constructed in Leapfrog. Grades for Ag, Au, Pb and Zn were estimated for each mineralization domain using 1.5 metre capped composites assigned to that domain. To generate grade within the blocks, the inverse distance squared (ID2) interpolation method was used for all domains.

- Average density values were assigned to each domain based on a database of 54 samples.

- Based on their size, shape and orientation, it is envisioned that the Caribou, Fox and Homestake deposits of the Keno project may be mined using open-pit mining methods. Mineral Resources are reported at a base case cut-off grade of 50 g/t AgEq. The in-pit Mineral Resource grade blocks are quantified above the base case cut-off grade, above the constraining pit shell, below topography and within the constraining mineralized domains (the constraining volumes).

- The results from the pit optimization, using the pseudoflow optimization method in Whittle 4.7.4, are used solely for the purpose of testing the "reasonable prospects for economic extraction" by an open pit and do not represent an attempt to estimate Mineral Reserves. There are no Mineral Reserves on the Property. The results are used as a guide to assist in the preparation of a Mineral Resource statement and to select an appropriate resource reporting cut-off grade.

- It is envisioned that the Formo deposit may be mined using underground mining methods. Mineral Resources for Formo are reported at a base case cut-off grade of 150 g/t AgEq. The mineral resource grade blocks were quantified above the base case cut-off grade, below surface and within the constraining mineralized wireframes (considered mineable shapes).

- Based on the size, shape, general thickness and orientation of the Formo mineralized structures, it is envisioned that the deposits may be mined using a combination of underground mining methods including sub-level stoping (SLS) and/or cut and fill (CAF) mining.

- The base-case AgEq Cut-off grade considers metal prices of $22.50/oz Ag, $1,800/oz Au, $1.00/lb Pb and $1.30/lb Zn, and considers metal recoveries of 95% for Ag, 50% for Au, 94% for Pb and 88% for Zn.

- The pit optimization and base case cut-off grade of 50 g/t AgEq considers a mining cost of US$2.20/t mined, and processing, treatment, refining, G&A and transportation cost of USD$25.00/t of mineralized material.

- The underground base case cut-off grade of 150 g/t AgEq a mining cost of US$65.00/t mined, and processing, treatment, refining, G&A and transportation cost of USD$25.00/t of mineralized material.

- The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

Figure 1. Keno Silver Project Showing Inferred Resource Area Locations

Sensitivity Analysis

In addition to the base case scenario presented in Table 1 above, Table 2 and Table 3 below, provide sensitivity analyses which demonstrates the variation in grade, tonnage and contained metal for the 2024 Resource Estimate at various cut-off grades for both the open pit scenarios at the Caribou, Fox and Homestake deposits and the more selective underground mining scenario at the Formo deposit. Different cut-off grades may be employed depending on variations in prevailing metal prices and mining costs.

Table 2. Underground Mineral Resource Estimate for the Formo Deposit at Various AgEq Cut-off Grades, February 1, 2024

Cut-off Grade (AgEq g/t) |

Tonnes |

AgEq (g/t) |

Ag (g/t) |

Au (g/t) |

Pb (%) |

Zn (%) |

AgEq (Moz) |

Ag (Moz) |

Au (oz) |

Pb (Mlbs) |

Zn (Mlbs) |

80 |

1,548,000 |

291 |

159 |

0.09 |

1.20 |

2.22 |

14.48 |

7.93 |

4,000 |

40.9 |

75.8 |

90 |

1,457,000 |

304 |

167 |

0.09 |

1.25 |

2.32 |

14.24 |

7.80 |

4,000 |

40.0 |

74.7 |

100 |

1,386,000 |

314 |

173 |

0.09 |

1.29 |

2.40 |

14.02 |

7.70 |

4,000 |

39.4 |

73.3 |

120 |

1,263,000 |

334 |

185 |

0.09 |

1.37 |

2.53 |

13.58 |

7.50 |

4,000 |

38.2 |

70.6 |

150 |

1,075,000 |

369 |

206 |

0.08 |

1.52 |

2.79 |

12.77 |

7.11 |

3,000 |

36.0 |

66.1 |

200 |

869,000 |

416 |

234 |

0.09 |

1.71 |

3.12 |

11.63 |

6.53 |

2,000 |

32.8 |

59.7 |

250 |

708,000 |

459 |

260 |

0.08 |

1.89 |

3.42 |

10.46 |

5.91 |

2,000 |

29.5 |

53.4 |

300 |

570,000 |

504 |

284 |

0.09 |

2.08 |

3.77 |

9.24 |

5.21 |

2,000 |

26.1 |

47.3 |

Note: Values in these tables reported above and below the base-case cut-off 150 g/t AgEq (highlighted) for in-pit Mineral Resources should not be misconstrued with a Mineral Resource Statement. The values are only presented to show the sensitivity of the block model estimates to the selection of the base case cut-off grade. All values are rounded to reflect the relative accuracy of the estimate and numbers may not add due to rounding.

Table 3. In-Pit Mineral Resource Estimate, combined Caribou, Fox and Homestake deposits, at Various AgEq Cut-off Grades, February 1, 2024

Cut-off Grade (AgEq g/t) |

Tonnes |

AgEq (g/t) |

Ag (g/t) |

Au (g/t) |

Pb (%) |

Zn (%) |

AgEq (Moz) |

Ag (Moz) |

Au (oz) |

Pb (Mlbs) |

Zn (Mlbs) |

30 |

1,787,000 |

101 |

50 |

0.10 |

0.24 |

0.93 |

5.82 |

2.87 |

6,000 |

9.4 |

36.8 |

40 |

1,642,000 |

107 |

53 |

0.11 |

0.25 |

0.98 |

5.66 |

2.80 |

6,000 |

9.1 |

35.4 |

50 |

1,460,000 |

115 |

58 |

0.12 |

0.28 |

1.02 |

5.40 |

2.70 |

5,500 |

8.9 |

32.9 |

60 |

1,253,000 |

125 |

63 |

0.13 |

0.31 |

1.08 |

5.03 |

2.55 |

5,400 |

8.4 |

29.8 |

70 |

1,046,000 |

137 |

70 |

0.16 |

0.34 |

1.13 |

4.60 |

2.37 |

5,300 |

7.9 |

26.1 |

80 |

884,000 |

148 |

78 |

0.18 |

0.38 |

1.16 |

4.21 |

2.21 |

5,200 |

7.4 |

22.6 |

90 |

748,000 |

160 |

86 |

0.22 |

0.43 |

1.17 |

3.84 |

2.06 |

5,200 |

7.0 |

19.3 |

100 |

641,000 |

170 |

93 |

0.20 |

0.47 |

1.17 |

3.51 |

1.92 |

4,100 |

6.7 |

16.6 |

120 |

464,000 |

194 |

109 |

0.27 |

0.57 |

1.18 |

2.89 |

1.62 |

4,100 |

5.8 |

12.1 |

150 |

287,000 |

231 |

132 |

0.33 |

0.74 |

1.19 |

2.13 |

1.22 |

3,000 |

4.7 |

7.5 |

200 |

148,000 |

287 |

168 |

0.42 |

1.00 |

1.34 |

1.36 |

0.80 |

2,000 |

3.3 |

4.4 |

Note: Values in these tables reported above and below the base-case cut-off 50 g/t AgEq (highlighted) for in-pit Mineral Resources should not be misconstrued with a Mineral Resource Statement. The values are only presented to show the sensitivity of the block model estimates to the selection of the base case cut-off grade. All values are rounded to reflect the relative accuracy of the estimate and numbers may not add due to rounding.

DISCUSSION

The Formo Vein Deposit

Located in the West-central part of the Keno Hill district, the Formo Inferred Resource is the largest and highest-grade contributor to the 2024 Resource Estimate with 12.77 Moz AgEq at a grade of 369 g/t AgEq using a 150 g/t AgEq cut-off. The Formo deposit, in the West Keno area, is on trend with the 100 Moz historic Hector-Calumet mine controlled by Hecla. Formo is ideally located near infrastructure as it is adjacent to the Silver Trail highway (Highway 11) and power lines that feed the central Keno Hill mill and village of Keno City. The Formo deposit also directly adjoins Hecla's Keno Hill property, where Hecla is actively mining the nearby Bermingham mine.

Minor amounts of historic production at Formo, from both a small surface pit and underground workings, generated the initial exploration interest by the Company which acquired the project in 2017. Subsequent drilling resulted in significant silver-rich intercepts including some of the highest-grade x thickness values on the property (See Table 4).

The 2024 Resource Estimate envisions higher-grade selective mining methods at Formo but also demonstrates the potential for lower-cost open pit mining methodologies on the shallower portions. The Formo vein system is open along strike and at depth. Modern drilling of the property began in 2020 and only 26 diamond drill holes (4,418 meters) have been drilled since, indicating the minimal nature of drill testing at the Formo property. Over 1,300 m of the Formo vein systems strike length occurs on Metallic Minerals claims which has only been drilled on 400 meters of strike and to less than 250 meters deep. There is ample opportunity for continued resource expansion and new discoveries with additional drilling at the Formo target as tested during the fall 2023 drill campaign.

The Caribou Vein Deposit

The Caribou target in the central part of the district is the second largest contributor to the 2024 Resource Estimate totaling 2.82 Moz AgEq grading 149 g/t at a 50 g/t AgEq cut-off grade (see Table 1). The Inferred Resource has been defined by a total of 82 drill holes totaling 5,980 m of both reverse circulation and diamond core drilling averaging just 72 meters depth per hole. The shallowly explored target has been drilled only to a depth of 120 m locally and remains open to further expansion.

The Caribou deposit historically produced very high-grade material grading more than 1,000 g/t silver from near surface. Mineralization at the Caribou target consists of high-grade, north-striking Ag-Pb-Zn structures with a shallow 34-degree dip. Exploration on the high-grade vein structure has also defined a surrounding envelope of broader bulk tonnage mineralization. These broader zones of mineralization not only include wide veins but also parallel veinlets, stringers and breccia zones. In 2021 and 2022, drilling of the broader Caribou zone returned intervals up to 34.2 m wide (averaging 18.2 m), with grades up to 134 g/t AgEq (see New Release dated April 10th, 2023). These wide widths combined with a shallow dip and a near surface environment make this bulk tonnage and high-grade mineralization amenable to low cost, bulk tonnage mining methods.

The Fox Sheeted Vein Deposit

Located in East Keno and discovered by the Company in 2020, the Fox target area has subsequently seen 2,748 meters of drilling in 18 holes. The 2020 Discovery of the Fox target resulted from drill testing of a multi-kilometer silver-in-soil anomaly developed through the Company's district wide geochemical sampling programs.

The morphology of the Fox deposit is unique to the district. The Fox target is a sheeted vein system with shallow-dipping individual bedding parallel veins predominantly from 1 cm to 10 cm that are hosted in the Earn Group schists. Mineralized widths from the 2022 drilling on the Fox deposit returned the widest zones of mineralization ever reported in the Keno Hill silver district and on a grade x thickness basis are comparable in contained metal with some of the richest zones encountered on the property (See Table 4). Mineralization begins at surface and exhibits a shallow dip of less than 30 degrees with continuous mineralized drill intercepts to 177 meters estimated true thickness. The sheeted Ag-Pb-Zn veins are mineralogically similar to other known productive veins in the district.

The Fox deposit remains open to expansion in all directions and only covers a small part of the multi-kilometer scale anomaly leaving significant room to grow additional resources. The westernmost drilling in the Fox target area, in 2022, demonstrated increasing widths of mineralization that will be tested in future programs along with untested areas of very high-level silver in soil values.

The Homestake Deposit

The Inferred Resource at the historically productive Homestake vein located in the central Keno Hill district is accessible from the Keno road system approximately 6 km from the Keno Area mill (see Figure 1). The Homestake target has seen limited shallow drilling to date with only 88 drill holes for a total of 5,126 m (44 diamond core drill holes totaling 4,007 m and 44 reverse circulation drill holes totaling 1,119 m), at an average of 58 m per hole.

The 2024 Resource Estimate at the Homestake deposit is supported by a number of very high-grade drill results in a limited area of the vein system. The Homestake target area comprises two parallel vein structures within a broad structural corridor over 200 m wide that has a demonstrated strike length of over 1 km in the host Keno Hill quartzite. Homestake #1 vein shows classic Keno-style, high-grade silver-lead-zinc mineralization, while the #2 vein can also show significantly elevated gold with modest silver grades, which is characteristic of some structures in the larger deposits within the Keno Hill Silver District. The strongest grades to date include assays of 4,027 g/t silver from drilling and 4,717 g/t silver from trenching on the Homestake #1 vein, and 22.1 g/t gold with 332 g/t silver from trenching on the Homestake #2 vein.

Over the larger Homestake area there is limited bedrock exposure, but soil sampling has identified a broad corridor of elevated Ag-Pb-Zn results that strikes over 4 km within the host Keno Hill quartzite. The orientation and general indications are that this structure is comparable to the structural corridors seen at the Keno Summit and in the western part of the district at Bermingham/Hector-Calumet.

Historical drilling was targeted near the Homestake adit area where the vein is exposed at surface and early-stage sampling and trenching work returned high grades. To date there are 21 drilled vein intersections grading more than 600 g/t silver equivalent on the Homestake structures, including five that exceed 10 g/t gold on the Homestake #2 structure. Exploration at Homestake will continue to focus on extensions of the structures to the southwest and northeast along the newly identified soil anomalies with a focus on targeting thicker, more massive sections of the Keno Hill quartzite stratigraphy within the estimated 1 km thick target window.

Project Review and Exploration Update

The Keno Silver Project 2024 Resource Estimate is an important milestone following acquisition of most of the land package from 2016 to 2018 on the less explored eastern and southern extensions of the Keno Hill district. The 18.16 Moz AgEq resource is the culmination of only 18,983 m of drilling over the last five field seasons, where the exploration activities have progressed from data compilation to property acquisitions followed by geochemical rock and soil sampling, geologic mapping and geophysical surveys, and then drilling programs to advance early-stage targets. This led to a considerable number of high-grade silver drill intercepts (see Table 4) and at least five drill discoveries (Fox, Gold Hill, UKHM, McKim Creek and Zone 2) and now to the Company's inaugural Inferred Resources for the project (see Table 1).

Metallic Minerals' drilling on the project since 2016 has been 18,983 meters in 165 drill holes with total exploration expenditures of $19.46 million. With the 2024 Resource Estimate, the Company has demonstrated a highly successful systematic and efficient approach to discovery and resource delineation delivering nearly 1,000 AgEq ounces per meter drilled.

Table 4. Summary of Significant Keno Silver Project Drill Results

Hole |

From (m) |

To (m) |

Length (m) |

Ag (g/t) |

AgEq (g/t) |

Target |

AgEq g/t x Length (m) |

FOR23-03 |

239.95 |

286.0 |

46.05 |

99.1 |

256.8 |

FORMO |

11,825.6 |

DDH-FOR-20-003 |

96 |

101.1 |

5.1 |

939.0 |

1,848.7 |

FORMO |

9,428.6 |

FOR22-04 |

125.13 |

146 |

20.87 |

144.6 |

228.8 |

FORMO |

4,774.8 |

CH11-007 |

14.6 |

18.5 |

3.9 |

314.8 |

1,170.0 |

CARIBOU |

4,563.2 |

FOX22-03 |

29.55 |

101.75 |

72.2 |

22.6 |

62.9 |

FOX |

4,538.3 |

FOR21-05 |

94.6 |

112.5 |

17.9 |

88.0 |

250.9 |

FORMO |

4,491.6 |

FOR21-06 |

114.4 |

123 |

8.6 |

309.5 |

497.7 |

FORMO |

4,280.6 |

CH17-23 |

39.7 |

46 |

6.3 |

375.9 |

630.9 |

CARIBOU |

3,974.4 |

KS21-47 |

105.16 |

114.3 |

9.14 |

204.8 |

383.2 |

CARIBOU |

3,502.4 |

FOX22-04 |

67.48 |

117 |

49.52 |

20.9 |

67.0 |

FOX |

3,317.7 |

CH11-018 |

24.1 |

40.8 |

16.7 |

182.6 |

185.3 |

CARIBOU |

3,094.2 |

KS21-57 |

35.05 |

41.15 |

6.1 |

335.2 |

443.3 |

CARIBOU |

2,704.4 |

CH11-009 |

13.5 |

20 |

6.5 |

388.9 |

411.4 |

CARIBOU |

2,674.4 |

NA12-02 |

19.81 |

28.53 |

8.72 |

210.2 |

261.1 |

NABOB |

2,276.5 |

CH17-21 |

38.85 |

43 |

4.15 |

265.0 |

541.4 |

CARIBOU |

2,246.8 |

FOR22-01 |

96 |

103.95 |

7.95 |

125.4 |

276.6 |

FORMO |

2,199.1 |

NA12-12 |

5.4 |

27.55 |

22.15 |

74.7 |

97.4 |

NABOB |

2,156.3 |

Notes to Table 4 reported values:

- Ag Equivalent is presented for comparative purposes using conservative long-term metal prices (all USD): $22.50/oz silver (Ag), $1,800/oz Gold, $1.00/lb lead (Pb), $1.30/lb zinc (Zn).

- Recovered Silver Equivalent in Table 4 is determined as follows: AgEq g/t = [Ag g/t x recovery] + [Au g/t x recovery x Au price/ Ag price] + [Pb % x 10,000 x recovery x Pb price / Ag price] + [Zn% x 10,000 x recovery x Zn price / Ag price].

- In the above calculations: 1% = 10,000 ppm = 10,000 g/t.

- The following recoveries have been assumed for purposes of the above equivalent calculations: 95% for precious metals (Ag/Au) and 90% for all other listed metals, based on recoveries at similar nearby operations.

- Intervals are reported as measured drill intersect lengths. And do not represent true width.

This stepwise process of systematic exploration on the Keno Silver project provides a template for the continued expansion of existing resources, the advancement of early-stage targets to resources and the discovery of new deposits and targets. To date, the Company has defined 42 early-stage targets and has drill tested 11 targets that have returned significant drill intercepts for follow-up. With most of the broad-scale exploration activities completed across the property, the Company will continue to focus on drilling the highest priority targets with the goal of near-term resource growth and new discoveries.

About SGS Geological Services

SGS Geological Services has an experienced and respected mining team focused on the domestic and international mining industry. The team has considerable experience in estimation and modeling of deposits of all types and practical and theoretical experience having carried out hundreds of assessments for clients. The SGS team consists of a multi-disciplinary group of qualified persons with a strong understanding of the disclosure requirements for Mineral Resources set out in the NI 43-101 Standards of Disclosure for Mineral Projects (2016), CIM Definition Standards for Mineral Resources and Mineral Reserves (2014) and a strong understanding of the CIM Estimation of Mineral Resources & Mineral Reserves Best Practice Guidelines 2019.

About Metallic Minerals

Metallic Minerals Corp. is a Canadian exploration and development stage company, focused on copper, silver, gold, and platinum group elements in the La Plata mining district in Colorado, and silver and gold in the high-grade Keno Hill and Klondike districts of the Yukon. Our objective is to create shareholder value through a systematic, entrepreneurial approach to making exploration discoveries, growing resources, and advancing projects toward development.

At the Company's La Plata project in southwestern Colorado, the expanded 2023 NI 43-101 mineral resource estimate highlights a significant porphyry copper-silver resource containing 1.2 Blbs copper and 17.6 Moz of silver with numerous additional targets showing potential for a district scale porphyry corridor. Drill results announced in early 2023 included the longest and highest-grade interval ever encountered at La Plata and one of the top intersections for any North American copper project in the past several years. In May 2023, the Company announced a 9.5% strategic investment by Newcrest Mining Limited (acquired by Newmont Corporation in November 2023) to accelerate the advancement of the La Plata project. A 4,500-meter drill program focused on expanding the current mineral resource and testing extensions of strong porphyry-style mineralization was completed in December 2023 with results pending. In the 2023 Fraser Institute's Annual Survey of Mining Companies, Colorado ranked 5th globally for investment attractiveness and 2nd in the USA.

In Canada's Yukon Territory, Metallic Minerals has consolidated the second-largest land position in the historic high-grade Keno Hill silver district, directly adjacent to Hecla Mining Company's operations, with more than 300 Moz of high-grade silver in past production and current M&I resources. The new 2024 Resource Estimate at the Company's Keno Silver Project adds 18.16 Moz silver equivalent (including 9.81 Moz silver) to the district, representing an 8.4% increase to the district's total silver resource3. Hecla, the largest primary silver producer in the USA and third largest in the world, is anticipating full production at its Keno Hill operations in 2024.

The Company is also one of the largest holders of alluvial gold claims in the Yukon and is building a production royalty business by partnering with experienced mining operators, including Parker Schnabel of Little Flake Mining from the Discovery Channel show Gold Rush.

All of the districts in which Metallic Minerals operates have seen significant mineral production and have existing infrastructure, including power and road access. Metallic Minerals is led by a team with a track record of discovery and exploration success on several major precious and base metal deposits in the region, as well as having large-scale development, permitting and project financing expertise. The Metallic Minerals team has been recognized for its environmental stewardship practices and is committed to responsible and sustainable resource development.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Website: www.mmgsilver.com Phone: 604-629-7800

Email: cackerman@mmgsilver.com Toll Free: 1-888-570-4420

Footnotes:

- Cathro, R. J., Great Mining Camps of Canada 1. The History and Geology of the Keno Hill Silver Camp, Yukon Territory. Geoscience Canada, Sept. 2006. ISSN 1911-4850.

- See Hecla Mining general presentation from September 2023, Slide 17, at www.hecla.com. Hecla IR Update September 2023

- See Hecla Mining online reserves and resources statement at www.hecla.com. Hecla-2022_YE_Reserves-and-Resources-Charts.pdf

Qualified Persons

The Mineral Resource Estimate for the Keno Silver Project was completed by Allan Armitage, Ph.D., P.Geo., of SGS Geological Services. Dr. Armitage is an independent Qualified Person as defined by NI 43-101. Dr. Armitage has reviewed and approved the technical content regarding the Mineral Resource Estimate in this news release.

Taylor Haid, P.Geo, a qualified person for the purposes of National Instrument 43-101, has reviewed and approved the technical disclosure, not pertaining to the resource estimate, contained in this news release. Mr. Haid is a Senior Geologist for Metallic Minerals.

Sampling Protocol, Quality Assurance & Quality Control

All recovered drill core was transported via helicopter or UTV from the drill at the end of each shift to the core logging facility located on the Formo claims. Down hole surveys were conducted using a Reflex EZ-SHOT at 30 m intervals. Drill core was logged on site by geologists where all geotechnical and geological data was captured and documented. The analyzed core was then marked for sampling and photographed. Drill core was sampled over intervals ranging between 0.5 m to 2 m, ensuring samples were not collected across lithological boundaries. Core samples were cut in half lengthwise with a core saw, placed into a clear sample bag with an associated sample number and tag. The half-core samples were shipped in sealed rice bags by truck to the Bureau Veritas facility in Whitehorse, Yukon. The remaining half remains stored on site near the Formo core logging facility for reference.

All samples were prepared by Bureau Veritas' (BV) Whitehorse, Yukon facility and geochemically analyzed at the BV laboratory in Vancouver, British Columbia. All samples were prepared using BV code PRP70-250, which crushed, split, and pulverized 250 grams of core to 200 mesh pulps. These pulps were then analyzed by 37 Element 1:1:1 Aqua Regia Digestion followed by Inductively Coupled Plasma Mass Spectrometry (ICP-ES/MS) analyses (BV Code AQ202). Over-limit silver, lead, and zinc samples were further analyzed with multi-acid digestion and atomic absorption spectrometry (BV Code MA404). Samples with over-limit gold (and silver when over-limit was reached via multi-acid) were re-analyzed using a 30-gram fire assay fusion with gravimetric finish (BV Code FA530).

All results have passed the QAQC screening by the lab and the company utilizes a quality control and quality assurance protocol for the project, including insertion of blanks, duplicates, and certified reference materials approximately every tenth sample. Certified reference materials were acquired from OREAS North America Inc. of Sudbury, Ontario, and CDN Resource Laboratories Ltd. Of Langley, British Columbia for the 2023 drill program at the Keno Silver Project.

Forward-Looking Statements

This news release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, statements about expected results of operations, royalties, cash flows, financial position and future dividends as well as financial position, prospects, and future plans and objectives of the Company are forward-looking statements that involve various risks and uncertainties. Although Metallic Minerals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, unsuccessful operations, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration, development of mines and mining operations is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Metallic Minerals and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Metallic Minerals Corp.

View the original press release on accesswire.com