LITTLETON, CO / ACCESS Newswire / November 3, 2025 / Ur-Energy Inc. (NYSE American:URG)(TSX:URE) (the "Company" or "Ur-Energy") has filed the Company's Form 10-Q for the quarter ended September 30, 2025, with the U.S. Securities and Exchange Commission at www.sec.gov/edgar.shtml and with Canadian securities authorities at www.sedarplus.ca.

Third Quarter 2025 Financial and Operating Results

The ramp up at Lost Creek continued with 93,523 pounds of U3O8 dried and packaged.

Ur-Energy sold 110,000 pounds of U3O8 during the quarter, at an average price of $57.48 per pound, generating revenue of $6.3 million.

Uranium sold in Q3 2025 was sourced from previously purchased inventories. Ur-Energy currently has sufficient produced inventory on hand to meet its remaining 2025 sales obligation of 165,000 pounds.

Q3 2025 cash costs per pound of produced inventory remained consistent with Q2, decreasing slightly from $43.61 in Q2 2025 to $43.00 in Q3 2025.

Shirley Basin's professional and operational teams are fully staffed, and site construction is well advanced. Wellfield and plant development remain on track for uranium production startup in Q1 2026.

As of September 30, 2025, we had cash and cash equivalents of $52.0 million, a decrease of approximately $24.1 million from the $76.1 million balance on December 31, 2024. Cash position as of October 30, 2025, was $35.4 million.

Ur-Energy President, Matthew Gili, commented: "The continued ramp-up and plant optimization at Lost Creek, together with the advanced construction status at Shirley Basin, position Ur-Energy to capitalize on the resurgence of both the U.S. and global nuclear power industry, illustrated by the recently announced U.S. government's $80 billion investment to build new nuclear reactors in the United States."

Lost Creek Operations

We dried and packaged 93,523 pounds and shipped 70,190 pounds to the conversion facility in Q3. As of September 30, 2025, we held 278,150 pounds of U₃O₈ at the conversion facility. Subsequent to quarter end, we shipped an additional 69,604 pounds to the conversion facility and purchased 100,000 pounds, after which we will have 447,754 pounds in finished inventory at the conversion facility.

Four header houses have been brought online this year in Lost Creek's second mine unit ("MU2"). Production flow for the third quarter averaged approximately 2,100 gpm from MU2 production areas. The flow was controlled at a lower rate to optimize MU2 production by removing solids incidental to production that had accumulated in the main pipeline. That maintenance, primarily occurring during September and October, is substantially complete and preparations are underway to continue increasing flow rates from MU2 commensurate with production needs. Production grade for the quarter averaged 66 ppm, reflecting the controlled flow rates during maintenance. Year-to-date, the average production grade remains at approximately 58 ppm.

Development continues in MU1 Phase 2, where well installations are substantially complete in four of the ten header houses. Surface construction is advancing, with the first header house for Phase 2 in commissioning. Three header houses have been delivered to Lost Creek, and two more are being prepared at our Casper construction shop.

Successful production operations depend upon strong safety programs and consistently good safety records. Our safety program and culture both continue to improve at Lost Creek and with our staff at Shirley Basin. We are pleased to see continued and sustained safety improvements and will remain focused on safety and compliance throughout our operations.

Our total sales in 2025 are projected at 440,000 pounds of U3O8 at an average price per pound sold of $61.77 and we expect to realize revenues of $27.2 million. The sales are a result of contracts negotiated in 2022 and 2023, when the long-term price was between $43 and $57 per pound. Deliveries of 165,000 pounds and 110,000 pounds were made in Q2 and Q3, respectively. A delivery of 165,000 pounds at an average price of $63.20 is expected to be made in Q4 2025 from produced inventory.

Shirley Basin: Fully Staffed and Advancing Toward Uranium Production

Construction activities are ongoing and gaining momentum at our fully permitted Shirley Basin ISR Project. Construction of the foundation for the processing building began in early August and we have poured nearly 900 of the required 1,100 total cubic yards of concrete. The internal foundation of the processing building is substantially complete. 11 ion exchange columns were delivered to Shirley Basin in September, and two have been placed on the internal foundation.

As previously disclosed, Shirley Basin construction milestones include road upgrades, completion of 125 monitor wells and groundwater work, power installation to the site, and setup of communications, security, and septic systems. We also refurbished the warehouse, and construction and maintenance bays, including the installation of modular offices.

The metal building components of the plant facility have been delivered to the project site. The general contractor is preparing for pre-assembly while also continuing to prepare for offsite fabrication and procurement of steel piping, supports, and catwalks.

The 10,000 square-foot Shirley Basin modular office is now fully operational, with all management and professional personnel onsite leading wellfield construction and development. The Shirley Basin team is working closely with our Casper-based professionals to advance all aspects of construction in preparation for production. We have also added contracted project management expertise to enhance coordination and ensure we meet schedule and quality objectives as we progress toward the anticipated Q1 2026 startup and commissioning.

We have hired all operational staff, including our maintenance and wellfield services teams. Training of all staff is progressing, with operations staff expected to receive hands-on experience at Lost Creek along with additional training during satellite plant construction at Shirley Basin.

Photo 1. Shirley Basin Satellite ISR Plant Under Construction - October 28, 2025

One of the two evaporation ponds is constructed, with the second pond nearing completion. Once both are fully constructed, work will commence on the installation of liners and technical components.

Installation of production and injection wells in Shirley Basin Mine Unit 1 is progressing, with drilling and completion of wells for the first header house finished and work on the next two is advancing. All monitor wells have been installed and sampled. The first header house has been fabricated in Casper and fabrication of the second is underway. Onsite construction and main pipeline installation continue, with trenching complete through the seventh header house and piping past the third.

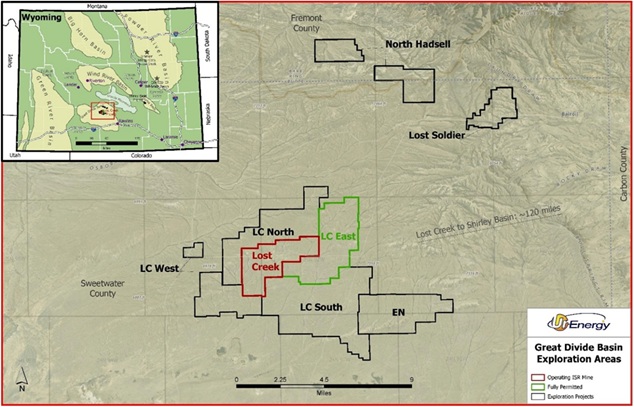

Third Quarter 2025 Great Divide Basin Exploration Activities

During the third quarter, we initiated exploration programs in the Great Divide Basin ("GDB") on our Lost Soldier Project, located less than 10 miles northeast of the Lost Creek ISR Mine. The work at Lost Soldier included the installation of 18 aquifer test wells designed to enhance our understanding of the local hydrogeology. While the geology of the project area is well understood and supported by data from more than 4,000 historical drillholes, this additional hydrogeologic characterization will assist our technical teams in optimizing potential future mine planning, permitting, and development activities.

Due to the proximity of our operating Lost Creek ISR facility, Lost Soldier has the potential to be developed as a satellite operation. If exploration work is successful, we will evaluate the potential to advance Lost Soldier through the FAST-41 permitting process, a federal framework designed to streamline and improve coordination among agencies for large-scale infrastructure and energy projects.

Figure 1. Great Divide Basin Exploration Areas

As the work at Lost Soldier concludes, drill rigs will move to the North Hadsell Project for a 50-hole drill program. Next, we will move to our third exploration program in the GDB at LC South, where we anticipate commencing a 120-drillhole program in Q1 2026. The goal of our GDB exploration programs is to identify additional uranium roll fronts and potentially expand the Company's uranium resource base in Wyoming's prolific Great Divide Basin.

U3O8 Product Profit (Loss)

The following table provides information on our U3O8 product profit and loss:

U3O8 Product Profit (Loss) |

Unit |

|

2024 Q4 |

|

|

2025 Q1 |

|

|

2025 Q2 |

|

|

2025 Q3 |

|

|

2025 YTD |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U3O8 Product Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Produced |

$000 |

|

|

5,857 |

|

|

|

- |

|

|

|

10,428 |

|

|

|

- |

|

|

|

10,428 |

|

Non-produced |

$000 |

|

|

16,500 |

|

|

|

- |

|

|

|

- |

|

|

|

6,323 |

|

|

|

6,323 |

|

$000 |

|

|

22,357 |

|

|

|

- |

|

|

|

10,428 |

|

|

|

6,323 |

|

|

|

16,751 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

U3O8 Product Costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Produced |

$000 |

|

|

5,896 |

|

|

|

- |

|

|

|

8,397 |

|

|

|

- |

|

|

|

8,397 |

|

Non-produced |

$000 |

|

|

22,760 |

|

|

|

- |

|

|

|

- |

|

|

|

7,063 |

|

|

|

7,063 |

|

$000 |

|

|

28,656 |

|

|

|

- |

|

|

|

8,397 |

|

|

|

7,063 |

|

|

|

15,460 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

U3O8 Product Profit (Loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Produced |

$000 |

|

|

(39 |

) |

|

|

- |

|

|

|

2,031 |

|

|

|

- |

|

|

|

2,031 |

|

Non-produced |

$000 |

|

|

(6,260 |

) |

|

|

- |

|

|

|

- |

|

|

|

(740 |

) |

|

|

(740 |

) |

$000 |

|

|

(6,299 |

) |

|

|

- |

|

|

|

2,031 |

|

|

|

(740 |

) |

|

|

1,291 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

U3O8 Pounds Sold |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Produced |

lb |

|

|

95,000 |

|

|

|

- |

|

|

|

165,000 |

|

|

|

- |

|

|

|

165,000 |

|

Non-produced |

lb |

|

|

300,000 |

|

|

|

- |

|

|

|

- |

|

|

|

110,000 |

|

|

|

110,000 |

|

lb |

|

|

395,000 |

|

|

|

- |

|

|

|

165,000 |

|

|

|

110,000 |

|

|

|

275,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

U3O8 Price per Pound Sold |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Produced |

$/lb |

|

|

61.65 |

|

|

|

- |

|

|

|

63.20 |

|

|

|

- |

|

|

|

63.20 |

|

Non-produced |

$/lb |

|

|

55.00 |

|

|

|

- |

|

|

|

- |

|

|

|

57.48 |

|

|

|

57.48 |

|

$/lb |

|

|

56.60 |

|

|

|

- |

|

|

|

63.20 |

|

|

|

57.48 |

|

|

|

60.91 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

U3O8 Cost per Pound Sold |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ad valorem and severance taxes |

$/lb |

|

|

1.73 |

|

|

|

- |

|

|

|

2.62 |

|

|

|

- |

|

|

|

2.62 |

|

Cash costs |

$/lb |

|

|

50.25 |

|

|

|

- |

|

|

|

40.21 |

|

|

|

- |

|

|

|

40.21 |

|

Non-cash costs |

$/lb |

|

|

10.08 |

|

|

|

- |

|

|

|

8.06 |

|

|

|

- |

|

|

|

8.06 |

|

Produced |

$/lb |

|

|

62.06 |

|

|

|

- |

|

|

|

50.89 |

|

|

|

- |

|

|

|

50.89 |

|

Non-produced |

$/lb |

|

|

75.87 |

|

|

|

- |

|

|

|

- |

|

|

|

64.21 |

|

|

|

64.21 |

|

$/lb |

|

|

72.55 |

|

|

|

- |

|

|

|

50.89 |

|

|

|

64.21 |

|

|

|

56.22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

U3O8 Profit (Loss) per Pound Sold |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash costs |

$/lb |

|

|

11.40 |

|

|

|

- |

|

|

|

22.99 |

|

|

|

- |

|

|

|

22.99 |

|

Less ad valorem and severance taxes |

$/lb |

|

|

(1.73 |

) |

|

|

- |

|

|

|

(2.62 |

) |

|

|

- |

|

|

|

(2.62 |

) |

Less non-cash costs |

$/lb |

|

|

(10.08 |

) |

|

|

- |

|

|

|

(8.06 |

) |

|

|

- |

|

|

|

(8.06 |

) |

Produced |

$/lb |

|

|

(0.41 |

) |

|

|

- |

|

|

|

12.31 |

|

|

|

- |

|

|

|

12.31 |

|

Non-produced |

$/lb |

|

|

(20.87 |

) |

|

|

- |

|

|

|

- |

|

|

|

(6.72 |

) |

|

|

(6.72 |

) |

$/lb |

|

|

(15.95 |

) |

|

|

- |

|

|

|

12.31 |

|

|

|

(6.72 |

) |

|

|

4.69 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

U3O8 Profit (Loss) Margin per Pound Sold |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash costs |

% |

|

|

18.5 |

|

|

|

- |

|

|

|

36.4 |

|

|

|

- |

|

|

|

36.4 |

|

Less ad valorem and severance taxes |

% |

|

|

(2.8 |

) |

|

|

- |

|

|

|

(4.1 |

) |

|

|

- |

|

|

|

(4.1 |

) |

Less non-cash costs |

% |

|

|

(16.4 |

) |

|

|

- |

|

|

|

(12.8 |

) |

|

|

- |

|

|

|

(12.8 |

) |

Produced |

% |

|

|

(0.7 |

) |

|

|

- |

|

|

|

19.5 |

|

|

|

- |

|

|

|

19.5 |

|

Non-produced |

% |

|

|

(37.9 |

) |

|

|

- |

|

|

|

- |

|

|

|

(11.8 |

) |

|

|

(11.8 |

) |

% |

|

|

(28.2 |

) |

|

|

- |

|

|

|

19.5 |

|

|

|

(11.8 |

) |

|

|

7.7 |

|

|

The U3O8 and cost per pound measures included in the above table do not have a standardized meaning within US GAAP or a defined basis of calculation. These measures are used by management to assess business performance and determine production and pricing strategies. They may also be used by certain investors to evaluate performance.

U3O8 Production and Ending Inventory

The following tables provide information on our production and ending inventory of U3O8 pounds:

U3O8 Production |

Unit |

|

2024 Q4 |

|

|

2025 Q1 |

|

|

2025 Q2 |

|

|

2025 Q3 |

|

|

2025 YTD |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Pounds captured |

lb |

|

|

81,771 |

|

|

|

74,479 |

|

|

|

128,970 |

|

|

|

89,267 |

|

|

|

292,716 |

|

Pounds drummed in

|

lb |

|

|

74,006 |

|

|

|

83,066 |

|

|

|

112,033 |

|

|

|

93,523 |

|

|

|

288,622 |

|

Pounds shipped |

lb |

|

|

66,526 |

|

|

|

106,301 |

|

|

|

105,316 |

|

|

|

70,190 |

|

|

|

281,807 |

|

Non-produced pounds acquired |

lb |

|

|

550,000 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

U3O8 Ending Inventory |

Unit |

|

2024 Q4 |

|

|

2025 Q1 |

|

|

2025 Q2 |

|

|

2025 Q3 |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Pounds |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In-process inventory |

lb |

|

|

39,169 |

|

|

|

29,700 |

|

|

|

37,590 |

|

|

|

29,362 |

|

Plant inventory |

lb |

|

|

33,919 |

|

|

|

10,772 |

|

|

|

17,484 |

|

|

|

40,817 |

|

Conversion inventory - produced |

lb |

|

|

12,239 |

|

|

|

118,540 |

|

|

|

65,607 |

|

|

|

138,150 |

|

Conversion inventory - non-produced |

lb |

|

|

250,000 |

|

|

|

250,000 |

|

|

|

250,000 |

|

|

|

140,000 |

|

lb |

|

|

335,327 |

|

|

|

409,012 |

|

|

|

370,681 |

|

|

|

348,329 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In-process inventory |

$000 |

|

|

42 |

|

|

|

382 |

|

|

|

509 |

|

|

|

630 |

|

Plant inventory |

$000 |

|

|

1,840 |

|

|

|

582 |

|

|

|

921 |

|

|

|

2,267 |

|

Conversion inventory - produced |

$000 |

|

|

704 |

|

|

|

6,463 |

|

|

|

3,409 |

|

|

|

7,290 |

|

Conversion inventory - non-produced |

$000 |

|

|

18,158 |

|

|

|

16,058 |

|

|

|

16,058 |

|

|

|

8,992 |

|

$000 |

|

|

20,744 |

|

|

|

23,485 |

|

|

|

20,897 |

|

|

|

19,179 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Cost per Pound |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In-process inventory |

$/lb |

|

|

1.07 |

|

|

|

12.86 |

|

|

|

13.54 |

|

|

|

21.46 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Plant inventory |

$/lb |

|

|

54.25 |

|

|

|

54.03 |

|

|

|

52.68 |

|

|

|

55.54 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Conversion inventory: |

$/lb |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ad valorem and severance tax |

$/lb |

|

|

1.57 |

|

|

|

2.16 |

|

|

|

3.06 |

|

|

|

3.29 |

|

Cash cost |

$/lb |

|

|

46.83 |

|

|

|

43.43 |

|

|

|

40.55 |

|

|

|

39.71 |

|

Non-cash cost |

$/lb |

|

|

9.12 |

|

|

|

8.94 |

|

|

|

8.35 |

|

|

|

9.77 |

|

Conversion inventory - produced |

$/lb |

|

|

57.52 |

|

|

|

54.53 |

|

|

|

51.96 |

|

|

|

52.77 |

|

Conversion inventory - non-produced |

$/lb |

|

|

72.63 |

|

|

|

64.23 |

|

|

|

64.23 |

|

|

|

64.23 |

|

$/lb |

|

|

71.93 |

|

|

|

61.11 |

|

|

|

61.68 |

|

|

|

58.54 |

|

|

About Ur-Energy

Ur-Energy is a uranium mining company operating the Lost Creek in situ recovery uranium facility in south-central Wyoming. We have produced and packaged approximately 3 million pounds of U3O8 from Lost Creek since the commencement of operations. Ur-Energy has begun development and construction activities at Shirley Basin, the Company's second in situ recovery uranium facility in Wyoming. Ur-Energy is engaged in uranium recovery and processing activities, including the acquisition, exploration, development, and operation of uranium mineral properties in the United States. The primary trading market for Ur-Energy's common shares is on the NYSE American under the symbol "URG." Ur-Energy's common shares also trade on the Toronto Stock Exchange under the symbol "URE." Ur-Energy's corporate office is in Littleton, Colorado and its registered office is in Ottawa, Ontario.

Contact Information

Valerie Kimball

IR Director

Valerie.kimball@ur-energy.com

720-460-8534

Cautionary Note Regarding Forward-Looking Information

This release may contain "forward-looking statements" within the meaning of applicable securities laws regarding events or conditions that may occur in the future (e.g., timing to complete our ramp-up to steady state full production levels at Lost Creek, including whether MU1 Phase 2 comes online as scheduled, wellfield flow rates increase as anticipated, and efforts to optimize plant production are successful; our ability to complete build out of Shirley Basin as currently projected and budgeted; whether our safety program and record will continue to see sustained improvements and whether compliant operations can be maintained; the ability to capitalize on the resurgence of the nuclear industry; the results of our 2025 exploration program in the Great Divide Basin; and whether we will advance Lost Soldier and on what timeline, and permitting program) and are based on current expectations that, while considered reasonable by management at this time, inherently involve a number of significant business, economic and competitive risks, uncertainties and contingencies. Generally, forward-looking statements can be identified by the use of forward-looking terminology such as "plans," "expects," "does not expect," "is expected," "is likely," "estimates," "intends," "anticipates," "does not anticipate," or "believes," or variations of the foregoing, or statements that certain actions, events or results "may," "could," "might" or "will be taken," "occur," "be achieved" or "have the potential to." All statements, other than statements of historical fact, are considered to be forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements express or implied by the forward-looking statements. Factors that could cause actual results to differ materially from any forward-looking statements include, but are not limited to, capital and other costs varying significantly from estimates; failure to establish estimated resources and reserves; the grade and recovery of ore which is mined varying from estimates; production rates, methods and amounts varying from estimates; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; inflation; changes in exchange rates; fluctuations in commodity prices; delays in development and other factors described in the public filings made by the Company at www.sedarplus.ca and www.sec.gov. Readers should not place undue reliance on forward-looking statements. The forward-looking statements contained herein are based on the beliefs, expectations and opinions of management as of the date hereof and Ur-Energy disclaims any intent or obligation to update them or revise them to reflect any change in circumstances or in management's beliefs, expectations or opinions that occur in the future.

SOURCE: Ur-Energy Inc.

View the original press release on ACCESS Newswire