Gold Equivalent Ounce ("GEO") Production of 11,163 GEO for the 1st Quarter 2025

Record Production of 7,228, GEO from Heap Leach operations during the quarter

2025 Production Guidance Increased to 55,000 - 60,000 GEO

Underground Production commencing in H2/2025

TORONTO, ON / ACCESS Newswire / April 15, 2025 / Cerrado Gold Inc. (TSXV:CERT)(OTCQX:CRDOF) ("Cerrado" or the "Company") announces production results for the first quarter ended March 2025 ("Q1 2025") from the Minera Don Nicolas Mine in Santa Cruz Province, Argentina ("MDN"). Full quarterly financial results are expected to be released prior to May 30, 2025.

Q1 Operating Highlights

Q1 Production of 11,163 GEO vs 10,431 in Q4

Heap leach production ramping up to expanded capacity with over 2,800 GEO produced in March and 7,228 GEO for the quarter

CIL plant to continue to process low-grade stockpiles in anticipation of blending with high-grade ore from underground in H2/2025

Underground development at Paloma to commence in Q2 with initial production expected in Q3/2025

Expanded crushing capacity installation at Calandrias Sur to be completed in Q2 2025

Operational results for Q1 2025 showed a modest improvement in production over the previous quarter, driven by the ongoing ramp-up and transition to a focus on heap leach production as the high-grade ore feed for the CIL plant has been depleting as we await ongoing exploration activities. The CIL plant will continue to process lower-grade stockpiles until underground operations at Paloma are initiated in Q3 2025 with development commencing in Q2 2025. The heap leach operational performance continued to improve over the quarter, reaching record production levels as more ore was added to the pad. The performance of the heap leach continues to improve, exiting the quarter at near full capacity.

The second phase of the expansion of the crushing circuit is set to be concluded in May, supporting a doubling of capacity which will increase feed stability in order to deliver steady ore to the pad. While supporting higher production, additional crushing facilities are also expected to reduce the feed size to the pad and result in increased recoveries. Despite the introduction of material from the primary zone, recoveries have increased from 33% to 38% in this first quarter. The 2nd phase of the crusher project will decrease the particle size (p80) from 15mm to 7.8mm and include the installation of a 500tph agglomerator. Test work has shown that an increase of up to 15% in recoveries can be expected by reducing the particle size. Metallurgical test work will continue during the 2nd quarter, aiming at reducing the p80 even further to improve the expected recovery for the primary zone. Having an agglomerator installed, will ensure better leaching conditions and allow for smaller particle sizes after crushing. The new configuration is also expected to lower unit operating costs by removing the current complement of costly rented crushing capacity.

In addition, the company is currently well advanced with detailed analysis and preparations for equipment sourcing to commence underground development during Q2 2025 beneath the Palmoa pit. While initial production expectations are relatively modest given the current known underground resource, underground access is expected to provide a platform for major exploration activities at lower costs than drilling from surface. Underground exploration aims to materially expand resources at MDN, leveraging the underground development for a potential expansion in production and/or mine life.

The Company is raising its 2025 annual production guidance to 55,000 to 60,000 GEO, up from 50,000 - 55,000 GEO, to include the addition of modest underground production. AISC costs are expected to be modestly higher than previously anticipated with an ASIC of between $1,500 - $1,700 per GEO as compared to prior expectations of $1,300 - $1,500 per GEO. The increased costs are the result of the inclusion of underground mining, ongoing processing of low-grade ores, continued inflationary pressure in Argentina, and the use of rental crushing equipment as the new permanent crushing capacity is being installed.

Mark Brennan, CEO and Chairman commented, "Q1 results are generally in line with expectations based upon the current mine plan and the ramp-up profile of the expanded heap leach operations. The addition of underground mining in the second half of 2025 should see overall production levels increase as the year progresses, delivering strong cash flows to support extensive exploration activities which are expected to expand resources and mine life. Cerrado continues to progress the Mont Sorcier project towards completion of the feasibility study by Q1/2026."

Mont Sorcier Project Update

At the Mont Sorcier high-purity iron project, detailed metallurgical test work and flow sheet design continued during the quarter. As announced in early December 2024, (see press release dated December 4, 2024) test work has reaffirmed the potential to produce high grade and high purity iron concentrate grading in excess of 67% iron with silica and alumina content below 2.3%. Ongoing test work is focused on flotation testing, greater detailed variability tests, grind size and reagent optimization programs as well as equipment sizing.

Current test work and overall process design are to be at the core of the NI 43-101 Bankable Feasibility Study ("BFS") which is targeted to be completed by the end of Q1 2026. The Bankable Feasibility Study will look to provide greater detail of the potential for the project that was highlighted in the previous 2022 NI 43-101 Preliminary Economic Assessment ("PEA") that delivered a project NPV8% of US$1.6 Billion based upon iron concentrates grading 65% iron. All principal consultants are now actively engaged in the BFS process.

Corporate Activities

The Company has also continued to make progress on improving its working capital position during the quarter with the receipt of cash from asset sales in Q4/2024 and steady production cashflows, allowing for an ongoing deleveraging of the MDN balance sheet. The Company's balance sheet is expected to further improve following receipt of future payments from the sale of the Brazilian Monte do Carmo asset sale totaling US$15 million (U$10 million due in July 2026 and US$5 million by March 2027) as well as a further US$10 million should the option granted over the Company's Michelle properties in Argentina be exercised.

During the quarter the Company also announced the proposed acquisition of Ascendant Resources Inc. (see announcement dated February 3, 2025 for details). This transaction is expected to close in May 2025 subject to all necessary approvals.

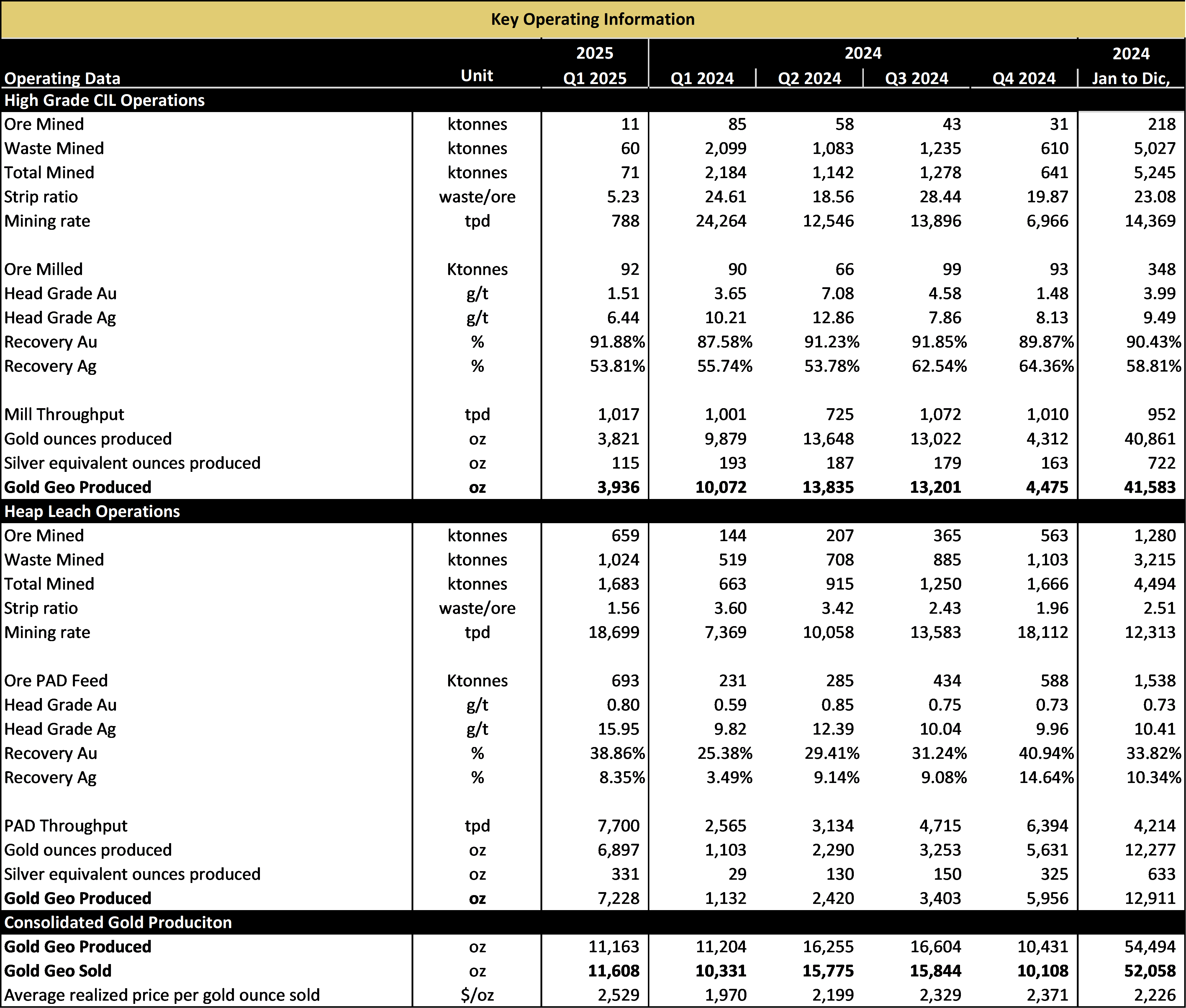

Table 1. Key Operating Information

Review of Technical Information

The scientific and technical information from Minera don Nicolas in this press release has been reviewed and approved by Cid Bonfim, P. Geo., Senior Geologist Cerrado Gold, and Pierre Jean LaFleur, P. Geo., VP Exploration for Voyager Metals, a 100% owned subsidiary of Cerrado Gold, are Qualified Persons as defined in National Instrument 43-101.

About Cerrado

Cerrado Gold is a Toronto-based gold production, development, and exploration company focused on gold projects in South America. The Company is the 100% owner of both the producing Minera Don Nicolás and Las Calandrias mines in Santa Cruz province, Argentina. In Canada, Cerrado Gold is developing its 100% owned Mont Sorcier Iron Ore and Vanadium project located outside of Chibougamou, Quebec.

In Argentina, Cerrado is maximizing asset value at its Minera Don Nicolas operation through continued operational optimization and is growing production through its operations at the Las Calandrias Heap Leach project. An extensive campaign of exploration is ongoing to further unlock potential resources in our highly prospective land package in the heart of the Deseado Masiff.

In Canada, Cerrado holds a 100% interest in the Mont Sorcier Iron Ore and Vanadium project, which has the potential to produce a premium iron ore concentrate over a long mine life at low operating costs and low capital intensity. Furthermore, its high-grade and high-purity product facilitates the migration of steel producers from blast furnaces to electric arc furnaces, contributing to the decarbonization of the industry and the achievement of SDG goals.

For more information about Cerrado please visit our website at: www.cerradogold.com.

Mark Brennan

CEO and Chairman

Mike McAllister

Vice President, Investor Relations

Tel: +1-647-805-5662

mmcallister@cerradogold.com

Disclaimer

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado, production forecasts and estimated AISC for 2025 and beyond, the potential for additional crushing capacity that may be added and the performance of the heap leach pad, the possibility of commencing underground mining, the potential to produce iron concentrate grading in excess of 67% at Mont Sorcier, further deleveraging during 2025, receipt of the deferred closing payment of US$15 million in connection with the asset sale, the likelihood of the Michelle option being exercised by the optionor and the related option payment being received, and the closing of the proposed acquisition of Ascendant Resources Inc. including assumptions as to the satisfaction of closing conditions related thereto including shareholder, regulatory and court approvals and the timely receipt of required approvals. In making the forward-looking statements contained in this press release, Cerrado has made certain assumptions. Although Cerrado believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, Cerrado disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

SOURCE: Cerrado Gold Inc.

View the original press release on ACCESS Newswire