Michael Burry, best known for betting against the U.S. housing market from 2005 onwards when the sector was red hot but eventually crashed in 2008, is now betting against artificial intelligence (AI) plays. 13F filings reveal that his Scion Asset Management bought put options on both Nvidia (NVDA) and Palantir (PLTR) in Q3 2025. Both these stocks have been at the forefront of the AI trade, and betting against them is nearly blasphemous for a section of the market, even as Burry has suggested that he has closed his Palantir short position

Burry is not very active on social media and often posts cryptic tweets, including a one-word tweet, “sell,” in early 2023, only to subsequently admit that he was “wrong.” U.S. stocks rallied spectacularly in both 2023 and 2024 and look on track for double-digit returns in 2025 as well.

Burry Accuses Hyperscalers of Fraud

Meanwhile, this time around, Burry is relatively active on social media, explaining his bearish thesis on AI stocks. In his recent post on X, formerly Twitter, he accused the hyperscalers of “understating depreciation by extending useful life of assets artificially boosts earnings,” terming the phenomenon “one of the more common frauds of the modern era.”

Burry estimates that hyperscalers will understate depreciation by $176 billion between 2026 and 2028, while specifically calling out Oracle (ORCL) and Meta Platforms (META) for overstating earnings by 26.9% and 20.8%, respectively, by 2028. While “AI bubble” chatter has been an intermittent theme and many, including Burry, have been warning about one, the Scion Asset founder has made some serious allegations this time around, accusing the Big Tech giants of accounting fraud by understating their depreciation to inflate their earnings.

Burry Will Release More Details Later This Month

According to the Big Short investor, Alphabet (GOOG) (GOOGL) doubled the network/compute useful life to six years since 2020, which would let the company spread the depreciation expense over a longer period, thereby boosting near-term earnings.

To be sure, hyperscalers do face a wall of depreciation, as the billions of dollars that they are pouring into building AI infrastructure will need to be accounted for in the income statement. The impact of higher depreciation is already visible in their earnings, where profits are no longer witnessing the kind of outsized growth relative to revenue that we saw over the last two years when aggressive cost cuts helped Big Tech companies boost their bottom line. Burry said he would drop more details on Nov. 25, and we could see back and forth from the companies that he is accusing of understating their depreciation expense.

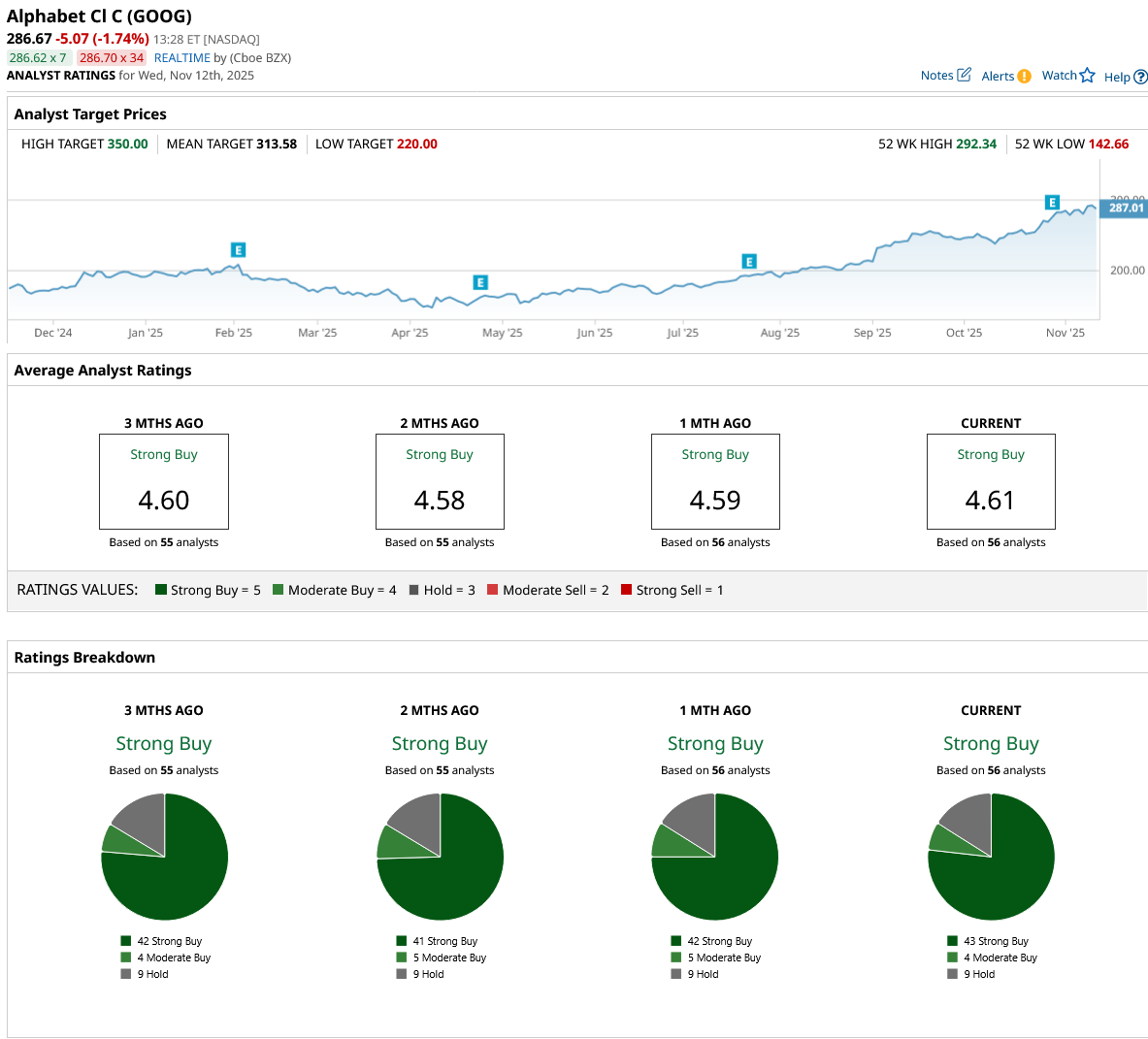

Meanwhile, while Oracle and Meta Platforms closed in the red yesterday, Nov. 11, it was business as usual for Alphabet shares, which continued their upward journey to rise to a new record high in intraday trade. The Google parent’s market cap has topped $3.5 trillion, and it looks well-placed to join the $4 trillion market cap club.

GOOG Stock Looks Like a Buy

While markets had been concerned about AI upstarts like OpenAI eating Alphabet’s lunch in the online search and subsequently digital ad market, the Sundar Pichai-led company has held its ground quite well.

The company reported stellar results for Q3 2025, and its quarterly revenues topped $100 billion for the first time ever. Google search revenues rose 15% year-over-year (YoY) in the quarter, which helped allay fears of AI negatively impacting that business. Google Cloud revenues rose 34% YoY to $15.2 billion, and backlog grew to $155 billion, which is 46% higher than what it was at the end of June. The company stressed that the number of cloud deals over $1 billion that it has signed in the first nine months of 2025 is higher than what it did in the previous two years.

Google has managed to maintain its dominant market position in Search and has several growth drivers that can take the stock higher. These include YouTube, which I have said multiple times is a key growth catalyst and an underappreciated part of its arsenal. The company’s Cloud business also continues to benefit from growing demand, and along with Microsoft (MSFT), Google continues to gain market share at Amazon's (AMZN) cost.

Alphabet’s Tensor Processing Units (TPUs) could be another growth driver, and Anthropic has announced plans to buy as many as 1 million of these, which is a revenue opportunity worth billions of dollars. Third-party sales of these TPUs could potentially become a major business for Alphabet. Finally, I believe Alphabet doesn't have much respect for its Waymo self-driving business, which it has expanded globally to Japan and the U.K.

I have been bullish on GOOG despite the underperformance in the first half of the year, and the optimism has paid off well with the stock now sitting on year-to-date (YTD) gains of 51%. The stock has seen a rerating amid the rally, with the forward price-to-earnings (P/E) multiple expanding to 26.7x.

At these multiples, I don’t find GOOG’s risk-reward too attractive, even though valuations aren’t frothy yet, and while I don't have any intentions of selling my existing positions as yet, I don't find the current levels tempting enough to buy more. However, I will still be keeping a close eye on the details that Burry releases later this month, as it might yet again ignite the AI bubble narrative, putting pressure on names like Alphabet.

On the date of publication, Mohit Oberoi had a position in: GOOG , AMZN , META , MSFT , NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Rivian Wants to Be the Next Tesla With Huge Pay Package for CEO RJ Scaringe. Should You Buy RIVN Stock?

- AMD Strengthens Its Bull Case. Can the Stock Hit $350 in a Year?

- Is GOOG Stock a Buy or Sell as Michael Burry Accuses Hyperscalers of ‘Fraud’?

- Western Digital Stock Soars 280% This Year. Is WDC Worth Chasing Now?