Bridgewater Associates, the hedge fund founded by Ray Dalio, quietly opened a new stake in Applied Materials (AMAT) in Q3 2025. Its latest 13F filing shows Bridgewater added roughly $94.9 million of AMAT shares. This is notable because Bridgewater recently trimmed big bets in Nvidia (NVDA) and other mega-cap tech names at the same time. The stock jumped on the news, which reflects the buzz in chip-making circles.

Applied Materials, a leading supplier of equipment for building semiconductors and displays, isn’t as famous as Nvidia, but it underpins the AI and memory chip boom. With Bridgewater “adding new positions in Applied Materials” and praising its outlook, investors are asking, if a legendary fund is loading up on AMAT, is it a buy signal for us too? Let's find out.

About AMAT Stock

Based in California, Applied Materials is a major Silicon Valley player that builds the large, complex machines used to manufacture computer chips and advanced displays. In straightforward terms, AMAT provides the tools and software that transform plain silicon wafers into the chips that power smartphones, PCs, servers, and many other devices. The company essentially acts as the industry’s toolmaker, supplying systems that deposit and etch materials for logic and memory chips across the globe.

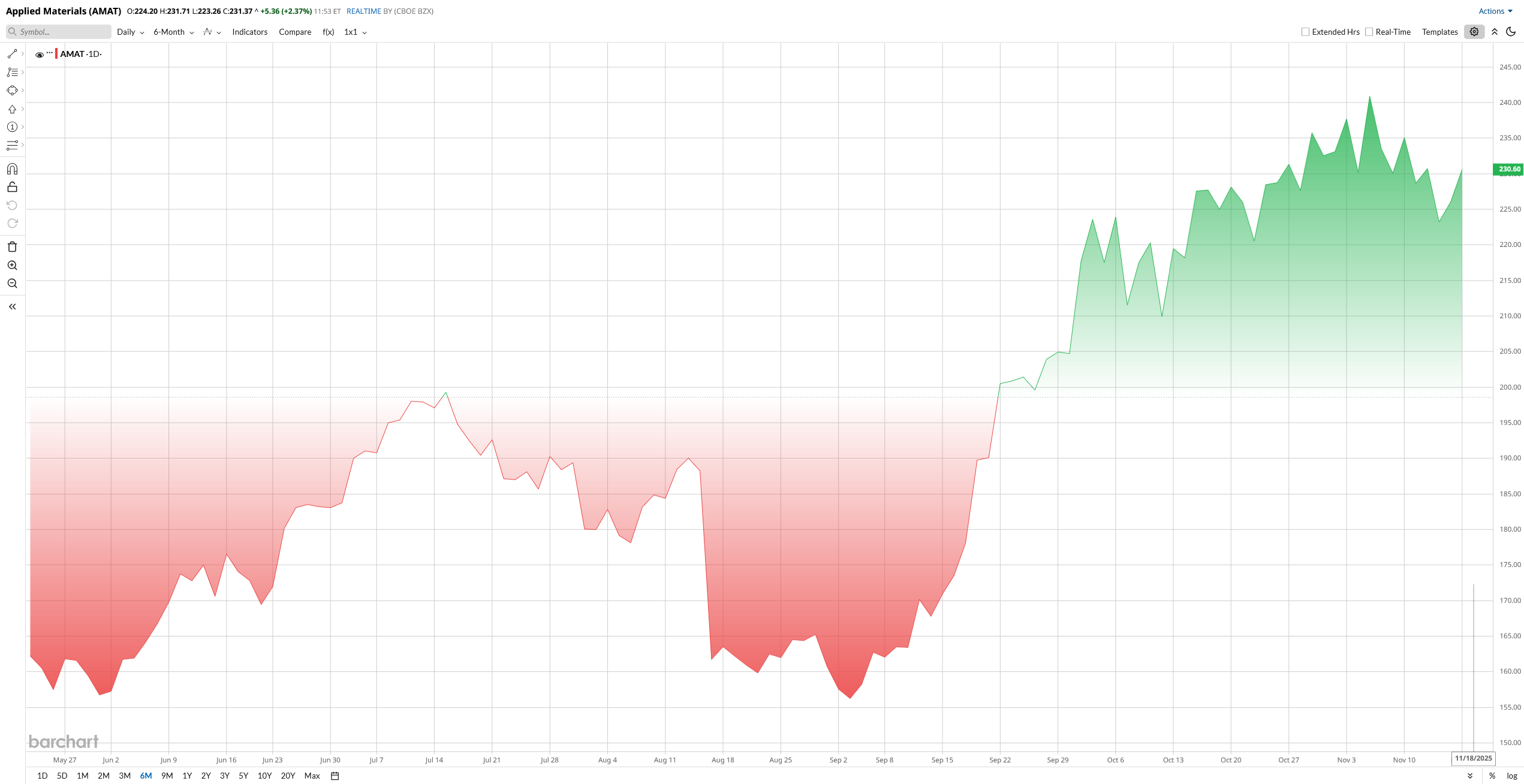

Valued at $180 billion by market cap, shares of AMAT’s stock have had a strong run in 2025. So far this year, the shares are up roughly 40% year-to-date (YTD), much of that driven by growing demand for AI and memory chips.

From a valuation standpoint, AMAT’s shares look reasonable, trading in the mid-20s forward P/E and about 6x sales, well below lofty sector averages. It’s cheaper than high-growth peers like ASML and Nvidia, yet still tied to strong AI and memory-chip demand. Overall, the stock appears fairly priced given its growth outlook.

Bridgewater’s Bet and What It Means

When Bridgewater takes a new position, it catches attention. In this case, the fund slashed stakes in big tech giants while adding AMAT. I think Bridgewater’s move to initiate a new position in semiconductor giant Applied Materials shows it’s still bullish on select semiconductor names even as it grows more cautious on overvalued tech. In everyday terms, Bridgewater seems to be saying, “We believe Applied Materials has staying power.” This shift could have ripple effects. Other investors may view it as a vote of confidence in AMAT’s future.

On the plus side, it suggests Bridgewater expects continued AI-driven chip demand. On the risk side, it reflects a play for stability, choosing a well-established equipment maker over a hyper-growth stock. For now, at least, smart money is giving a nod to AMAT as a solid chip-cycle play.

AMAT Beats Q3 Earnings Estimate

Applied Materials’ latest quarter was another solid beat on the bottom line. Revenue reached $7.30 billion, up 8% from last year. Non-GAAP net income rose to $1.99 billion, and EPS increased 17% to $2.17. Free cash flow was about $2.05 billion. Semiconductor Systems led sales with $5.43 billion on strong logic and memory demand. Services grew modestly, while the Display segment added $263 million.

Management guided next-quarter revenue to about $6.7 billion and EPS near $2.11. For the full fiscal year, the company delivered record results: roughly $28.37 billion in revenue and $9.42 billion in non-GAAP EPS, slightly above expectations.

The CEO highlighted that accelerating AI adoption continues to drive investment in advanced semiconductors and wafer-fab equipment. Overall, the quarter reinforced that Applied Materials is benefiting from major tech and AI spending trends despite some near-term China softness.

Recent Developments and News

Applied Materials hasn’t been short on headlines lately. On the positive side, in August the company announced a partnership with Apple (AAPL) and Texas Instruments (TXN) to bolster U.S. chipmaking: AMAT will supply American-made equipment and invest over $200 million in a new Arizona factory. CEO Dickerson hailed this as vital for “strengthening America’s semiconductor leadership” in the AI era.

Fast forward to early October, when AMAT unveiled next-generation chipmaking systems, such as the Kinex hybrid bonder and the Xtera epitaxy tool, designed for advanced logic, memory, and AI chips. These innovations signal the company is staying at the cutting edge of chip tech.

On the flip side, geopolitical and macro headwinds are real. In mid-November, AMAT shares dipped after management warned that new U.S. export curbs on China would cut next year’s Chinese equipment spending. Executives had recently estimated that about $600 million of fiscal 2026 revenue could be at risk due to trade rules, and they even trimmed roughly 4% of the workforce to streamline costs in response. So while AI demand is strong, U.S.-China tensions are a definite overhang.

What Analysts Are Saying About AMAT Stock

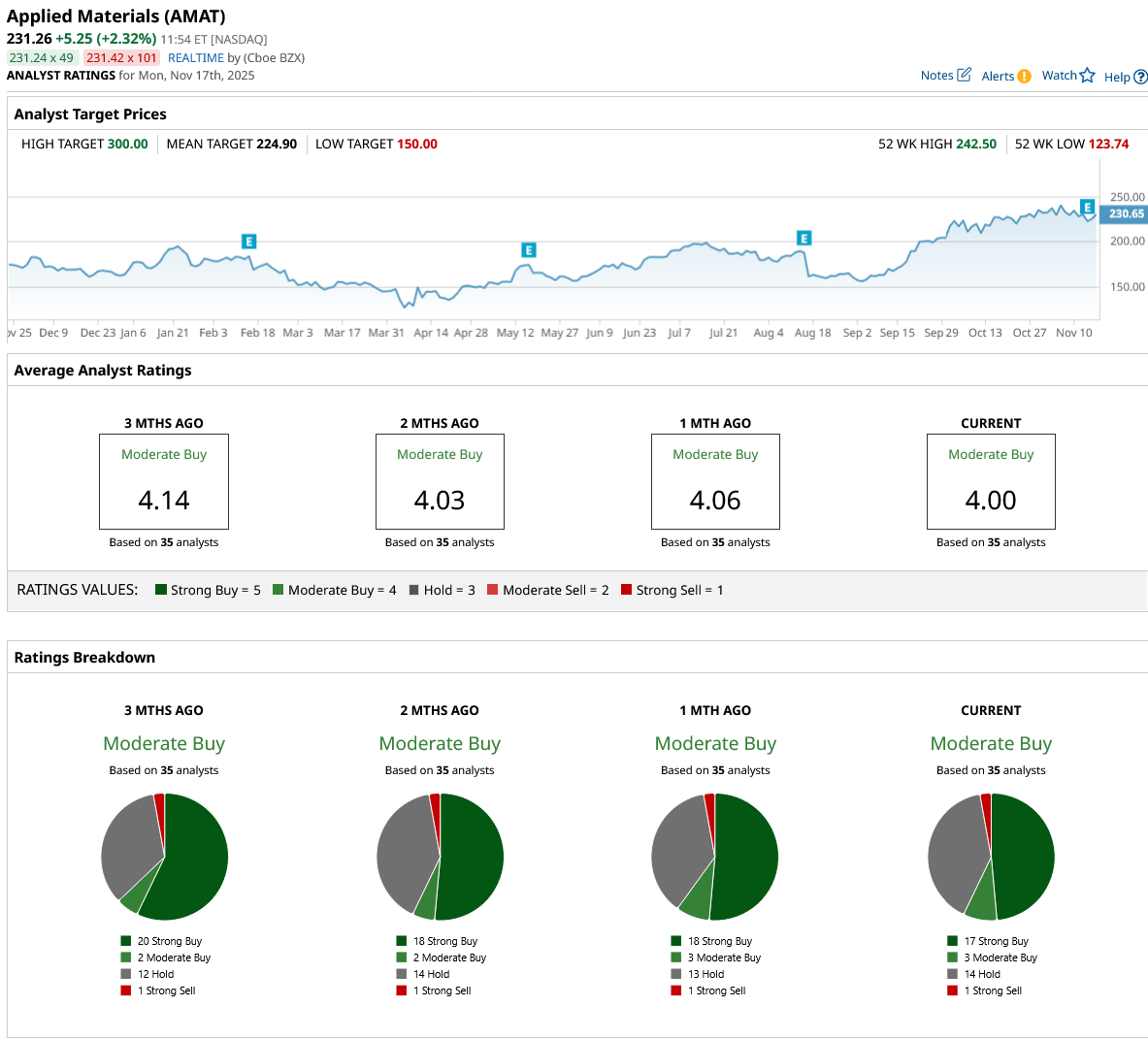

Wall Street remains broadly positive. Morgan Stanley, an influential name in tech coverage, recently raised its price target on AMAT to $256 from $209 and kept an “Overweight” rating, noting that upcoming earnings could “meaningfully shift the narrative” on the stock.

Similarly, Goldman Sachs has been bullish too: it maintained a “Buy” rating with a $250 target, and the firm’s analysts highlight AMAT’s exposure to the memory chip cycle. Even more aggressively, Evercore ISI reaffirmed its “Outperform” rating and set a lofty $290 objective.

Citigroup, Stifel, and others have all bumped their AMAT targets toward the mid-$200s. Analysts’ comments generally cite the same catalysts we’ve discussed, strong AI-driven demand and a healthy memory market, while acknowledging risks from China.

Overall, the consensus rating is “Moderate Buy” from all 33 analysts in coverage. However, the stock already surpassed the mean price target of $222 and is moving towards the street high target of $300, which is around 33% higher than its current price.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Dear Coinbase Stock Fans, Mark Your Calendars for December 17

- Warren Buffett Says to Embrace Stock Volatility Because ‘A Tolerance for Short-Term Swings Improves Our Long-Term Prospects’

- Bridgewater Is Betting Big on This 1 Chip Stock (Not Nvidia). Should You Buy Shares Here?

- S&P Futures Slip on Souring Risk Sentiment