Valued at a market cap of $87.6 billion, Waste Management, Inc. (WM) provides waste collection, recycling, and environmental services to residential, commercial, industrial, and municipal customers. The Houston, Texas-based company manages the full waste lifecycle through a vast network of collection operations, transfer stations, recycling facilities, and landfills.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and WM fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the waste management industry. The company continues to strengthen its competitive positioning through investments in automation, sustainability, and advanced recycling technologies.

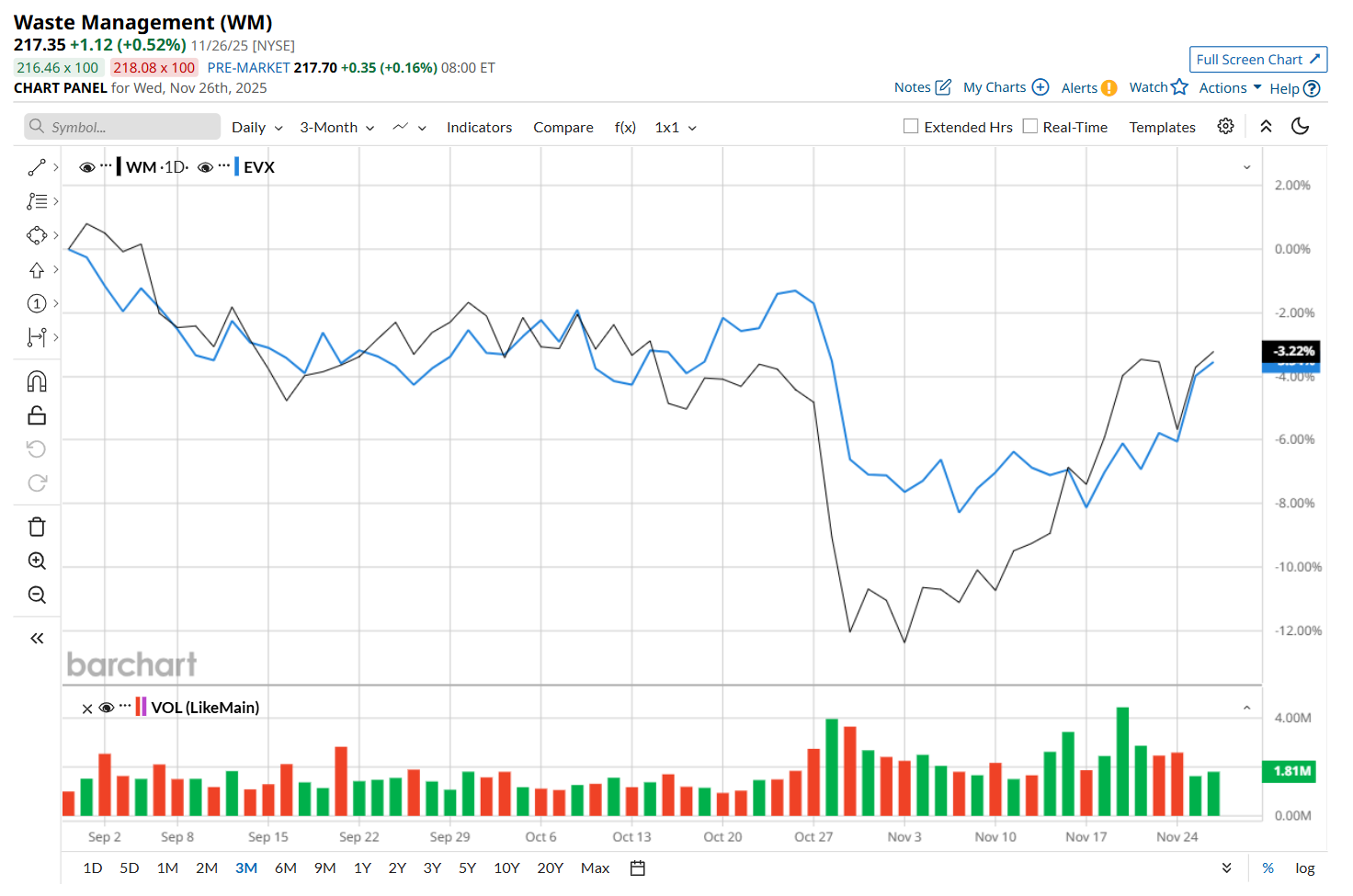

This waste management company has slipped 10.4% from its 52-week high of $242.58, reached on Jun. 8. Shares of WM have declined 3.5% over the past three months, slightly lagging behind the VanEck Environmental Services ETF’s (EVX) 3.3% drop during the same time frame.

Moreover, on a YTD basis, shares of WM are up 7.7%, compared to EVX’s 12.4% return. In the longer term, WM has fallen 4.4% over the past 52 weeks, underperforming EVX’s slight uptick over the same time frame.

To confirm its bearish trend, WM has been trading below its 200-day moving average since early September. However, it has remained above its 50-day moving average since mid-November, with minor fluctuations.

On Oct. 27, WM reported weaker-than-expected Q3 earnings results, prompting its shares to tumble 4.5% in the following trading session. While the company's revenue increased 14.9% year-over-year to $6.4 billion, it missed analyst expectations by a slight margin. Moreover, its adjusted EPS of $1.98 climbed 1% from the year-ago quarter, but fell short of consensus estimates by 1.5%. Additionally, the company also lowered its fiscal 2025 revenue outlook to approximately $25.3 billion, placing it at the low end of its previous guidance range. Management attributed the reduced forecast to continued weakness in recycled commodity pricing and slightly lower revenue expectations from WM Healthcare Solutions, which likely added to the negative investor reaction.

WM has also trailed behind its rival, Republic Services, Inc.'s (RSG) marginal downtick over the past 52 weeks and an 8.1% YTD rise.

Despite WM’s recent underperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 29 analysts covering it, and the mean price target of $247.81 suggests a 14% premium to its current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Argus Just Slashed Its Earnings Estimates for Coinbase. Should You Dump COIN Stock Here?

- Big Money is Betting on Natural Gas Prices to Break Out. Here’s the Setup.

- Is This Under-the-Radar High-Yield AI Stock a Buy Now?

- Wall Street Likes Server Stocks After Nvidia’s Q3. Is DELL or HPE Stock a Better Buy Here?