Robinhood (HOOD) just stole the spotlight again. This week, the Menlo Park-based brokerage revealed a plan to launch its own CFTC-licensed exchange for event contracts via a joint venture with Susquehanna International Group and Miami International (MIAX).

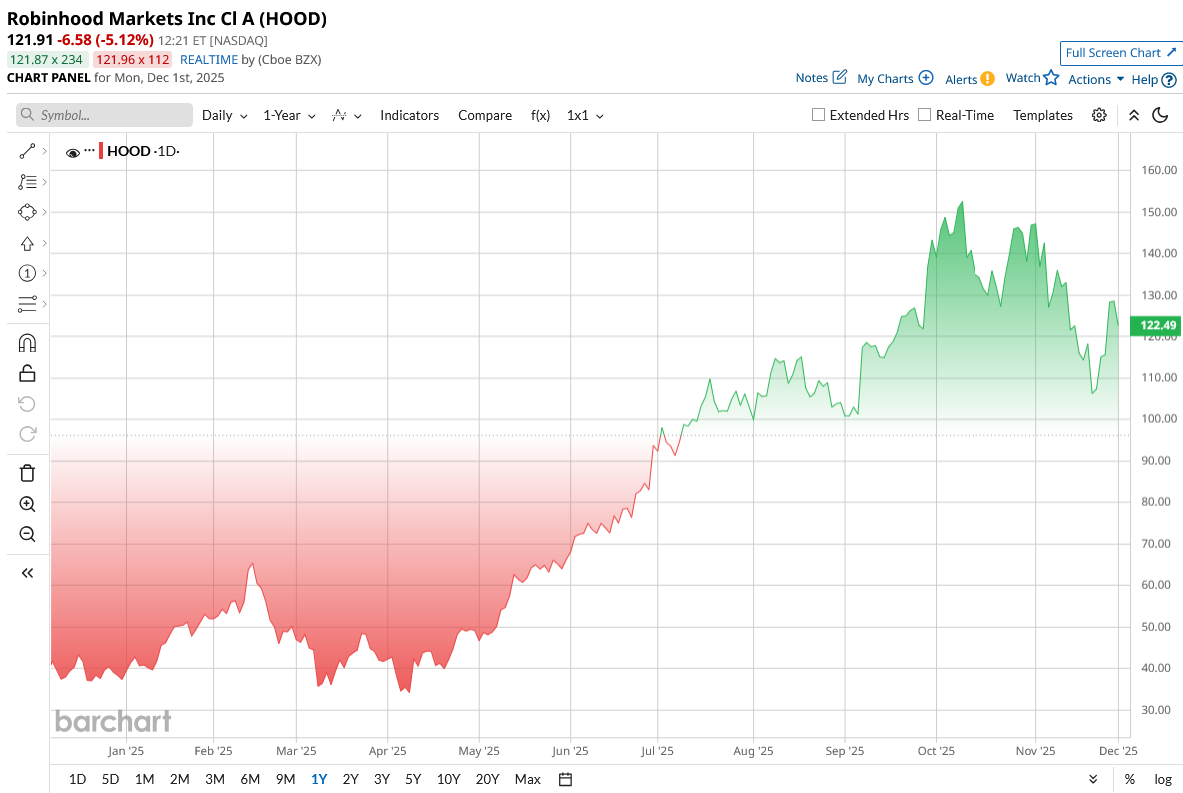

Under the deal, Robinhood will acquire 90% of MIAX’s MIAXdx derivatives exchange (with MIAX keeping 10%), giving it direct control over the clearing and listing of futures, options, and prediction market contracts. The news sent HOOD shares jumping 10% on the announcement day. That’s hardly surprising. This year, the stock has already nearly tripled versus its January price, as Robinhood’s revenue and user growth have been scorching hot.

For investors, the key question is, does this bold new venture make HOOD stock a buy or a sell? Let's find out.

About HOOD Stock

Founded in 2013, Robinhood is a financial services company offering a modern platform that allows users to invest in various financial instruments, including stocks, ETFs, options, gold, and cryptocurrencies. The company boasts roughly 28 million funded accounts and over $333 billion in platform assets. HOOD’s market cap is in the $115 billion range today, making it one of the largest fintech platforms.

HOOD stock has outperformed this year. Year-to-date (YTD), the shares are up more than 225%, making it one of the best-performing financial sectors. This rally is fueled by blockbuster earnings, explosive growth in prediction markets, booming crypto and options trading, and massive customer deposits, which reignited investor confidence.

From a valuation perspective, HOOD is expensive. On a trailing basis, it trades at roughly 52x earnings and 27x sales, versus only 12x and 3x, respectively, for its fintech peer group. This implies HOOD is richly valued; investors are essentially betting on continued explosive growth.

The Prediction Market Push

So what’s this new joint venture all about? It's simple: Robinhood wants to become the exchange, not just a trader, for prediction and futures contracts. By teaming up with Susquehanna and taking over MIAXdx, which is a CFTC-authorized exchange and clearinghouse, Robinhood will run a venue where its customers, and others, can trade event-based futures and options. This could be a big deal. Robinhood CEO Vlad Tenev calls prediction markets “the fastest-growing business we’ve ever had,” noting volumes have doubled each quarter. The new exchange should let Robinhood capture more of the fees and margins on these trades, rather than routing them through third parties. It also positions them to woo institutional participants who lack their own platform.

On the positive side, this strengthens Robinhood’s “one-stop-shop” strategy. The firm already handles about 30% to 35% of U.S. retail prediction-contract volume, and running its own exchange could solidify that lead. A Robinhood-run platform might also innovate faster on product features tailored to its user base.

In short, if prediction markets really are “on fire,” as Tenev says, this move could turbocharge growth and margins.

HOOD Tops Q3 Earnings Estimate

Robinhood recently reported stellar Q3 earnings. Total revenue surged to $1.27 billion, up 100% year over year and well ahead of Wall Street’s expectations. Transaction-based revenue jumped 129% to $730 million as crypto trading exploded with a 300% annual increase. Net interest revenue from margin lending and customer cash climbed 66% to $456 million.

Profit growth was even more impressive, as net income reached $556 million, up 271% from a year ago, while diluted EPS surged 259% to $0.61. In short, Robinhood crushed expectations on both revenue and earnings.

Operational performance was equally strong. Funded accounts rose 10% to 26.8 million, while platform assets expanded to $333 billion. The company attracted record net deposits of $20.4 billion during the quarter and now counts 3.9 million Gold subscribers.

Cash and equivalents totaled roughly $4.3 billion. Management also repurchased $107 million worth of stock at an average price near $105 per share, signaling confidence in the business.

On the earnings call, management struck an upbeat tone. CEO Vlad Tenev credited “relentless product velocity” for driving record financial results and emphasized that prediction markets are scaling rapidly. CFO Jason Warnick noted that Robinhood now operates 11 distinct business lines, each producing around $100 million in annualized revenue, including the newly acquired Bitstamp platform and event-based contracts. He added that the fourth quarter is already shaping up strongly, with record monthly trading volumes.

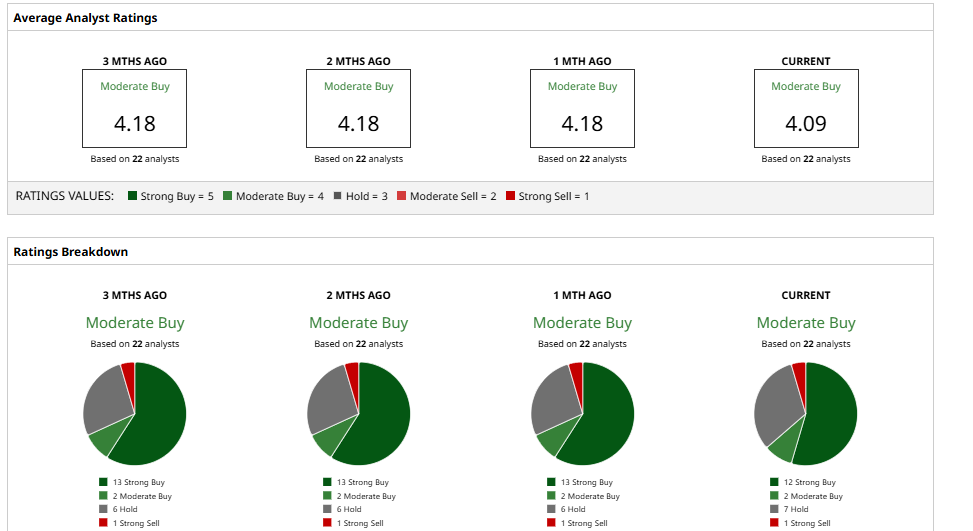

What Analysts Are Saying About HOOD Stock

Regarding HOOD stock, Wall Street’s take is mixed. Overall, the consensus remains a “Moderate Buy” with only modest upside from here, basically reflecting that HOOD has already run up hard. The average 12-month price target among 22 analysts is about $155, which implies, roughly, a 27% upside.

Notably, Morgan Stanley kept an “Equal-Weight” stance, which translates to a neutral view with an average target of $126. In contrast, more bullish houses have been raising their targets. For example, Bank of America’s Craig Siegenthaler bumped his target to $157 while keeping a “Buy” rating.

Goldman Sachs’ Will Nance likewise lifted his target to $152 “Buy.” Other firms like JMP Securities and Cantor Fitzgerald have even higher levels, reaching $160. So in conclusion, analysts appreciate Robinhood’s strong execution, but the lofty valuation tempers enthusiasm.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- IonQ Just Locked In Another Defense Deal. Should You Buy the Quantum Computing Stock Here?

- Did Wall Street Accidentally Hide This Arbitrage Trade for NetApp (NTAP) Stock?

- Lumentum Just Got a New Street-High Price Target. Should You Buy the Laser Stock Fueling the AI Boom?

- Apple Stock Looks Cheap Here Based on Strong FCF - Shorting OTM Put Options Has Worked