President Donald Trump has recently made clear that he opposes Netflix's (NFLX) planned takeover of Warner Bros. Discovery (WBD), and his administration could potentially block the deal for a while, although the courts could eventually overrule the administration's decision. In the short-to-medium term, NFLX stock would likely climb if the takeover is prevented.

But history has shown that Trump's presidential power does not necessarily affect firms' fate. What's more, the market is currently enthralled primarily with data center power generation for AI and healthcare. Since Netflix is not remotely involved in either of these areas (although the company is “all in” on GenAI), NFLX stock is likely to at best perform slightly better than the market in the short-to-medium term. Therefore, I believe that investors with a time horizon of a year or less should sell NFLX stock.

On the other hand, the company has multiple means of continuing to grow its top and bottom lines prolifically over the longer term, and the stock's valuation is historically low. Further, NFLX stock is likely a good name to hold during recessions. In light of these points, long-term, conservative investors and long-term value investors should buy the shares now.

About Netflix Stock

Netflix dominates the online-streaming market and has become one of the world's most popular content providers overall. In the third quarter, its sales climbed nearly 4% versus the same period a year earlier to $11.5 billion, while its operational cash flow surged 54% year-over-year (YoY) to $8 billion.

NFLX stock has a forward price-earnings ratio of 27.85 times.

Trump's Position on the Warner Bros. Deal and His Potential Impact on NFLX Stock

Trump recently reposted a column that suggested that Netflix's takeover of Warner Bros. Discovery should be blocked. The author of the piece contended that the deal would stifle competition in the video-content market and limit the ability of voices opposed to Netflix's cultural and political views from being heard in America. And in December, the president warned that the company's takeover of Warner Bros. “could be a problem.”

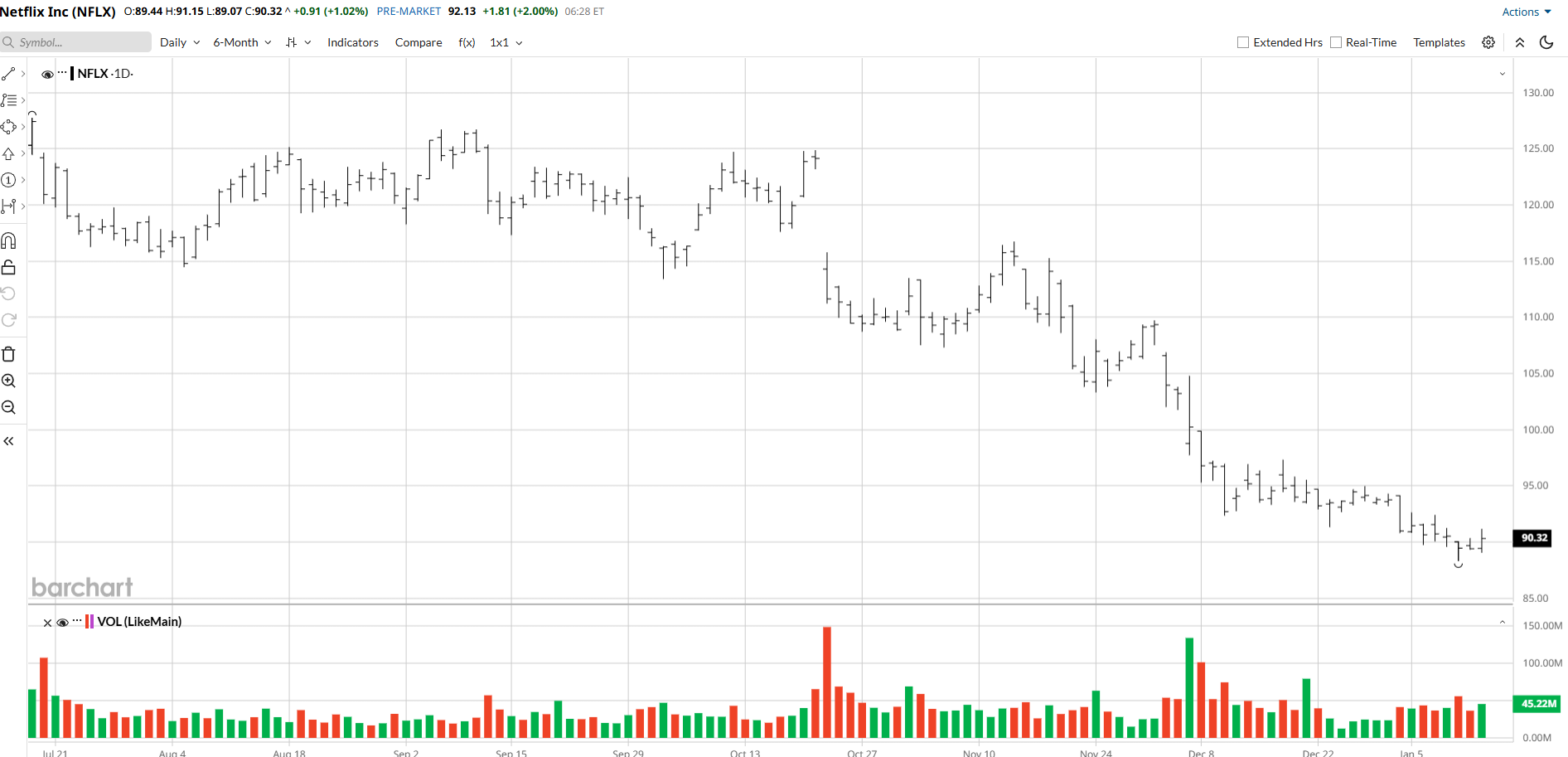

Historically, the shares of firms that make big acquisitions tend to underperform following these deals. That's because the transactions cause their financial positions to deteriorate, while the extent to which the deals will boost the companies' performance over the long term is often difficult to determine. Netflix has not been an exception to this general rule, as its shares sank from around $103 on Dec. 4, the day before the proposed takeover was announced, to $90.32 as of the market close on Jan. 13.

There's a good chance that NFLX stock would recover much of those losses if the Trump administration blocks the deal. But if Trump's first term is any guide, his ability to influence companies' performance through regulation is questionable. Specifically, although Trump harshly criticized both Alphabet (GOOG) (GOOGL) and Amazon (AMZN) at times during his first term, both companies' shares performed very well during those years. Further, despite the president's antipathy towards Netflix's proposed deal, the administration's lawyers may not find sufficient reasons to attempt to overturn the transaction.

The Positive Long-Term Outlook of NFLX Stock

Netflix has multiple, relatively easy means of continuing to meaningfully raise its top and bottom lines over the longer term. After the firm noted that its ad revenue was poised to jump 100% in 2025, its ad sales will likely continue to surge in 2026 as more of its users switch to its ad tier and as Netflix adds more live events to its repertoire. Additionally, the company can monetize the games that it's providing. And although NFLX stopped sharing subscriber data as of the first quarter of 2025, there's a good chance that its subscriber base is continuing to climb significantly in developing countries, such as India.

Also, importantly for long-term investors, since many subscribers would be reluctant to stop “binge-watching” on Netflix even if the economy deteriorates and Netflix is a rather cheap form of entertainment, the stock should be fairly recession-resistant.

Meanwhile, the name's price-earnings ratio of 37.7 times as of Jan. 13 is its lowest since September 2023.

On the date of publication, Larry Ramer had a position in: AMZN , AMZU . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Could a Short Squeeze Start Brewing in BARK Stock Following a New Go-Private Offer?

- A $3 Trillion Reason to Buy Nvidia Stock in January 2026

- Devon Energy Unusual Call Option Activity - Investors Expecting a Dividend Hike?

- As Trump Casts Doubt on the Netflix-Warner Bros. Discovery Deal, How Should You Play NFLX Stock?