Legendary investor Michael Burry is once again grabbing Wall Street’s attention—this time by turning bearish on Oracle (ORCL). Known for his prescient bet against the U.S. housing market ahead of the financial crisis, Burry has built a reputation for identifying risks that many investors overlook. So when he reveals a new bearish position in a mega-cap technology name, the market tends to take notice.

Oracle has been one of the standout beneficiaries of the artificial intelligence (AI) boom, with its aggressive push into AI data centers driving sharp gains last year. The company’s massive backlog and deepening ties to key AI customers have fueled a bullish narrative that Oracle is positioning itself as a critical backbone of the AI economy. But beneath the surface, that growth story comes with rising leverage, heavy capital spending, and execution risks that are increasingly difficult to ignore.

Let's break down what Michael Burry’s bearish bet means, examine the key pillars of the bear case for ORCL, and walk through how investors might think about trading the stock from here.

About Oracle Stock

Oracle Corporation is a global technology leader specializing in cloud infrastructure, software, and hardware. The company is one of the world’s largest software providers and is primarily known for its flagship product, the Oracle Database, the first commercially available SQL-based relational database management system. It also provides a comprehensive suite of Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS) solutions, including the world’s first autonomous database. In addition, the company offers a deep suite of AI-powered enterprise applications, including Enterprise Resource Planning, Human Capital Management, Customer Relationship Management, and Supply Chain Management. ORCL’s market cap currently stands at $570.4 billion.

Shares of the database software maker have kicked off the new year on a decent footing; while they are up 4% in the last month, they are down 1.2% year-to-date (YTD). Oracle shares rose 19.6% in 2025, slightly outperforming the S&P 500 ($SPX). In September, ORCL stock jumped nearly 36% in a single session, pushing YTD gains close to 100% after the company reported a sharp increase in backlog largely tied to OpenAI’s commitment. However, Oracle shares sold off in the fourth quarter, giving back their September surge amid concerns over OpenAI’s ability to meet its commitments to Oracle, along with broader unease surrounding the AI trade.

Michael Burry Reveals Bearish Bet Against Oracle

Michael Burry, known for his early bet against the U.S. housing market and for being portrayed by Christian Bale in the movie “The Big Short,” has made headlines in recent months for questioning the sustainability of the AI boom. The famed investor disclosed bearish bets against AI heavyweights Nvidia (NVDA) and Palantir Technologies (PLTR) in November. And last Friday, Burry revealed his latest move—taking a bearish position against Oracle.

In his paid newsletter, Cassandra Unchained, launched in November after he liquidated his hedge fund, Scion Asset Management, Burry said he owns put options on Oracle shares. Put options typically gain value as the price of the underlying asset declines. He also disclosed that he had directly shorted Oracle within the past six months.

Oracle’s aggressive expansion into cloud-computing services has required a costly data center build-out, prompting the company to take on substantial debt. Notably, Oracle has roughly $95 billion of debt outstanding. And that approach appears to be a major point of concern for Burry. Meanwhile, he did not disclose the size or strike price of the put options.

The Bear Case for ORCL Stock

The bear case for ORCL stock centers not only on its growing debt but also on its ability to convert a substantial backlog into revenue and how quickly it can do so. With that, let’s take a closer look at these key points.

As mentioned earlier, Oracle has made an aggressive pivot toward building AI data centers. So, the company’s new strategy focuses on investing in building data centers to power AI databases across all cloud environments. And this requires billions of dollars in new investments. In the most recent quarter (Q2 fiscal 2026, ended Nov. 30), the company’s capital expenditures (CapEx), a key measure of data center spending, totaled about $12 billion, up from $8.5 billion in the prior period. Oracle is spending so heavily on AI that its free cash flow turned negative $10 billion in FQ2. Moreover, the company said it expects CapEx to reach roughly $50 billion in FY26, an increase of $15 billion from its forecast in the previous quarter. Unlike other tech giants that fund such investments mostly through operating cash flow, Oracle is largely borrowing to cover these costs. Including operating lease liabilities, its debt swelled to $124 billion in FQ2, up 39% year-over-year (YoY). The heavy debt burden increases the company’s financial risk, reflected in a surge in credit default swap costs (insurance on its debt) to levels not seen since the 2008 financial crisis following its FQ2 earnings report. With that, investors are growing wary of Oracle’s debt, questioning whether its massive AI investments will deliver handsome returns.

Of course, Oracle bulls will point to the company’s impressive backlog, which stood at $523 billion at the end of FQ2, a fivefold increase from the same quarter a year earlier. In FQ2 alone, the backlog increased by nearly $70 billion. Undoubtedly, the company’s backlog is impressive, but it also introduces another pillar of the bear case: how fast that backlog can be converted into revenue. There are concerns about a “deployment gap,” where infrastructure spending runs ahead of near-term revenue generation. In a 10-Q filing, the company said that only 10% of its backlog is expected to be realized as revenue over the next 12 months, a figure that disappointed some investors. Moreover, the company faces customer concentration risk, as a large portion of its backlog is tied to contracts with specific AI partners such as OpenAI. Notably, 57.3% of ORCL’s backlog is tied to OpenAI (based on a reported $300 billion cloud infrastructure agreement), whose funding and competitive position remain uncertain amid intensifying competition in large language models. That said, if OpenAI or other major customers face funding challenges or weaker demand, a substantial portion of Oracle’s anticipated revenue could be affected.

How to Trade ORCL Stock From Here?

Well, I don’t think selling ORCL stock makes sense at this point, as the stock is already well below its all-time high and, more importantly, appears to have found support around the $180 level, a zone that also acted as resistance in February-March 2025, making it a stronger technical area. However, the arguments behind the bear case for Oracle also make it challenging to view the stock as a compelling buy. With that, I view ORCL stock as a “Hold” at current levels, as I believe a wait-and-see approach is most appropriate here.

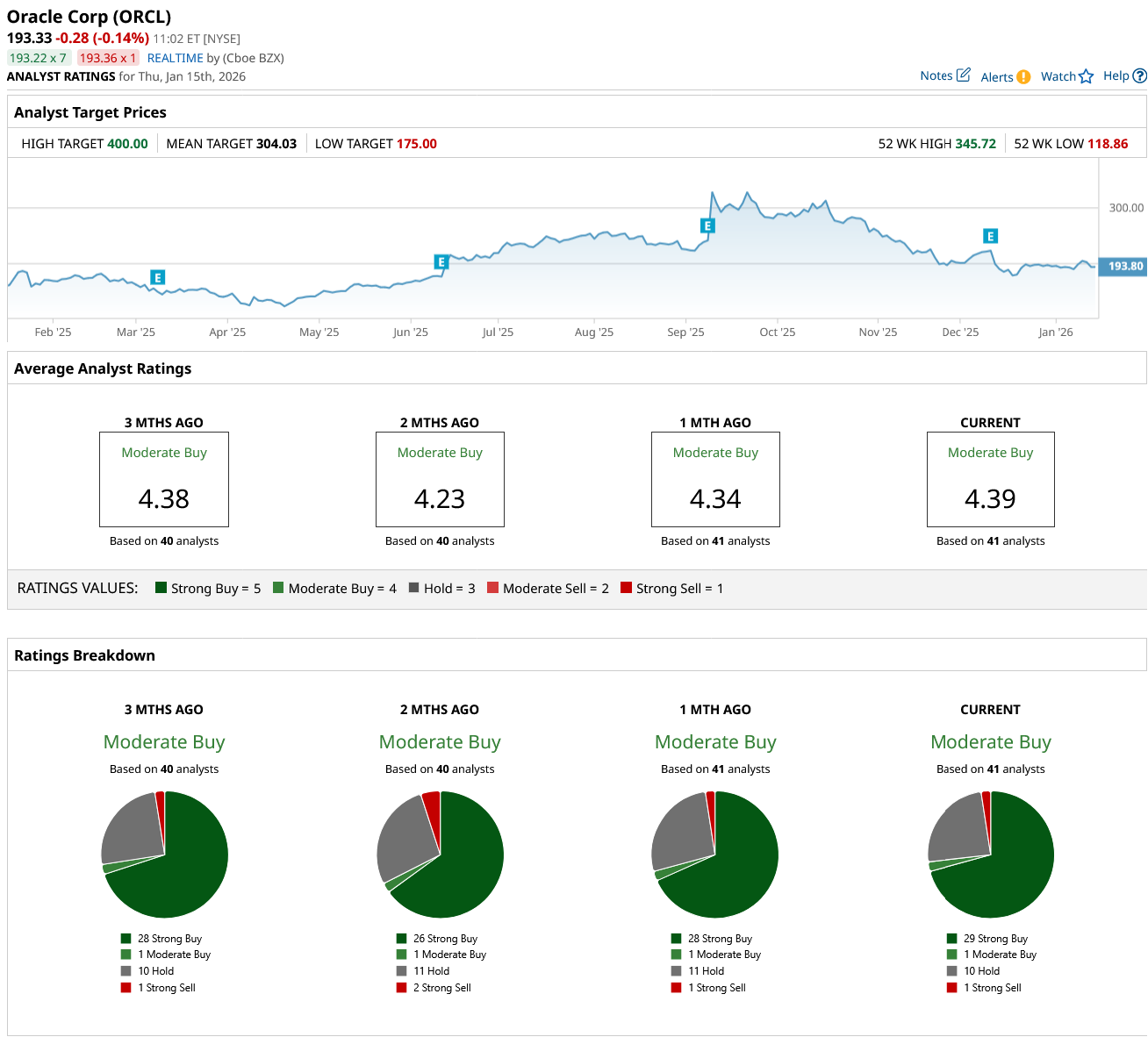

Meanwhile, Wall Street analysts are mostly bullish on ORCL stock, as reflected in its consensus “Moderate Buy” rating. Among the 41 analysts covering the stock, 29 recommend a “Strong Buy,” one suggests a “Moderate Buy,” 10 advise holding, and one assigns a “Strong Sell” rating. The mean price target for ORCL stock stands at $304.03, implying a 57% upside potential from current levels.

On the date of publication, Oleksandr Pylypenko did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart