Every once in a while, dividend stocks lose momentum after a weekend of news, even though confidence in the business does not. When prices dip for reasons other than changes in fundamentals, opportunity tends to follow.

That’s the mindset behind this list. Rather than chasing yield or reacting to short-term headlines, I focused on dividend stocks where the underlying story remains intact, but the valuation has become more compelling. In these situations, higher yields result from lower prices, not weaker fundamentals, creating an attractive setup for income-focused investors.

How I came up with the following stocks

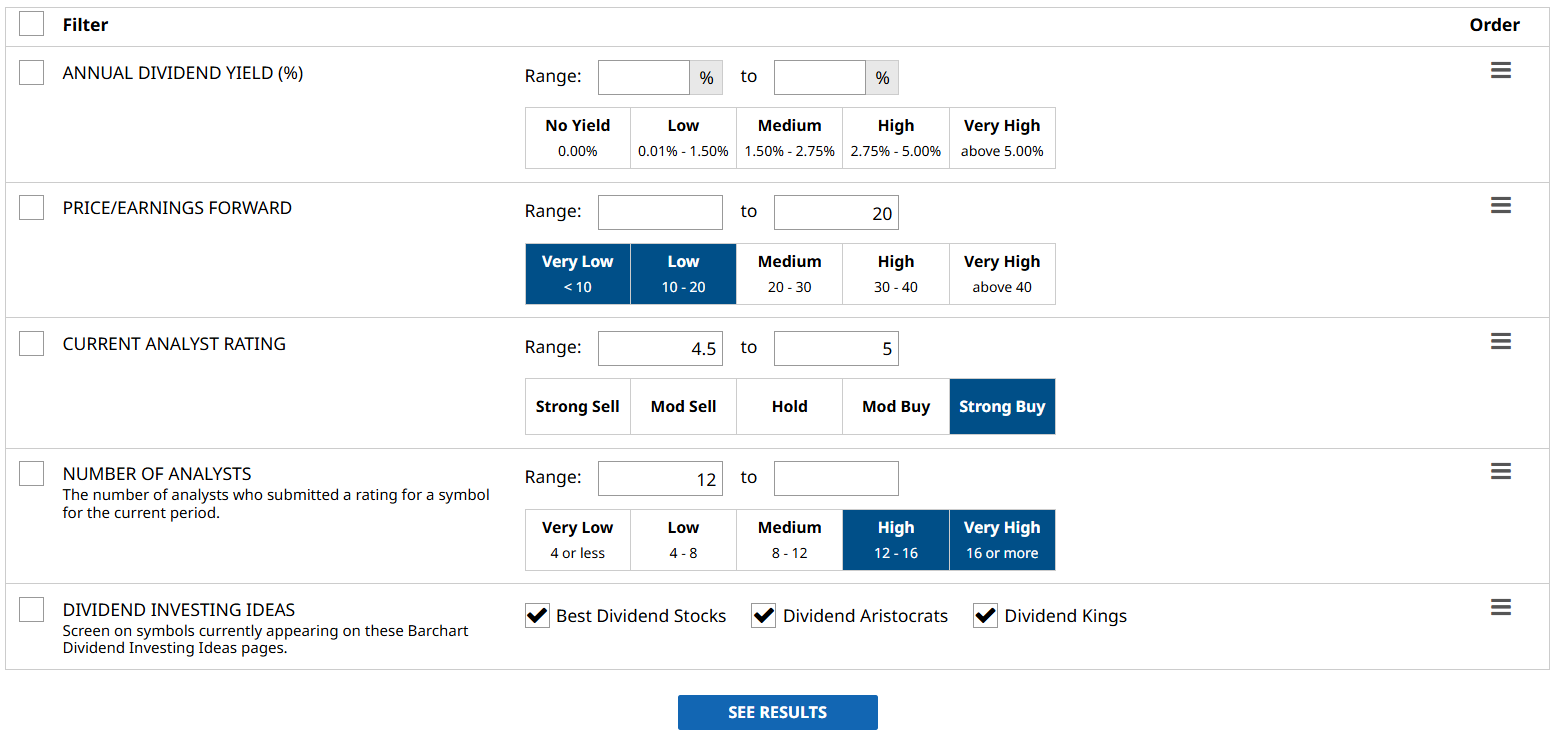

Using Barchart’s Stock Screener, I selected the following filters to get my list:

- Annual Dividend Yield (%): Left blank so I can sort it from highest to lowest.

- Price/Earnings Forward: Up to 20%. This can be an indication of whether the stock is undervalued based on its forward earnings relative to the trading price. Generally, a lower P/E compared with the sector average indicates that the stock is undervalued.

- Current Analyst Rating: 4.5 - 5. “Best-of-the-best” companies according to Wall Street analysts.

- Number of Analysts: 12 or more. A higher number suggests a stronger consensus.

- Dividend Investing Ideas: Best Dividend Stocks, Dividend Aristocrats, Dividend Kings.

I ran the screen and got 6 results. I will cover three of them, arranged from highest to lowest annual dividend yield.

Let’s start this list with the first Dividend Stock:

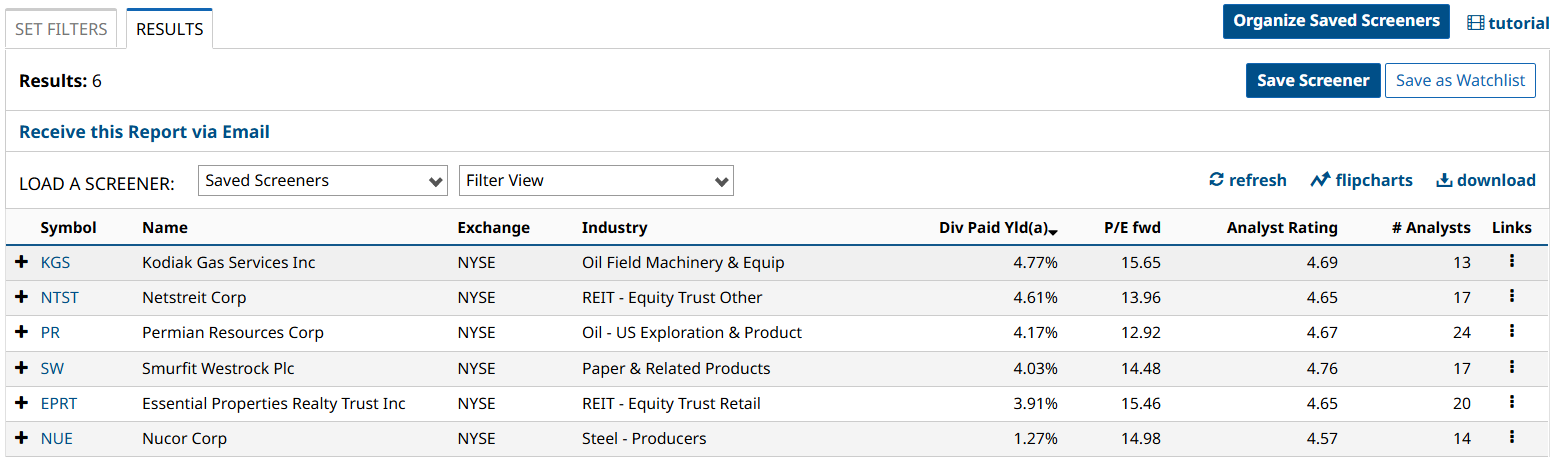

Kodiak Gas Services Inc (KGS)

Kodiak Gas Services Inc. supplies and maintains natural gas compression equipment for energy companies. Its compressor stations process gas efficiently through advanced technology.

In its recent quarterly financials, Kodiak Gas reported sales were down almost 1% YOY to $322 million. Meanwhile, it incurred a net loss that grew 148% to $14 million due to higher depreciation, interest expense, and, among others. That said, the company is positioned for long-term earnings as its new capacity comes online.

The company has a forward price-to-earnings ratio of 15.65, below the sector average of 18.13, suggesting the stock is undervalued. Still, it pays a forward annual dividend of $1.96, translating to a yield of 5.19%, the highest in this list.

A consensus among 13 analysts rates the stock a “Strong Buy”. Further, there’s as much as 27% upside potential, should the stock reach its high price target of $48.

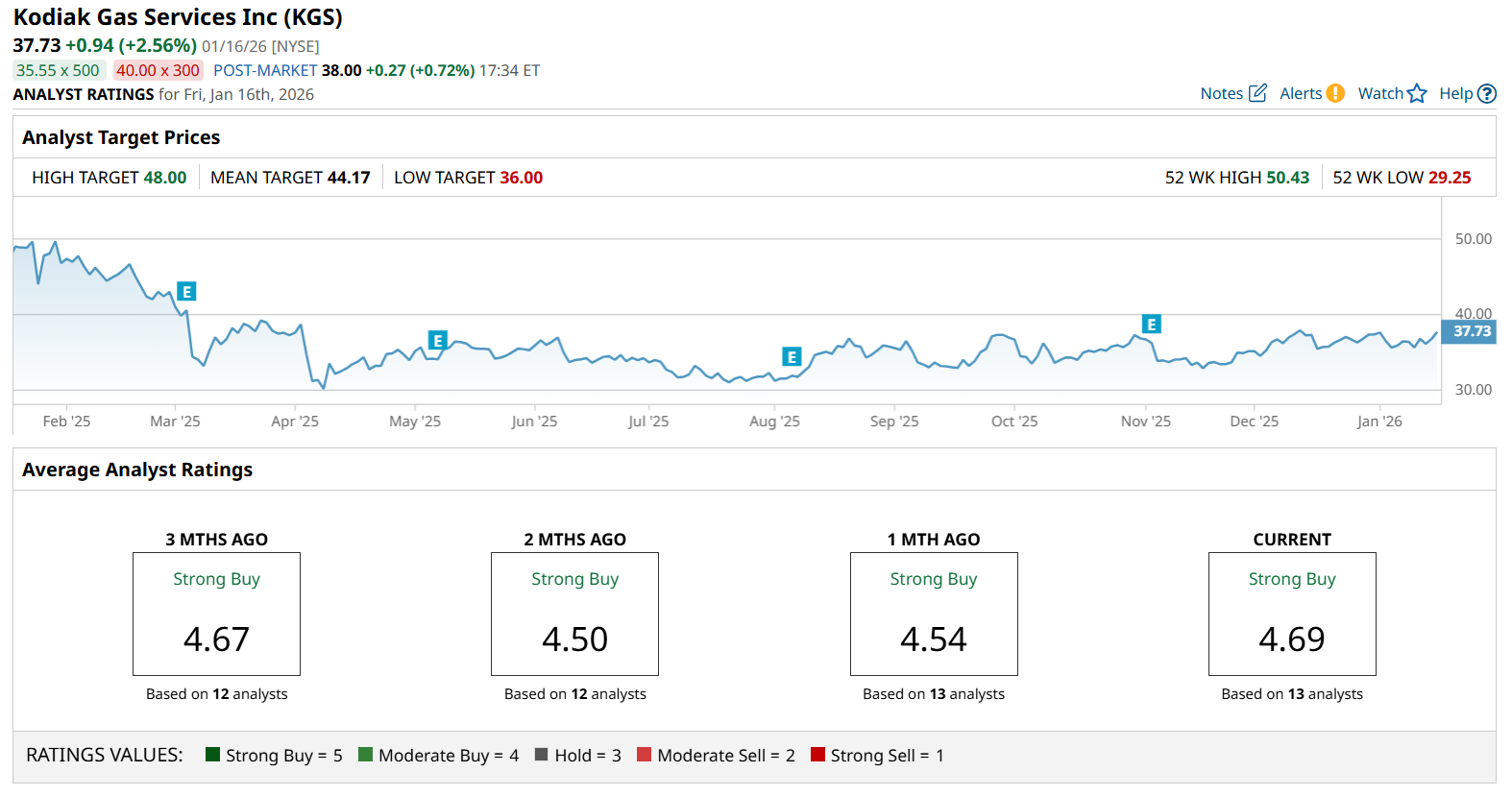

Netstreit Corp (NTST)

The second Dividend Stock on my list is Netstreit Corp., a leading Real Estate Investment Trust (REIT) that owns and manages retail properties.

In its most recent financials, the company reported that sales rose 17% YOY to $48 million. Its net income swung from a loss, to $618 million. It has a forward price-to-earnings of 13.96, lower than the sector average of 18.35. The company also pays a forward annual dividend of $0.86, which translates to a yield of approximately 4.66%, a great deal for consistent payouts.

Further, a consensus among 17 analysts rates the stock a “Strong Buy”. With a high target of $22, there could be as much as 19% upside in the stock over the next year.

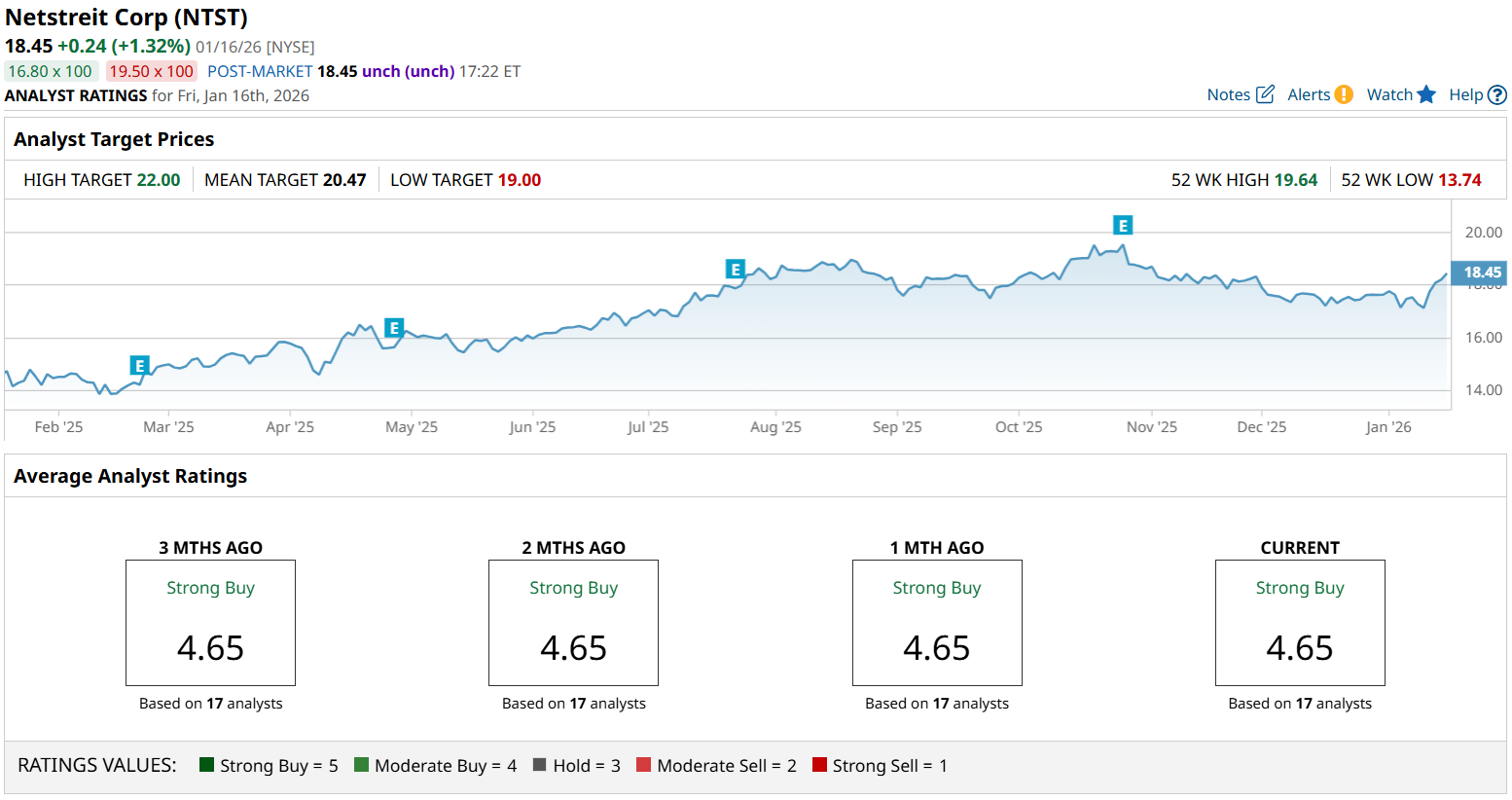

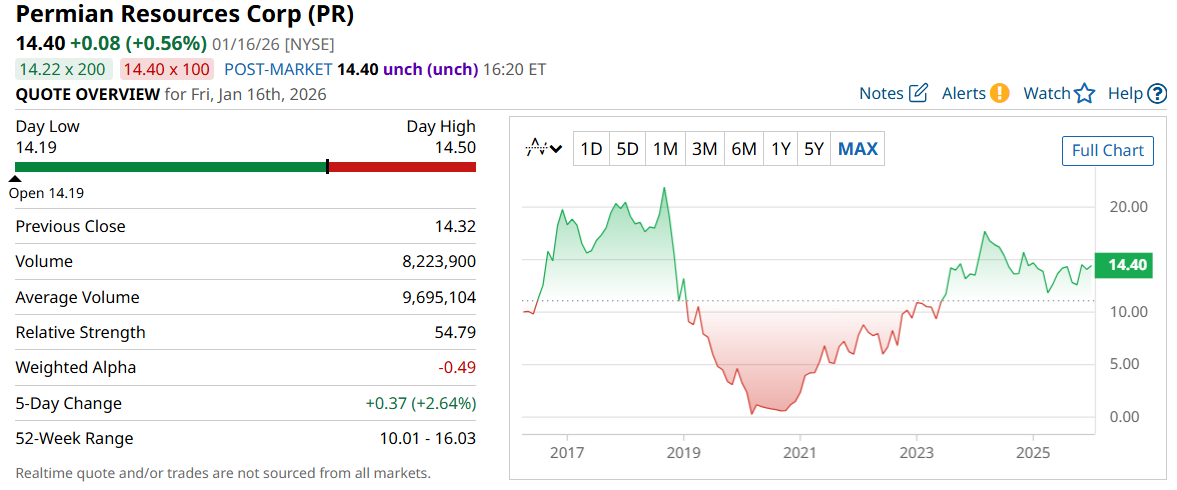

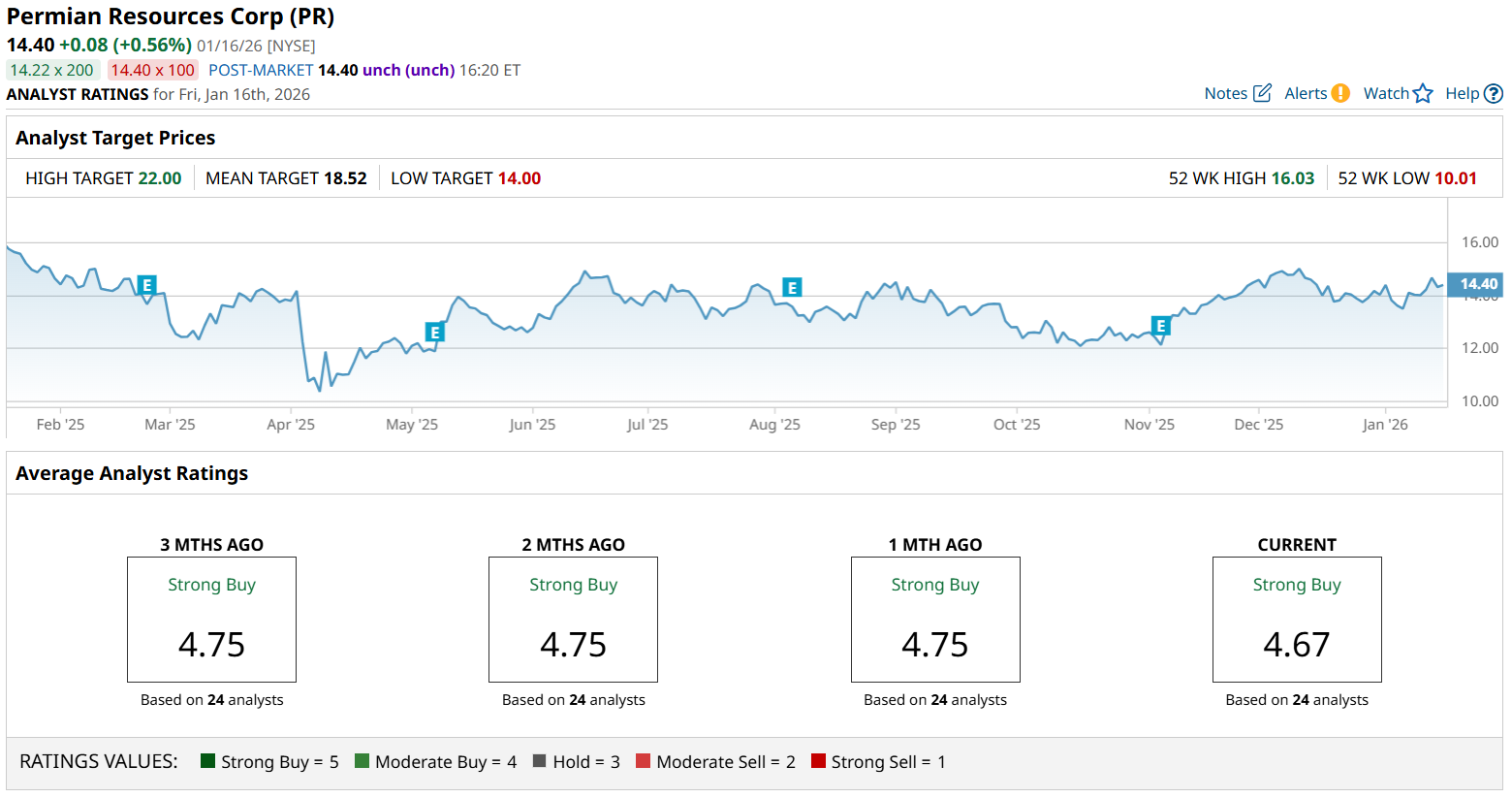

Permian Resources Corp (PR)

The third and final Dividend Stock on my list is Permian Resources Corp., another gas and oil company like Kodiak Gas. The difference is that Permian Resources focuses on upstream, or finding and producing raw oil and natural gas, rather than their transport.

In its most recent quarterly financials, the company reported sales were up 9% YOY to $1.3 billion. While its net income softened, decreasing 85% to $59 million due to lower commodity prices and higher operating and non-cash charges.

The stock trades at a forward price-to-earnings ratio of 12.92, below the sector average of 18.13, suggesting it is undervalued. Permian Resources also pays a forward annual dividend of $0.60, translating to an above-average yield of 4.17%.

Last, a consensus among 24 analysts rates the stock a “Strong Buy” with a high target price of $22. Should the stock hit that target in the next year, that would represent a 53% lift from today's prices.

Final thoughts

These three Dividend Stocks all offer the same thing: a relatively high and consistent payout at a bargain price, making them a great investment today and well backed by Wall Street. While these companies do not make most headlines, metrics show that they continue to deliver dependable income and solid value for long-term investors.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart