General Motors (GM) released its fourth-quarter 2025 earnings on Jan. 27. Barring the slight revenue miss, it was otherwise a strong earnings report from the Detroit auto giant whose 2025 U.S. market share rose to a decade high after four years of incremental gains.

The company’s 2026 guidance implies an improvement over 2025 across all metrics. At the top end, the company expects to post adjusted earnings before interest and taxes (EBIT) of $15 billion, $2.3 billion higher than what it posted last year. Notably, while U.S. President Donald Trump has threatened to increase tariffs on imports from South Korea by 25%, GM’s guidance bakes in the 15% tariff, which CEO Mary Barra said the company will “work to offset” for the period it stays at that level.

GM Expects Margins to Rise in 2026

GM expects its North America adjusted EBIT margins to be back in the 8% to 10% range this year, which is a major improvement from the previous year. There are several drivers of the step up, including the expected narrowing of electric vehicle (EV) losses, improvement in warranty expenses, and lower spending towards regulatory credits.

The U.S. automotive industry's landscape has changed over the last year. The Trump administration did away with the $7,500 EV tax credit, which has dampened the sales of electric cars. Tesla (TSLA) — which is by far the biggest EV seller in the U.S. — reported a 16% drop in Q4 2025 deliveries and wrapped up its second year of degrowth.

Legacy automakers are not immune to the changes, and both Ford (F) and GM have incurred billions of dollars in charges, some of which happen to be in cash, as they realign their EV capacity to weak end user demand. However, legacy automakers have always had the option to fall back on their internal combustion engine (ICE) portfolios, which are firing on all cylinders — and quite literally so — despite tariffs, an increase in raw material costs, and unfavourable forex movements.

Meanwhile, apart from withdrawing the EV tax credit, the Trump administration also eased the Corporate Average Fuel Economy (CAFE) standards. This move means that legacy automakers don't necessarily need to buy regulatory credits from the likes of Tesla. Specifically, GM expects a regulatory benefit between $500 million and $750 million this year, primarily on account of not having to buy regulatory credits. While none of the companies break down their specific business dealings, GM has previously disclosed buying regulatory credits from Tesla.

The easing of CAFE standards would be a big blow for Tesla, as sales of these credits were $2.76 billion in 2024. For 2025, the numbers are set to drop following the regulatory changes. Things could also worsen further in 2026 as U.S. automakers scale back purchases.

To be sure, the dichotomy between the fortunes of EV companies and legacy automakers hasn’t been lost on the analyst community. Last year, Morgan Stanley downgraded Tesla and Rivian (RIVN) while upgrading GM.

The downgrade didn’t come from analayst Adam Jonas, a perma bull on Tesla who shifted to a new internal role focused on artificial intelligence (AI) companies, but from Andrew Percoco, who has assumed the coverage. Still, it was the first Tesla downgrade from Morgan Stanley in two years, and a sign of how the fortunes of legacy automakers and EV companies have swapped.

To be sure, Tesla has been pivoting toward AI, and AI products and services now take up the lion’s share in the company’s earnings call, even as their contribution to the company’s current earnings is quite low. However, when it comes to the automotive business — which despite all the talks of Tesla being an AI play still accounts for the bulk of the company’s earnings — legacy automakers are gaining at Tesla’s cost thanks to Trump’s policies.

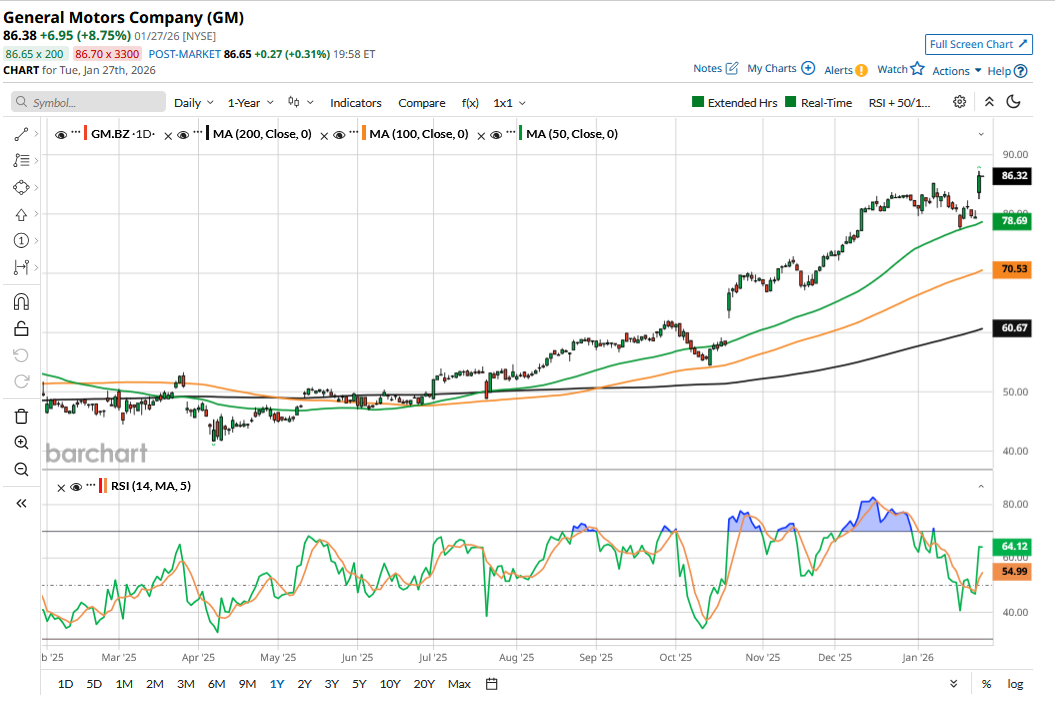

Can GM Stock Continue to Rally?

GM stock still looks undervalued at a forward price-to-earnings (P/E) multiple of 7.1 times. The company also feels the same about its depressed valuation and announced a $6 billion share buyback authorization to capitalize on its low stock price.

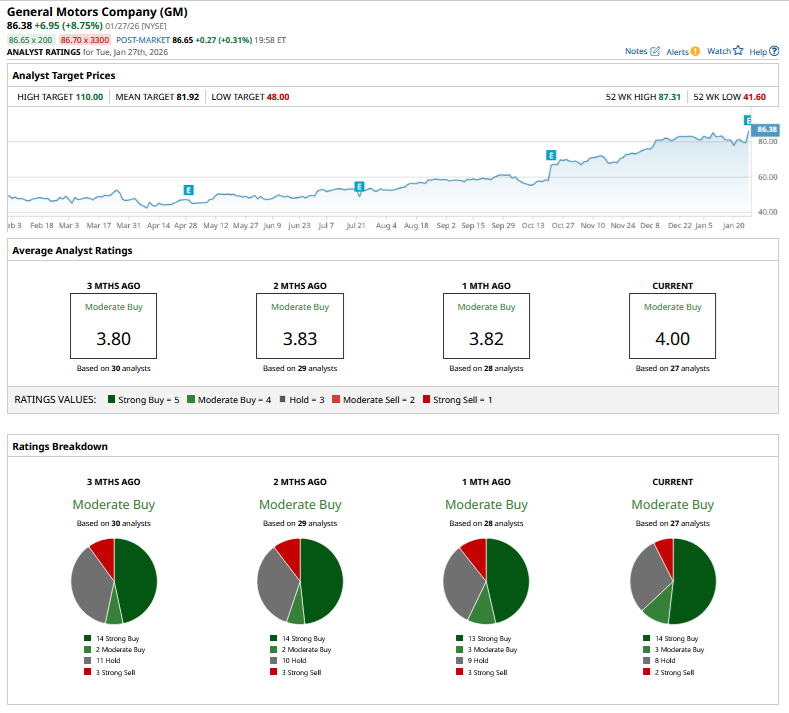

Analysts were impressed with GM’s Q4 earnings, and several raised their target prices after the report, with Goldman Sachs raising its target from $98 to $104. While GM stock trades above its mean target price of $82.28, things should change as more brokerages raise their price targets following the strong Q4 performance and 2026 outlook.

The recent target prices have been in the ballpark of $100, which I believe is a reasonable expectation for GM stock over the course of 2026. Overall, I remain bullish on GM as the company continues to generate strong free cash flows, which it is deploying to ramp up U.S. capacity while also buying back shares in a frenzy.

On the date of publication, Mohit Oberoi had a position in: GM , F , TSLA , RIVN . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 1 Dividend King to Buy and Hold Through Any Market

- Intel Has a Problem Investors Might Actually Love: Is INTC a Buy Now?

- The S&P 500 Is Near Record Highs, But Volatility Is Rearing Its Ugly Head. The Best Way to Play It Now.

- This Old-School Company Is Up 100% on AI Demand. Should You Buy Shares Now?