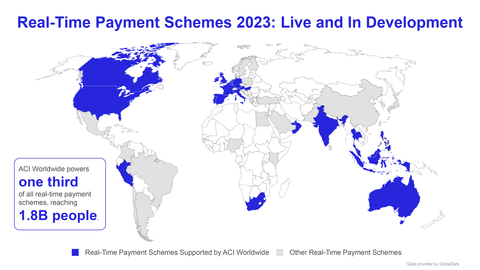

ACI covers approximately one-third of the countries that offer real-time payments services

ACI Worldwide (NASDAQ: ACIW), a global leader in mission-critical, real-time payments software, today announced the expansion of the global reach of its industry-leading, real-time payments software solutions. ACI now powers 25 domestic and pan-regional real-time schemes across six continents — including nine central infrastructures — providing solutions to central banks, participant banks, fintechs and other payment service providers.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230131005963/en/

(Graphic: Business Wire)

Europe, the Middle East and the UK are ACI’s leading regional markets, with 12 countries having integrated real-time payment software capabilities, followed by nine countries in the Asia-Pacific and four in the Americas region. The latest additions to ACI’s growing client roster are the central banks of three nations in the Middle East.

“In 2022, we signed three new countries who trust ACI to support their central infrastructure mandates,” said Alessandro Silva, ACI Worldwide’s chief revenue officer. “This adds to our long history of success in Asia, where ACI powers the central infrastructure for Indonesia, Malaysia and Thailand and supports many real-time payments schemes across the APAC region, including Singapore, Philippines and Australia.”

Globally, ACI covers approximately one-third of the countries that offer real-time payments services, reaching about 1.8 billion people* served by various organizations, including central governments, payment networks, banks, financial institutions and fintech companies.

ACI Worldwide’s platform expansion responds to rapidly increasing real-time payment adoption rates worldwide. According to intelligence by GlobalData, real-time payments will account for nearly a quarter of global electronic payments by 2026.

Government and central intervention in national payment schemes is the primary driver of real-time adoption, with many nations mandating compliance or taking a consensus-driven and collaborative approach. The European Commission unveiled draft law recently that would require banks to offer instant payments in euros at no extra cost, and immediate payments in the U.S. is expected to see a strong uptick with the launch of FedNow in 2023.

From Latin America to Asia, to Africa, to Europe, governments taking the lead have also improved economic prosperity and promoted financial inclusion, with tangible success in strengthening GDP. By 2026, real-time payments are expected to facilitate an additional $131 billion in GDP in the world’s top five global real-time markets (India, China, Thailand, Brazil and South Korea), according to ACI’s 2022 Prime Time for Real-Time report.

Debbie Guerra, chief product officer of ACI Worldwide, said, “ACI’s decades of experience as a pioneer and trusted partner in real-time payments has allowed us to evolve our expertise to be a natural fit to empower payment networks, banks, merchants and billers across the world to stay ahead of customer demand and increasing regulatory changes and competitors for modern payments infrastructure with real-time. Within this landscape, our customers are accelerating the launch of new real-time payment services in months rather than years. ACI is leading the real-time revolution, meeting our customers at the forefront of technology with a ready solution scalable worldwide and easily adaptable with local requirements.”

Thomas Warsop, president and interim CEO of ACI Worldwide, added, “Our real-time implementations represent a significant long-term growth opportunity for ACI. The movement of funds within seconds rather than days unlocks money — billions of dollars every day — usually tied up in inefficient payment systems and with intermediaries. Money that people, businesses and government can instantly put to work to generate value, drive growth and enhance prosperity. Removing friction from payments also removes systemic limits on economic consumption and investment, lowers business costs, accelerates innovation and improves financial inclusion. In the background, ACI is powering central banks and banks, merchants and billers, processors and acquirers to facilitate payments end-to-end securely, reliably and in real-time across the globe.”

*Note to editors: Data provided by Global Data

About ACI’s Real-Time Payments Software

ACI’s innovative real-time payments software accelerates speed to market by bringing innovative payment offerings through a highly configurable, service-oriented architecture. It facilitates faster market share capture, bringing new customer experiences and payment methods, including instant payments, P2P and more. It offers value-added services for fast digital transformation through digital overlays, partnerships and platform offerings, and simplifies payment systems by supporting multiple global schemes and add-on capabilities from a single implementation.

About ACI Worldwide

ACI Worldwide is a global leader in mission-critical, real-time payments software. Our proven, secure and scalable software solutions enable leading corporations, fintech companies and financial disruptors to process and manage digital payments, power omni-commerce payments, present and process bill payments, and manage fraud and risk. We combine our global footprint with a local presence to drive the real-time digital transformation of payments and commerce.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230131005963/en/

Contacts

Media Relations: Nick Karoglou, I Head of Communications and Corporate Affairs I nick.karoglou@aciworldwide.com