Advertising and marketing company Zeta Global (NYSE: ZETA) reported Q3 CY2024 results beating Wall Street’s revenue expectations, with sales up 42% year on year to $268.3 million. On top of that, next quarter’s revenue guidance ($295 million at the midpoint) was surprisingly good and 9.7% above what analysts were expecting. Its GAAP loss of $0.09 per share was 44.6% below analysts’ consensus estimates.

Is now the time to buy Zeta? Find out by accessing our full research report, it’s free.

Zeta (ZETA) Q3 CY2024 Highlights:

- Revenue: $268.3 million vs analyst estimates of $252.5 million (6.3% beat)

- EPS: -$0.09 vs analyst expectations of -$0.06 (44.6% miss)

- EBITDA: $53.6 million vs analyst estimates of $49.96 million (7.3% beat)

- Revenue Guidance for Q4 CY2024 is $295 million at the midpoint, above analyst estimates of $268.8 million

- EBITDA guidance for the full year is $188.5 million at the midpoint, above analyst estimates of $178.1 million

- Gross Margin (GAAP): 60.6%, in line with the same quarter last year

- Operating Margin: -4.6%, up from -19.7% in the same quarter last year

- EBITDA Margin: 20%, up from 17.9% in the same quarter last year

- Free Cash Flow Margin: 12.8%, up from 8.7% in the previous quarter

- Billings: $268.2 million at quarter end, up 42.7% year on year

- Market Capitalization: $8.40 billion

“The bets we made seven years ago on AI, the investment in a ‘1 of 1’ marketing platform, and our commitment to our customers’ success has resulted in record setting third-quarter financial results, above of our previously raised guidance,” said David A. Steinberg, Co-Founder, Chairman, and CEO of Zeta.

Company Overview

Co-founded by former Apple CEO John Scully, Zeta Global (NYSE: ZETA) provides software and data analytics tools that help companies market their products to billions of customers.

Advertising Software

The digital advertising market is large, growing, and becoming more diverse, both in terms of audiences and media. As a result, there is a growing need for software that enables advertisers to use data to automate and optimize ad placements.

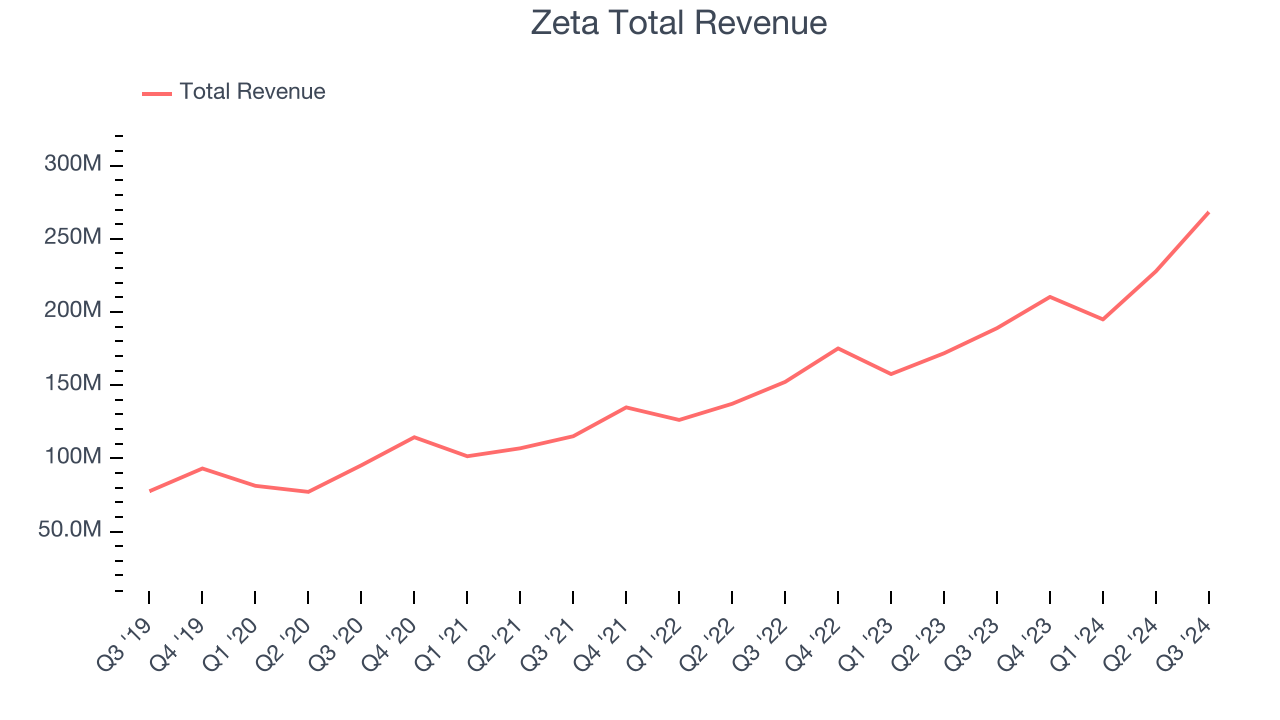

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Zeta’s sales grew at a solid 27.2% compounded annual growth rate over the last three years. Its growth beat the average software company and shows its offerings resonate with customers.

This quarter, Zeta reported magnificent year-on-year revenue growth of 42%, and its $268.3 million of revenue beat Wall Street’s estimates by 6.3%. Company management is currently guiding for a 40.3% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 18.3% over the next 12 months, a deceleration versus the last three years. This projection is still admirable and implies the market is baking in success for its products and services.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

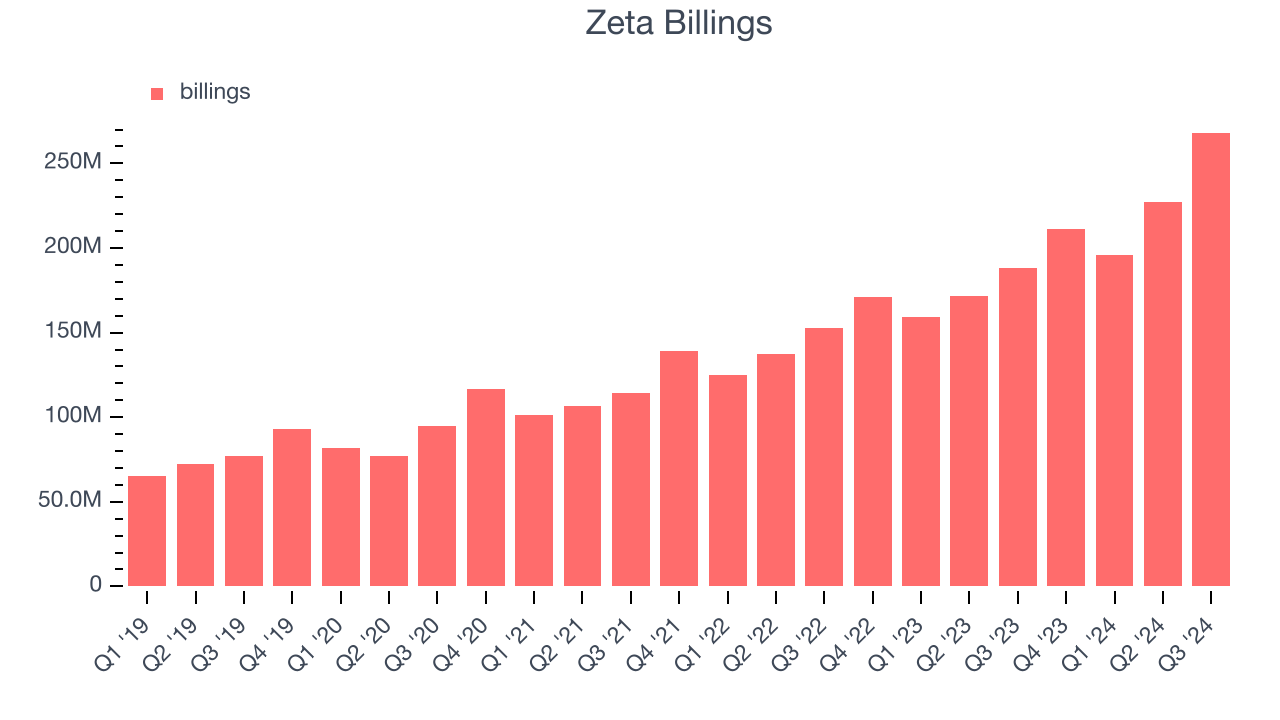

Billings

In addition to revenue, billings is a non-GAAP metric that sheds additional light on Zeta’s business quality. Billings is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Over the last year, Zeta’s billings growth has been fantastic, averaging 30.4% year-on-year increases and punching in at $268.2 million in the latest quarter. This performance was in line with its revenue growth, indicating robust customer demand and a strong sales pipeline. The high level of cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Zeta is extremely efficient at acquiring new customers, and its CAC payback period checked in at 3.3 months this quarter. The company’s efficiency indicates that it has a highly differentiated product offering and strong brand reputation, giving it the freedom to invest resources into new growth initiatives while maintaining optionality.

Key Takeaways from Zeta’s Q3 Results

We were impressed by how strongly Zeta blew past analysts’ billings expectations this quarter. We were also glad next quarter’s EBITDA guidance exceeded Wall Street’s estimates. Zooming out, we think this was a solid quarter. The stock traded up 5.2% to $38.70 immediately following the results.

Zeta put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.