Over the last six months, Manitowoc’s shares have sunk to $10.56, producing a disappointing 13.2% loss - a stark contrast to the S&P 500’s 13.4% gain. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Manitowoc, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons why we avoid MTW and one stock we'd rather own.

Why Do We Think Manitowoc Will Underperform?

Contracted by the United States Navy during WWII, Manitowoc (NYSE: MTW) provides cranes and lifting equipment.

1. Backlog Declines as Orders Drop

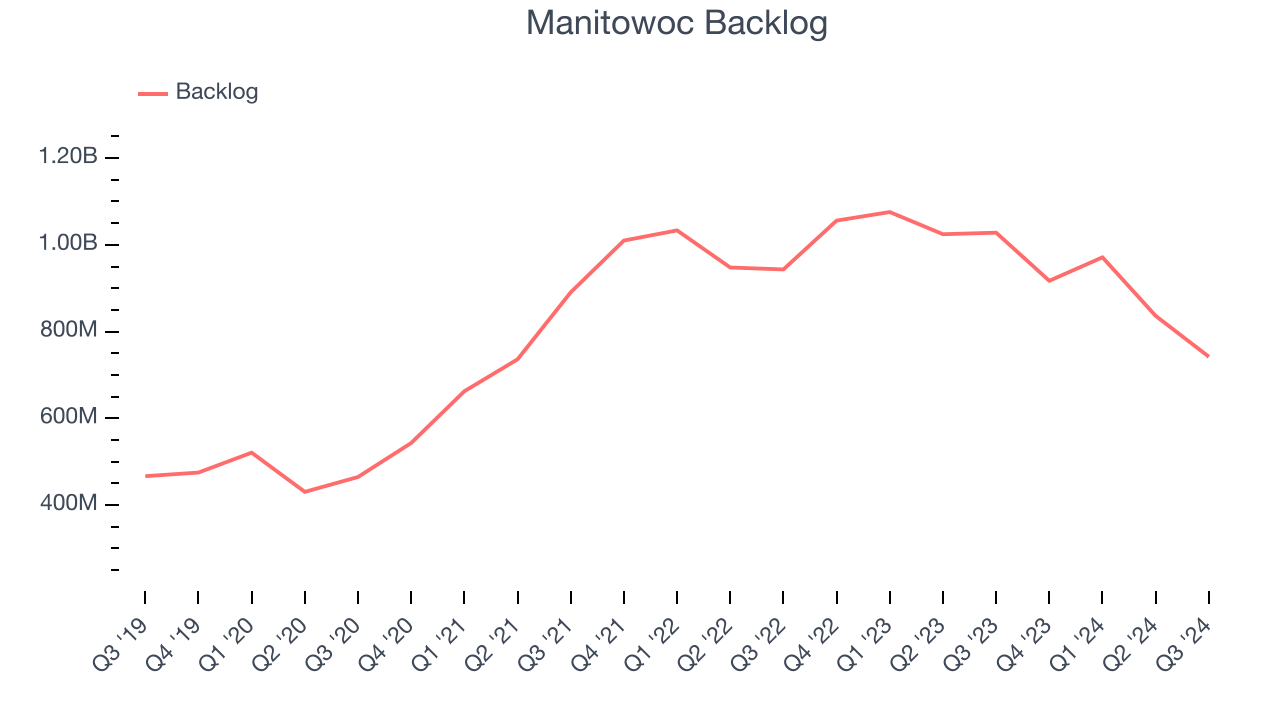

In addition to reported revenue, backlog is a useful data point for analyzing Construction Machinery companies. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into Manitowoc’s future revenue streams.

Manitowoc’s backlog came in at $742.1 million in the latest quarter, and it averaged 5.4% year-on-year declines over the last two years. This performance was underwhelming and shows the company is not winning new orders. It also suggests there may be increasing competition or market saturation.

2. Free Cash Flow Margin Dropping

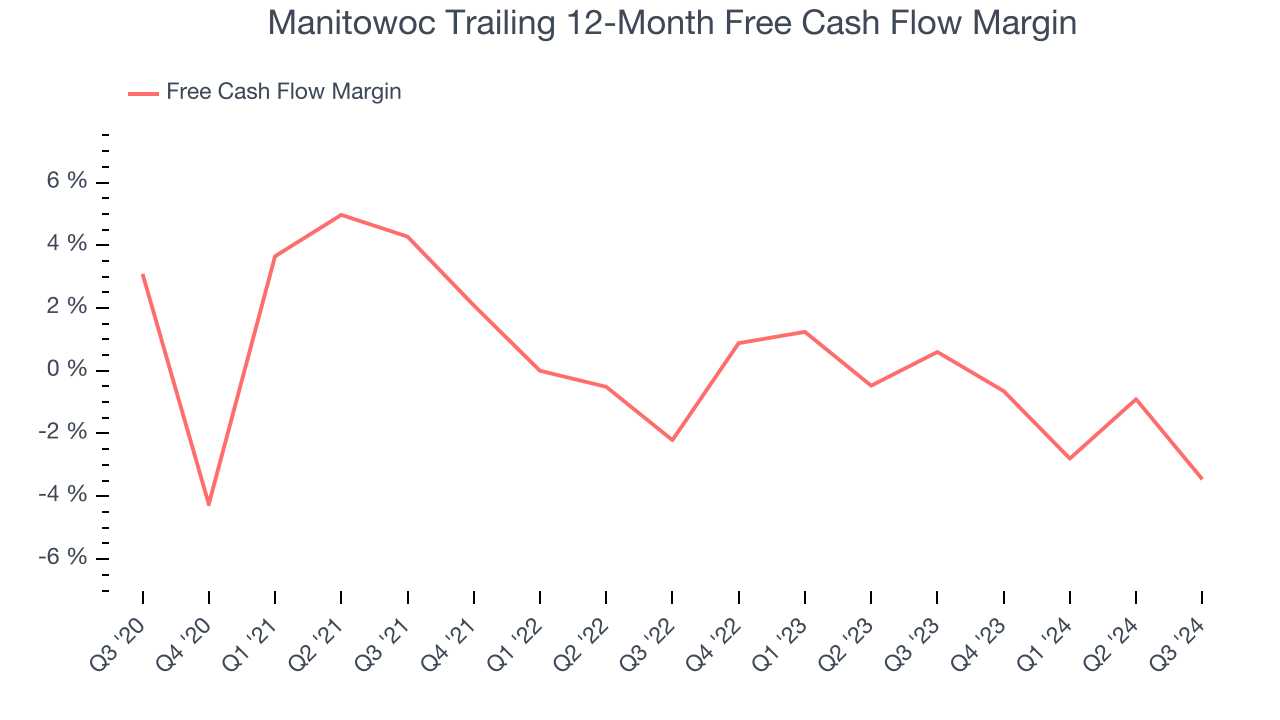

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Manitowoc’s margin dropped by 6.5 percentage points over the last five years. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. Manitowoc’s free cash flow margin for the trailing 12 months was negative 3.5%.

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Over the last few years, Manitowoc’s ROIC has decreased. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

Manitowoc falls short of our quality standards. Following the recent decline, the stock trades at 12.9x forward price-to-earnings (or $10.56 per share). This valuation multiple could be justified, but we don’t have much confidence in the company. There are superior stocks to buy right now. We’d suggest taking a look at Deere, the leading supplier of autonomous agriculture equipment.

Stocks We Like More Than Manitowoc

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.