Real estate technology company eXp World (NASDAQ: EXPI) missed Wall Street’s revenue expectations in Q3 CY2024 as sales only rose 1.4% year on year to $1.23 billion. Its GAAP profit of $0.06 per share was in line with analysts’ consensus estimates.

Is now the time to buy eXp World? Find out by accessing our full research report, it’s free.

eXp World (EXPI) Q3 CY2024 Highlights:

- Revenue: $1.23 billion vs analyst estimates of $1.27 billion (3.4% miss)

- EPS (GAAP): $0.06 vs analyst expectations of $0.06 (in line)

- EBITDA: $23.94 million vs analyst estimates of $22.79 million (5% beat)

- Gross Margin (GAAP): 7.1%, in line with the same quarter last year

- Operating Margin: -0.7%, in line with the same quarter last year

- EBITDA Margin: 1.9%, in line with the same quarter last year

- Free Cash Flow Margin: 3.6%, up from 1.8% in the same quarter last year

- Market Capitalization: $2.21 billion

Company Overview

Founded in 2009, eXp World (NASDAQ: EXPI) is a real estate company known for its virtual, cloud-based approach to real estate brokerage.

Real Estate Services

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

Sales Growth

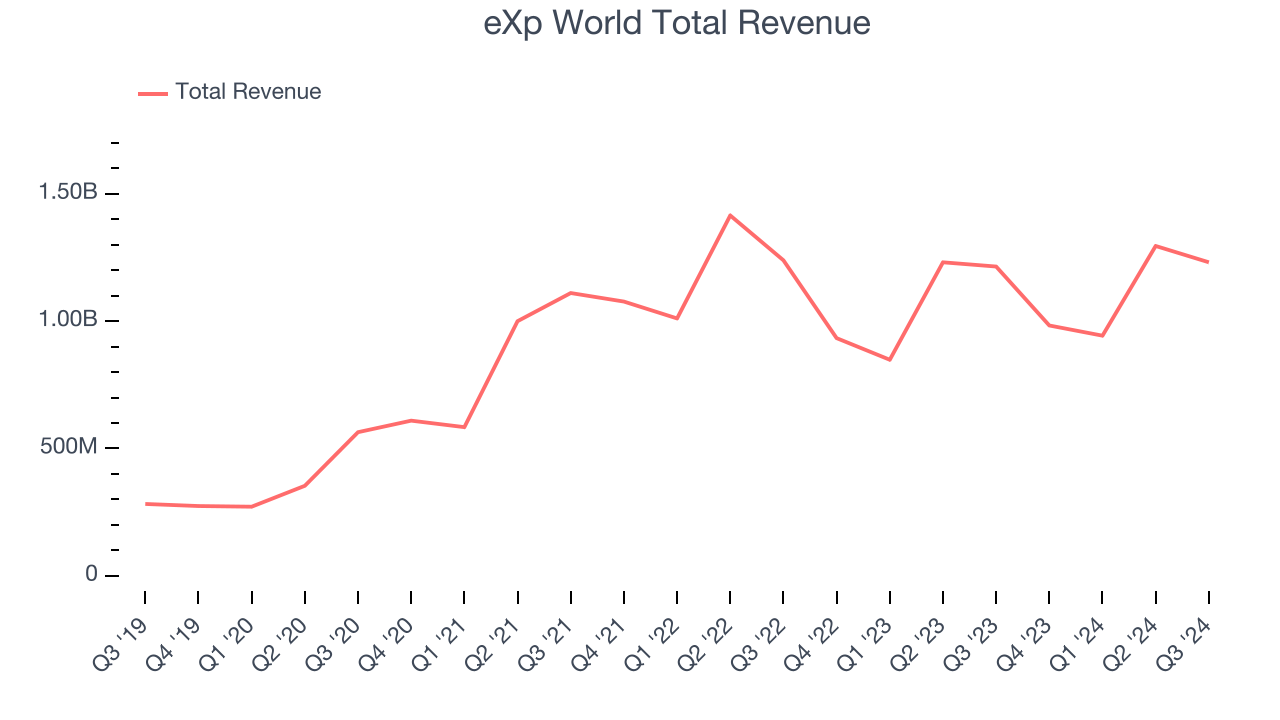

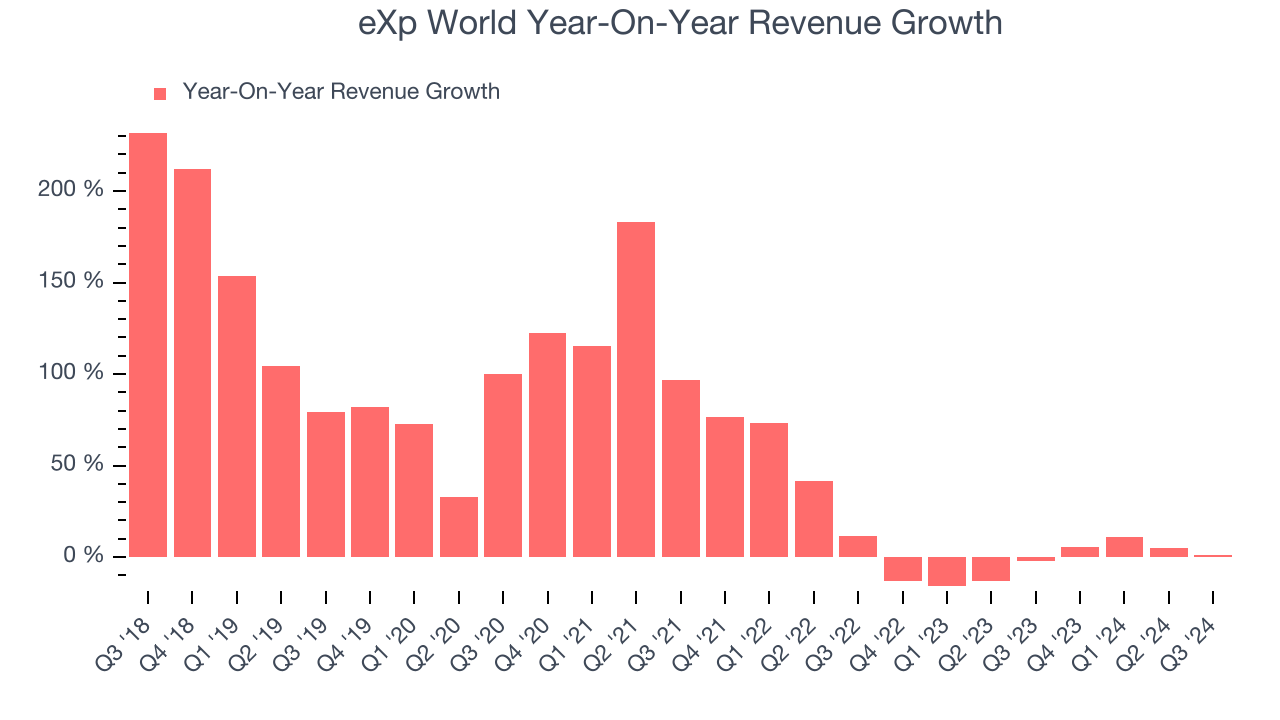

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, eXp World’s sales grew at an incredible 39.1% compounded annual growth rate over the last five years. This is a useful starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. eXp World’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 3.1% over the last two years.

This quarter, eXp World’s revenue grew 1.4% year on year to $1.23 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 5.1% over the next 12 months, an improvement versus the last two years. While this projection illustrates the market thinks its newer products and services will catalyze better performance, it is still below average for the sector.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

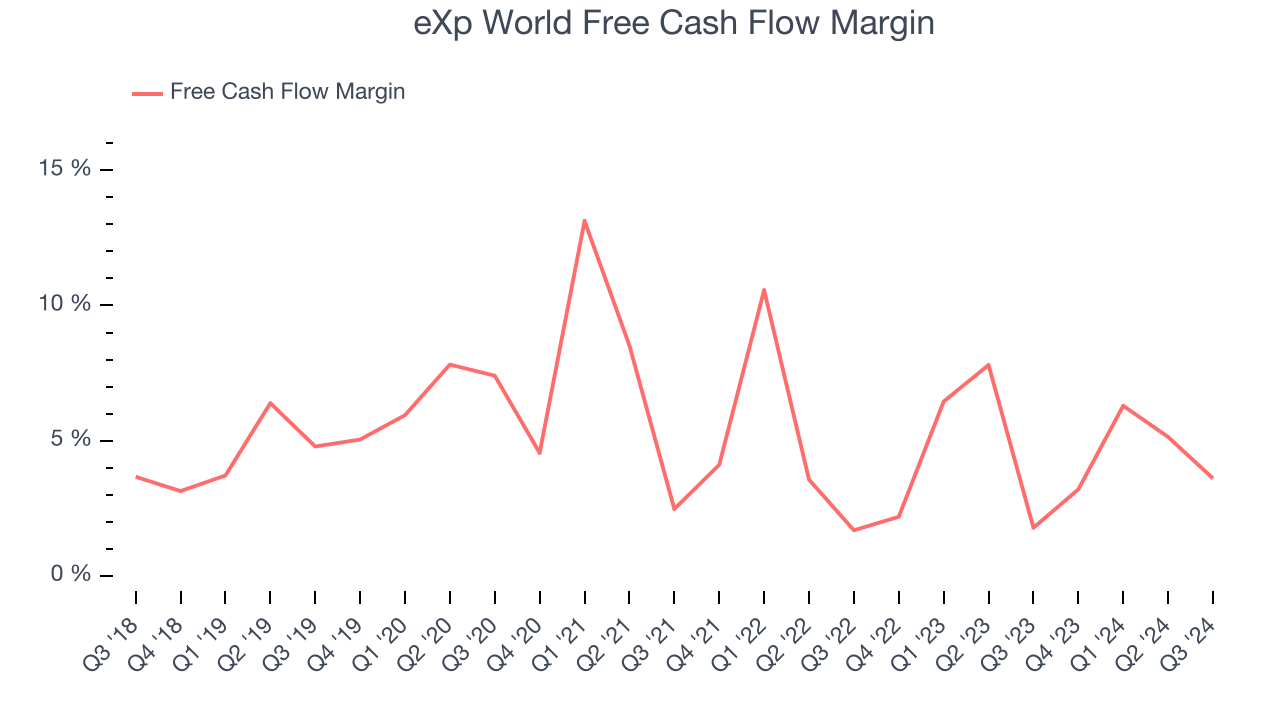

eXp World has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.5%, lousy for a consumer discretionary business.

eXp World’s free cash flow clocked in at $44.36 million in Q3, equivalent to a 3.6% margin. This result was good as its margin was 1.8 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

Key Takeaways from eXp World’s Q3 Results

It was good to see eXp World beat analysts’ EBITDA expectations this quarter. On the other hand, its revenue missed. Overall, this was a weaker quarter. The stock traded down 1.2% to $14.60 immediately after reporting.

eXp World’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.