Educational publishing company John Wiley & Sons (NYSE: WLY) reported revenue ahead of Wall Street’s expectations in Q3 CY2024, but sales fell by 13.4% year on year to $426.6 million. The company expects the full year’s revenue to be around $1.67 billion, close to analysts’ estimates. Its non-GAAP profit of $0.97 per share was 38.6% above analysts’ consensus estimates.

Is now the time to buy John Wiley & Sons? Find out by accessing our full research report, it’s free.

John Wiley & Sons (WLY) Q3 CY2024 Highlights:

- Revenue: $426.6 million vs analyst estimates of $420 million (13.4% year-on-year decline, 1.6% beat)

- Adjusted EPS: $0.97 vs analyst estimates of $0.70 (38.6% beat)

- Adjusted EBITDA: $105.5 million vs analyst estimates of $100 million (24.7% margin, 5.5% beat)

- The company reconfirmed its revenue guidance for the full year of $1.67 billion at the midpoint

- Management reiterated its full-year Adjusted EPS guidance of $3.43 at the midpoint

- EBITDA guidance for the full year is $397.5 million at the midpoint, above analyst estimates of $393.5 million

- Operating Margin: 15%, in line with the same quarter last year

- Free Cash Flow was -$19.81 million compared to -$21.39 million in the same quarter last year

- Market Capitalization: $2.69 billion

“Continuous improvement is a way of life for us now, and it’s beginning to pay off in our quality growth and margin expansion,” said Matthew Kissner, Wiley President and CEO.

Company Overview

Established in 1807, John Wiley & Sons (NYSE: WLY) is a global leader in academic publishing, providing educational materials, scholarly research, and professional development resources.

Media

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

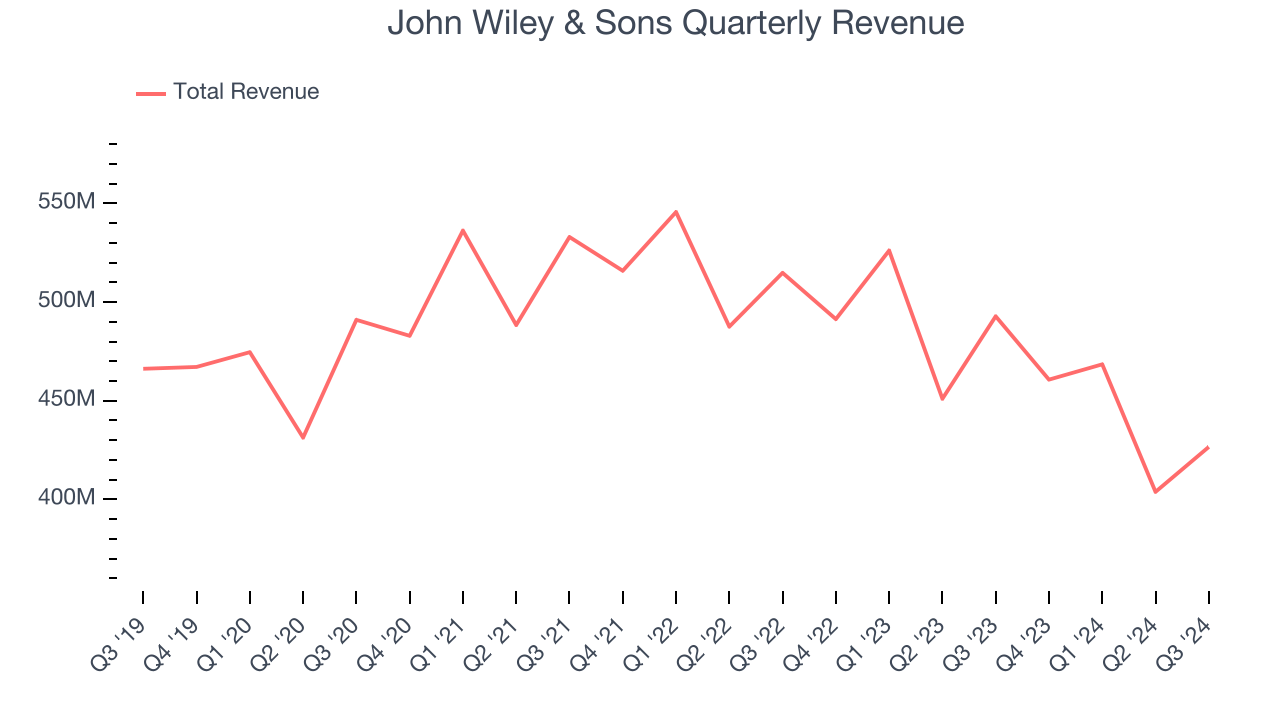

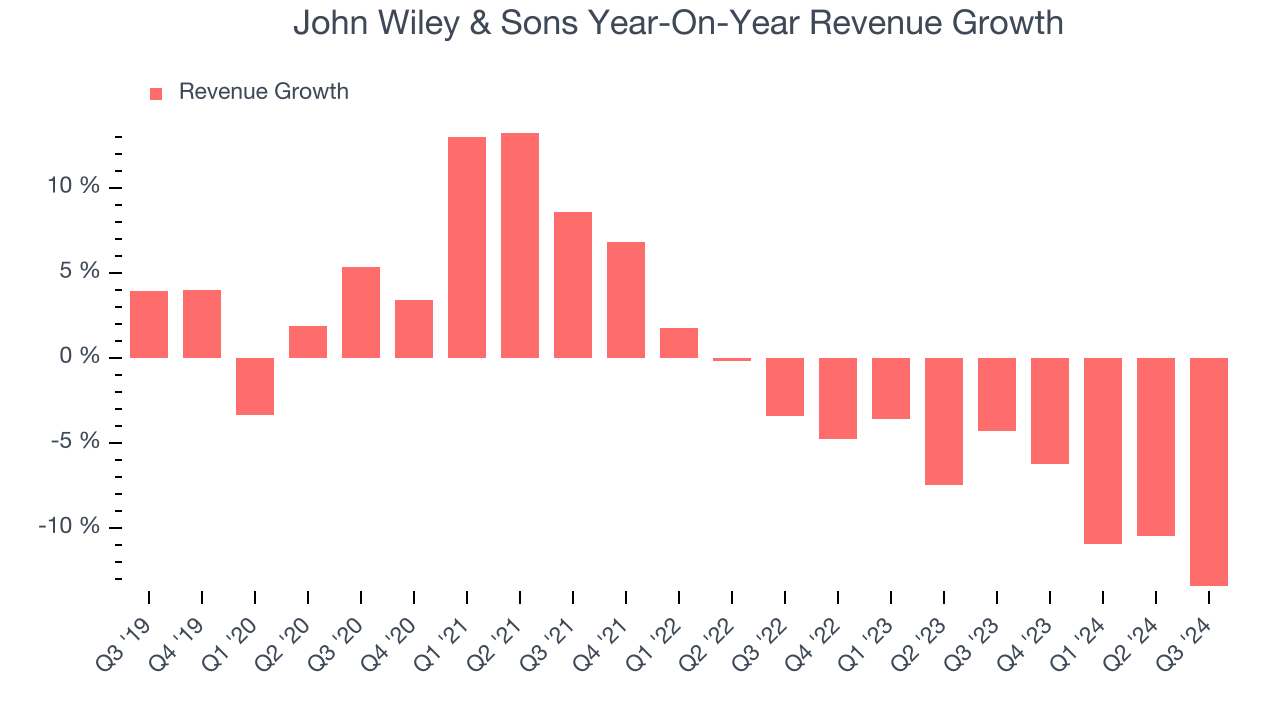

Sales Growth

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, John Wiley & Sons struggled to consistently increase demand as its $1.76 billion of sales for the trailing 12 months was close to its revenue five years ago. This fell short of our benchmarks and signals it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. John Wiley & Sons’s recent history shows its demand has stayed suppressed as its revenue has declined by 7.7% annually over the last two years.

This quarter, John Wiley & Sons’s revenue fell by 13.4% year on year to $426.6 million but beat Wall Street’s estimates by 1.6%.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

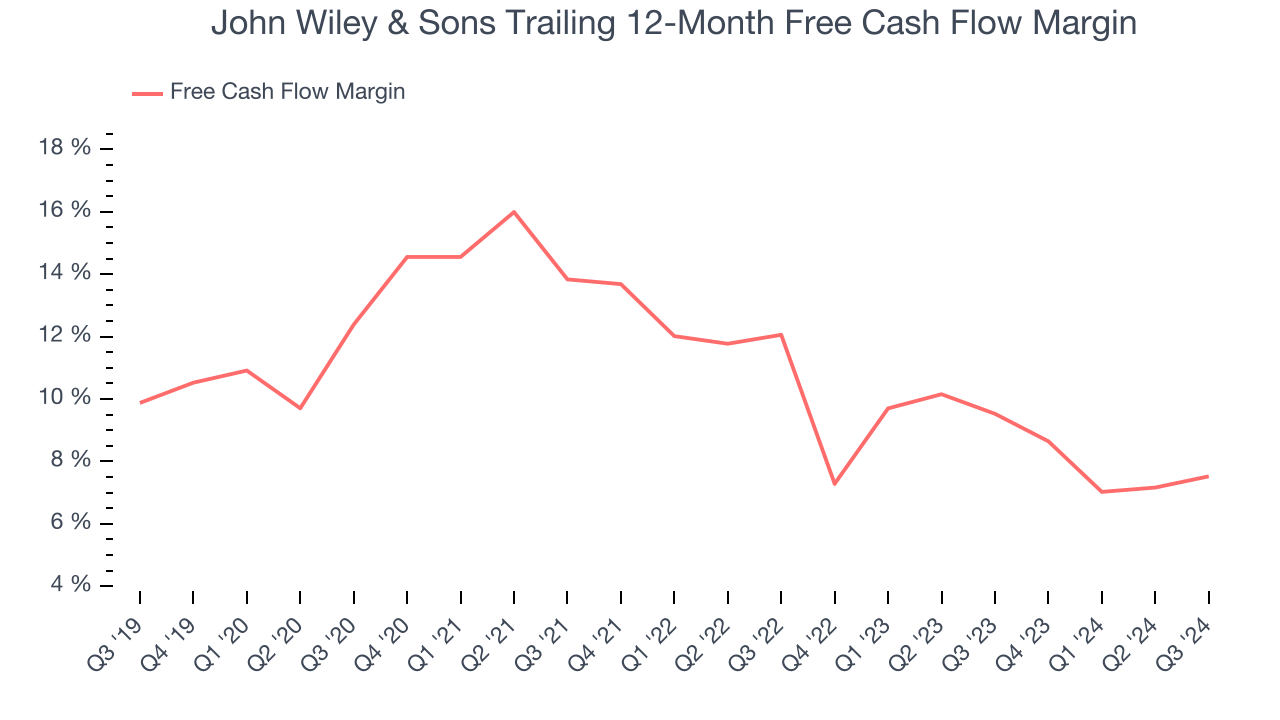

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

John Wiley & Sons has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 8.6%, subpar for a consumer discretionary business.

John Wiley & Sons burned through $19.81 million of cash in Q3, equivalent to a negative 4.6% margin. The company’s cash burn was similar to its $21.39 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, indicating it is a seasonal business that must build up inventory during certain quarters.

Key Takeaways from John Wiley & Sons’s Q3 Results

It was good to see John Wiley & Sons beat analysts’ revenue and EPS expectations this quarter. We were also glad its full-year EPS guidance came in much higher than Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $49.51 immediately after reporting.

Indeed, John Wiley & Sons had a rock-solid quarterly earnings result, but is this stock a good investment here? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.