Since April 2025, Avantor has been in a holding pattern, posting a small return of 2.3% while floating around $15.30. The stock also fell short of the S&P 500’s 30.6% gain during that period.

Is now the time to buy Avantor, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Is Avantor Not Exciting?

We're sitting this one out for now. Here are three reasons why AVTR doesn't excite us and a stock we'd rather own.

1. Core Business Falling Behind as Demand Declines

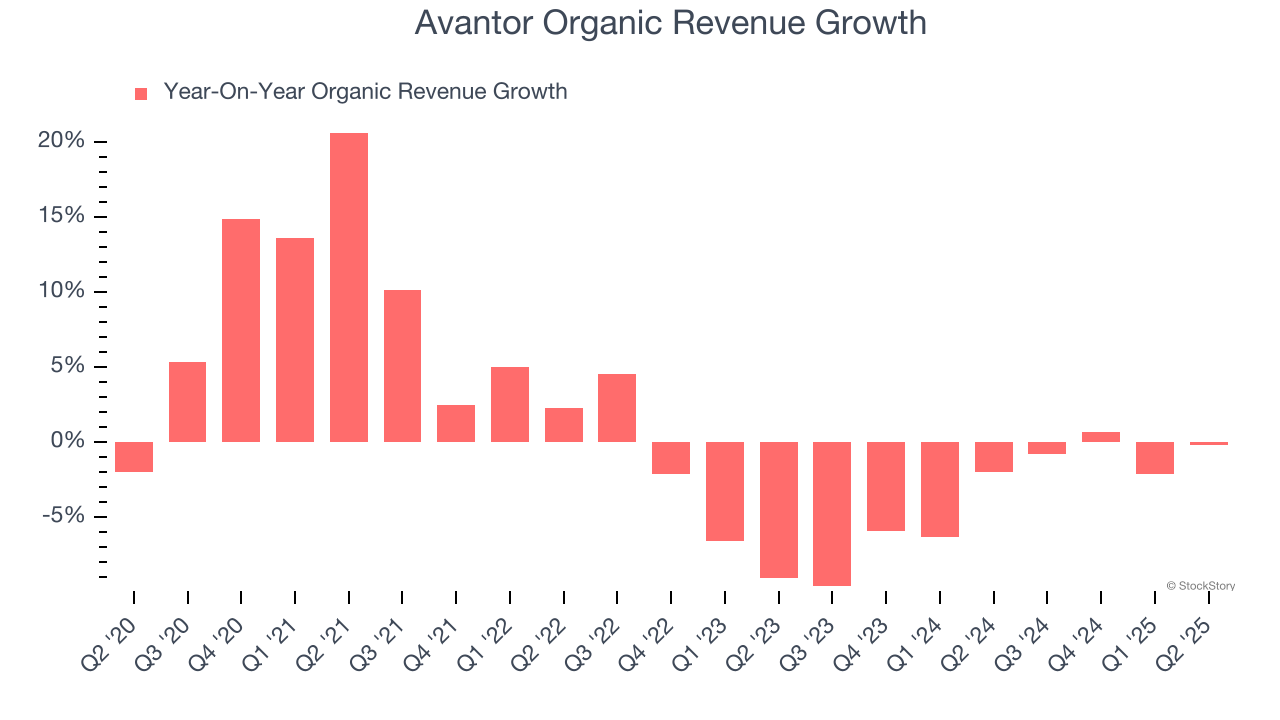

In addition to reported revenue, organic revenue is a useful data point for analyzing Research Tools & Consumables companies. This metric gives visibility into Avantor’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Avantor’s organic revenue averaged 3.3% year-on-year declines. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests Avantor might have to lean into acquisitions to grow, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

2. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Avantor’s revenue to stall. While this projection indicates its newer products and services will fuel better top-line performance, it is still below average for the sector.

3. Free Cash Flow Margin Dropping

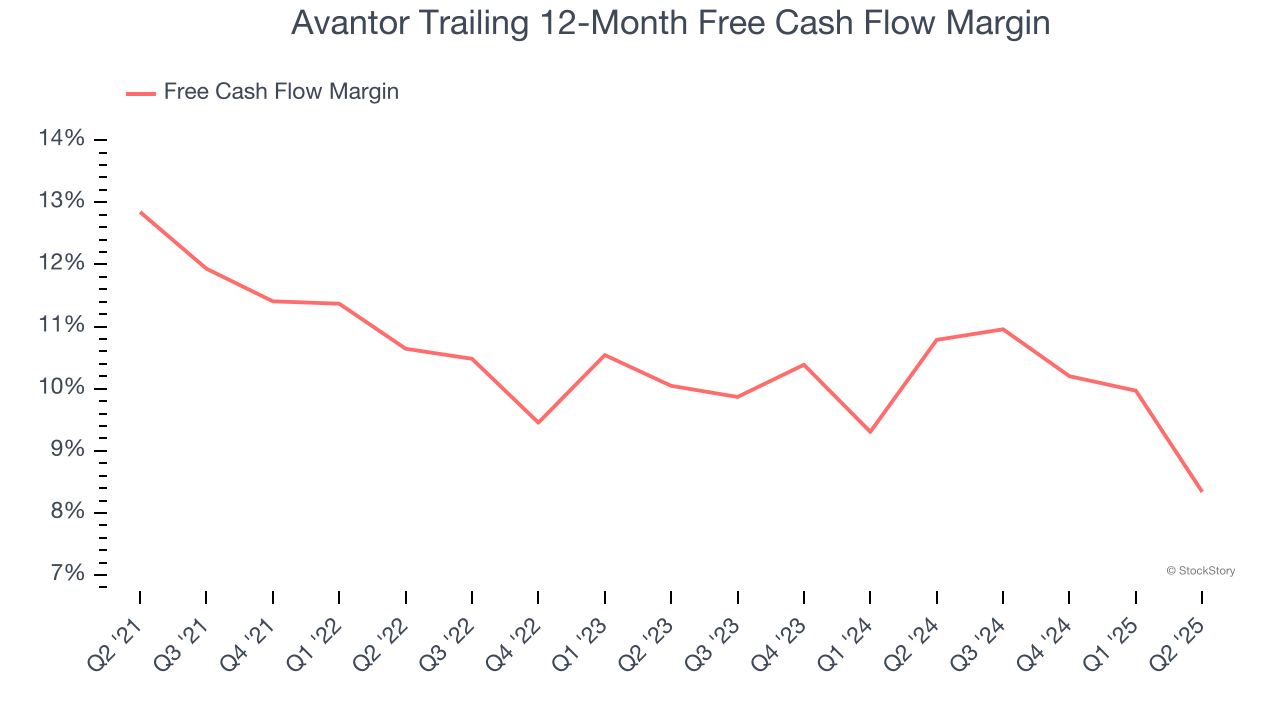

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Avantor’s margin dropped by 4.5 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. Avantor’s free cash flow margin for the trailing 12 months was 8.3%.

Final Judgment

Avantor isn’t a terrible business, but it doesn’t pass our bar. With its shares trailing the market in recent months, the stock trades at 15.8× forward P/E (or $15.30 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better stocks to buy right now. We’d suggest looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Like More Than Avantor

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.