Conveyorized car wash service company Mister Car Wash (NYSE: MCW) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 5.7% year on year to $263.4 million. The company expects the full year’s revenue to be around $1.05 billion, close to analysts’ estimates. Its non-GAAP profit of $0.11 per share was in line with analysts’ consensus estimates.

Is now the time to buy Mister Car Wash? Find out by accessing our full research report, it’s free for active Edge members.

Mister Car Wash (MCW) Q3 CY2025 Highlights:

- Revenue: $263.4 million vs analyst estimates of $261.1 million (5.7% year-on-year growth, 0.9% beat)

- Adjusted EPS: $0.11 vs analyst estimates of $0.10 (in line)

- Adjusted EBITDA: $86.79 million vs analyst estimates of $83.79 million (32.9% margin, 3.6% beat)

- The company reconfirmed its revenue guidance for the full year of $1.05 billion at the midpoint

- Adjusted EPS guidance for the full year is $0.43 at the midpoint, beating analyst estimates by 0.6%

- EBITDA guidance for the full year is $340 million at the midpoint, in line with analyst expectations

- Operating Margin: 19.7%, in line with the same quarter last year

- Free Cash Flow was $25.81 million, up from -$16.84 million in the same quarter last year

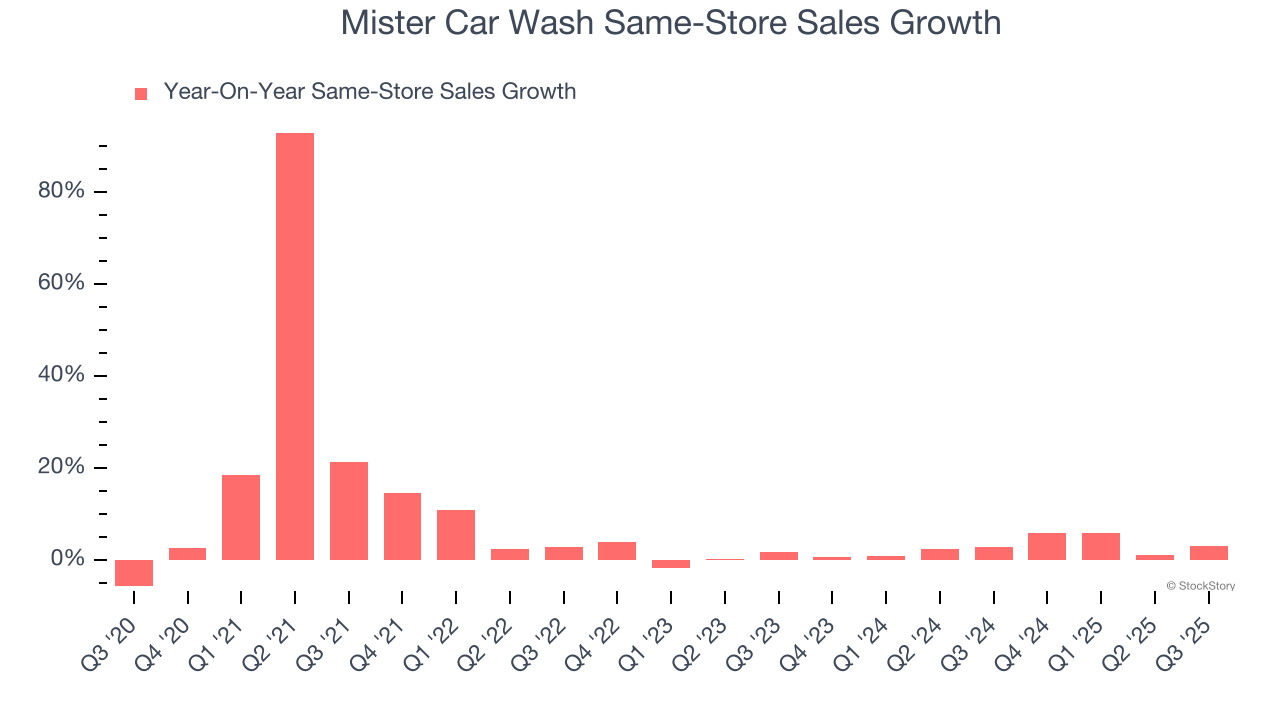

- Same-Store Sales rose 3.1% year on year, in line with the same quarter last year

- Market Capitalization: $1.70 billion

“We delivered a solid third quarter performance, underscoring the strength of our strategy, the resilience of our business model, and the dedication of our team,” said John Lai, Chairperson and CEO of Mister Car Wash.

Company Overview

Formerly known as Hotshine Holdings, Mister Car Wash (NYSE: MCW) offers car washes across the United States through its conveyorized service.

Revenue Growth

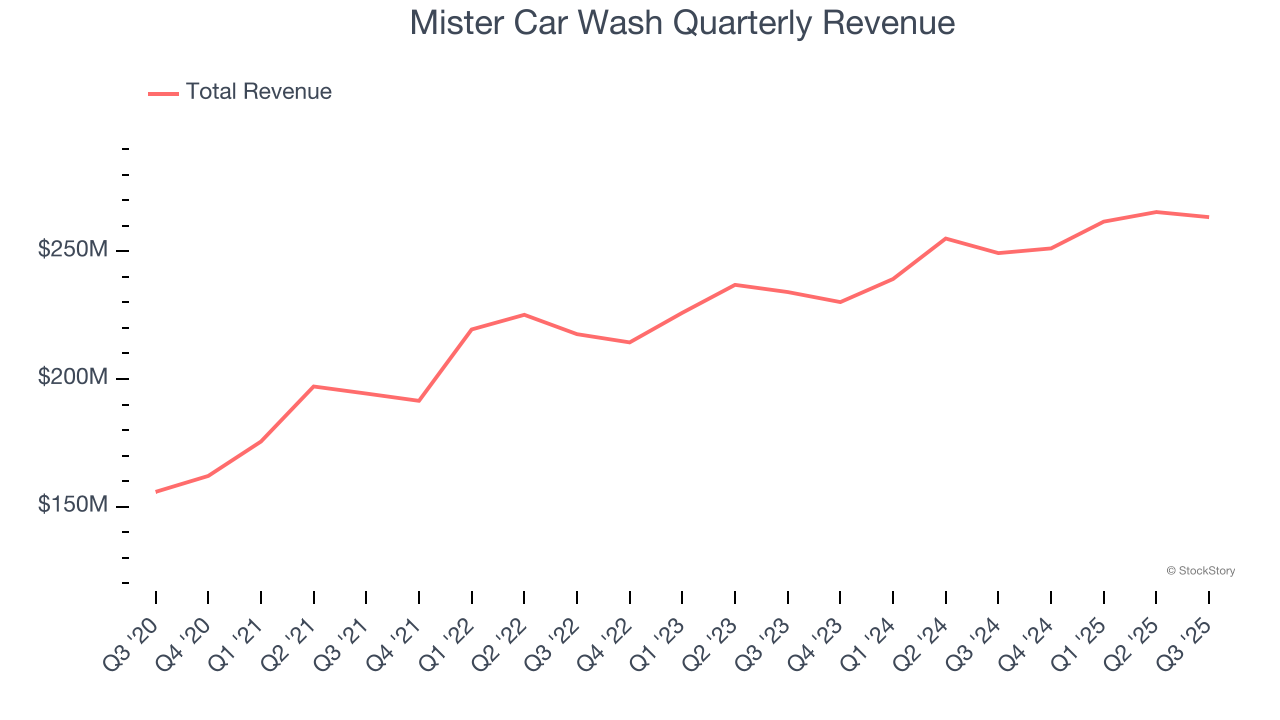

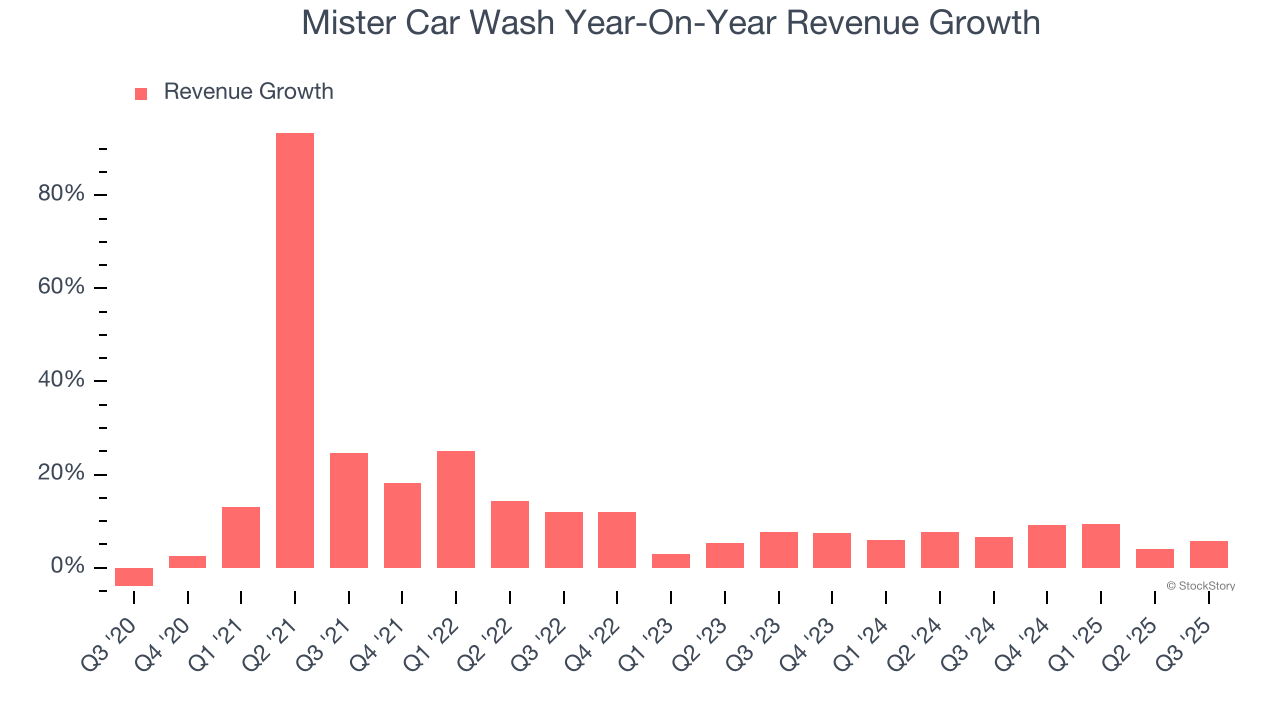

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Mister Car Wash grew its sales at a 12.8% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Mister Car Wash’s recent performance shows its demand has slowed as its annualized revenue growth of 6.9% over the last two years was below its five-year trend.

We can better understand the company’s revenue dynamics by analyzing its same-store sales, which show how much revenue its established locations generate. Over the last two years, Mister Car Wash’s same-store sales averaged 2.9% year-on-year growth. Because this number is lower than its revenue growth, we can see the opening of new locations is boosting the company’s top-line performance.

This quarter, Mister Car Wash reported year-on-year revenue growth of 5.7%, and its $263.4 million of revenue exceeded Wall Street’s estimates by 0.9%.

Looking ahead, sell-side analysts expect revenue to grow 5.6% over the next 12 months, similar to its two-year rate. This projection is underwhelming and implies its products and services will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

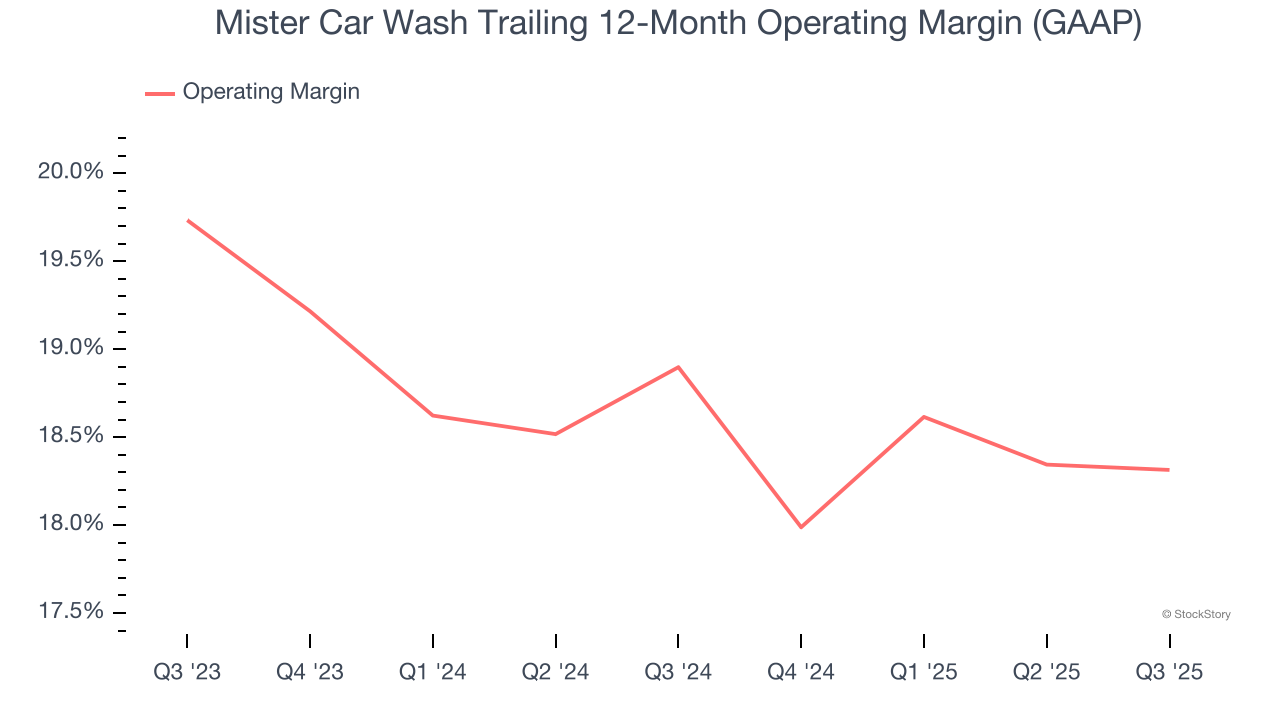

Mister Car Wash’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 18.6% over the last two years. This profitability was top-notch for a consumer discretionary business, showing it’s an well-run company with an efficient cost structure.

In Q3, Mister Car Wash generated an operating margin profit margin of 19.7%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

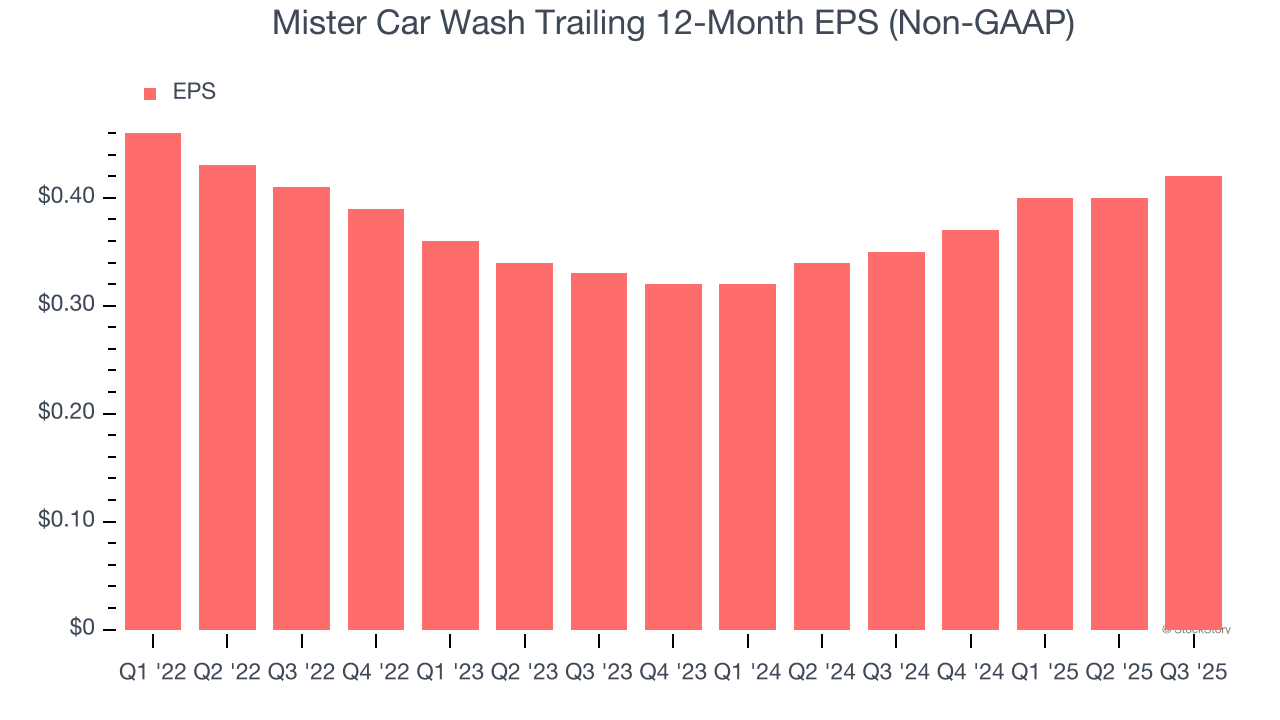

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Mister Car Wash’s full-year EPS dropped 13.2%, or 3.1% annually, over the last four years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. Consumer Discretionary companies are particularly exposed to this, and if the tide turns unexpectedly, Mister Car Wash’s low margin of safety could leave its stock price susceptible to large downswings.

In Q3, Mister Car Wash reported adjusted EPS of $0.11, up from $0.09 in the same quarter last year. This print beat analysts’ estimates by 7.4%. Over the next 12 months, Wall Street expects Mister Car Wash’s full-year EPS of $0.42 to grow 11.2%.

Key Takeaways from Mister Car Wash’s Q3 Results

We enjoyed seeing Mister Car Wash beat analysts’ same-store sales, revenue, and EPS expectations this quarter. We were also glad its full-year EPS guidance slightly topped Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 11.5% to $5.82 immediately following the results.

So should you invest in Mister Car Wash right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.