Simply Good Foods has gotten torched over the last six months - since June 2025, its stock price has dropped 36.7% to $20 per share. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Simply Good Foods, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Do We Think Simply Good Foods Will Underperform?

Despite the more favorable entry price, we don't have much confidence in Simply Good Foods. Here are three reasons there are better opportunities than SMPL and a stock we'd rather own.

1. Fewer Distribution Channels Limit its Ceiling

With $1.45 billion in revenue over the past 12 months, Simply Good Foods is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

2. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Simply Good Foods’s revenue to stall, a deceleration versus This projection doesn't excite us and implies its products will face some demand challenges.

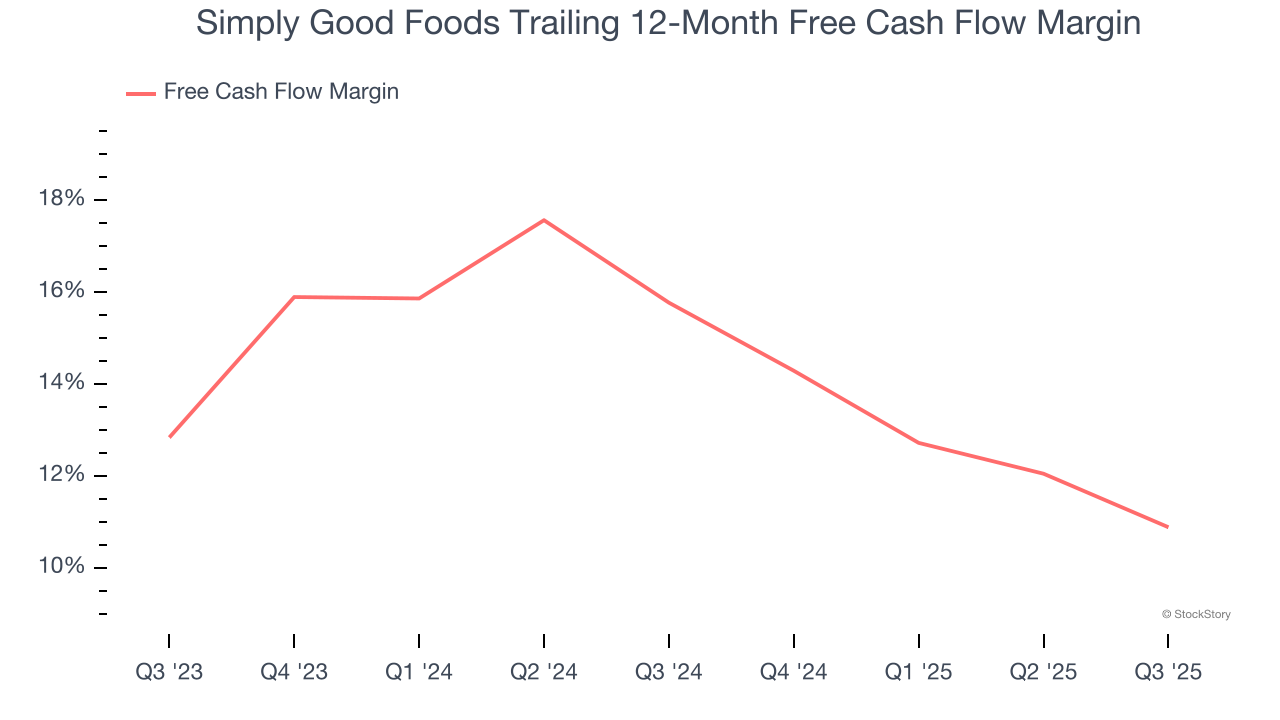

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Simply Good Foods’s margin dropped by 4.9 percentage points over the last year. Continued declines could signal it is in the middle of an investment cycle. Simply Good Foods’s free cash flow margin for the trailing 12 months was 10.9%.

Final Judgment

We see the value of companies helping consumers, but in the case of Simply Good Foods, we’re out. Following the recent decline, the stock trades at 10.2× forward P/E (or $20 per share). This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are better stocks to buy right now. We’d suggest looking at an all-weather company that owns household favorite Taco Bell.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.